After the collapse of Japanese bonds, Japan's second-largest bank has spoken out: prepare to buy the dip, and double the holdings!

Sumitomo Mitsui Financial announced plans to double its holdings to over 20 trillion yen after the stabilization of Japanese bond yields, achieving a strategic return from foreign debt to domestic debt. Despite recent fiscal concerns triggering a collapse in the bond market, the bank is optimistic about the fair value of 30-year government bonds and predicts that the Nikkei index will break 60,000 points and the yen will fall to 180 by the end of the year

As Japan's second-largest bank, Sumitomo Mitsui Financial Group plans to significantly rebuild its domestic sovereign debt holdings after market yields stabilize. The bank's global markets head, Arihiro Nagata, stated that it is preparing to double its current Japanese government bond portfolio size from 10.6 trillion yen (approximately 67 billion USD). This statement marks a shift in the investment strategy of this financial giant from overseas bonds back to domestic Japanese bonds.

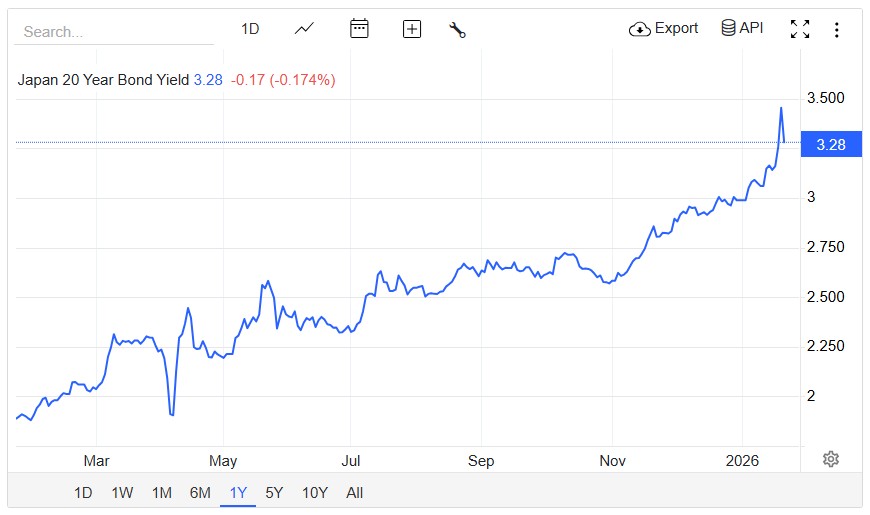

This Tuesday, the Japanese bond market experienced a fierce sell-off, with long-term yields soaring to record highs. The market is concerned about Prime Minister Sanae Takaichi's fiscal policies ahead of the February 8 election, combined with the impact of the Bank of Japan's reduction of large-scale bond purchases, leading to significant market volatility. On Wednesday, Japanese bond yields had retreated from their highs, with the 20-year government bond yield falling 10 basis points to 3.245%. The benchmark 10-year government bond yield also decreased by 5 basis points to 2.290%.

Despite the market turmoil, Arihiro Nagata pointed out in an interview that once the momentum of rising yields ends, the bank will fully return to the Japanese government bond market. He revealed that Sumitomo Mitsui has already begun purchasing some 30-year bonds, believing their prices are close to fair value. However, he also emphasized that due to inflation risks and uncertainties ahead of the election, the bank remains cautious about large-scale purchases at this time.

In addition to the bond strategy, Nagata made several notable predictions about the Japanese market. He expects the Nikkei 225 index to break through 60,000 points by the end of this year, while the yen exchange rate may fall to 180 yen per dollar in the coming years. This series of predictions highlights the institution's expectations for a dramatic revaluation of Japanese asset prices.

Return to the Japanese Bond Market

According to Bloomberg, Arihiro Nagata candidly discussed the shift in investment direction during the interview: “I used to be very enthusiastic about foreign bond investments, but that is no longer the case. The focus now is on Japanese government bonds (JGBs).” He stated that Japanese government bonds will become the mainstay of the core department's investment portfolio at Sumitomo Mitsui Banking Corporation. Currently, this department holds approximately 12 trillion yen in foreign bonds.

Although the bank's current holdings of Japanese government bonds are primarily in short-term securities, with an average duration of only 1.7 years, and the scale of Japanese government bonds held by Sumitomo Mitsui peaked at 15.8 trillion yen in March 2022, Nagata indicated that the scale of future rebuilding will “far exceed this level.”

Despite the surge in long-term yields leading to a sharp decline in the bond market, Nagata noted that at the beginning of this week, the yield on 30-year bonds was already near fair value. Earlier on Tuesday, the yield on these bonds had surged more than 25 basis points. However, given that investors are re-pricing the inflation risks that Takaichi and the main opposition party's policies may trigger, there is still a possibility for yields to rise further, which is why the bank has not yet fully entered the market Regarding the trend of benchmark yields, Nagata expects the 10-year Japanese government bond yield to break 2.5% by the end of this year and believes its fair value is between 2.5% and 3%.

The Japanese banking sector has previously been reducing its holdings of domestic sovereign debt and has taken a wait-and-see attitude towards new purchases as yields continue to rise, since newly bought securities may quickly depreciate. This statement from Sumitomo Mitsui is an important signal from large institutional investors amid market turbulence, suggesting that after a long period of selling, institutional funds are waiting for the right moment to reallocate domestic assets.

According to a previous article from Wall Street Insight, the Japanese government bond market has experienced a historic collapse due to structural imbalances, with Goldman Sachs bluntly stating that verbal interventions have failed, and the Bank of Japan is being forced toward the only "logical conclusion"—to restart unlimited bond purchases. However, while this "money printing to save the market" can lower yields, it is likely to cause the yen to breach the 160 defense line, putting the central bank in a difficult position between "protecting bonds" and "protecting the currency."

Central Bank Policy Game and Yen Trend

The sell-off in the bond market has made the policy path for the Bank of Japan more complex. Nagata believes that the Bank of Japan has a "considerable chance" of raising interest rates three times this year, which is higher than the two times generally expected by economists and traders, aimed at addressing the weakness of the yen. If the widening U.S.-Japan interest rate differential exacerbates yen depreciation, the Bank of Japan may raise rates as early as April and implement two more hikes by the end of the year, doubling the policy rate to 1.5%. He expects a terminal rate of 2%, but this level could be higher if the Federal Reserve starts raising rates in 2027.

Regarding the Federal Reserve, Nagata predicts that it will cut rates twice this year in response to Donald Trump's calls for lower borrowing costs. However, he warns that due to "excessive" rate cuts, the Federal Reserve may be forced to pivot in 2027, implementing larger-than-normal rate hikes to address rising inflation.

He also pointed out that given the strong performance of the U.S. economy, the downward trend of the yen against the dollar is unlikely to reverse. "I wouldn't be surprised if it reaches 180 in the next three years," Nagata said. He believes that the weakness of the yen is caused by the flow of funds in the real economy (such as cross-border mergers and acquisitions and retail investors buying U.S. stock funds) and the productivity gap between the two countries, suggesting that government intervention in the currency market may have limited effects. However, if the yen falls to 180, it may self-correct by lowering manufacturing costs in Japan.

Despite uncertainties in the global trade situation, Nagata holds an optimistic view of the global economic outlook for this year and is particularly bullish on the Japanese stock market.

He predicts that the Nikkei 225 index will continue to rise from its current level of less than 53,000 points and break 60,000 points by the end of this year, setting a new high. "I have a positive attitude towards our risk exposure in Japanese stocks," Nagata said. This means that while the bond market is adjusting, large financial institutions in Japan remain confident in the performance of domestic equity assets