Takami Takashima personally opened the "Pandora's Box." Can the central bank's intervention prevent the collapse of Japanese bonds?

JP Morgan stated that the market is not worried about one-time fiscal stimulus, but rather that this tax cut has triggered four deep concerns: the credibility of restoring tax rates is completely questioned, the policy lacks growth attributes, the last line of fiscal discipline has been breached, and sovereign rating risks have re-entered the pricing framework. Nomura believes that the "high market shock" presents a more challenging situation than in 2025, and if the Bank of Japan intervenes hastily, it may trigger concerns about "policy lag," leading to a further steepening of the yield curve and reinforcing inflation expectations through yen depreciation, creating a vicious cycle

The Japanese government bond market is experiencing not just a typical rise in interest rates, but a trust crisis triggered by politics, amplified by fiscal measures, and ultimately falling on the central bank.

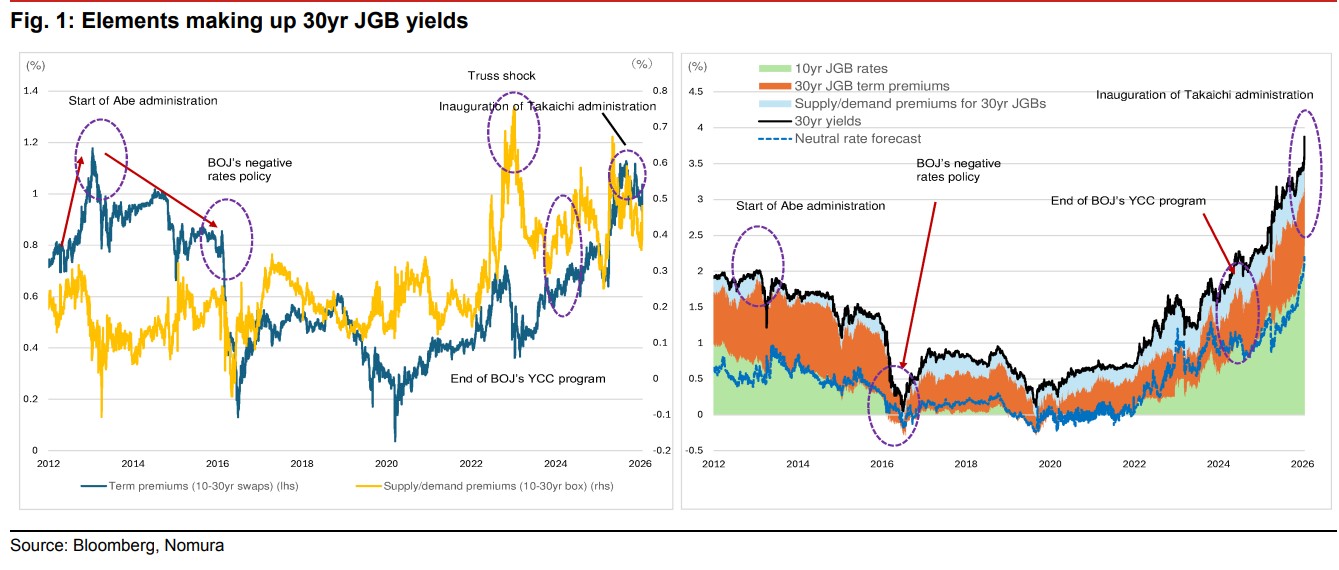

After Prime Minister Kishi Sanae proposed a tax exemption on food consumption, the market responded in the most direct way: selling off government bonds, selling off the yen, and simultaneously compressing stock market valuations. Within just two trading days, the yield on Japan's 10-year government bonds rose by about 15 basis points, while the 30-year yield surged by as much as 30 basis points, a level of volatility that is extremely rare in history.

According to the Wind Trading Desk, JP Morgan bluntly stated that this policy "is like opening Pandora's box for Japan's finances"; while Nomura further warned that the Japanese bond market is facing a risk of "Kishi shock" similar to the "Truss shock" in the UK.

The key issue is not how much this tax cut "costs," but rather — it has shaken the market's trust in the last line of defense of Japan's fiscal discipline.

Election Politics Combined with Fiscal Commitments, Risks Priced in at Once

According to Xinhua News Agency, Kishi Sanae has announced that the House of Representatives will be dissolved on January 23, and elections will be held on February 8. During this highly sensitive political window, she clearly stated in campaign activities that she hopes to exempt food and beverage consumption taxes within two years, acknowledging that this goal "faces significant obstacles," but she will still promote related discussions.

This statement quickly triggered a chain reaction. Major political parties have joined the discussion on consumption tax exemptions, with the Center Reform Alliance even proposing to fill the fiscal gap by utilizing the Government Pension Investment Fund (GPIF) or government assets. It is also believed that the Liberal Democratic Party may consider using foreign exchange or special pension accounts.

However, for the bond market, these proposals can hardly be seen as "qualified sources of funding."

Consensus Between Nomura and JP Morgan: This is an "Election-Driven Fiscal Shock"

Nomura's calculations show that even if the exemption period is limited to two years, the suspension of the food consumption tax will still result in an annual tax revenue loss of about 5 trillion yen for central and local governments. This scale alone is not enough to immediately trigger a debt crisis, but the signals it sends are extremely dangerous.

What particularly alarms investors is that some political parties have proposed filling the gap by utilizing the Government Pension Investment Fund (GPIF), foreign exchange reserves, or other government assets. JP Morgan clearly pointed out that these methods do not constitute "real fiscal sources" in the eyes of the bond market, and may instead further blur the boundaries of fiscal policy.

JP Morgan noted that the market is not worried about one-time fiscal stimulus, but rather concerned that the consumption tax, which has long been viewed as the "last bastion" of Japan's fiscal discipline, is being used for political purposes.

Why is the "Pandora's Box" More Dangerous than the Numbers on Paper?

JP Morgan describes this tax cut as a "Pandora's box" not because of its short-term costs, but because it triggers four deep-seated concerns:

First, the credibility of restoring the tax rate is completely questioned. Many market participants believe that once the food consumption tax is reduced to 0%, restoring it to 8% two years later is politically nearly impossible. The commitment to the "temporary" nature of the tax cut lacks credible constraints

Second, the policy lacks growth attributes. This tax reduction is not seen as a measure to enhance productivity, promote technological investment, or improve potential growth, but rather as a short-term benefit under the guise of alleviating people's livelihood pressures.

Third, the last line of fiscal discipline has been breached. The consumption tax has long been regarded as the "last bastion" of Japan's fiscal discipline. Once this tool is politicized, the market will reassess the credibility of all fiscal commitments.

Fourth, sovereign rating risk re-enters the pricing framework. Rating agencies' tolerance for Japan's finances is based on "policy predictability." Once this premise is weakened, the risk of a downgrade in rating outlook will persist.

Investor behavior begins to "de-Japanize"

From a trading structure perspective, this round of shock is not an emotional outburst, but rather a systematic adjustment of capital behavior.

JP Morgan points out that the main marginal buyers of ultra-long-term Japanese government bonds are concentrated among overseas investors and pension systems. However, in the current environment:

- Overseas investors may be forced to close out yield curve flattening trades;

- Pension funds' willingness to reallocate bonds decreases in the face of a stagnant stock market rebound;

- Regional banks face pressure from the Financial Services Agency regarding unrealized losses on government bonds, leading to passive position adjustments;

- Life insurance companies are accelerating the sale of ultra-long-term bonds against the backdrop of rising interest rates and shortened liability durations.

The result is a structural vacuum in demand for ultra-long-term government bonds.

What is even more alarming is that the recent rise in yields is not limited to 30-year and 40-year maturities; the increase in risk premiums has begun to transmit to the mid-end, indicating that the market is concerned about the overall fiscal path rather than a simple supply-demand imbalance for a single maturity.

"High market shock": a more challenging situation than 2025

Nomura strategist Nakako Matsuzawa points out that, unlike the ultra-long-term government bond turmoil in the spring of 2025, which was primarily focused on supply-demand structure, the current sell-off stems from a crisis of trust in policy direction.

In the latest round of trading, an extremely unusual combination has emerged: ultra-long-term yields have skyrocketed while the stock market and yen have weakened simultaneously.

This indicates that investors are overall reducing their allocation to Japanese assets rather than merely adjusting the duration structure.

Matsuzawa warns that if the Bank of Japan intervenes rashly, it may trigger concerns about "policy lag," leading to a further steepening of the yield curve and reinforcing inflation expectations through yen depreciation, creating a vicious cycle.

Central Bank and Ministry of Finance: Intervention space significantly compressed

From an operational perspective, the Bank of Japan does have tools:

In the short term, it can choose to temporarily expand government bond purchases, the Ministry of Finance can repurchase ultra-long-term bonds, and reduce auction sizes;

In the medium term, it can slow down quantitative tightening (QT), revise issuance plans, and normalize repurchase operations But the problem is — when the market questions the fiscal direction itself, the central bank's technical intervention may have a counterproductive effect.

As JP Morgan stated, once the "Pandora's box" is opened, it is difficult for the market to restore trust on its own. The fundamental solution remains to withdraw or clearly limit the proposal for consumption tax reductions and provide a credible fiscal path explanation.

Conclusion: This is a crisis of trust, not a liquidity crisis

The current turmoil in the Japanese government bond market is essentially not due to uncontrolled inflation or disorderly interest rates, but rather a politically driven fiscal trust crisis.

Sanae Takaichi's statement on tax cuts may have practical significance at the electoral level, but in the eyes of the bond market, it touches on a deeper issue: Is Japan still willing to pay the political cost for fiscal discipline?

Before this question is clearly answered, the central bank's intervention can at most delay adjustments but cannot prevent the market from repricing