Ignoring Trump's interference? Wall Street institutions maintain a bullish stance: history shows a 60% probability of a rebound in U.S. stocks after turmoil

Since 1940, in 36 major geopolitical events, U.S. stocks have risen 60% of the time in the following three months, unless geopolitical factors cause a significant spike in oil prices. At the same time, factors such as corporate earnings expectations, continued returns from AI trading, and improvements in market breadth support a bullish outlook. Institutions like JP Morgan and Barclays recommend that investors maintain long positions but hedge against downside risks

Despite the Trump administration's threats to impose tariffs on European countries and the instability in Japan's political situation impacting the global bond market, U.S. stocks experienced their largest decline since October of last year on Tuesday. However, Wall Street strategists believe that the foundation for market growth remains solid, and the current turmoil actually provides a buying opportunity.

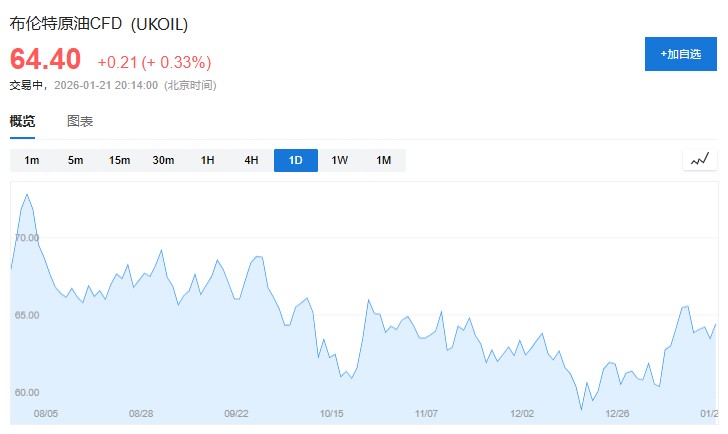

The strategists' optimistic assessment is primarily based on historical experience: Since 1940, in 36 major geopolitical events, U.S. stocks have risen 60% of the time in the following three months, unless geopolitical factors caused a significant spike in oil prices. Currently, the prices of Brent crude oil and West Texas Intermediate crude oil are both well below long-term averages.

Expectations for corporate earnings, continued returns from AI trading, and improvements in market breadth support the bullish outlook. Institutions like JP Morgan and Barclays recommend that investors maintain long positions but hedge against downside risks.

Geopolitical Turmoil Cannot Hinder Stock Market Upward Movement

Historical data shows that the impact of geopolitical risks on the stock market is often limited. HSBC's emerging markets and equity strategist Alastair Pinder noted in a report on January 20 that unless geopolitical tensions lead to a sharp rise in oil prices, the stock market typically can absorb such shocks.

Despite rising oil prices, the two major benchmark oil prices remain well below long-term average levels, indicating that the current geopolitical tensions have not yet reached a critical pain point for the stock market.

Chris Verrone, head of technical and macro strategy at Strategas Asset Management, stated that about 70% of S&P 500 constituents were above their 200-day moving average last week, and indices like the Russell 2000 and equal-weighted S&P 500 reached all-time highs. "This is not the kind of backdrop we expect to see before a major top," he said. "While such a one-sided sentiment may trigger a consolidation, we still adhere to the long-term trend."

Earnings Growth Supports Valuation

The outlook for corporate earnings is a key pillar of the bullish view. Analysts expect corporate profits to grow by about 9% in the fourth quarter, with double-digit growth in each quarter of 2026.

Data from Bank of America shows that in the first week of earnings reports for S&P 500 constituents, 73% of companies exceeded analyst expectations, higher than the average of 68% for this period.

Dan Greenhaus, chief economist and strategist at Solus Alternative Asset Management, stated, "If the earnings season proves itself, then other factors should take a back seat."

Forecasters also expect that tax cuts and real wage growth will boost the U.S. economy, while inflation will continue to decline, all of which are favorable for stock market performance. AI trading continues to bring substantial returns to index-weighted stocks, and investor interest in broader sectors such as healthcare, resources, and consumer goods is also heating up

Maintain Bullish but Hedge Risks

Despite the prevailing bullish sentiment, strategists acknowledge the need for caution in the face of volatility. The bull-bear ratio of the American Association of Individual Investors has risen to its highest level since 2024, and a survey by the National Association of Active Investment Managers shows that fund managers' stock positions are close to 96%.

Alexander Altmann, Head of Global Equity Tactical Strategy at Barclays, told clients that he maintains a risk-on stance in the near term, although volatility may increase, at least until the earnings season concludes. "The team here remains constructive, but certainly acknowledges that with the government's initial speed at this level, the volatility mechanism is shifting to higher levels," he said.

J.P. Morgan's trading department also expressed a similar view on Tuesday. Andrew Tyler, Head of Global Market Intelligence, suggested in a report to clients to "stay bullish but hedge," maintaining a tactical bullish stance while adopting a cautious approach in the near term.

Tyler stated that his team's optimism is rooted in a resilient macroeconomic backdrop, positive earnings growth, and a de-escalation of trade tensions. "This framework is now being challenged, but it is still too early to say that the macro story is deteriorating fast enough to turn bearish," he said. "We also believe it is too early to abandon U.S. assets, and it is better to hedge against downside risks, especially if we see Trump pivoting after the Davos meeting."

There is also the possibility that Trump may "back down." The president had previously retracted his order for reciprocal tariffs within a week after the market plummeted on April 2 last year. Allianz Global Investors even stated on Monday that European policymakers should amplify market turmoil to pressure Trump.