Precious metals continue to adjust! Silver drops over 3%, gold declines, and the important commodity index rebalancing begins today

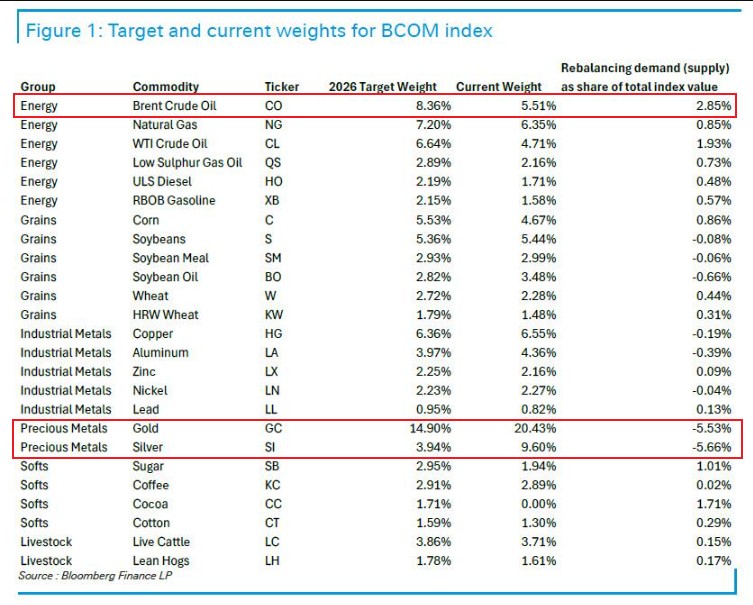

Affected by the annual weight rebalancing of the Bloomberg Commodity Index (BCOM), the precious metals market has encountered liquidity shocks. At the end of the Asian market on January 8, spot silver fell over 3%, and gold declined. This adjustment will reduce the weight of gold from 20.4% to 14.9%, and silver from 9.6% to 3.94%, triggering large-scale passive selling. Deutsche Bank expects $7.7 billion in silver sell orders to flood in over the next two weeks, which may lead to a sharp price reevaluation

The precious metals market is experiencing a liquidity shock triggered by index rebalancing.

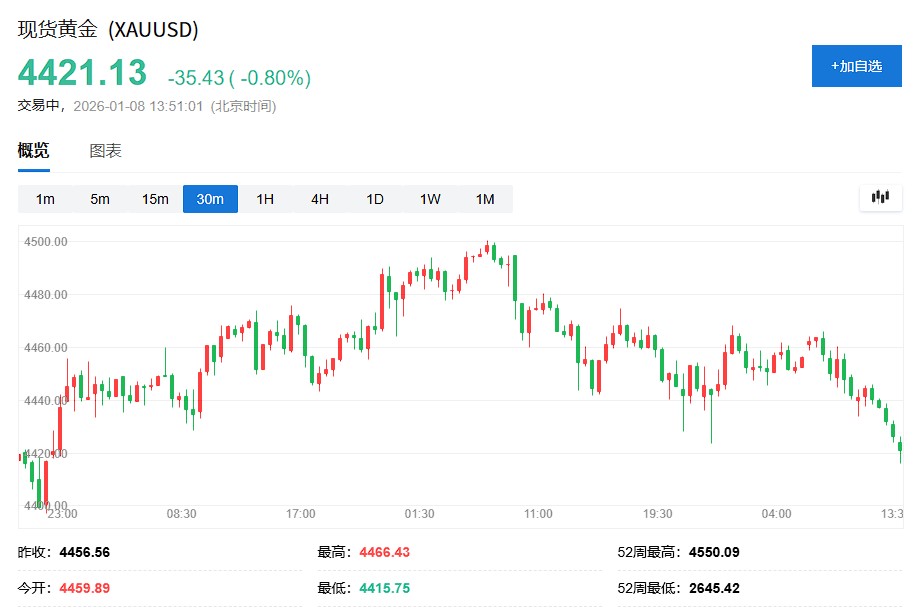

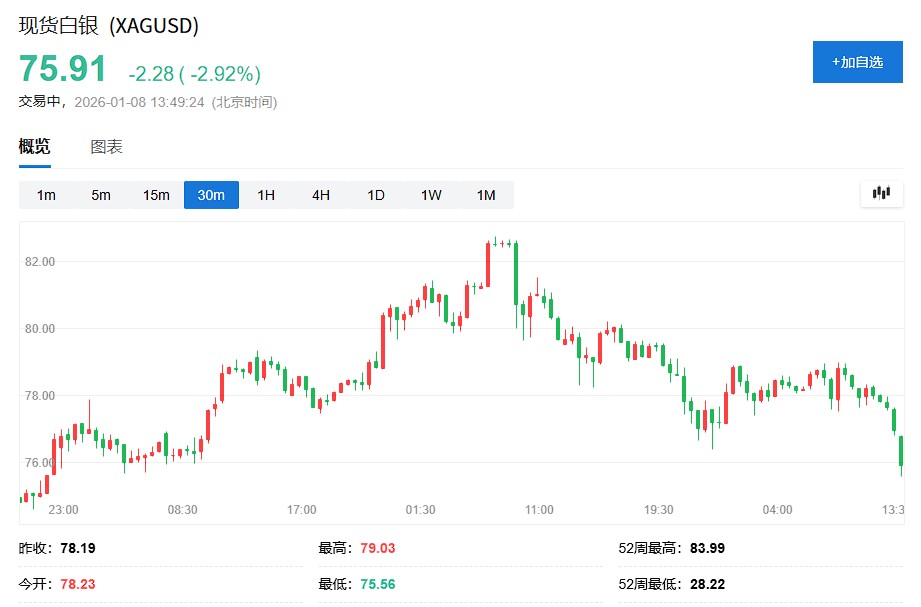

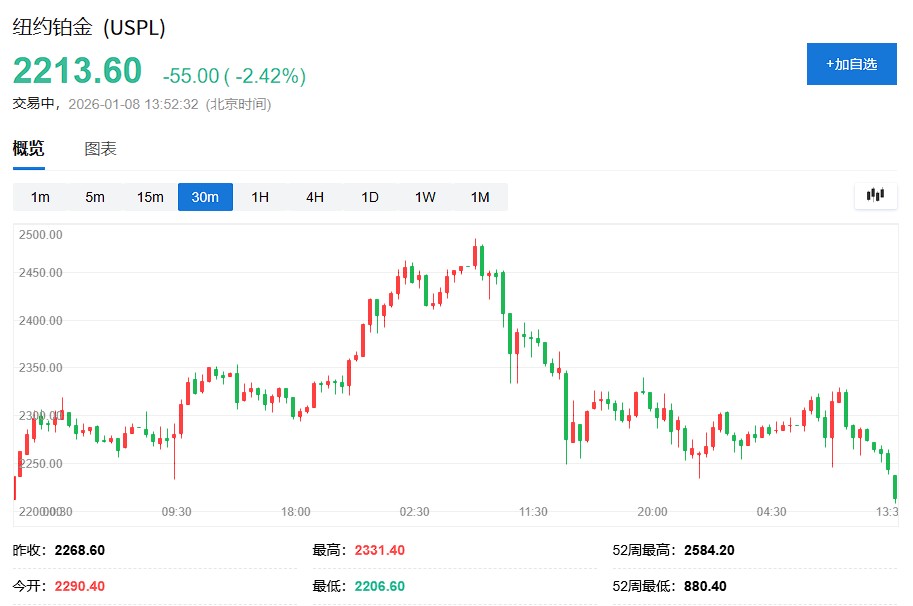

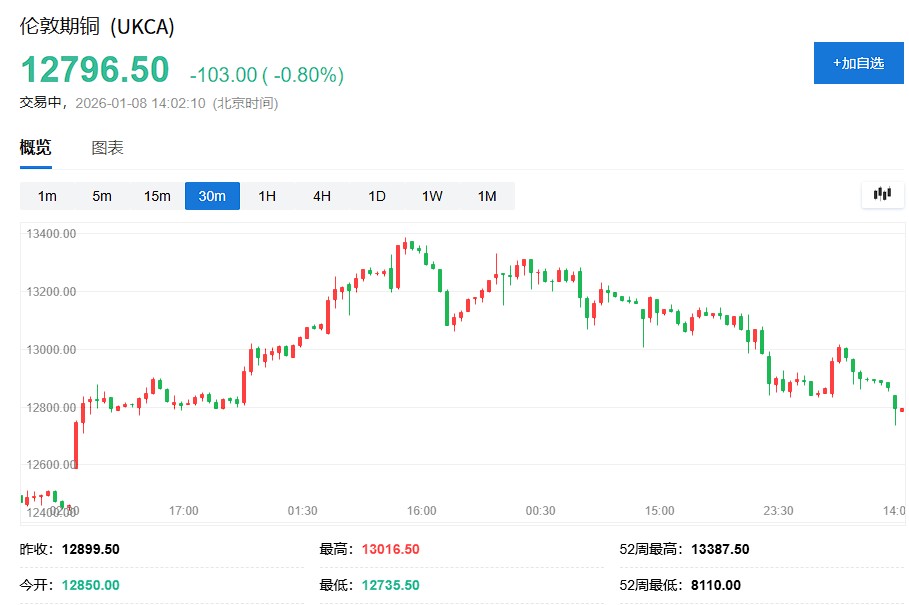

At the end of the Asian market on January 8, the precious metals market collectively adjusted again, with spot gold briefly plunging to around $4,415. COMEX silver fell over 2%, and spot silver dropped more than 3%, hitting a low of $75.58. Additionally, platinum, palladium, and other metals like copper also declined.

(30-minute chart of spot gold)

(30-minute chart of spot silver)

(30-minute chart of New York platinum)

(30-minute chart of New York palladium)

(30-minute chart of LME copper)

The current adjustment in the precious metals market is directly related to the annual weight rebalancing of the Bloomberg Commodity Index (BCOM), which was initiated after the market closed on January 8 and will continue until the 14th. This adjustment will reduce the weight of gold from 20.4% to 14.9% and silver from 9.6% to 3.94%, forcing passive funds tracking this index to make mechanical position adjustments.

Deutsche Bank and TD Securities expect $7.7 billion in silver sell orders to flood the market over the next two weeks, equivalent to 13% of the total open contracts in the COMEX silver market. Market analysis shows that the futures sell orders triggered by this rebalancing will account for 9% and 3% of the total positions in silver and gold, respectively.

It is noteworthy that the decline in precious metals such as gold and silver occurred after a rare epic rise. Spot gold's cumulative increase for the entire year of 2025 exceeded 70%, and silver's annual increase once reached about 150%, entering a skyrocketing mode since December 23 of last year and continuously setting historical highs. Such a massive accumulation of short-term profits has made the market extremely vulnerable in the face of liquidity events

Index Rebalancing Triggers Large-Scale Technical Sell-Off

The Bloomberg Commodity Index employs an annual rebalancing mechanism, with weight calculations based on two-thirds trading volume and one-third global production, and sets weight limits at the commodity, sector, and group levels. According to index rules, the weight of a single commodity cannot exceed 15% to maintain diversification.

According to an article from Wall Street Insight, Deutsche Bank analyst Michael Hsueh pointed out that "it is unfavorable for precious metals and favorable for crude oil." In terms of open interest, silver will bear the largest rebalancing sell-off pressure, followed by aluminum and gold.

Michael Hsueh estimates that a sale of 2.4 million ounces of gold could lead to a price drop of 2.5%-3.0%, depending on the ETF sensitivity model and time window used.

TD Securities analyst Daniel Ghali warned in a report on December 31 that the trading volume of the largest silver ETF has reached extreme levels only seen at historical market tops, with premiums at historical highs, reflecting the speculative frenzy of retail investors.

He believes that the recent surge in silver is "similar to a liquidation arbitrage trade, and what follows will be a severe repricing commonly seen in commodity cycles."

Ghali emphasized that since November, silver's "devilish blow-off top" has not reflected demand, supply, or fundamentals.

He expects that 13% of the open interest in the COMEX silver market will be sold in the next two weeks, leading to a significant repricing of prices under a continued liquidity vacuum. This $7.7 billion sell-off and related trading activity will stem from a broad commodity index rebalancing, with trading volumes potentially far exceeding the extreme levels previously set by the largest silver ETF