"The first stock of domestic large models" KNOWLEDGE ATLAS faced a risk of surge on its first day of listing: Can model iteration × ecological flywheel drive growth?

Soochow Securities stated that as a Tsinghua University system unicorn, KNOWLEDGE ATLAS maintains its technological leadership through continuous upgrades (iterations) of its self-developed GLM architecture; it attracts millions of developers using open-source strategies, supplemented by an AI toolchain to enhance user stickiness (flywheel), thereby reducing customer acquisition costs and driving exponential growth in API call volume. This model aims to convert technological potential into cloud-based commercial monetization, supporting high growth expectations

As a Chinese artificial intelligence unicorn transformed from the Computer Science Department of Tsinghua University, KNOWLEDGE ATLAS officially landed on the Hong Kong Stock Exchange, becoming the "first stock of domestic large models."

On January 8, KNOWLEDGE ATLAS was officially listed on the main board of the Hong Kong Stock Exchange, with an issue price set at HKD 116.2. Although the stock price briefly fell below the issue price at the opening, it quickly rebounded and turned positive, rising over 10% at one point during the trading session. As of the time of publication, KNOWLEDGE ATLAS's stock price was HKD 130, up 12%, with a total market capitalization of HKD 57.4 billion. The public offering portion of this IPO was oversubscribed by more than 1,159 times, demonstrating the high enthusiasm of retail investors for this rare AI target, while the international offering portion was also oversubscribed by over 15 times.

This listing serves as a barometer for the entire AI sector. KNOWLEDGE ATLAS is not only the largest revenue-generating company among independent general large model developers in China but also the first foundational model vendor to undergo the pricing test in the secondary market. Market reactions indicate that, despite facing short-term profit pressures, investors place greater value on its rarity in model iteration speed, developer ecosystem construction, and government-enterprise implementation capabilities.

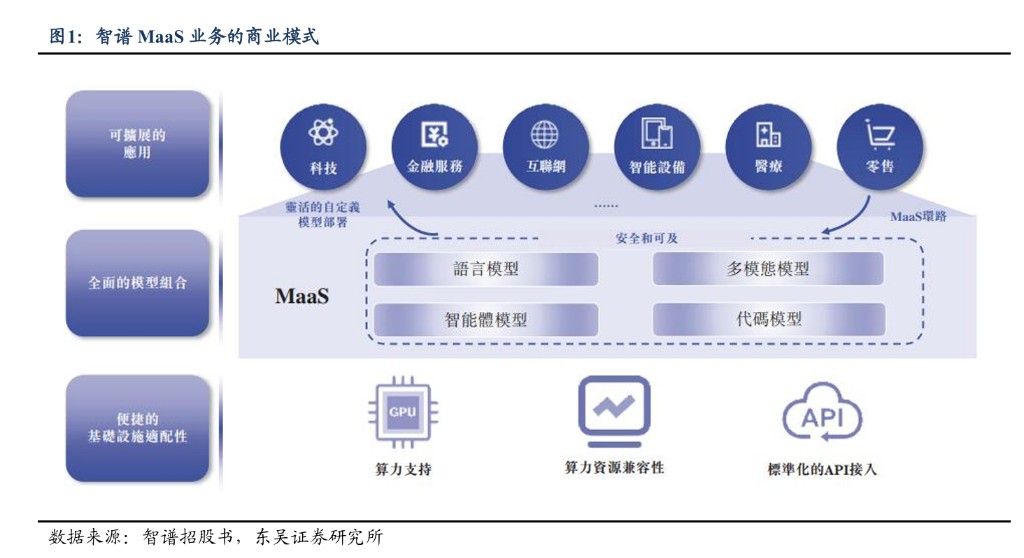

KNOWLEDGE ATLAS was established in 2019, transformed from the Knowledge Engineering Laboratory (KEG) of the Computer Science Department of Tsinghua University, and possesses the capability for independent research and development from underlying algorithms to full-link solutions. The company's vision is to achieve Artificial General Intelligence (AGI), and it has currently built a full-stack model matrix that includes language, vision, code, and intelligent agents. As the capital frenzy subsides and the industry returns to rationality, how KNOWLEDGE ATLAS balances high-intensity R&D investment with commercial returns through the MaaS (Model as a Service) model will become a core focus of the market.

MaaS Dual-Drive: From Localized "Self-Sustaining" to Cloud Scale Expansion

KNOWLEDGE ATLAS's business model exhibits a clear "dual-drive" characteristic: on one hand, it relies on high-margin localized deployments to provide stable cash flow for the company; on the other hand, it expands future growth space through cloud API services. According to a research report released by the Dongxing Securities team led by Zhang Liangwei on the 7th, localized deployments target government and enterprise clients sensitive to data security, with a gross margin of up to 59% in the first half of 2025, contributing approximately 85% of revenue and serving as the current performance cornerstone for the company.

However, cloud business is seen as a key variable for the company's long-term value. Dongxing Securities stated that as model iterations accelerate, a trend is emerging where clients are migrating from localized solutions to cloud services. Although the cloud business is currently under pressure on gross margins due to a strategic low-price policy, it possesses strong marginal effects. Data shows that the proportion of cloud revenue has rapidly increased from a low base of 2022 to 15.2% in the first half of 2025, with daily token consumption reaching 4.2 trillion by November 2025Analysis indicates that KNOWLEDGE ATLAS is at a critical period of business structure transformation. Dongxing Securities predicts that with the iteration and application penetration of the GLM series models, the company's revenue structure will gradually shift from being localized to being cloud-dominated, with cloud deployment revenue expected to account for 56% by 2027. This transformation will open up revenue ceilings but also place higher demands on the company's computing cost control and scalable operational capabilities.

Technical Foundation: Differentiated Breakthrough of GLM Architecture

In terms of technology, KNOWLEDGE ATLAS has not blindly followed the mainstream GPT architecture but has adhered to a fully self-developed GLM (General Language Model) pre-training framework. This architecture, which employs an autoregressive fill-in-the-blank design, demonstrates unique advantages in long text understanding, logical reasoning, and low hallucination rates.

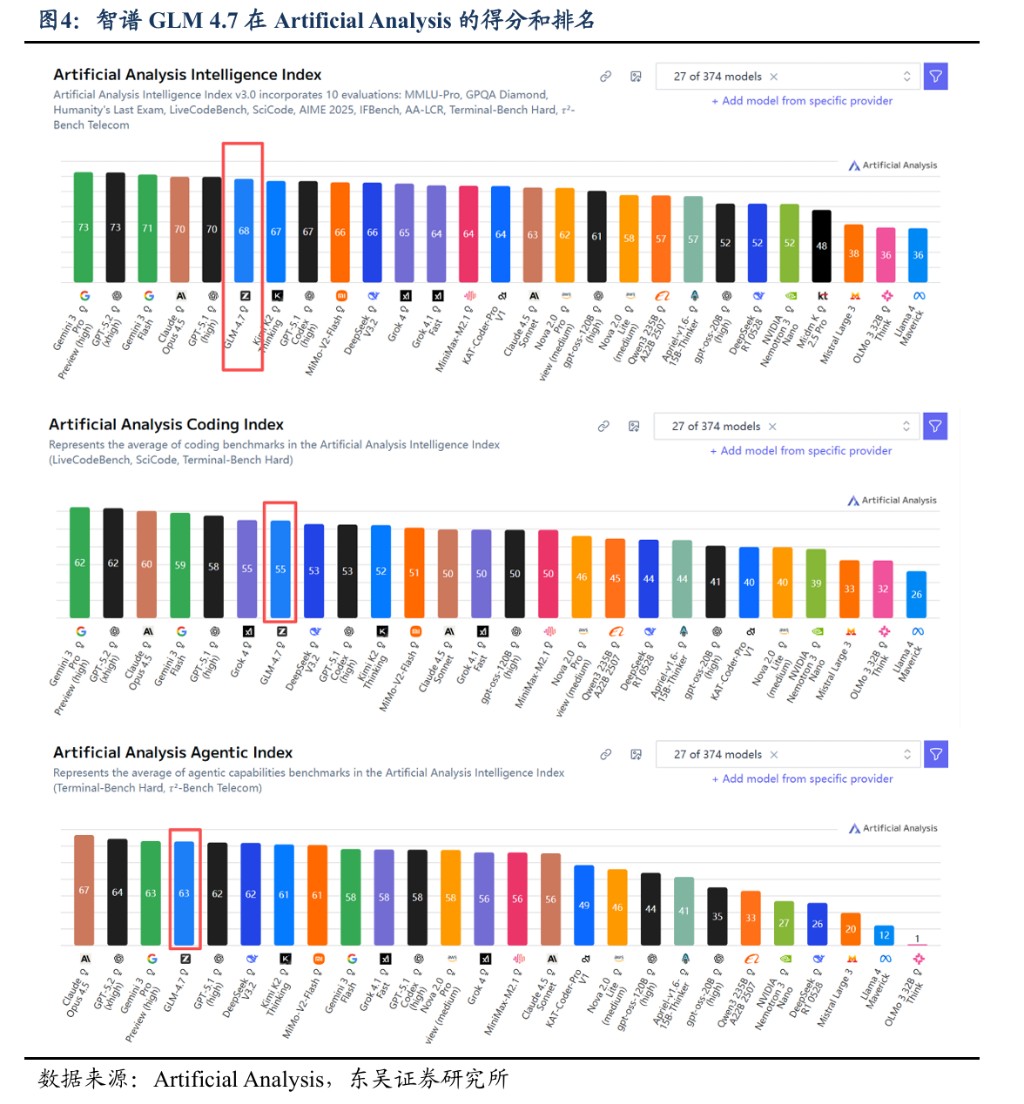

The continuity of model iteration is the core competitiveness of KNOWLEDGE ATLAS. The flagship model GLM-4.7, released in December 2025, introduced innovative mechanisms such as "interwoven thinking," excelling in programming and complex task planning, and ranking among the top open-source models in several international benchmark tests like Code Arena. Additionally, the company has aggressively laid out in the multimodal and agent fields, with the launch of AutoGLM capable of autonomously operating smartphones and computer GUIs, extending the boundaries of AI capabilities from "dialogue" to "action."

This technological advantage has translated into actual market share. According to Frost & Sullivan data, based on 2024 revenue, KNOWLEDGE ATLAS ranks first among independent general large model developers in China, with a market share of 6.6%. Nine of the top ten internet companies in China have become users of the GLM model.

Ecological Flywheel: Open Source Traffic and Toolchain Stickiness

Another major moat for KNOWLEDGE ATLAS lies in its constructed "ecological flywheel." The company insists on a strategy of parallel open source and commercialization, attracting global developers through high-performance open-source models, and then converting traffic into commercial orders through toolchains and services. As of the first half of 2025, the KNOWLEDGE ATLAS MaaS platform has registered over 2.7 million developers, and global downloads of open-source models have exceeded 45 million.

To further enhance developer stickiness, KNOWLEDGE ATLAS recently launched applications such as Zcode (AI code editor) and Zread (code repository analysis tool). These tools are deeply integrated with the programming capabilities of GLM-4.7, significantly improving development efficiency and thereby driving exponential growth in cloud API call volumes.

Dongxing Securities believes that the open-source strategy effectively reduces customer acquisition costs, while the improvement of the toolchain enhances user retention rates and willingness to pay. With the maturation of the agent ecosystem and the expansion into overseas markets, this "open source traffic - tool retention - API monetization" business closed loop is expected to accelerate its operation

Financial Perspective: High Growth Accompanied by Investment Period, Valuation Logic Reconstruction

From the financial data, KNOWLEDGE ATLAS exhibits typical characteristics of a high-growth technology stock. According to a research report released by the Xiong Li team at Guosen Securities on January 7, KNOWLEDGE ATLAS is expected to achieve revenue of 191 million RMB in the first half of 2025, a year-on-year increase of 35.03%. However, the company's net loss during the same period reached 2.351 billion RMB. This loss is primarily attributed to the significantly increased computing service fees and R&D expenses to maintain a technological leadership advantage.

Soochow Securities also stated that changes in the cost structure reflect the objective laws of the industry. With the explosion of cloud business volume, computing service fees (computing costs) have become the second-largest expense after labor costs, with the proportion of computing costs rising to 19% in the first half of 2025. In the future, as the proportion of domestically produced chips increases and inference optimization technologies are applied, the marginal decline in computing costs will be key to improving profitability.

In terms of valuation, the market tends to use the Price-to-Sales (PS) ratio for pricing. According to Soochow Securities' calculations, based on the IPO pricing, KNOWLEDGE ATLAS's expected PS for 2026 is approximately 30 times. Although this valuation level is higher than that of some comparable AI companies, considering its rarity as a pure large model target, the explosive potential of cloud business, and its leading layout in Agent scenarios, institutions generally believe that its high valuation is reasonable and expect that with the rapid expansion of revenue scale, there will be significant room for compression of its valuation multiples