The "wealth gap" in storage chips is widening. How to choose winners and losers?

Morgan Stanley pointed out that artificial intelligence is driving a sharp differentiation in the semiconductor industry, forming a "K-shaped" recovery. AI memory chips (such as HBM) are in short supply, significantly benefiting upstream manufacturers like Samsung and SK Hynix; however, downstream PC and smartphone manufacturers are facing pressure from the inability to pass on costs. This trend is dominated by the "capacity squeeze effect" of AI, even leading to shortages in traditional memory (such as DDR4), becoming a key watershed that distinguishes industry winners from losers

The wave of artificial intelligence is reshaping the valuation logic of the semiconductor industry. With the explosive demand driven by AI, the storage chip market is experiencing a significant differentiation.

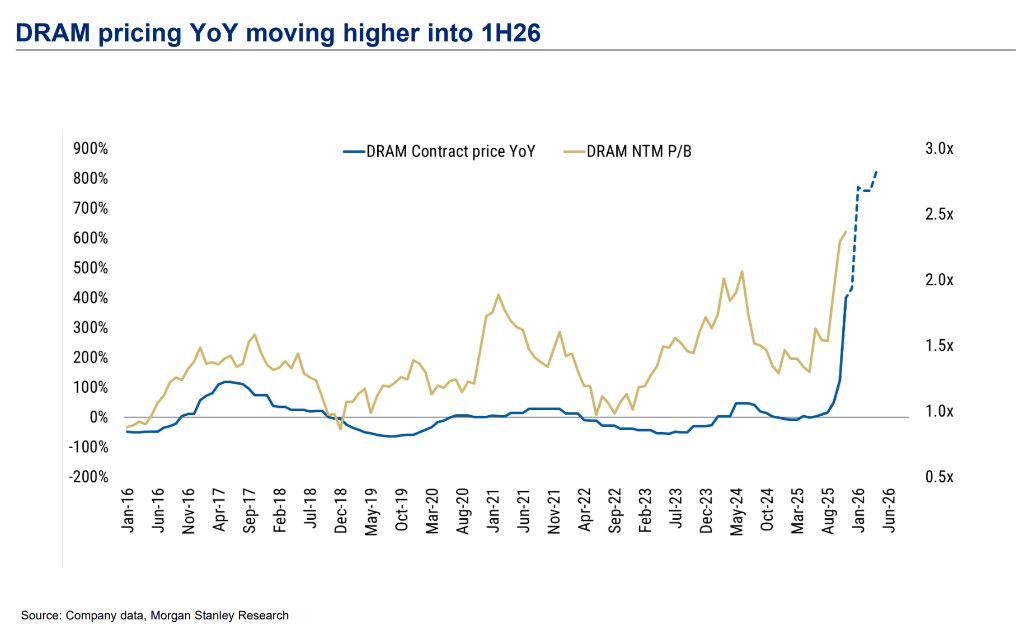

According to the Chasing Wind Trading Desk, a research report released by Morgan Stanley on January 20 shows that in the first half of 2026, DRAM (Dynamic Random Access Memory) prices are expected to continue rising year-on-year, but this is not a "one-size-fits-all" feast. The market is rapidly dividing into two camps: the "winners" benefiting from AI inference and high-performance computing demand, and the "losers" constrained by macro headwinds and cost inflation.

Morgan Stanley analyzes that the technological inflation brought by AI is exacerbating the cost pressures in the supply chain, leading to a widening "wealth gap" between storage chip manufacturers and traditional hardware manufacturers. Analysts point out that AI is not only driving strong demand for HBM (High Bandwidth Memory) and enterprise-grade SSDs but has even led to a persistent shortage of traditional storage products like DDR4. However, the rising upstream storage costs are evolving into severe profit pressures for downstream PC and smartphone OEM manufacturers.

In this "K-shaped" recovery, investors should pay close attention to companies that are at the core of the AI supply chain. Morgan Stanley clearly lists SK Hynix, Samsung, and SanDisk as the "most favored" targets, as they directly benefit from the AI-driven commodity cycle and NAND super cycle. In contrast, traditional PC peripherals and OEM manufacturers, such as Acer and Logitech, which cannot pass on the rising storage costs to consumers, still face market pressure.

The core logic of this trend lies in AI's "crowding-out effect." As foundries and supply chains prioritize the production of AI-related chips, the capacity in non-AI fields is being squeezed, leading to overall supply tightness from high-end HBM to traditional DDR4. For investors, understanding this supply-demand mismatch is key to positioning in the semiconductor market for 2026.

Winners: Core Assets in the AI Wave

In the storage chip sector, AI is undoubtedly the strongest catalyst at present. Morgan Stanley's report points out that suppliers with advanced storage technology and capacity are experiencing a valuation reassessment due to the surge in demand for AI servers and inference.

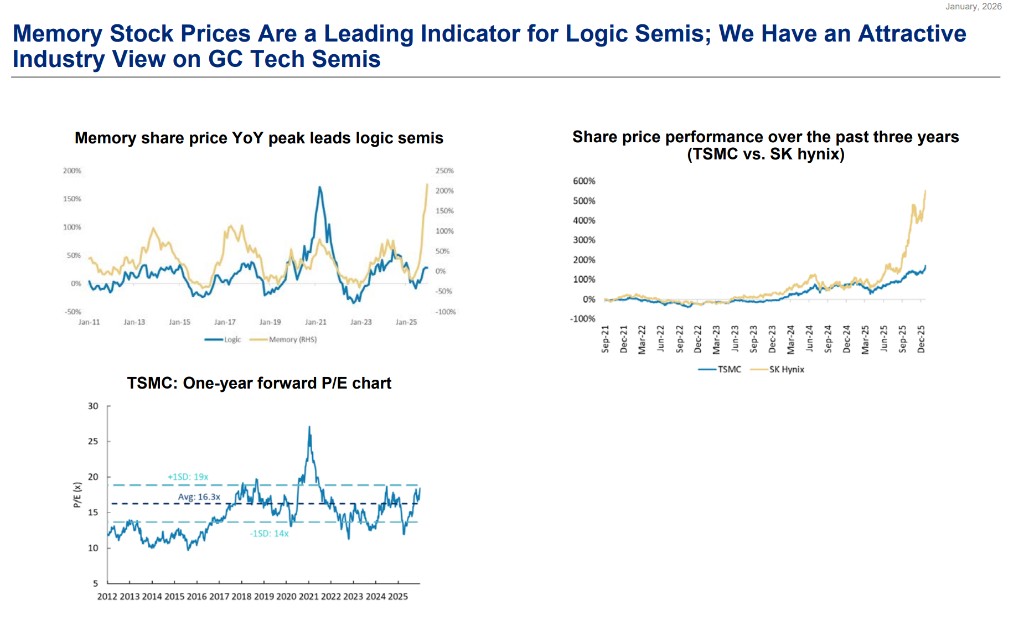

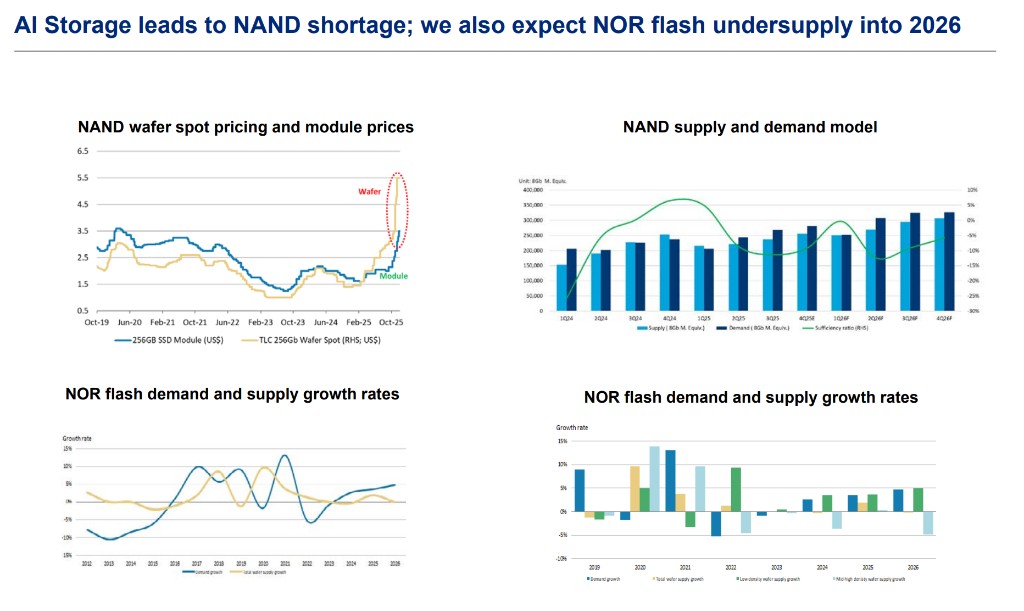

SK Hynix and Samsung are listed as top picks, with upside potential of 13% and 14%, respectively. This judgment is based on their dominant positions in the HBM market and the overall improvement in the commodity cycle. Meanwhile, the NAND market is also entering a "super cycle" supported by AI inference demand. SanDisk and KIOXIA are favored for their potential in the enterprise-grade SSD sector. Analysis shows that the demand for AI storage is leading to a shortage of NAND, and even the supply of NOR Flash may continue to be insufficient until 2026.

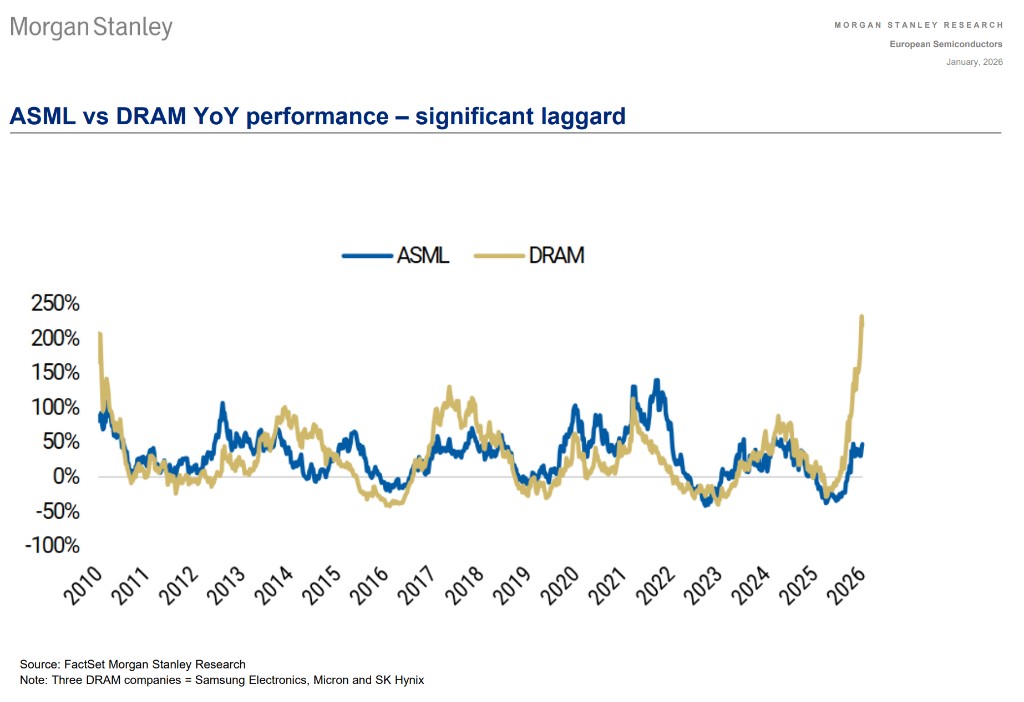

In addition to direct storage chip manufacturers, semiconductor equipment (SPE) manufacturers are also beneficiaries of this feast. ASML benefits from the increase in EUV layers, with a bullish target price of €1,400, representing a potential upside of 25%. Japanese equipment manufacturers such as Advantest and DISCO are also seen as high-growth targets due to their products being indispensable in the HBM manufacturing process.

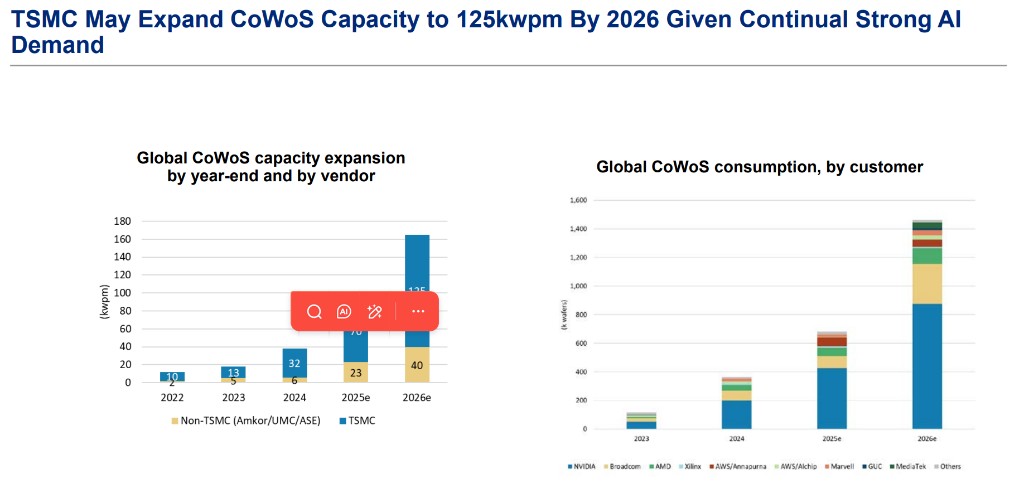

Moreover, among technology companies in Greater China, TSMC remains the undisputed core. As the foundry leader for AI logic chips, TSMC not only plans aggressive expansion in advanced packaging (CoWoS) capacity but also shows strong capital expenditure and structural profit margin improvement for 2026. Morgan Stanley expects TSMC to maintain its dominance in high-end processes as NVIDIA's Rubin chip ramps up in 2026 and Apple's A20 processor adopts the N2 process.

Losers: The Strugglers Under Cost Inflation

In stark contrast to the revelry of upstream storage manufacturers, downstream hardware OEM manufacturers are facing severe challenges. Morgan Stanley analysts warn that the inflation of storage costs is seen as a challenge for the entire industry, especially for consumer electronics brands that lack pricing power.

Acer has been listed as one of the "least favored" stocks, with a target price of only NT$20, representing a potential downside of 25%. The core reason is that the rise in storage component prices cannot be fully passed on to end consumers, which will directly erode the profit margins of OEM manufacturers. Similarly, HP and Dell are facing similar headwinds, although they are also trying to venture into AI PCs, the rising storage costs remain a major negative factor in the short term.

This pressure has also affected the peripherals and radio frequency (RF) sectors. Logitech SA is considered to be impacted by storage inflation, as these costs have not been offset by macroeconomic headwinds, but rather intensified operational pressure. RF giants Qorvo and Skyworks Solutions are also viewed negatively due to high costs potentially suppressing downstream hardware demand, with analysts believing this will lead to further weakening of demand.

Supply-Demand Mismatch: Not Just a Shortage of High-End Chips

It is worth noting that the impact of AI is not limited to high-end chips; it is causing a chain reaction throughout the entire storage supply chain. Morgan Stanley's research highlights a key phenomenon: the shortage of DDR4 will continue until the second half of 2026 This shortage is not due to a surge in demand for DDR4 itself, but rather because the supply chain's capacity has been occupied by high-end AI-related products (such as HBM and DDR5). As wafer fabs prioritize the production of high-margin AI chips, the capacity allocation for traditional DDR4 and DDR3 has been reduced, leading to supply tightness and subsequent price increases. This is beneficial for niche memory manufacturers like Winbond Electronics and Nanya Technology in Taiwan, as they have better pricing power.

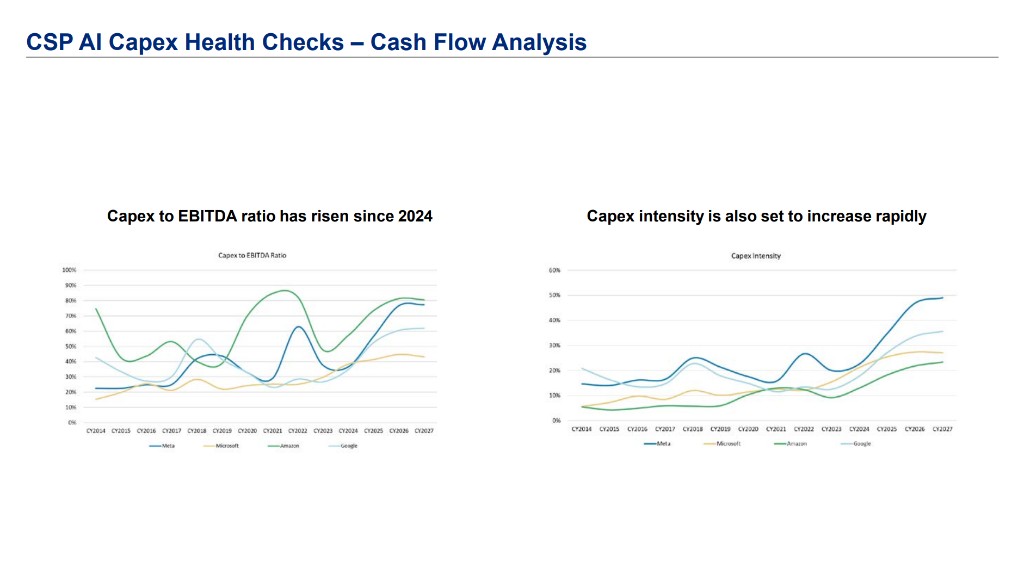

In addition, the demand for AI storage has also led to an increase in spot prices for NAND wafers and module prices. As capital expenditures by cloud service providers (CSPs) are expected to reach $632 billion by 2026, the construction of data centers for AI training and inference will consume a large amount of storage resources. This not only drives up prices for enterprise-level storage but also boosts the pricing recovery of consumer-grade NAND, benefiting controller manufacturers like Phison Electronics Corp and Silicon Motion in Taiwan.

Long-term Logic: The Rise of a Trillion-Dollar Market

Looking ahead, Morgan Stanley has reiterated its long-term optimism for the AI semiconductor market. NVIDIA's CEO has predicted that global cloud capital expenditures will reach $1 trillion by 2028, and Morgan Stanley's data supports this trend, suggesting that the global semiconductor market could reach the $1 trillion mark by 2030.

In this grand narrative, technological inflation, AI's self-cannibalization, and technological diffusion will be the three main driving forces dominating the market. Although emerging AI models like DeepSeek demonstrate lower-cost inference capabilities, this has not changed the entire industry's reliance on high-performance computing and massive storage.

For investors, the current strategy is very clear: embrace upstream suppliers with core technologies and capacity filled by AI demand, while avoiding hardware assemblers that are downstream in the supply chain, constrained by rising costs and lacking the ability to pass on those costs. The prices of memory chips are not only a thermometer for industry cycles but also a watershed that distinguishes market winners from losers.