Perfect combination to hedge against AI bubble: clean energy, critical metals, infrastructure, and defense?

Bank of America believes that clean energy, as the core support for the physical operation of AI, has a demand scale far exceeding that of the AI industry itself. Key metals such as copper and tin are driven by the construction of data centers and semiconductors, with the supply-demand gap continuing to widen. The power grid infrastructure faces a trillion-dollar investment demand, which has become a key bottleneck restricting energy security and AI development. The defense security sector is driven by geopolitical factors, with strong certainty of capital investment and low correlation with the AI business cycle, making it an ideal hedging asset

In the current market dominated by AI narratives, the vulnerabilities brought about by capital crowding can no longer be ignored. Bank of America stated that when the AI frenzy recedes, the real opportunities lie in the "hard assets" that support the physical operation of AI.

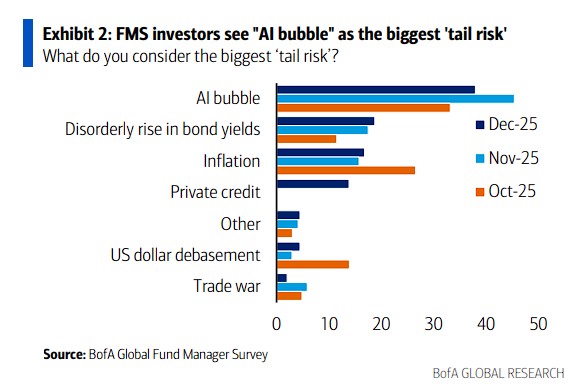

On January 21, according to news from the Chasing Wind Trading Desk, Bank of America, in its latest research report, mentioned that although AI represents a fundamental technological revolution, high valuations and uncertainties in time cycles have become risks that cannot be overlooked. 38% of fund managers now view the "AI bubble" as the biggest tail risk.

The research report states that the "perfect hedge" strategy proposed by Bank of America is not about shorting AI, but rather shifting towards "Transition Investing." Instead of directly betting on overvalued AI tech stocks, it is better to invest in the physical infrastructure that the AI revolution must rely on: clean energy, grid infrastructure, critical metals, and national defense.

The core logic of Bank of America is: the end of AI is electricity and resources. The bank predicts that by 2030, global capital expenditure related to AI will exceed $1.2 trillion. This massive amount of capital will inevitably flow into the energy that powers data centers, the metals that build hardware, and the national defense that protects technology.

At the same time, Bank of America believes that these areas have support from policy, geopolitical drivers, and supply chain fundamentals, which can provide relative resilience even if the AI bubble bursts.

Clean Energy: The Shift from Supporting Role to Leading Role

Bank of America pointed out that the best way to invest in AI may be to not directly hold AI stocks. Strategies such as defense, infrastructure, and transition metals are key drivers of the AI revolution, but their stock prices are more influenced by policy and geopolitical factors, allowing them to effectively withstand the severe fluctuations in the AI sector.

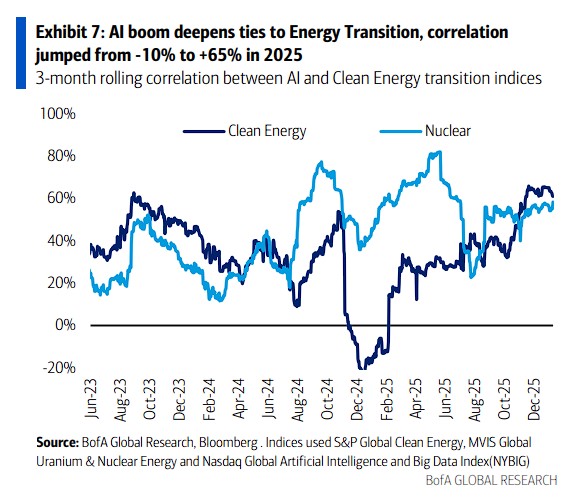

However, the research report states that the market is quickly realizing this connection. The correlation between clean energy and AI has surged from -10% to 65% within a year.

The research report states that hyperscalers account for about 70% of clean energy transactions in the United States, and the energy consumption of each new generation of NVIDIA chips is 1.5 to 2 times that of the previous generation, making the energy intensity of AI a structural theme.

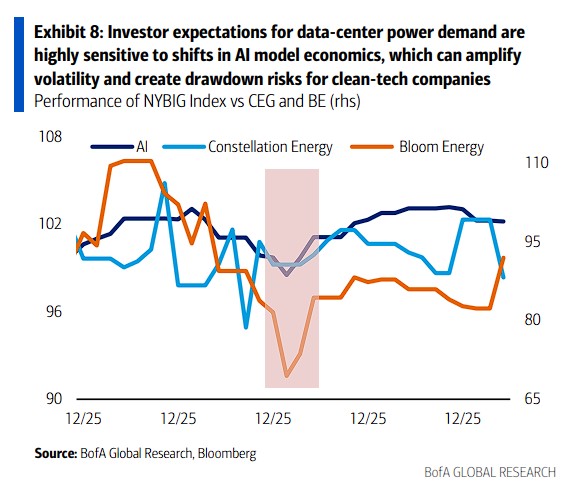

However, Bank of America also pointed out that this sudden increase in correlation has brought about a double-edged sword effect:

It means that if the AI bubble bursts, clean energy may face short-term downside risks; but it also indicates that investors are beginning to realize that without reliable low-carbon electricity, the growth of hyperscale cloud providers will be difficult to sustain.

The weak performance of power producer stocks in December 2025 reflects the market's concerns about the AI bubble spreading to the clean energy sector. Investors worry that data centers may bypass independent power producers in favor of vertically integrated utility companies or self-built power plants.

According to research reports, small modular reactors (SMRs) are emerging in the clean energy landscape. Hyperscale cloud service providers have captured about 40% of the 47 GW SMR pipeline projects, highlighting the critical role of nuclear power in meeting the high utilization rates and stable power demands of AI clusters.

Although SMRs are unlikely to be deployed on a large scale in the near term, their economic and technical characteristics may become highly attractive by the 2030s.

Bank of America also pointed out that battery energy storage systems (BESS) are rapidly becoming central to data center power strategies. Suppliers report that nearly all large data centers are considering adopting BESS for renewable energy peak shaving, interruptible service support, or diesel backup alternatives.

Among the approximately 245 GW of planned installed capacity for U.S. data centers tracked by Wood Mackenzie, about 35% show signs of on-site generation beyond traditional backup power, with BESS being the second most common technology after natural gas, totaling 34 GW across 12 sites.

Despite short-term fluctuations, the fundamental drivers of clean energy demand far exceed AI itself. The International Energy Agency (IEA) predicts an addition of 4,600 GW of renewable energy installed capacity over the next five years, with solar photovoltaic accounting for 80%. Bank of America commodity strategists expect the share of electricity in total energy demand to rise from 13% in 1990 to around 20% by 2030.

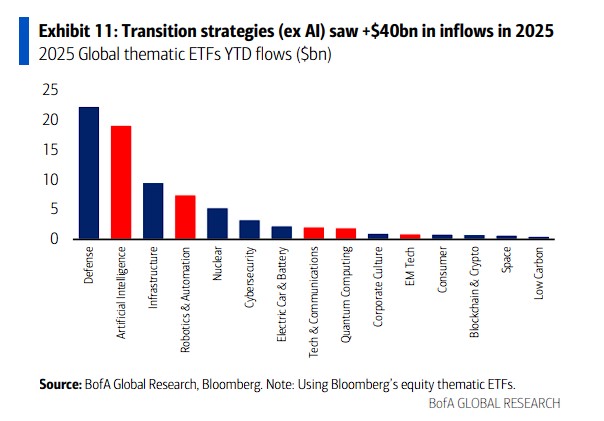

The research report states that even if the AI boom cools, the rigid demand for grid upgrades and defense spending remains. In fact, the transformation strategies excluding AI have already attracted over $40 billion in funding by 2025.

Grid Infrastructure: Trillion-Dollar Investment Driven by Energy Security

The research report points out that the bottlenecks in electricity transmission and distribution infrastructure are becoming key factors constraining the AI and overall electrification process. The International Energy Agency estimates that 80 million kilometers of transmission lines must be deployed or upgraded by 2040, effectively doubling the scale of the global grid.

The report states that this unprecedented scale of construction makes grid operators, transmission equipment manufacturers, energy storage solution providers, and renewable energy developers the core beneficiaries.

Data shows that capital expenditures for U.S. electric utilities are expected to grow at a compound annual growth rate of 9% from 2019 to 2025, with an anticipated increase of 8% in 2025. In Europe, the grid investment plans of 23 transmission and distribution system operators have been continuously revised upward, from €185 billion in 2021 to €678 billion in 2025 Bank of America analysts predict that capital expenditures related to AI infrastructure will reach $150 billion by 2028, covering servers, infrastructure, and engineering construction. However, compared to infrastructure stocks directly related to AI (such as Vertiv, which derives about 80% of its revenue from data centers and has an AI beta coefficient of 1.23), traditional grid infrastructure companies have much lower correlation with AI.

The research report states that grid investments are supported by regulatory frameworks, energy security strategies, and long-term power purchase agreements, and their return cycles and risk characteristics effectively complement AI stocks.

Key Metals: Structural Bull Market for Copper and Tin

According to the research report, there is no AI without metals. The construction of data centers and the upgrade of power infrastructure will directly drive up demand for copper, aluminum, nickel, and tin.

Bank of America commodity strategists believe that this demand growth has weak cyclicality and is more driven by structural trends in energy infrastructure reconstruction.

In particular, copper, as the core material for power transmission, will face severe challenges in demand in the coming years. Bank of America expects that by 2028, the demand for copper from data centers alone will bring an incremental demand of about 600,000 tons.

Additionally, tin, which is highly correlated with semiconductor sales (historical correlation of 88%), will see demand grow by 3.5% in 2025 and continue to grow by 2.7% in 2026 as AI applications accelerate and semiconductor intensity increases.

Defense and Security: Hard Assets Driven by Geopolitics

In the context of increasing global turmoil, security resilience has become an undeniable long-term theme. Governments around the world are prioritizing the development of advanced defense technologies, not only for military purposes but also involving dual-use technologies (such as satellites and batteries).

According to Bank of America's research report, the funding commitments in this area are staggering:

United States: President Trump's proposed defense budget for fiscal year 2027 is as high as $1.5 trillion, a significant increase of 50% from previous levels.

European Union: Plans to allocate €800 billion for defense over the next decade.

Japan: The defense budget for fiscal year 2026 is expected to be around ¥9 trillion (a year-on-year increase of 4%).

Bank of America believes that these expenditures will translate into long-term demand for unmanned systems, cybersecurity, AI algorithms, and raw materials, and that this demand is primarily driven by national security intentions, with low correlation to the commercial cycle of consumer-level AI.

Bubble or Reality? The Hard Landing Risk of Capital Expenditures

Although Bank of America suggests hedging through "transformational investments," the research report also points out that the current AI boom is not entirely based on fantasy. Bank of America states that the capital intensity of hyperscale cloud providers has surged from 13% in 2012 to 64% today, even surpassing that of oil giants.

Additionally, the vacancy rate for data centers is currently close to zero, and the construction pipeline is at full capacity. Bank of America analysts predict that infrastructure-related data center expenditures (servers, infrastructure, engineering) will reach $150 billion by 2028.

However, the risk lies in "over-investment." **If AI demand stagnates at high levels, aggressively expanding companies may face a crisis of overcapacity similar to that after the internet bubble burst. This is why Bank of America emphasizes the need to position in "low AI beta" assets that are still supported by policies, energy security, and geopolitics, even if AI cools down **