480 billion, "Luckin Coffee's operator" Li Hui bets, the last of the "domestic GPU four little dragons" has gone public

ILUVATAR COREX successfully went public, opening at HKD 190.2, up 31.54% from the issue price, with a market capitalization of HKD 48.37 billion. The company received over 100 times subscription, with 18 cornerstone investors subscribing a total of HKD 1.583 billion. ILUVATAR COREX is one of the first general GPU companies in the country, and although it lags behind its peers in market attention, its financial data shows strong performance. Dazhong Capital is the largest investor, holding 20.62%

Another general GPU has landed on the Hong Kong stock market!

ILUVATAR COREX opened at HKD 190.2, up 31.54% from the issue price of HKD 144.60, with a total market capitalization of HKD 48.37 billion.

What astonished the market is that the company received a subscription multiple of over 100 times, with 18 well-known cornerstone investors subscribing for a total amount of HKD 1.583 billion.

ILUVATAR COREX is the fourth general GPU company to go public recently, following Moore Threads, Muxi, and Birun, which have successively listed on the A-share and Hong Kong stock markets.

ILUVATAR COREX is one of the earliest companies in China to launch general GPUs. Unfortunately, it "rose early but arrived late," lagging behind the aforementioned peers in terms of capital progress and social attention.

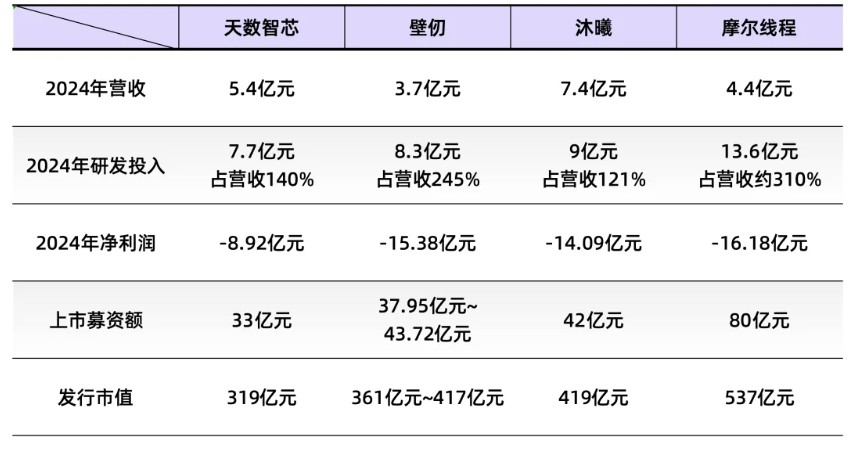

However, in recent years, the company has shown strong financial data: by June 2025, ILUVATAR COREX had delivered over 52,000 general GPU products; its revenue for 2024 is expected to be HKD 540 million, on par with Moore Threads and Muxi; the Tianhai used for AI training has gone through three iterations, supporting the operation of AI large models with hundreds of billions of parameters; the top five customers account for less than 40% of revenue, while Moore Threads exceeds 80%.

The investors behind ILUVATAR COREX are also of great interest, with Dazhang Capital holding a 20.62% stake, making it the largest external institutional shareholder. It previously led a deep transformation of Luckin Coffee, turning it into a leading coffee brand in China. With its early involvement and strong controlling philosophy, it has had a significant impact on the development of ILUVATAR COREX.

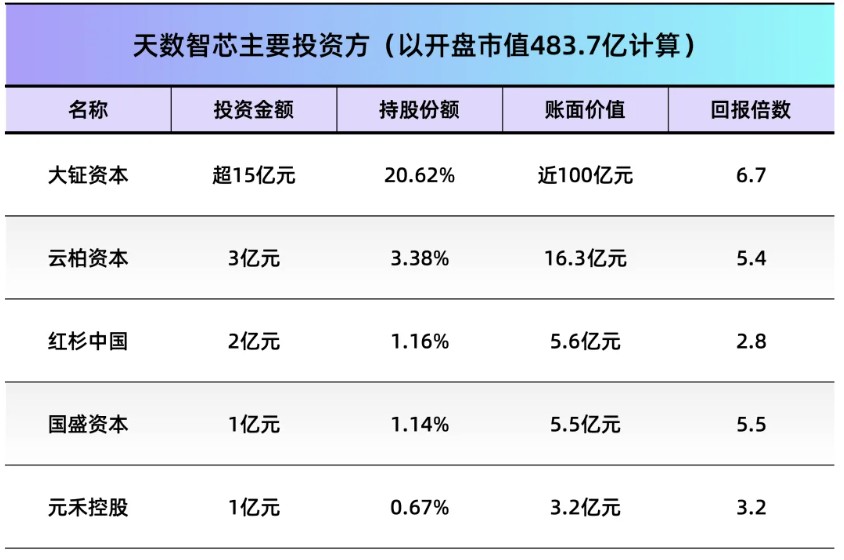

Based on the opening market capitalization of HKD 48.37 billion, as the largest investor, Dazhang Capital (20.62%) holds nearly HKD 10 billion. Other major external shareholders include Yunbai Capital (3.38%), Sequoia China (1.16%), Guosheng Capital (1.14%), and Yuanhe Holdings (0.67%), with approximate holdings of HKD 1.63 billion, HKD 560 million, HKD 550 million, and HKD 320 million, respectively. The return multiples for these five investment institutions are 6.7, 5.4, 2.8, 5.5, and 3.2, respectively.

The founder is a junior of Huang Zheng, and the core team has undergone a second transformation

The founder of ILUVATAR COREX is Li Yunpeng. In 2002, after graduating from the Computer Science Department of Nanjing University, he went to the University of Wisconsin-Madison in the United States to pursue a master's degree in computer science. He is a true "brother" of Huang Zheng, the founder of Pinduoduo—Huang Zheng graduated from the same master's program in 2002. In 2005, Li Yunpeng completed his studies and chose to join Oracle's database department, where he worked for ten years.

During his time at Oracle, he led a multinational team spanning five time zones and participated in the release of six major versions of the Oracle database from 10g to 12c. This experience gave him a deep understanding of the importance of foundational software for a country's technological independence and planted the seeds for his future entrepreneurship.

In 2015, Li Yunpeng made an important decision: to return to China to start a business. At that time, China was highly dependent on overseas technology in the field of foundational software, which made him see opportunities and feel a sense of mission. On December 29 of the same year, ILUVATAR COREX was officially established in Nanjing Software Valley However, unlike many entrepreneurs eager to prove themselves, Li Yunpeng chose a seemingly "conservative" path—first developing a software platform before moving on to chip hardware. This decision raised considerable skepticism at the time: since the goal was to make chips, why not dive in directly? But Li Yunpeng had his own considerations.

In 2015, the GPU industry was still in its infancy; directly making chips was not only highly risky but also extremely difficult in terms of financing. Accumulating customers and technical experience through a software platform and waiting for the right moment to shift to hardware was a more pragmatic choice.

The turning point occurred in 2018.

That year, the domestic AI industry developed rapidly, leading to a surge in GPU demand and a significant improvement in the financing environment. Through three years of operating the software platform, TianShu ZhiXin had accumulated ample customer resources and technical experience. Li Yunpeng was elected one of the "Top Ten Outstanding Youths of Nanjing," and the company officially launched its general-purpose GPU design and completed its Series A financing that year. The strategic shift from software to hardware marked TianShu ZhiXin's entry into the fast lane of development.

In 2019, TianShu ZhiXin released its first AI chip, Iluvatar CoreX I, which was three years ahead of the later renowned Moore Threads.

In 2021, the company released its cloud GPGPU chip, TianYuan Gen 1, which was hailed as "the first fully self-developed general-purpose GPU in the country."

With the earliest product releases and the fastest technological breakthroughs, TianShu ZhiXin should have become a darling of the capital market, but reality was not so.

Compared to competitors like Moore Threads and MuXi, TianShu ZhiXin did not receive as much capital favor at the time, and the founder's background may have been a key factor. Zhang Jianzhong of Moore Threads had previously served as a global vice president at NVIDIA, while Chen Weiliang of MuXi came from AMD; their "big company halo" naturally attracted capital's attention. Although Li Yunpeng had a technical background, his experience with Oracle databases had no direct connection to the GPU field, which somewhat affected capital confidence.

On May 27, 2021, TianShu ZhiXin faced its biggest upheaval since its founding. Just as the company's first GPU chip was entering mass production and a critical commercialization phase, founder Li Yunpeng stepped down, with Diao Shijing taking over as chairman and general manager.

Diao Shijing's background was quite unique: he had served as the director of the Electronic Information Department of the Ministry of Industry and Information Technology and co-president of Tsinghua Unigroup, possessing deep political and enterprise resources as well as industry management experience. This personnel change was driven by investors like DaZheng Capital reassessing the company's strategic direction—during the critical period of commercialization and financing, a management team with government backgrounds could bring more policy support and industry resources.

However, Diao Shijing's tenure was not long. In 2022, due to personal reasons related to an investigation involving Tsinghua Unigroup, Diao Shijing exited the management team of TianShu ZhiXin. The board was adjusted again, with the finance-background Gai Lujing serving as chairman and CEO, and the technology-background Sun Yile leading core research and development. Gai Lujing has approximately 17 years of financial and investment experience, having held executive positions at PwC, Deloitte, and other institutions Sun Yile has 14 years of GPU chip design experience and previously served as a senior manager at AMD.

Two management changes are a significant test for any startup. However, TianShu ZhiXin has not only continued to progress but has also made breakthroughs in products and markets.

In 2023, TianShu ZhiXin launched the TianHeng Gen 2, while the TianHeng Gen 3 is set to enter mass production in 2026, with a significant performance upgrade. At the same time, it has also launched another series, ZhiKai, which has gone through two iterations for AI large model inference scenarios. To date, TianShu ZhiXin has formed two parallel product lines: AI training TianHeng and AI inference ZhiKai.

Li Hui Aiming to Recreate a "Luckin" in the GPU Field?

Among the shareholders of TianShu ZhiXin, DaZhang Capital is an unavoidable name. This investment firm, founded by Li Hui in 2017, holds a 22.92% stake, making it the largest external institutional shareholder, second only to the founding team’s 23.61%.

Li Hui's investment history is legendary. Before founding DaZhang, he led Warburg Pincus in the Asia-Pacific region, overseeing a series of significant investments in companies such as Shenzhou Car Rental, Red Star Macalline, and Intime Retail. In 2017, he established DaZhang Capital with the slogan "Investment Drives Change," aiming to create "China's KKR, Warburg Pincus, and Blackstone."

DaZhang is most renowned for its involvement with Luckin Coffee. Before the financial fraud scandal at Luckin Coffee, DaZhang became its largest external shareholder through multiple investments; after the scandal, DaZhang again invested to become the controlling shareholder of Luckin Coffee, leading it out of the mire to become one of China's largest coffee brands. In April 2025, Li Hui returned to the Luckin board and assumed the role of chairman.

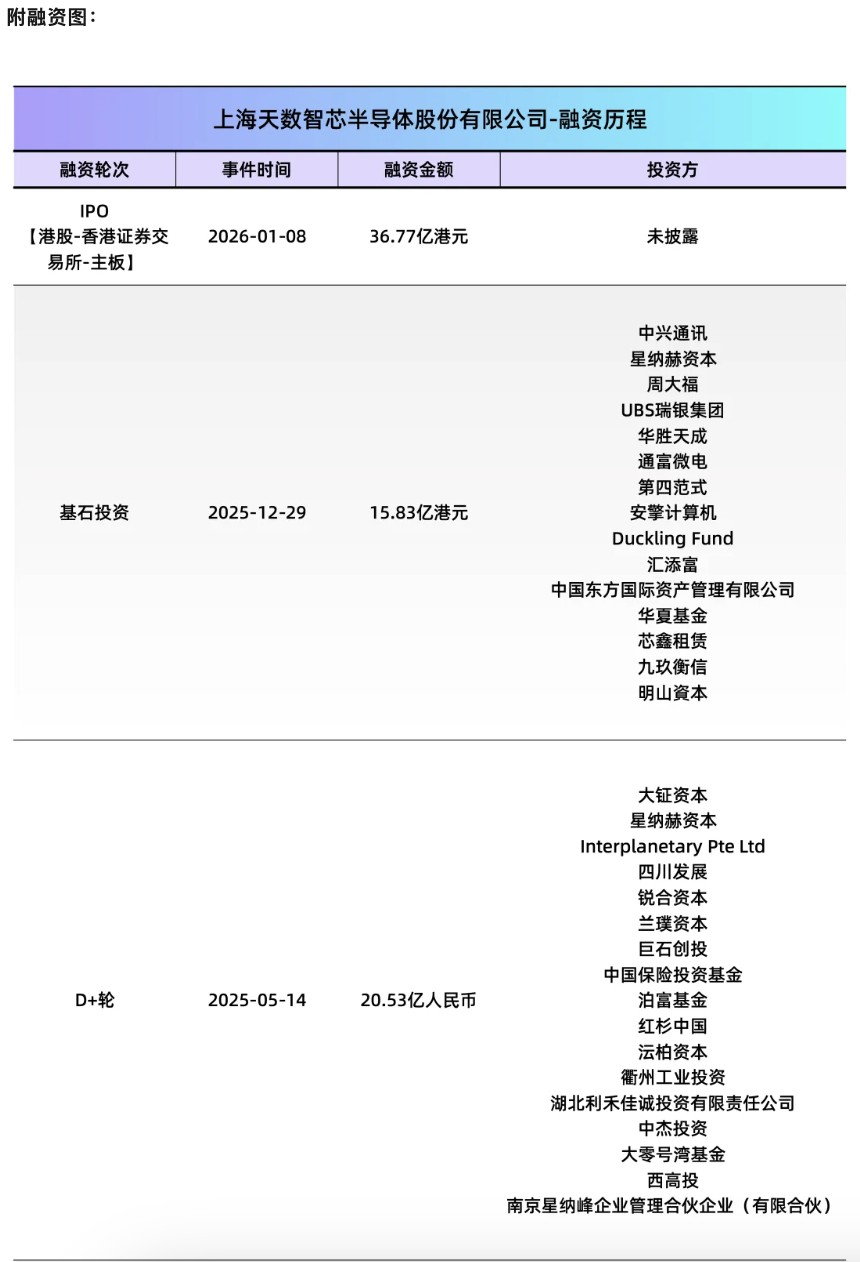

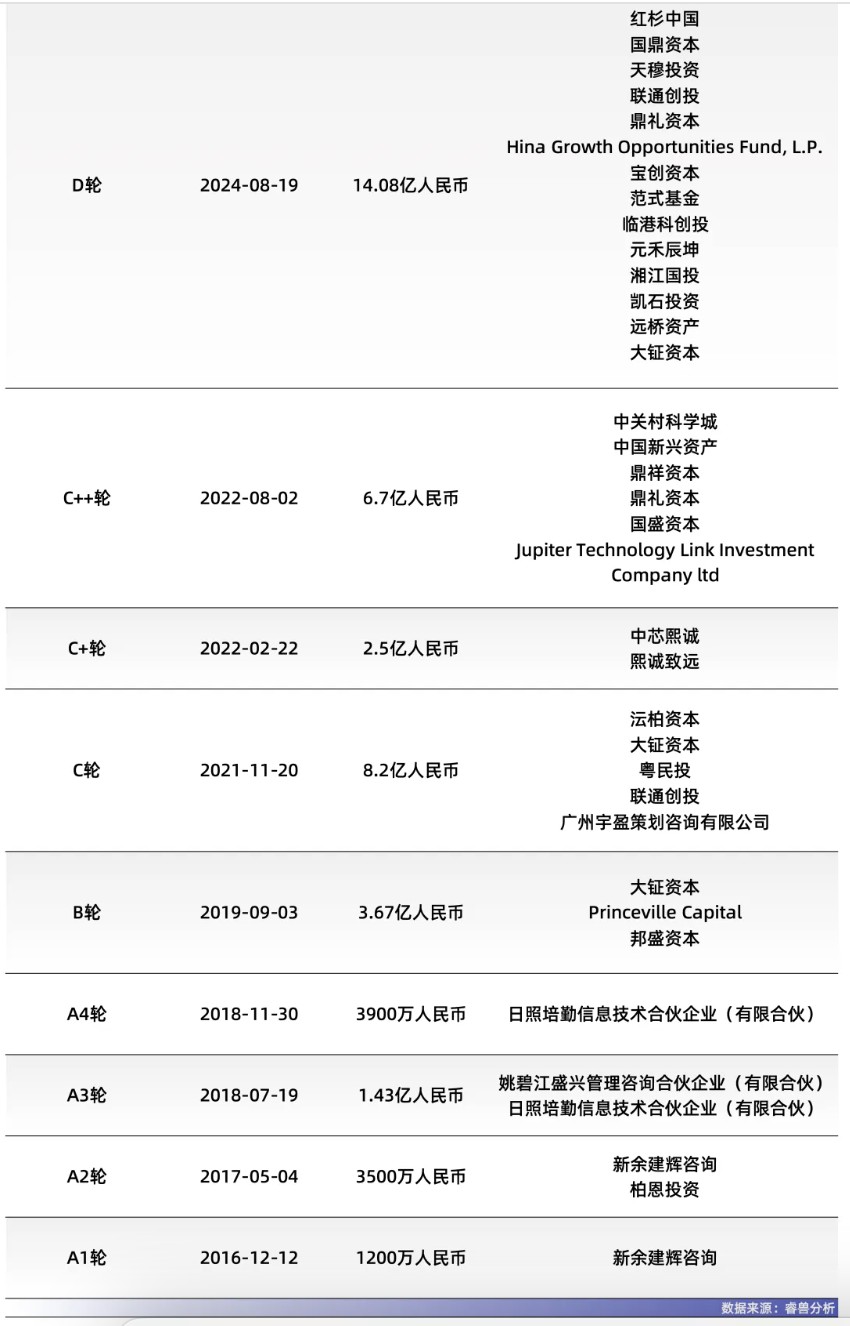

In the same year DaZhang was founded, it completed its early investment in TianShu ZhiXin through its affiliated company Xinyu Jianhui, with an initial investment of nearly 30 million yuan, making Xinyu Jianhui the first investor in TianShu ZhiXin. In the following years, DaZhang continued to provide deep support: investing 200 million yuan in the B round in 2019, over 400 million yuan in the C round in 2020, and adding over 1 billion yuan in the D and D+ rounds from 2023 to 2025. Cumulatively, it has invested over 1.5 billion yuan, witnessing the company's growth from an initial 68 million yuan to a valuation of 12 billion.

DaZhang's investment strategy has three notable characteristics: active involvement in management with strong influence; resource empowerment. Whether in Luckin Coffee or TianShu ZhiXin, this is a typical approach of private equity investment. However, it is uncommon in past Chinese VC/PE and technology investments to intervene strongly in management when a company faces issues and changes its leadership. Additionally, the Asian culture often prefers to be the head of a chicken, coupled with the practical difficulties of lacking experienced professional managers, has led to many failures in changing CEOs and chairpersons in China. DaZhang has successfully achieved a soft landing in both cases, providing a good example for China's private equity investment.

DaZhang chose to invest early in the development of both Luckin and TianShu ZhiXin, gaining significant power to influence management decisions through continuous investments. Moreover, it actively promotes management restructuring. At Luckin Coffee, Da Chan led the power transition from the era of Lu Zhengyao to that of Guo Jinyi; at ILUVATAR COREX, Da Chan similarly facilitated two management changes from Li Yunpeng to Diao Shijing, and then to Gai Lujiang.

In terms of resource empowerment, Da Chan deeply optimized the supply chain and store management for Luckin Coffee; for ILUVATAR COREX, the empowerment focused on "investment + technology + market," supporting key technology route decision-making, assisting in the introduction of high-end R&D talent, and helping to connect with industrial clients and government resources.

From the perspective of investment returns, Da Chan is undoubtedly the biggest winner from ILUVATAR COREX's listing. Based on an opening market value of 48.37 billion, Da Chan's 20.62% (post-IPO) stake is valued at nearly 10 billion yuan. Compared to a cumulative investment cost of 1.5 billion yuan, the expected return multiple is approximately 6.7 times.

As ILUVATAR COREX progresses to Series C and D rounds, more well-known investors have entered, such as Shanghai State-owned Assets Guosheng Capital in Series C, and Sequoia China and Yuanhe Holdings in Series D.

It is worth mentioning that Sequoia China has successfully backed all "domestic GPU four little dragons," with Moore Threads and Muxi already listed on the A-share Sci-Tech Innovation Board, and ILUVATAR COREX also successfully completing its Hong Kong IPO. However, it is regrettable that Sequoia China participated in early investments at the inception of Bilan in November 2019 but exited in December 2019.

From the perspective of post-listing equity, ILUVATAR COREX's holding platform accounts for 21.25%, Da Chan Capital's holding platform 20.62%, Hainan Shuxin 6.76%, and Yunbo Capital 3.38%, making them some of the larger shareholders.

Now, with the listing on the Hong Kong stock market, the market's recognition confirms Da Chan's judgment. Over 100 times subscription multiple, endorsements from 18 cornerstone investors, and 1.583 billion Hong Kong dollars in cornerstone investments all indicate the capital market's confidence in ILUVATAR COREX's prospects.

The First Domestic Company to Mass Produce General GPUs

The term "first" repeatedly appears in the narrative of ILUVATAR COREX: the first to achieve mass production of GPU chips, the first to achieve dual mass production of training and inference, and the first to achieve full-stack self-research. These "firsts" are supported by solid financial and operational data.

In 2021, ILUVATAR COREX released its first product, Tianhai Gen 1, which is the first domestic general GPU chip and achieved mass production and shipment. In comparison, Moore Threads mass-produced its first general GPU chip "Sudi" in 2022.

From 7,800 units in 2022 to 16,800 units in 2024, and then to 15,700 units in the first half of 2025, the shipment volume has doubled.

As of June 2025, ILUVATAR COREX has cumulatively delivered over 52,000 general GPU products, serving over 290 clients and completing over 900 actual deployment applications What is more noteworthy is the optimization of the customer structure: the revenue share of the top five customers decreased from 94.2% in 2022 to 38.6% in the first half of 2025, while the total number of customers increased from over 10 in 2022 to 106 in the first half of 2025. This indicates that the company has broken free from its reliance on a few large clients and established a healthier customer ecosystem.

In contrast, the top five customers of Moore Threads and Muxi account for over 75% of their revenue.

On the technical side, TianShu ZhiXin has built a fully autonomous technology system covering the entire chain from chip architecture, instruction set to core operators and software stack. On the hardware side, the TianHui series focuses on AI model training, having completed three iterations from Gen 1 to Gen 3, with single cards supporting the operation of large models with billions of parameters, and performance increasing linearly during cluster deployment, with accuracy differences controlled within 0.6%; the ZhiKai series focuses on AI inference, optimizing for low latency and high throughput, with actual performance reaching 2-3 times that of similar products on the market.

On the software side, the company's self-developed full-stack suite includes core components such as compilers and drivers, deeply adapted to mainstream frameworks like PyTorch, TensorFlow, and PaddlePaddle, and compatible with both x86 and ARM architectures. This "cloud-edge integration, training-inference synergy" capability for full-scenario coverage makes TianShu ZhiXin one of the few domestic general GPU manufacturers capable of providing fully self-developed and cross-platform compatible solutions.

Financial data also shows a positive trend. From 2022 to 2024, the company's revenue increased from 189 million yuan to 540 million yuan, with a compound annual growth rate of 69%. Although still in a loss position, the net loss rate decreased from 292% in 2022 to 165% in 2024, indicating steady improvement in profitability.

From 2022 to 2024, the cumulative R&D investment reached 1.845 billion yuan, with R&D investment accounting for over 140% of revenue during the same period, which is less than that of Moore Threads and Muxi (over 600% and 250%, respectively).

The revenue structure is optimizing: the revenue share of AI computing power solutions increased from 0.4% in 2022 to approximately 30.8% in 2024, as the company upgrades from simply selling hardware to a more customer-retentive "hardware + service" model.

Compared to competitors, TianShu ZhiXin's advantage lies in being more "pragmatic." Moore Threads and Muxi have larger financing scales and stronger brand effects, but TianShu ZhiXin leads in dimensions such as product mass production capability, customer base, gross margin, and speed of loss improvement.

Achieving the most product deliveries with relatively less financing and completing the verification from technological breakthroughs to business closure in the most pragmatic way.

Thus, all four "domestic GPU small dragons" have now entered the capital market, marking the end of the first round of "positioning competition" driven by financing and technological breakthroughs. With the listing of TianShu ZhiXin, it also outlines different growth paths for local players: from TianShu ZhiXin's "pragmatic mass production" and "capital operations" to the "star halo" of Moore Threads and Muxi The stories of each company reflect the difficult balance between technology, capital, and commercialization in the early stages of the industry, despite their high-profile approaches.

Now, the "seating" in the capital markets of the four companies has become apparent: Wallen, ILUVATAR COREX have market capitalizations of 90 billion and 40 billion, respectively, while Muxi and Moore Threads have reached as high as 300 billion on the STAR Market. However, going public is not the end; it is merely a phase victory and ranking in the first stage of the capital market competition.

The ranking of market capitalization has been established, but the brutal competition determining its long-term trend—namely, revenue growth and profitability—has just entered the deep waters. In the next phase, the battlefield will shift from PPT and financing amounts to a comprehensive contest of product performance, mass production scale, ecosystem building, and sustainable profitability. The market will vote on true product strength with orders, and market capitalization will fluctuate dramatically and be re-ranked under the scrutiny of financial reports.

It is worth noting that the situation is far from settled, and the dimensions of competition are diversifying. The "Four Little Dragons" primarily develop GPGPU for the general market, while companies like Suiruan Technology and Kunlun Core focus more on serving the internal ecosystems and cloud businesses of the giants behind them. If the collective IPO of the "Four Little Dragons" marks the end of the first round of races for independent startups, then next, a multidimensional showdown will fully unfold between the "general market" breakthroughs of independent manufacturers and the "ecological closed-loop" deepening of companies under the giants.

The path of China's Nvidias is destined to be a marathon with different paths, testing comprehensive strength. The whistle of capital is just the beginning; true endurance and speed will be revealed in the long journey of commercial realization.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk