Securities firms "crossing borders" to break through, insurance agency sales enter the second half

Securities firms are gradually emerging in the insurance agency field. With the China Securities Association promoting securities firms to obtain insurance sales licenses, the proportion of insurance products in securities sales is gradually increasing. Several leading securities firms, such as CITIC Securities Co., Ltd. and CMS, have launched insurance sections on their apps, demonstrating their efforts in the transformation of wealth management business. Although the number of licensed securities firms has not increased, insurance sales still face performance pressure, becoming a new trend in the business of securities firms

Since 2025, the China Securities Association has made it clear to "promote more compliant and effective risk control brokerages to obtain sales licenses for bank wealth management and insurance products," leading to an increasing "visibility" of insurance products on brokerage shelves.

Wang Ping (pseudonym), a financial advisor at a leading brokerage, admitted that the proportion of insurance sales in her daily work is quietly increasing.

Now her desk is filled with plans for increasing whole life insurance that used to belong only to insurance agents or bank tellers;

Every quarter-end or during the window period for scheduled interest rate cuts, the pressure of insurance sales assessments comes crashing down. Amid the constant rhythm of annual and quarterly "sprints," Wang Ping can't help but exclaim, "The pressure is too great; during the 'opening red' period, I feel numb."

Her troubles are not unique.

Another employee from a leading brokerage branch revealed that their branch frequently emphasizes insurance KPIs, and under the pressure of performance targets, they have repeatedly chosen to purchase insurance for their family or themselves.

Xinfeng noticed that recently, several brokerages including CITIC Securities, CMS, Ping An Securities, and GF Securities have launched insurance sections on their apps, displayed alongside stocks, funds, and wealth management products.

Various signs indicate that brokerages are gradually moving towards "selling insurance."

Behind this is the transformation and breakthrough of brokerages in wealth management business under operational pressure, as well as a true reflection of the increasingly blurred boundaries of financial institutions in the era of stock competition.

Focusing on "Selling Insurance"

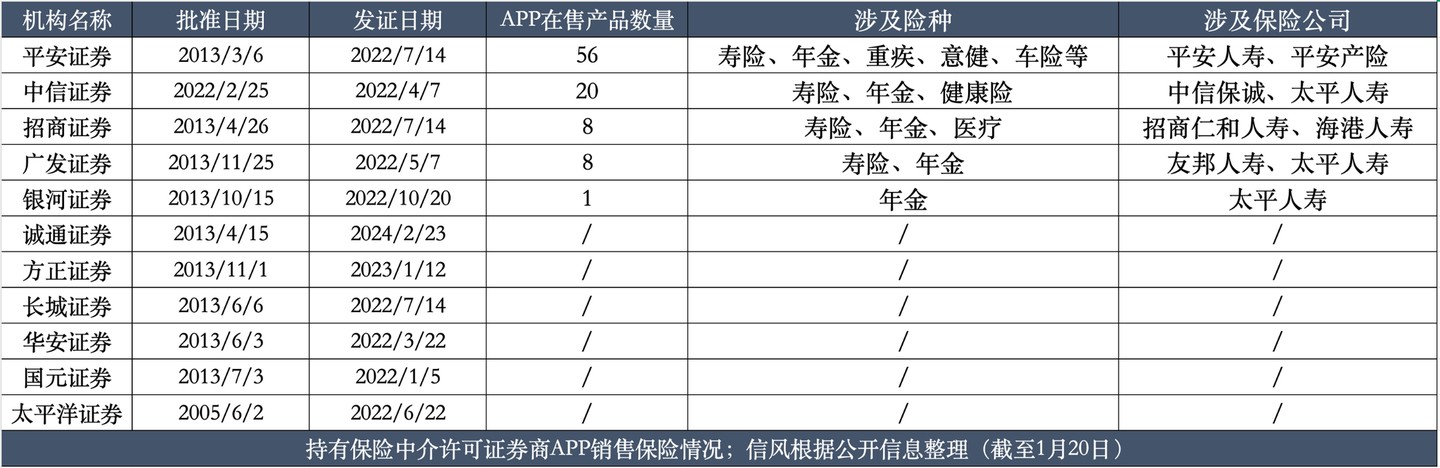

Xinfeng found that after the China Securities Association supported brokerages in obtaining insurance sales licenses in 2025, the number of brokerages holding insurance intermediary licenses issued by the Financial Regulatory Administration has not increased, remaining at 11 as of 2022;

At the same time, a very few brokerages also have insurance brokerage companies with insurance sales licenses to conduct related businesses.

In terms of license numbers, although many frontline employees have felt clear performance pressure, "selling insurance" remains a relatively niche market within brokerage businesses.

The limited number does not hinder the "head start" of existing license holders.

As of now, five leading brokerages, including CITIC Securities, CMS, and Ping An Securities, have taken the lead in launching insurance sections on their self-operated apps.

In terms of product quantity, Ping An Securities and CITIC Securities have 56 and 20 insurance products respectively, while CMS and GF Securities have 8 products;

Although Galaxy Securities has only 1 insurance product for sale, historical records show that the company has previously sold multiple whole life insurance products from New China Life and National Pension Insurance, but these products have recently been discontinued.

Several brokerages focusing on insurance agency sales generally have the "group operation" gene:

For example, Ping An Securities directly lists four sections on the homepage of its app: securities, property insurance, Peking University Medical, and life insurance;

The content displayed in the section, in addition to selected insurance products, also includes investment education consultation channels, covering 1V1 consultations, retirement and education planning, etc

Among major securities firms, Ping An Securities has the richest variety of insurance products:

In addition to savings-type insurance with strong financial attributes such as life insurance and annuities, Ping An Securities has also launched accident insurance, health insurance, children's insurance, travel insurance, and other protection-type insurance products that are closer to daily life, even setting up a dedicated page for pet insurance.

It can be observed that, based on the group's rich product spectrum, Ping An Securities is striving to bring insurance products covering the entire life cycle onto the APP, building a comprehensive insurance sales platform;

This also reflects the overall strategy of Ping An Group, making the securities APP no longer just a single trading channel, but a distribution center for comprehensive financial services.

CITIC Securities and CMS have also launched multiple products related to insurance companies:

For example, CITIC Securities has launched 12 products from CITIC Prudential Life, with the former being 18.45% owned by CITIC Financial Holdings and the latter being 50% owned by CITIC Financial Holdings;

CMS has launched 7 products from China Merchants Renhe Life, with China Merchants Jinling's ownership ratios being 23.55% and 20%, respectively.

This may piece together the two core logics of insurance agency sales by securities firms in the initial stage:

First, focus on selling synergistic products, prioritizing the digestion of internal resources during the initial stage, which can quickly enrich the shelf while reducing integration costs;

Second, place more emphasis on the financial attributes of insurance, apart from Ping An Securities, other securities firms have launched insurance products that are mainly life insurance and annuities, placing more importance on capital appreciation compared to pure risk protection.

In addition, some insurance companies have also begun to pay attention to securities channels. For example, Taiping Life, although not associated with any securities firm, has appeared in the sales lists of multiple securities firms.

This may indicate that, against the backdrop of reform in the insurance and banking channel fee rates and intensified competition, insurance companies are also eager to find new flow outlets.

Of course, the data on the APP does not represent the full picture of insurance agency sales by securities firms.

Some securities institutions have pointed out that the display role of the online insurance section is more significant, and agency sales still have a considerable concentration offline.

Since 2022, CITIC Securities has obtained the industry's only pilot opportunity for insurance agency sales with "corporate certification and branch registration";

CMS and Ping An Securities have respectively had 11 and 6 branch insurance sales qualifications approved.

Xinfeng Consulting found that a certain branch of CITIC Securities in North China sells insurance products that, in addition to those available on the APP, also include life insurance, annuities, and critical illness insurance from companies such as Taikang Life and Zhongyi Life, making the product offerings more diverse than online.

This means that in the "capillary" of offline branches, the cooperation between securities firms and insurance companies has quietly broken through the limitations of group synergy, moving towards a more market-oriented "full shelf" competition.

"Money" Prospects and Challenges

For securities firms, selling insurance is a trend, but it is not easy.

Looking back over a longer timeline, the origins of securities firms selling insurance are not lagging behind banks In 2001, when the insurance and banking channels rapidly expanded, Galaxy Securities also piloted the sale of life insurance through its Shanghai branch, while Xiangcai Securities established an insurance agency subsidiary, and China United Insurance Holdings partnered with three securities firms;

In 2022, the China Securities Regulatory Commission (CSRC) explicitly stated that insurance products could be sold by securities companies, opening the door for brokerages;

However, it wasn't until a decade after the policy breakthrough that CITIC Securities disclosed in 2022 that it had launched insurance agency sales, becoming the only pilot company in the industry approved for insurance and agency "legal person certification and branch registration";

After that year, CMS and Ping An Securities began to gradually obtain qualifications for insurance sales at their branches;

By July 2025, the "28 Measures for High-Quality Development of the Securities Industry" clearly supported brokerages in obtaining insurance sales licenses, prompting major brokerages to intensively list insurance products on their APP shelves.

Why did brokerages wake up early but arrive late?

Long Ge, co-founder and general manager of Zhongtuobang, pointed out that the early insurance sales by brokerages did not scale mainly due to mismatched customer risk preferences and an immature sales system;

For a long time, brokerages faced retail investors who pursued high returns and were accustomed to the fluctuations of K-line charts, while brokerage client managers' expertise in insurance was significantly weaker than that of insurance agents and bank tellers.

However, today, Long Ge pointed out that the operating environment for brokerages has reversed:

On one hand, there is the policy side, with the support of the China Securities Association in 2025 providing a regulatory foundation for brokerages to expand their insurance sales business;

On the other hand, brokerages themselves are under operational pressure, as commission rates have bottomed out, and brokerages need to transform through wealth management to explore new growth points. The 2% commission from insurance agency sales and the continuous cash flow from regular premium products will contribute to stable middle-income.

More importantly, facing the three major channels of insurance sales agents, bancassurance, and insurance brokers, brokerages may not be without "a fighting chance."

The core of this lies in the deep adjustments in the liability side of life insurance in recent years.

Against the backdrop of declining interest rates, insurance companies have begun to reduce the proportion of guaranteed products on the liability side, loosening restrictions on the investment side;

Several leading insurance companies have expressed support for floating income products this year, with low guaranteed ratios in participating insurance frequently occupying the "C position" in recommendations.

Although promoting participating insurance is a trend, such products have complex terms, requiring sales agents to have a thorough understanding of the dividend mechanism and customers to accept a certain degree of income volatility, often resulting in poor sales performance.

However, volatility is "poison" for bank customers accustomed to guaranteed returns, while it is "honey" for stock investors who watch K-lines daily.

Long Ge pointed out that compared to traditional agents and bancassurance channels, brokerages have three core competitive advantages:

First, the risk tolerance of their customer base is high, as stock investors have a strong acceptance of complex products like participating insurance and investment-linked insurance, naturally aligning with the "guaranteed + floating" income model;

Second, the investment advisory team excels in asset allocation, as compared to simply selling products, brokerage investment advisors have a broader perspective, integrating insurance into scenarios like private equity and family trusts, providing cross-cycle planning; Third, the digital trading system is adapted for high-frequency interactions, which outperforms the traditional offline model of agents in terms of user experience and trading efficiency.

In fact, the trust established based on "investment profits" in today's stock market also forms the real foundation for securities firms to sell insurance.

Wang Ping stated that the financial advisors at his branch have achieved good results in insurance sales.

"Some stock investors are not against buying insurance; they just want to see who is selling it," Wang Ping said. "These investment advisors know their core clients very well, and since their previous investment advice has made clients money, clients are also willing to accept insurance recommendations."

However, in the short term, it is still difficult for securities firms to shake the dominant position of banks in selling insurance;

After all, the vast network and depositor base of banks are hard for securities firms to reach, and securities firms also face severe challenges in sales compliance.

Long Ge stated that during the insurance sales process, securities firms may also package insurance as "high-yield financial products," conceal the uncertainty of dividends, or ignore the essence of protection.

Under performance pressure, such actions may become more likely to occur.

In response, regulators have strengthened regulations. For example, the "Measures for the Appropriateness Management of Financial Institution Products," which will be implemented in 2026, requires unified appropriateness management for cross-industry sales.

Long Ge emphasized that the differences in service processes between securities firms and insurance (such as the attribution of claims responsibility and the boundaries between investment advisors and insurance advisors) still need to be refined in collaboration mechanisms.

"Currently, gray areas are concentrated on customer risk assessment across channels and the division of service responsibilities online and offline. If not handled properly, these gray areas may become hotspots for future customer complaints," Long Ge stated.

For securities advisors, the pile of insurance plans on their desks represents both the hope for transformation and a new exam in their careers;

In the tide of financial convergence, whether securities firms can truly shift from "selling products" to "selling services" may determine the ultimate outcome of this breakthrough battle.

Risk warning and disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk.