Guo Weiling from Dacheng Fund: AI is still the main technology theme for 2026, with structural opportunities outperforming the overall market, optical communication > storage, liquid cooling > PCB upstream

Guo Weiling, the fund manager of Dacheng Fund, stated at the annual strategy meeting that the technology industry will revolve around AI in 2026, with structural opportunities outperforming the overall market. Fields such as optical communication, liquid cooling, and upstream PCB will become investment focuses. It is expected that optical communication will enter mass application in 2027, and the price increase cycle in the storage sector may last for 1-2 years. Overall AI capital expenditure will grow steadily, but attention should be paid to the sustainability of investment returns

On January 6th, Guo Weiling, the fund manager of Dacheng Fund, elaborated on her latest investment outlook for the technology industry in 2026 at the annual strategy meeting.

The investment representative summarized the key points as follows:

-

The expectation for the technology market in the first half of 2026 is still optimistic, primarily revolving around AI, but structural opportunities will be stronger than the overall market, and the overall investment difficulty will be greater than in 2025.

-

With stable growth in the overall market, the structural opportunities in AI investment will outperform the total. In terms of structural ranking, we believe that optical communication is stronger than storage, liquid cooling, and power supply, stronger than upstream PCB, stronger than PCB, stronger than GPU quantity, and stronger than the overall growth of AI capital expenditure.

-

In the field of optical communication, I believe that whether for training or inference, communication is currently a bottleneck.

It is expected that starting next year, we may gradually see plans for optical access to cabinets, and by 2027, it may enter the stage of mass application.

-

I am also quite optimistic about the current tight price increase cycle in storage, which I believe may last for 1 to 2 years.

-

In terms of structure, I am also optimistic about several directions: liquid cooling, upstream PCB, and PCB.

2026 may be the first year for domestic liquid cooling suppliers to officially receive orders and ramp up production, but this industry may face price wars in the long term.

The overall profitability of upstream PCB may enter a rapid improvement phase.

The PCB industry pattern is trending towards decentralization in 2026, but currently, the overall supply is still relatively tight, and there is not much downward pressure on prices.

- It is expected that overall AI capital expenditure will still achieve stable growth in the coming year. Risks may arise in specific areas.

Looking ahead to the next three years, global AI overall capital expenditure still needs to observe whether investment returns can continue to improve rapidly, which has certain uncertainties.

Guo Weiling has 10 years of experience in the securities industry and 5 years in fund management. She joined Dacheng Fund Management Co., Ltd. in July 2015, previously serving as a researcher in the research department and assistant fund manager, and is currently the fund manager of the equity investment department. From January 26, 2021, to June 2, 2023, she served as the fund manager of the Dacheng Industry Rotation Mixed Securities Investment Fund. Since January 26, 2021, she has been the fund manager of the Dacheng Technology Innovation Mixed Securities Investment Fund.

Her fund management scale is 1.822 billion yuan, with a clear investment philosophy focused on technology industry trends, dedicated to discovering companies with excellent quality, reasonable valuations, and broad growth potential.

In the 2025 fund performance list released by Zhitang, the Dacheng Technology Innovation Mixed A fund managed by Guo Weiling ranked 19th among actively managed equity funds with an annual return rate of 123.83%.

Top-performing active equity funds in 2025

Top-performing active equity funds in 2025

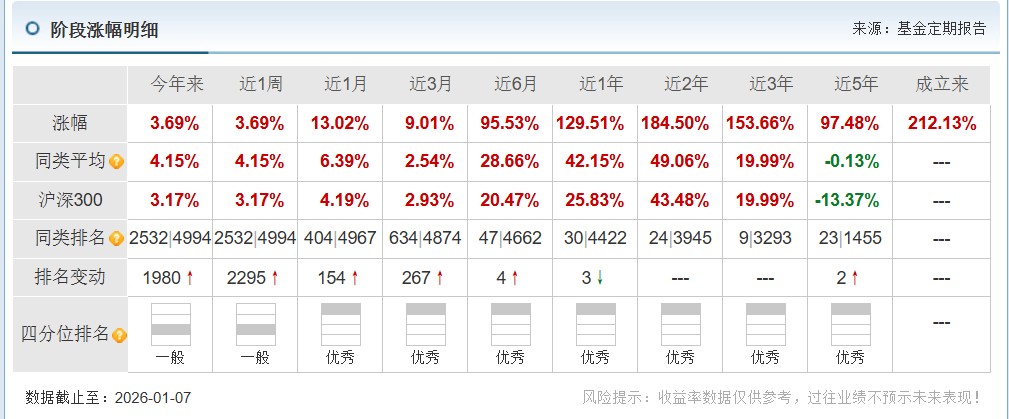

From a longer-term perspective, the performance of this fund is also outstanding: the cumulative return over the past two years exceeds 180%, the return over the past three years is over 150%, the return over the past five years is 97%, and the return over the past six months has reached 95%. From the past five years to the past six months, this fund has consistently ranked in the top 1% of its peers, always at the forefront of performance rankings.

However, the fund's performance has significantly corrected in the past three months, with a return of only 9%, and its year-to-date performance has not outperformed the market or the average of its peers.

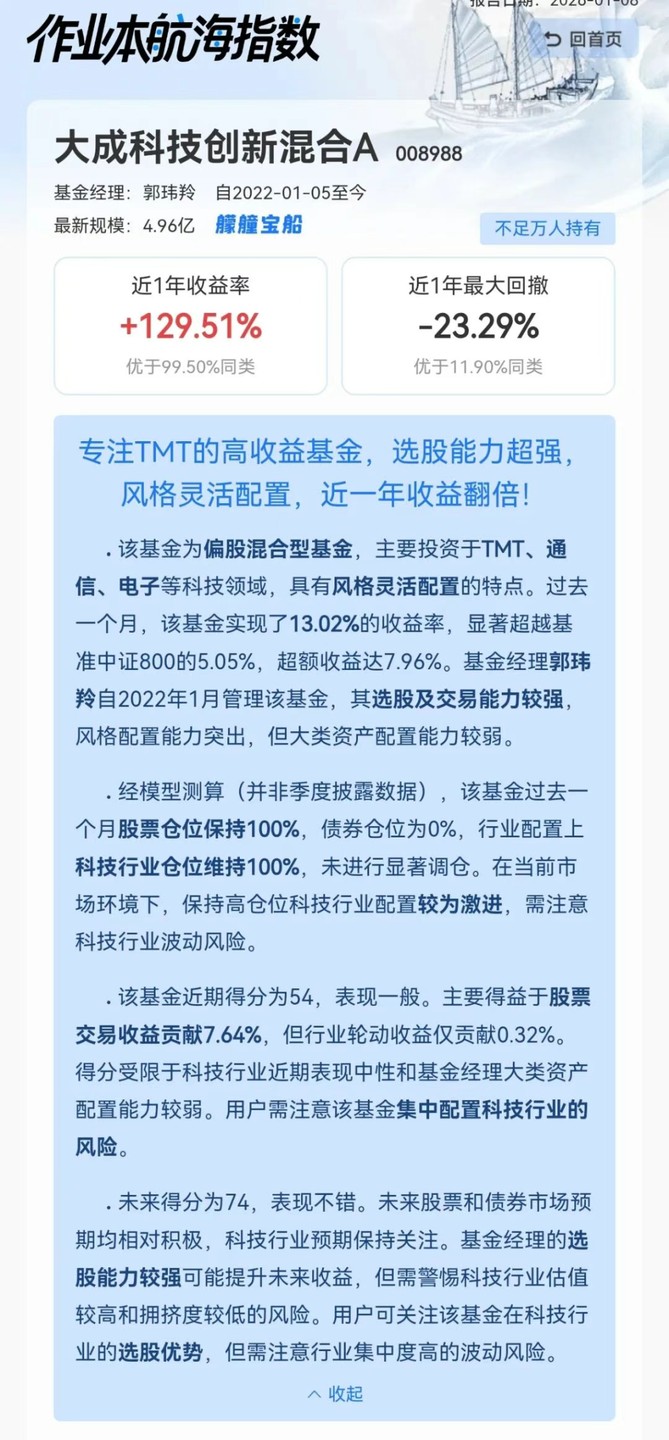

The Workbook Sailing Index analysis indicates that this fund focuses on investments in the TMT sector, with a return of 129.51% over the past year, surpassing 99.5% of its peers. Guo Weiling has strong stock selection and trading capabilities, maintaining a 100% stock position over the past month, and caution is advised regarding the volatility risk that may arise from the high valuations in the technology sector.

Note: The fund manager's management start date shown in the figure (January 2022) is based on the date Guo Weiling began independently managing the fund. From January 2021 until that date, the fund was co-managed by Guo Weiling and other fund managers.

The fund's third-quarter report shows that its core holdings remain concentrated in the overseas computing power industry chain, with some adjustments in individual stocks, mainly due to certain stocks having significantly outperformed their fundamentals in the short term, switching to some varieties with relatively low valuations that have a higher match between stock prices and fundamentals.

The following is a summary of key insights shared by Guo Weiling, organized by the investment Workbook (ID: touzizuoyeben), for your reference.

AI remains the main theme of technology in 2026

Today, I would like to share my thoughts on investments in the technology sector for 2026.

Overall, I believe that the technology market in the first half of 2026 is expected to continue, primarily revolving around AI, but structural opportunities will be stronger than the overall market, and the overall investment difficulty will be greater than in 2025.

The main difference is that in 2026, the market will pay more attention to the overall investment returns of AI. The current overall expectations have become relatively optimistic after a significant rise in 2025, which is different from the relatively low expectations of 2025, and the overall odds have also changed.

AI development in 2025 and outlook for 2026

Let me briefly review the main progress in the AI field in 2025 First, there is progress in models. Gemini 3 has unified multi-modal input and output, which is a significant breakthrough. In terms of application implementation, we also see rapid development in programming and video generation.

In terms of commercialization returns, OpenAI's ARR is expected to grow from less than $4 billion in 2024 to about $18 billion by the end of 2025.

Regarding token call volume, due to the popularity of chain reasoning, the overall call volume has seen exponential growth. At the same time, capital expenditure in the AI sector has also doubled monthly.

Looking ahead to 2026, we hope to see more advancements in models, and we have conducted more research in this area.

We believe that by 2026, it is relatively certain that we will see more editable multi-modal outputs, which may be achievable in the first half of 2026.

Additionally, locally verifiable world models and long-range causal reasoning are also expected to be preliminarily realized. At the same time, we look forward to some qualitative breakthroughs in online learning in 2026.

In terms of application implementation, we believe that agents in semi-closed environments, such as automated office suites and data analysis in strongly structured fields, may achieve a qualitative leap in task completion rates, for example, increasing from 40-50% to 80-90%.

However, everyone may need to pay attention to the progress of commercialization returns in 2026, and whether it can grow as rapidly as in 2025. This is because the willingness to pay has already picked some "low-hanging fruit" in 2025, and the difficulty of enhancing commercialization monetization may increase.

Token call volume is expected to continue to grow rapidly. Overall capital expenditure growth is expected to maintain around 40%-50%.

AI Capital Expenditure Expected to Grow Steadily in the Coming Year, Risks are Localized

In the longer term, it is expected that overall AI capital expenditure will still achieve steady growth in the coming year. Risks may arise in localized areas, such as some vendors whose current cash flow is insufficient to cover annual capital expenditures, like Oracle, but this is still a relatively localized situation.

In the long term, looking ahead to the next three years, I believe that global AI overall capital expenditure still needs to observe whether investment returns can continue to improve rapidly, which has a certain degree of uncertainty.

Preference for Selecting Targets in the Google Chain, Avoiding the Oracle Chain

However, from the current situation, the overall financial indicators of companies like Google and Amazon remain relatively healthy. Especially Google, whose model has established a leading position, has lower self-developed TPU costs, and the cloud business recovery cycle is shorter than its peers, should have a stronger ability to increase capital expenditure. Amazon's overall financial indicators are also relatively healthy.

Therefore, when selecting targets, we will tend to favor the Google chain and avoid chains like Oracle.

OpenAI has recently had relatively smooth financing, but in the longer term, it will still depend on whether its model can surpass multi-modal and Gemini 3 in 2026 In addition, from the perspective of overall observation indicators, we need to closely monitor the progress of models, the overall interest rate level and economic conditions in the United States, the payback period for server leasing, and the capital expenditure planning of leading companies.

AI structural opportunities outperform total volume, optical communication > storage, liquid cooling, power supply > PCB upstream.....

We believe that under stable growth of the overall market, the structural opportunities in AI investment will outperform the total volume. In terms of structural ranking, we believe that optical communication is stronger than storage, liquid cooling, and power supply, stronger than PCB upstream, stronger than PCB, stronger than the number of GPUs, and stronger than the overall growth of AI capital expenditure.

In the field of optical communication, I believe that whether for training or inference, communication is currently a bottleneck.

It is expected that starting next year, we may gradually see plans for optical integration into cabinets, with mass application expected by 2027.

The bandwidth within the cabinet is several times that of outside the cabinet, which has a significant impact on supporting the long-term growth of optical communication and can also support a proper increase in valuation.

Additionally, for TPU computing clusters like Google’s, looking at TPU v7, the optical module consumption per card is higher than that of GB300. Moreover, Google's guidance for future computing power investment is to double every six months, with growth rates expected to be much faster than the overall market, and the consumption of optical modules is expected to accelerate compared to before.

The tight pricing cycle in storage may last 1-2 years, and capacity expansion may exceed expectations

Structurally, I am also quite optimistic about this round of tight pricing cycle in storage, which I believe may last 1 to 2 years, as we are now entering a phase where the proportion of AI inference is increasing, leading to higher demand for various types of storage.

Furthermore, to create long-term user stickiness, future models will also enhance their memory of user behavior and preferences.

Currently, the capital expenditure plans of overseas storage wafer factories are relatively conservative, but domestically, the willingness and planning for capacity expansion of storage wafer factories may continue to exceed expectations, which is a great opportunity for domestic semiconductor equipment.

I am also optimistic about three directions: liquid cooling, PCB upstream, and PCB

Structurally, I am quite optimistic about several directions: liquid cooling, PCB upstream, and PCB.

Let me briefly talk about liquid cooling. In 2025, domestic liquid cooling suppliers will mainly be in the solution verification stage, and 2026 may be the first year to officially receive orders and ramp up production, but this industry may face price wars in the long term.

The PCB upstream is currently in a material upgrade cycle and a price increase cycle, and overall profitability may enter a rapid improvement phase.

At the same time, domestic manufacturers have caught up with the leading material upgrade cycle, and their willingness to expand production is stronger than that of overseas counterparts, so domestic manufacturers may gain market share.

The overall growth of the PCB industry is good, but due to the difficulty of capacity expansion, whether the capacity expansion overseas can translate into performance remains uncertain The industry landscape is trending towards decentralization by 2026, but currently, the overall supply is still relatively tight, and there is not much downward pressure on prices.

Three Key Risk Points to Focus on in 2026

There are several risks we need to focus on in 2026:

First, the risk that the revenue growth of leading large model companies may be lower than expected, which could lead to difficulties in subsequent financing and affect overall capital expenditure and expansion confidence.

Second, delivery pressure, which may be influenced by factors such as U.S. infrastructure capacity, electricity shortages, and supply chain constraints, could result in significant overall delivery pressure for data centers.

Currently, it can be verified that there is very strong order demand across the entire overseas AI supply chain, but there may also be a risk of overbooking due to tight supply.

Finally, we should also pay attention to the potential stagflation risk in the U.S., which mainly affects the stability of cloud service providers' revenues and their ability to undertake more capital expenditures, as well as the overall risk appetite for technology-related assets.

Source: Investment Workbook Pro, Author: Wang Li

For more insights from industry leaders, please follow↓↓↓

Risk Warning and Disclaimer

The market carries risks, and investments should be made cautiously. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investing based on this is at one's own risk