The results of the U.S. Section 232 tariff investigation will be released on Saturday! Silver, platinum, and palladium will face "significant uncertainty."

Citigroup believes that without tariffs, metals will flow out of the United States to other regions, alleviating the current extremely tight market conditions and lowering London spot prices. In a tariff scenario, if tariffs are imposed, a 15-day implementation window will trigger a "rush to ship," driving up U.S. benchmark prices and futures premiums. After the tariffs are imposed, a reduction in imports will only improve supply in non-U.S. regions, which will then relieve pressure on London prices

The results of the U.S. critical minerals Section 232 tariff investigation are expected to be announced this Saturday (January 10), and this decision will have a significant market impact on Comex silver and platinum group metal prices.

According to news from the trading desk, on January 8, Citigroup's Kenny Hu research team believes that in the absence of tariffs, metals will flow out of the U.S. to other regions, alleviating the current extremely tight market conditions and lowering London spot prices.

In a tariff scenario, there will be an implementation window of about 15 days, which will trigger a brief behavior of "rushing shipments to the U.S.," thereby pushing up U.S. benchmark pricing and exchange futures premiums (EFP) further before the tariffs are imposed, while after the tariffs, imports will decline, at which point the supply of non-U.S. metals will improve and the pressure on London spot prices will ease.

The investigation results were originally scheduled to be submitted on October 12, 2025, and President Trump has 90 days to take action, meaning the deadline is around January 10 (this Saturday). However, Citigroup believes that given the large number of products involved, President Trump's actions may be indefinitely delayed, which means that during this period, silver and platinum group metal prices are likely to continue rising.

As of January 7, EFP pricing shows that the market expects the platinum tariff rate to be about 12.5%, palladium about 7%, and silver about 5.5%. These implied tax rates reflect market uncertainty amid high volatility.

(Expected tariff rates for EFP pricing)

(Expected tariff rates for EFP pricing)

Silver Likely to Avoid Tariffs, May Face Price Correction

Due to the U.S. reliance on imported silver, the Citigroup research team leans towards a base scenario of no tariffs on silver, even if tariffs are imposed, exemptions will be granted to major exporting countries such as Canada and Mexico.

In a no-tariff scenario, silver prices may face temporary downward pressure.

From the historically high leasing rates, it can be seen that currently, outside the U.S. market, silver is in a severe physical shortage state. The absence of tariffs will incentivize metals to flow out of the U.S., alleviating global market tensions.

(Leasing rates remain at historically high levels, indicating extremely tight supply conditions in the physical market)

(Leasing rates remain at historically high levels, indicating extremely tight supply conditions in the physical market)

It is noteworthy that the timing of the tariff decision may overlap with the annual index rebalancing window. Wall Street Journal mentioned that the Bloomberg Commodity Index (BCOM) annual rebalancing will begin after the market closes on January 8 and continue until the 14th.

Citigroup expects this will lead to an outflow of about $7 billion in silver, equivalent to about 12% of Comex positions. At that time, improved market liquidity and price weakness caused by outflows from the U.S. may also temporarily suppress investment demand (such as ETFs)

Palladium Most Likely to Face High Taxes, Platinum's Outlook Uncertain

The Citigroup research team believes that among the three metals, palladium is the most likely to be subject to tariffs. There are two main reasons:

- Potential to Increase Domestic Supply in the U.S.: The U.S. has the potential to increase domestic supply of palladium by enhancing its domestic nickel or platinum mining and smelting activities, which can lead to increased palladium production. This reduces reliance on external imports, making tariffs more feasible from an industrial policy perspective.

- Strong Industry Lobbying: The political lobbying power of relevant domestic industries (such as automotive catalytic converter manufacturers or mining companies) is strong, and they may support tariffs to protect local industries or stimulate domestic investment.

Therefore, the basic assumption of the report is that palladium will face high tax rates, such as 50%. The research report emphasizes that if high tariffs are imposed on palladium, short-term prices will soar, and the cost of palladium imports in the U.S. will rise sharply, pushing up U.S. benchmark futures prices and EFP (the difference between spot and futures prices).

In the long term, this will create a "dual market" between the U.S. market and other regional markets. It will fundamentally change trade flows and pricing logic. This means:

The U.S. Becomes a Price High Ground: Due to tariff barriers, U.S. palladium prices (such as NYMEX futures) will systematically and persistently be higher than prices in major global pricing centers like London.

Premium Reflects Tariff Costs: This price difference (premium) will roughly reflect the tariff rate plus related logistics and financing costs, becoming the "local market premium" that U.S. buyers must pay.

Changes in Trade Flows: Global palladium will tend to flow to regions with no tariffs or low tariffs, while the U.S. market will rely more on domestic supply and a few exempted import sources (such as possible Canada and Mexico).

Regarding whether platinum will be subject to tariffs, the Citigroup research team expressed uncertainty, stating it is "like flipping a coin."

The U.S. is more dependent on platinum imports, and the potential for increasing domestic supply is lower, which reduces the likelihood of tariffs. However, platinum may still be subject to tariffs alongside palladium.

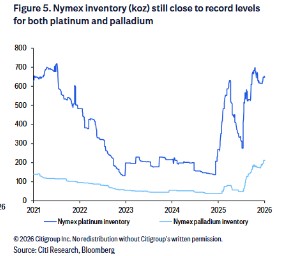

It is worth noting that the inventory of platinum and palladium on the New York Mercantile Exchange remains close to historical highs. Recently, there has been strong inflow into PGM ETFs, exacerbating physical tightness. CFTC-managed fund positions have turned net long for the first time since 2022.

(Inventory levels of platinum and palladium on the New York Mercantile Exchange remain close to historical highs)