Completely replace the Federal Reserve? After mortgage QE, Trump wants to set a "10% cap" on credit card interest rates

Trump calls for a cap on credit card interest rates at 10% starting January 20, 2026, for one year, aimed at protecting consumers from "extortion." However, the plan lacks implementation details and faces legal obstacles. Prominent investor Bill Ackman warned that this move is "wrong" and could lead banks to cancel credit card services, forcing consumers to turn to payday loans

Following the market shock in the mortgage sector, U.S. President Donald Trump has once again turned his attention to the consumer credit market, calling for strict controls on credit card interest rates.

On Friday, Trump posted on the social media platform Truth Social, urging that the cap on credit card interest rates be set at 10% starting January 20, 2026, for a duration of one year. He claimed that this move aims to prevent the American public from being "extorted" by credit card companies. Although this proposal echoes his commitments during the 2024 campaign, the statement did not provide any specific details on how to implement the plan or enforce compliance among companies.

The news immediately sparked strong reactions in the financial sector. Billionaire hedge fund manager Bill Ackman, who previously supported Trump's campaign, publicly expressed his opposition, stating that it is a "mistake." Ackman warned that if interest rates are forcibly lowered, leading lending institutions to be unable to cover potential losses and achieve reasonable equity returns, banks would have to massively cancel consumers' credit card services. This would force millions of consumers to turn to unregulated "usury" markets, facing worse borrowing terms than those in the current system.

Although the White House confirmed the president's intention to limit rates on social media, it did not respond to media requests for comments on the implementation details. So far, major issuing institutions, including JP Morgan, Bank of America, Citigroup, American Express, and First Capital, have not commented on the matter. Market analysts generally believe that without Congressional legislative support, a purely administrative appeal may struggle to be enforced legally.

Wall Street Warns: Artificial Price Limits May Trigger Credit Tightening

The core concern in the financial markets regarding Trump's radical proposal is the potential side effects it may cause. Bill Ackman's comments on the social media platform X represent the general view of institutional investors: artificially lowering interest rates will disrupt the risk pricing mechanism.

Ackman pointed out, "If credit card lenders cannot charge rates sufficient to cover losses and achieve equity returns, they will cancel consumer cards." He further elaborated on the potential chain reaction, where millions of consumers, rejected by the formal financial system, may ultimately have to turn to informal lending channels, facing higher rates and worse terms.

This concern is not unfounded. Credit card businesses typically come with high default risks, and banks cover bad debt losses through higher interest income. If interest rates are forcibly capped at 10%—a level far below the average annual interest rates of many current credit cards—banks may significantly tighten credit standards to avoid risk, leading to a liquidity crisis in the credit market, directly impacting the U.S. economy that relies on credit consumption.

Common 20%-25%! The High-Interest Situation of U.S. Credit Cards

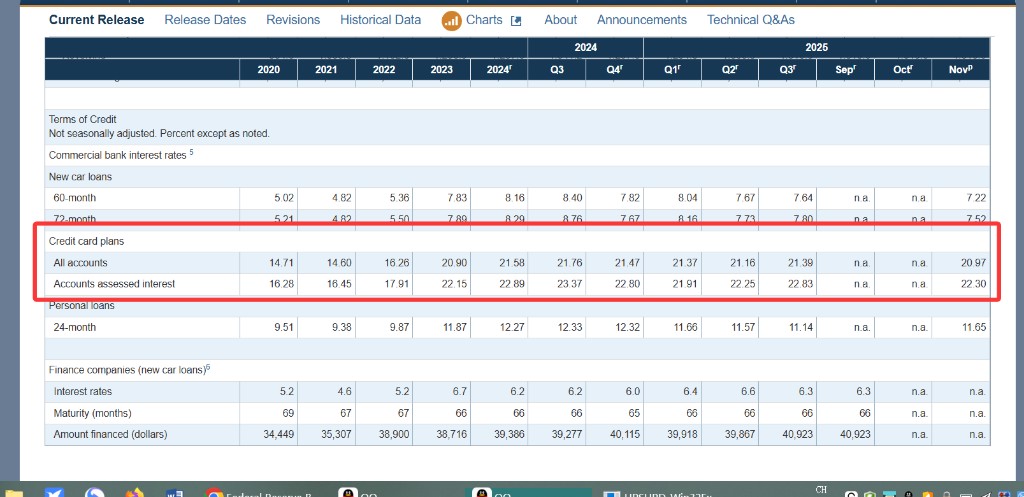

The reason Trump's proposal has shocked the market is that the current U.S. credit card market is in a "high-interest environment," with a significant gap between the actual interest rates and Trump's requested "10% red line." According to the latest data from authoritative institutions, market interest rates generally range between 20% and 25%, which means that the "10% cap" requirement would directly "halve" existing rates, or even cut them more:

- Actual burden on debtors: approximately 22.8%

According to the Federal Reserve's latest G.19 Consumer Credit Report, for those "debt" accounts (Accounts assessed interest) that fail to pay in full and actually need to pay interest, the average annual interest rate has remained at a high level of about 22.8%. This data best reflects the real pain points of ordinary borrowers.

- New card application threshold: approximately 24% - 25%

For those looking to apply for a credit card now, the interest rates are even higher. According to monitoring data from the well-known financial services platform LendingTree, by the end of 2025 to early 2026, the average promotional annual percentage rate (APR) for new credit cards is about 24%, at a historically high level.

- Overall average: approximately 21%

Even when accounting for those accounts that do not incur interest due to full repayment, the Federal Reserve data shows that the average listed interest rate for commercial bank credit card programs is as high as about 21%.

Analysis indicates that the combination of banks' funding costs and considerations of economic recession and default risk has formed the current market pricing. Forcing the average interest rate of around 23% down to 10%, without fiscal subsidies, almost breaks the profitability logic of issuing institutions.

Political Game: A "Blank Check" Lacking Legislative Support?

Analysts pointed out during the campaign that setting a national interest rate cap typically requires legislative approval from Congress, rather than being directly achieved through a presidential executive order.

Democratic Senator and member of the Senate Banking Committee Elizabeth Warren sharply criticized Trump's statement.

According to reports, Warren stated: "Begging credit card companies to 'do the right thing' is a joke. I said a year ago that if Trump was serious, I would work to pass a bill to limit interest rates." She believes that Trump's call is meaningless without a formal bill passed by Congress and accused Trump of actually trying to undermine the U.S. Consumer Financial Protection Bureau (CFPB), which is responsible for protecting consumers.

Currently, there are indeed bipartisan legislative attempts in Congress regarding high-interest rate issues. For example, Democratic Senator Bernie Sanders and Republican Senator Josh Hawley have proposed a bipartisan bill aimed at setting a credit card interest rate cap at 10%. In the House of Representatives, Democratic Congresswoman Alexandria Ocasio-Cortez and Republican Congresswoman Anna Paulina Luna have also proposed similar bills. However, Trump did not explicitly express support for any of the specific bills mentioned in his latest post, making the path for his policy implementation even more unclear