A month before Maduro was forcibly controlled, Trump had "leaked" to oil giants: Be prepared

Trump "lightning strike" Venezuela a month ago had hinted to U.S. oil executives to "be prepared," but did not disclose the details of the action. After the action, the White House announced an ambitious energy revival plan, calling for U.S. companies to invest billions of dollars to transform Venezuela's oil fields. However, oil giants including Chevron and Exxon Mobil have taken a cautious stance, citing political stability and capital safety as reasons for inaction

About a month before the political strongman Nicolás Maduro was arrested in Venezuela, U.S. President Donald Trump sent a vague but enticing message to several American oil executives: "Be prepared."

On January 6, according to media reports, informed sources revealed that although Trump hinted to the executives that Venezuela would undergo significant changes, he did not disclose specific details about the raid on Caracas, nor did he seek their advice on the energy revival plan announced that day.

According to CCTV News, the U.S. launched a large-scale military strike against Venezuela in the early hours of January 3, forcibly controlling Maduro and his wife and bringing them to the U.S. On January 6, when the Venezuelan President Maduro and his wife Flores, who were forcibly controlled by the U.S., appeared in federal district court in the Southern District of New York for the first time, they pleaded "not guilty" to the so-called "charges" from the U.S.

Reports indicate that on the day of the operation, the Trump administration announced a plan calling for U.S. energy companies to invest billions of dollars in the renovation of Venezuela's devastated oil fields. Trump stated at a press conference at Mar-a-Lago that the U.S. would send "the world's largest oil companies" into Venezuela to repair the severely damaged oil infrastructure.

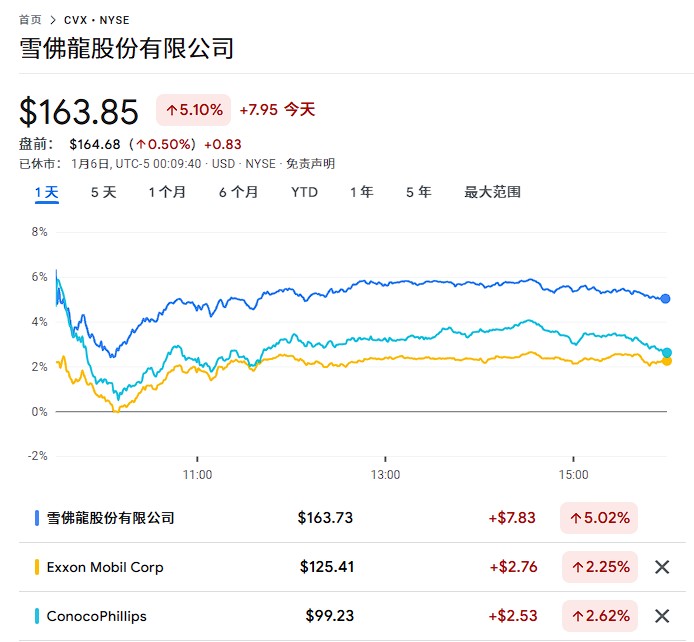

The market reacted positively to this prospect. On Monday, Chevron's stock rose about 5%, Exxon Mobil increased by about 2%, and ConocoPhillips climbed nearly 3%. Investors seem optimistic that Venezuela could become a new frontier for U.S. oil companies.

However, despite the ambitious plans of the Trump administration, the large U.S. oil companies most capable of investing in Venezuela have yet to make commitments. These companies need to assess multiple factors, including political stability, contract security, capital repatriation, and competition with the returns of their global investment portfolios before deciding whether to enter.

Oil Giants Like Chevron Take a Cautious Stance

Reports indicate that White House Press Secretary Karoline Leavitt stated on Monday that Trump looks forward to collaborating with U.S. oil companies on new investments and opportunities in Venezuela. A senior White House official revealed that Energy Secretary Granholm and Secretary of State Rubio are leading this effort on behalf of Trump, and communication with oil companies has already begun.

As the only large U.S. oil company still operating in Venezuela, Chevron is in a key position in Trump's plans. However, reports indicate that informed sources have revealed that Chevron currently has no plans to significantly increase spending or substantially raise production. A Chevron spokesperson stated:

"Chevron continues to focus on the safety and well-being of our employees, as well as the integrity of our assets. We continue to operate in full compliance with all relevant laws and regulations."

According to informed sources, Chevron has indeed developed detailed plans to expand its operations in Venezuela under specific circumstances. However, to advance these plans, the company needs relative certainty that employees can operate safely in the country and that funds can be transferred out. Currently, Chevron is more inclined to maintain existing production levels while focusing on ensuring the safety of its local employees The other two American oil companies with the scale and expertise in heavy oil extraction, capable of investing in Venezuela—ConocoPhillips and Exxon Mobil—have not indicated any plans to return to the country.

Dan Pickering, Chief Investment Officer of Pickering Energy Partners, stated that the reluctance of large oil companies to make new investments in Venezuela could pose a significant blow to the Trump administration's attempts to reform the country's government