Risk aversion sentiment rises again, stock markets in the US, Europe, and Asia all decline, global bond market sell-off intensifies, and spot gold rises above 4700 to set new highs

Trump's tariff threat regarding Greenland has reignited global trade tensions, triggering market risk aversion: the MSCI Asia-Pacific Index fell by 0.5%, S&P 500 futures dropped by 1%, the yield on 10-year U.S. Treasury bonds rose by 3 basis points to 4.26%, and spot gold broke through $4,700 per ounce, setting a new historical high. Although some markets, such as South Korea's stock market, showed resilience, investors are closely monitoring the potential escalation of confrontation between the U.S. and Europe, shifting funds towards gold to cope with policy uncertainty

President Trump’s tariff threats regarding Greenland's control have reignited global trade tensions, leading to a stock market retreat and triggering a sell-off in government bonds, as market confidence previously supported by the AI investment boom faces severe tests.

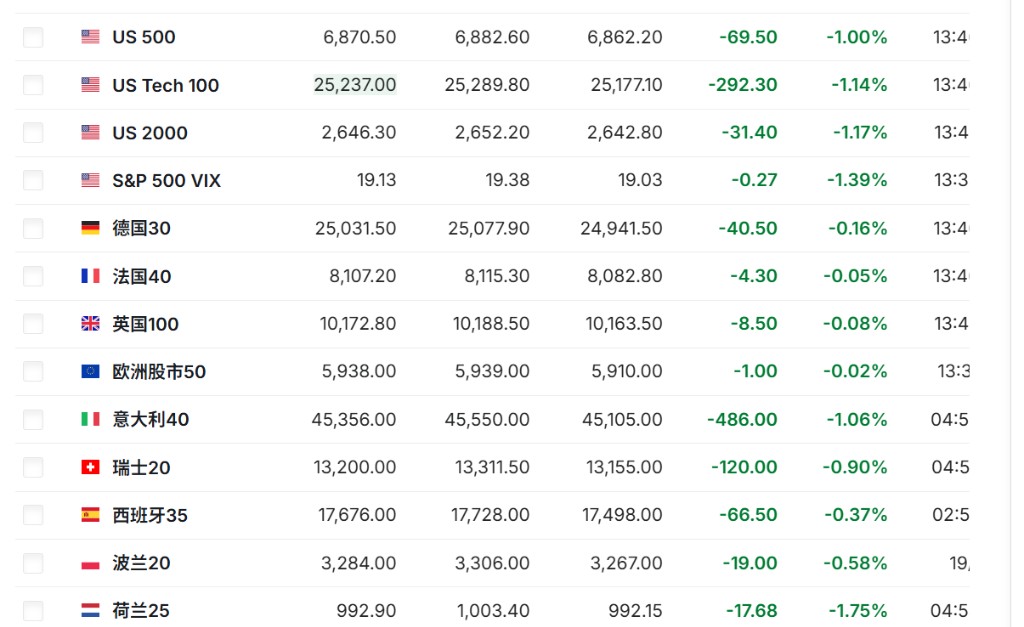

- The MSCI Asia-Pacific Index fell 0.69%, with 9 out of its 11 sub-industry sectors declining. The South Korean stock market experienced a rollercoaster, with the Seoul Composite Index closing down 0.4% at 4885.75 points. The Nikkei 225 Index closed down 1.1% at 52991.10 points. The Tokyo Stock Exchange Index closed down 0.8% at 3625.60 points.

- U.S. stock benchmark index futures opened lower after the holiday, with S&P 500 futures briefly down 1%.

- European stock market futures indicate that the downward trend will continue, following the region's worst single-day performance since mid-November last year.

- Risk aversion has driven global bond yields higher, with U.S. Treasuries leading the global bond sell-off. As fiscal pressures, tariff threats, and concerns over demand for U.S. assets intensify, the yield on 10-year U.S. Treasuries rose 3 basis points to 4.26%. In the Asian market, the yield on Japan's 40-year government bonds rose to 4%, the highest level since its listing in 2007.

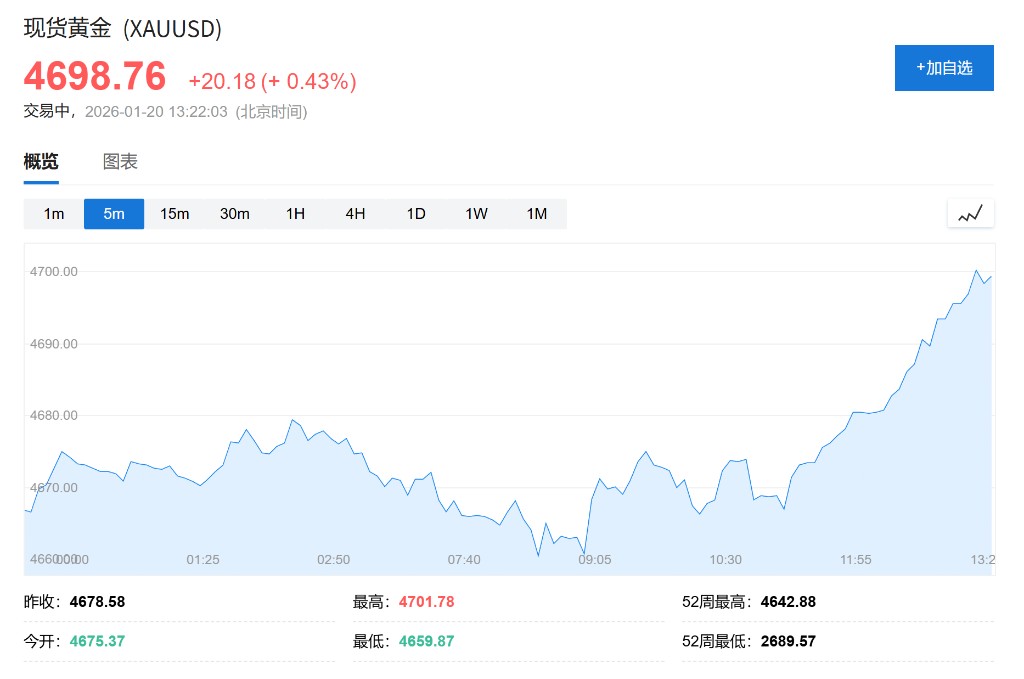

- In commodities, spot gold surpassed $4,700 per ounce, continuing to set record highs. Crude oil and spot silver remained relatively unchanged. In industrial metals, copper prices fell along with most base metals. LME three-month copper futures dropped to $12,900 per ton, marking the third decline in four days. As of the time of writing, copper prices fell 0.29% to $12,949 per ton, retreating from last week's record high of $13,407.

The current market focus is on the further developments of the U.S.-EU standoff and the upcoming World Economic Forum in Davos. Analysts point out that as the independence of the Federal Reserve is questioned and uncertainties from tariff policies grow, investors are turning to safe-haven assets like gold and remain vigilant about future volatility.

The current market direction partly depends on the EU's response. The EU is considering imposing counter-tariffs on U.S. goods worth €93 billion ($108 billion). French President Emmanuel Macron intends to request the activation of the EU's so-called "anti-coercion tool." However, there are divisions within the EU on this matter, with German leader Friedrich Merz stating on Monday that due to Germany's high dependence on exports, the country is less willing to take aggressive countermeasures.

After experiencing the largest annual increase since 2020, the global bond market has shown weak performance at the beginning of the year. Investors are demanding higher yields to compensate for ongoing inflation pressures and increased government borrowing. In addition to rising U.S. Treasury yields, bonds in Australia and New Zealand also fell, and German government bond futures also declined Andrew Ticehurst, senior interest rate strategist at Nomura Australia in Sydney, stated that the long end of the global sovereign bond curve appears very fragile. He pointed out that uncertainties surrounding the independence of the Federal Reserve, speculation about Rick Scott potentially becoming the next Fed Chair, and possible Supreme Court rulings on some tariffs imposed by Trump have intensified market concerns about the budget situation. Additionally, demand for Japan's 20-year government bonds was below the 12-month average, further confirming the weakness in the bond market.

13:06

Spot gold has risen above $4,700 per ounce, continuing to set record highs.

12:50

New York gold futures broke through $4,700 per ounce, reaching a new historical high, up 2.3% for the day.

12:42

The Indian rupee fell below 91 against the dollar for the first time since December 17 of last year.

12:41

Spot gold briefly rose to $4,691.57 per ounce, continuing to set record highs.

12:40

The yield on Japan's 20-year government bonds rose by 13.5 basis points to 3.39%.

12:29

India's Nifty IT index fell by 1.3%.

12:27

The yield on Japan's 10-year government bonds rose by 8 basis points to 2.350%.

12:12

The yield on Japan's 30-year government bonds rose by 10 basis points to 3.71%.

11:37

Thailand's SET index expanded its intraday gains to 1%.

11:36

Japan auctioned 20-year government bonds with a bid-to-cover ratio of 3.19, compared to the 12-month average of 3.34.

11:30

The Philippine stock market fell by 1% during the day