AI server demand remains strong, Hon Hai's Q4 sales increased by 22% year-on-year, exceeding expectations, with a month-on-month increase of 31.8% in December

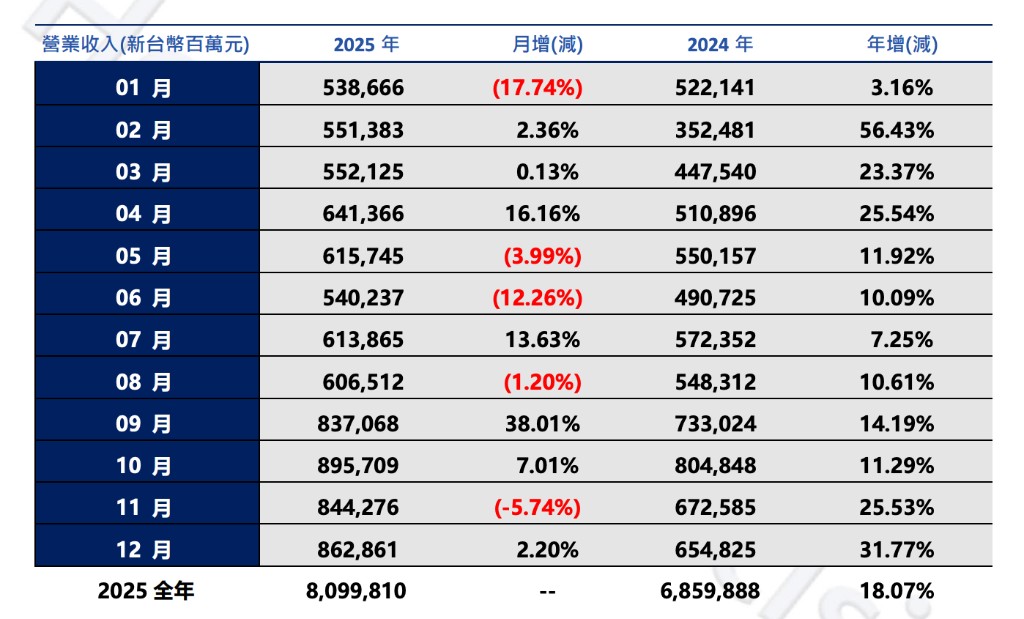

Hon Hai's sales in December reached NT$ 862.86 billion, a year-on-year increase of 31.8%; fourth-quarter revenue grew by 22.07% year-on-year to NT$ 2.6 trillion, exceeding analysts' average expectation of NT$ 2.4 trillion. The performance growth mainly relied on the two product lines of "components and others" and "cloud networking."

Benefiting from the accelerated construction of data centers for artificial intelligence by global technology companies, Hon Hai's sales for the quarter ending in December reached a record high.

On January 5th, Hon Hai's report showed that its sales for December 2025 reached NT$862.86 billion, a year-on-year increase of 31.8%; fourth-quarter revenue grew by 22.07% year-on-year to NT$2.6 trillion, exceeding analysts' average expectation of NT$2.4 trillion.

Hon Hai stated, "Revenue for the fourth quarter of 2025 achieved strong growth both quarter-on-quarter and year-on-year, exceeding our expectations for significant growth and establishing a high base for the first quarter." However, as the shipment volume of AI racks continues to rise, even based on the high base of the fourth quarter of 2025, the seasonal performance for this quarter is expected to approach the upper limit of the range seen over the past five years.

AI Server Demand Continues to Surge, Becoming the Core Growth Engine

In December, Hon Hai's revenue increased by 2.20% month-on-month and grew by 31.8% year-on-year. The growth in performance mainly relied on the two product lines of "Components and Others" and "Cloud Networking." Overall, AI-related infrastructure business has become the core engine of the company's growth, while consumer electronics and traditional computing businesses are undergoing cyclical adjustments.

Components and Other Products maintained dual growth in both monthly and year-on-year terms, driven by key components in the supply chain;

Cloud Networking Products benefited from the sustained strong demand for hardware such as AI servers, achieving significant growth both monthly and year-on-year;

Consumer Smart Products experienced a slight month-on-month decline due to seasonal stocking rhythms, but maintained year-on-year performance due to market demand;

Computer Terminal Products saw declines both quarter-on-quarter and year-on-year due to product cycles and base effects.

The company is currently expanding its production capacity in the United States, increasing AI server production in its operational parks in Wisconsin and Texas. Chip companies, including NVIDIA and its memory partner Micron Technology, have recently reiterated that AI demand is expected to remain solid in the coming quarters. NVIDIA stated in November that its sales for the January quarter are expected to be around $65 billion, about $3 billion higher than analysts' forecasts. The chip manufacturer also indicated that the anticipated $500 billion revenue feast in the coming quarters may be larger than expected