CSC Zhou Junzhi: The Future of Consumption in the Reassessment of the Balance Sheet

Zhongxin JianTou's Zhou Junzhi analyzed the revaluation of China's household balance sheet, pointing out that total household assets will reach 763.7 trillion yuan in 2024, with real estate accounting for 395.6 trillion yuan. Over the past 20 years, real estate has contributed more than 50% to household wealth. With the end of urbanization and the leverage era, consumption patterns will face transformation, and insufficient domestic demand and declining consumption are phase-specific phenomena. The importance of real estate in the economy is reflected in five dimensions: investment, assets, finance, consumption, and fiscal policy. In the future, household wealth creation and consumption patterns will undergo changes

Core Viewpoints

Reassessing the asset-liability balance of Chinese residents, focusing on four sets of data:

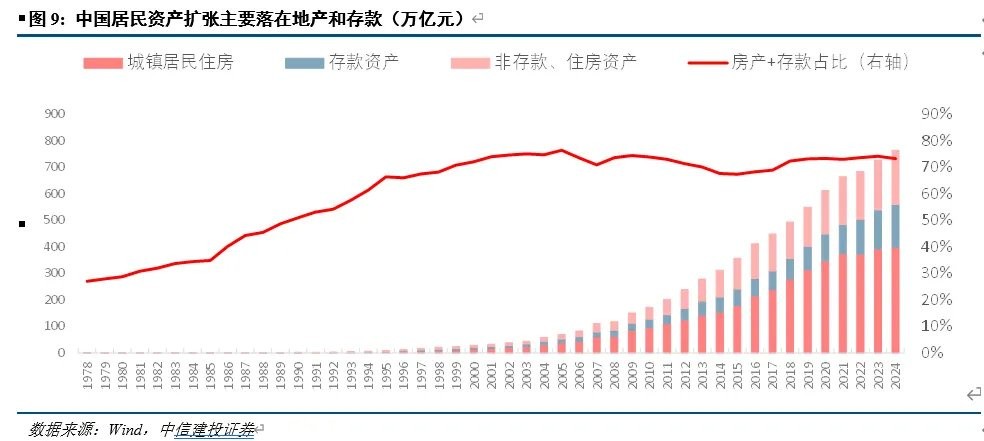

① In 2024, the total assets of Chinese residents will be 763.7 trillion, of which real estate accounts for 395.6 trillion and deposits for 163.2 trillion.

② Over the past 20 years, real estate has contributed more than 50% to the wealth of Chinese residents. Considering that the increase in resident deposits comes from credit expansion driven by real estate, the contribution of real estate to resident wealth is even higher.

③ From 2001 to 2020, over 900 million urban residents shared in the "wealth creation" from real estate, with resident assets expanding approximately 18 times and real estate wealth expanding 20 times. 1.4 billion people have experienced a broad increase in income and living standards, with per capita GDP and per capita disposable income expanding by about 8 times.

④ As the period of urbanization compresses, the era of leverage will also come to an end, and the accompanying wealth creation and consumption patterns will face transformation.

At this transitional juncture, "insufficient domestic demand" and "declining consumption" are naturally occurring phase phenomena, representing "issues in development and transformation."

Rather than expecting consumption to return to the past leveraged era, it is better to prepare for the four new trends of the future.

Summary

The importance of real estate to the past and present Chinese economy is self-evident. The significance of real estate is reflected in five dimensions: investment, assets, finance, consumption, and fiscal policy.

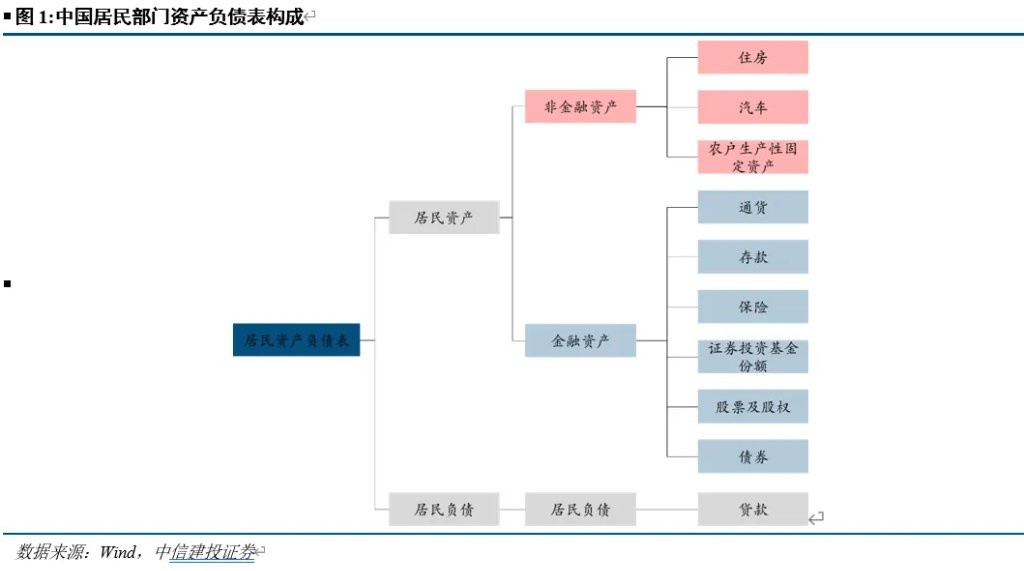

The impact of these five dimensions can be clearly expressed through the national asset-liability balance sheet, especially the asset-liability balance sheet of the resident sector.

By reassessing the resident asset-liability balance sheet, we can gain a clearer understanding of how, in the past, Chinese residents boarded the train of real estate to embark on a vigorous wealth expansion; in the future, as real estate transforms, what changes will occur in the wealth creation of Chinese residents and the accompanying consumption patterns.

It is important to emphasize that there are errors in estimating resident assets using different methods. First, because the market value reassessment of physical assets (taking real estate as an example) may be biased; second, different data sources for assets may lead to discrepancies in definitions; third, financial products have asset-liability interactions, which can easily result in double counting or omissions.

We have estimated the resident asset-liability stock data for as long a period as possible.

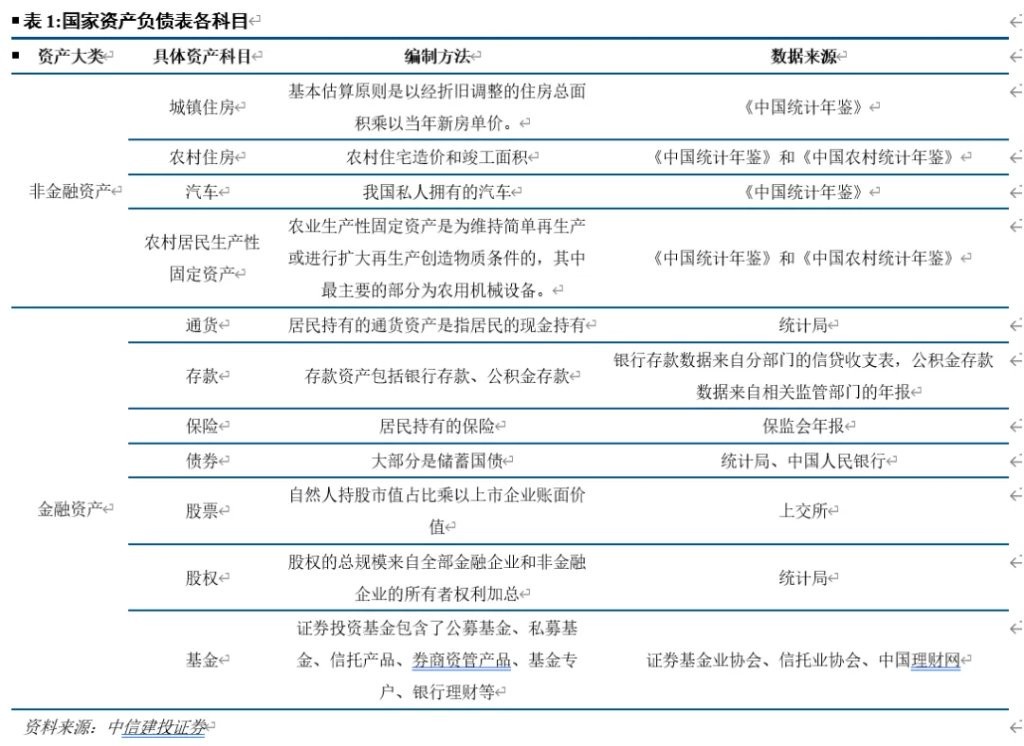

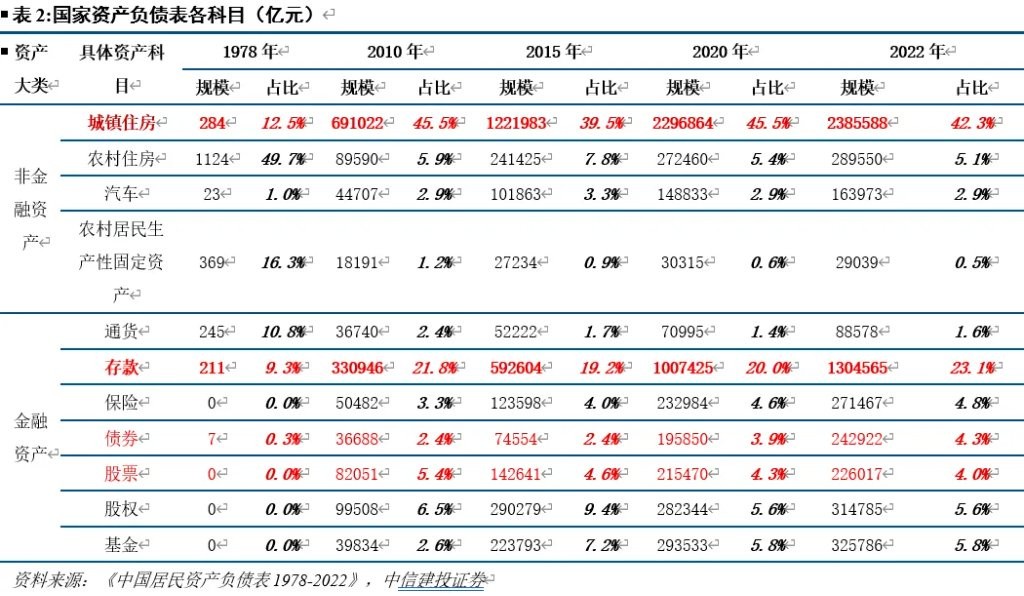

Currently, a commonly used estimate of the Chinese resident asset-liability balance sheet is found in "China's National Asset-Liability Balance Sheet 1978-2022" by Zhang Xiaojing and others from the National Financial and Development Laboratory, which discusses in detail how to compile the asset-liability balance sheet of the Chinese resident sector.

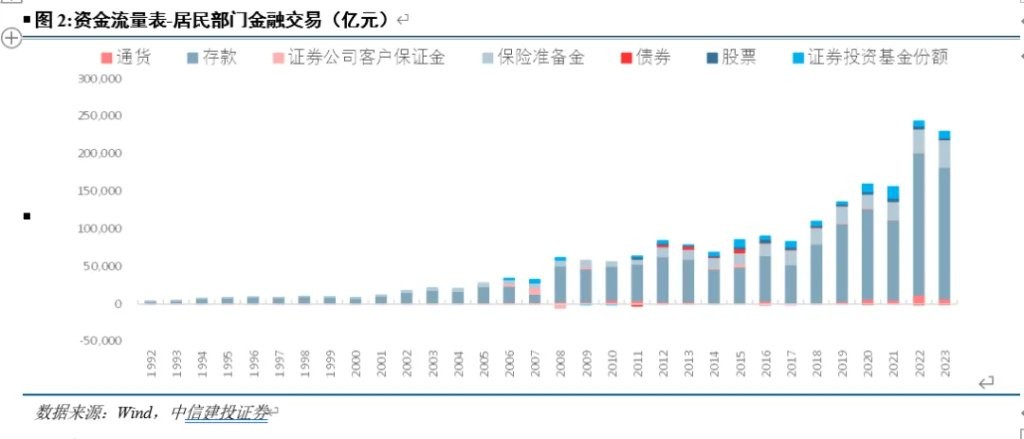

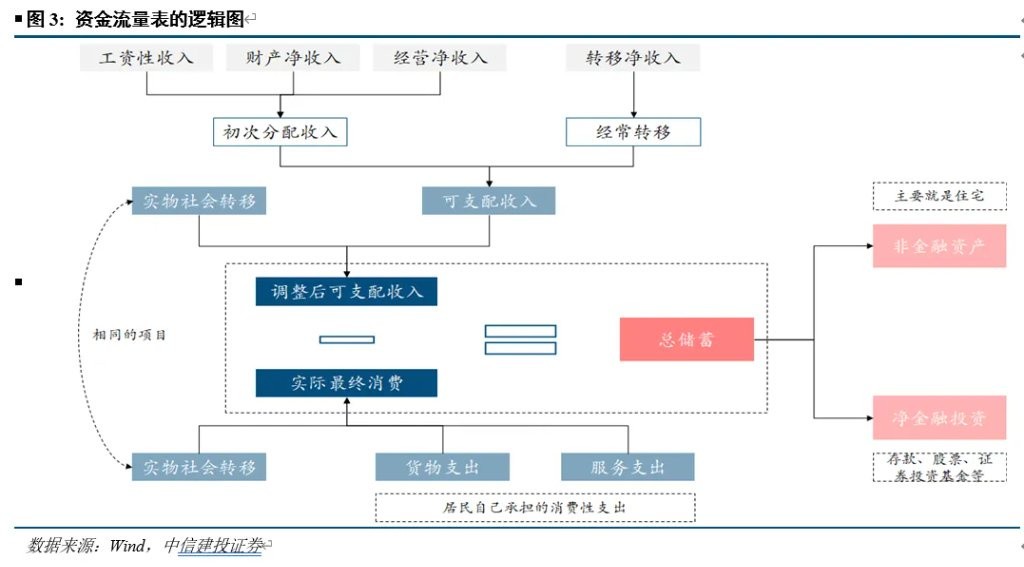

The official flow data of the asset-liability balance sheet currently published in China is found in the "National Economic Accounting" section of the "China Statistical Yearbook," specifically in the capital flow table. This can serve as a correction for the estimation process of the resident asset-liability balance sheet.

Based on a commonly accepted estimation methodology and with a focus on adjusting the estimation method for China's stock real estate, we ultimately obtained a relatively complete historical data set for the stock asset-liability balance sheet of Chinese residents.

As of 2024, the total stock assets of Chinese residents are 763.7 trillion, of which real estate accounts for 395.6 trillion and deposits for 163.2 trillion; total liabilities of residents are 82.8 trillion, with a net asset scale of 680.8 trillion.

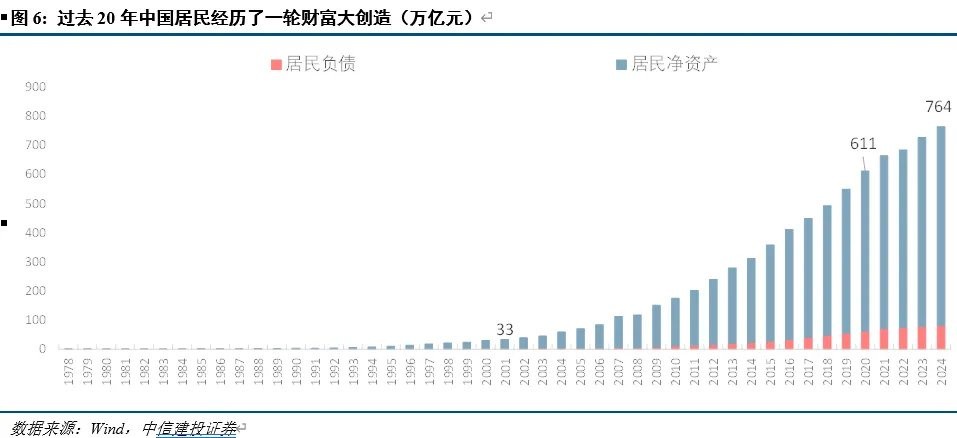

The picture depicted by the residents' balance sheet shows that since the reform and opening up, Chinese residents have experienced an unprecedented wealth creation.

Since 1978, total resident assets have rapidly expanded, with growth rates surpassing GDP growth rates and also outpacing the expansion of U.S. resident assets during the same period.

This set of data vividly illustrates how China's reform and opening up has benefited the people, how China has continuously approached the level of middle-income developed countries, and how the economic development gap between China and the U.S. has been continuously compressed.

Since the reform and opening up, the rapid expansion of Chinese resident assets has gone through two periods: from 1978 to 2000, and from 2001 to 2020.

From 1978 to 2000, the Chinese resident sector experienced the first golden period of rapid wealth creation.

During this period, wealth creation for residents was mainly focused on deposits and real estate, and historical data for these two types of assets is more detailed. Data on financial assets such as funds and wealth management products have weaker traceability, so when discussing Chinese resident assets before 2000, we mainly focus on the two major asset categories of deposits and real estate. Of course, these two categories are also the absolute mainstay of Chinese resident assets.

In 1978, residential housing assets were 43.2 billion yuan, and deposit assets were 21.1 billion yuan. By 2000, China's residential housing assets reached 15.32 trillion yuan, which is 355 times that of 1978; residential deposit assets reached 6.4 trillion yuan, which is 305 times that of 1978.

From 1978 to 2000, the annual compound growth rate of Chinese residential housing assets was 30.6%, and the annual compound growth rate of residential deposit assets was 29.7%, while the average growth rate of GDP at constant prices during the same period was 9.8%. The expansion of residential housing assets and deposit assets was more than three times that of China's GDP growth rate.

As a reference, the average growth rate of total assets for U.S. residents was 8.3%, and by 2000, total assets for U.S. residents were 5.7 times that of 1978.

After joining the WTO, the Chinese resident sector experienced a second wave of rapid wealth creation.

From 2001 to 2008, the annual compound growth rate of total resident assets in China was 20%, and the annual compound growth rate of net resident assets was also 20%, during which the expansion of resident liabilities relative to total assets was negligible. The average growth rate of GDP at constant prices during the same period was 10.7%, and the expansion rate of resident assets was twice that of GDP.

From 2009 to 2020, the annual compound growth rate of total resident assets in China was 13.2%, and the annual compound growth rate of net resident assets was 12.7%. During this period, the average growth rate of China's GDP at constant prices was 7.4%. The speed of expansion of Chinese resident assets was about twice that of GDP growth.

In 2009, total resident assets were 155.5 trillion yuan. By 2020, total resident assets in China reached 610.7 trillion yuan, which is 3.9 times that of 2009 As a reference, the compound growth rate of total assets for American residents during the same period was 6.3%, and in 2020, the total assets of American residents were twice that of 2009.

It was not until after 2020 that the asset expansion rate of Chinese residents began to slow down.

In 2024, the total assets of Chinese residents reached 763.7 trillion yuan, an increase of 25% compared to 2020.

As a reference, the compound growth rate of total assets for American residents during the same period was 6.6%, with a growth of 29.1% compared to 2020. The asset expansion rate of American residents is faster than that of China.

From 2020 to 2024, the average annual compound growth rate of total assets for Chinese residents was 5.7%, and the average annual compound growth rate of net assets was 5.6%. During the same period, the average growth rate of China's GDP at constant prices was 5.5%. After 2020, the expansion rate of net assets for Chinese residents slowed compared to total assets, and the GDP growth rate was slower than the expansion rate of net assets.

In the past 20 years, the creation of wealth for Chinese residents has been primarily driven by real estate.

From 1978 to 2010, the compound growth rate of housing assets for urban residents was 30.6%. From 2011 to 2020, the growth rate of housing assets for urban residents slowed but still maintained a high annual compound growth rate of 17.1%.

By examining three sets of data, we can clearly understand why it is said that the expansion of wealth for Chinese residents after joining the WTO was driven by real estate.

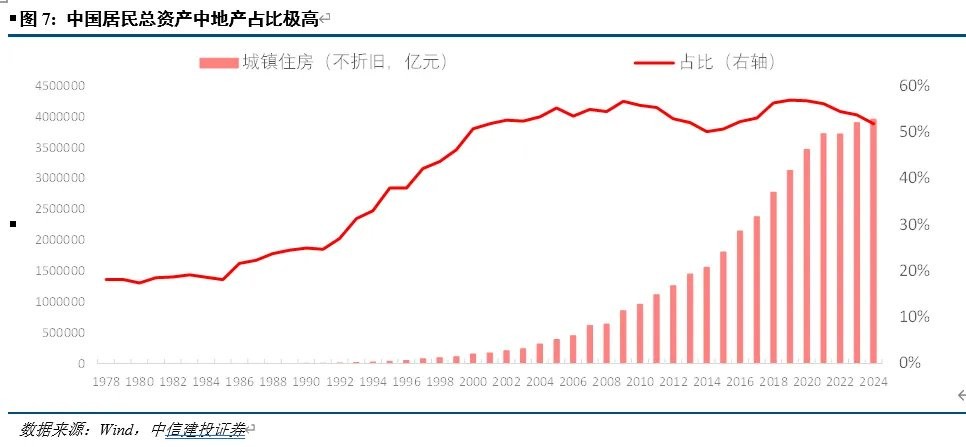

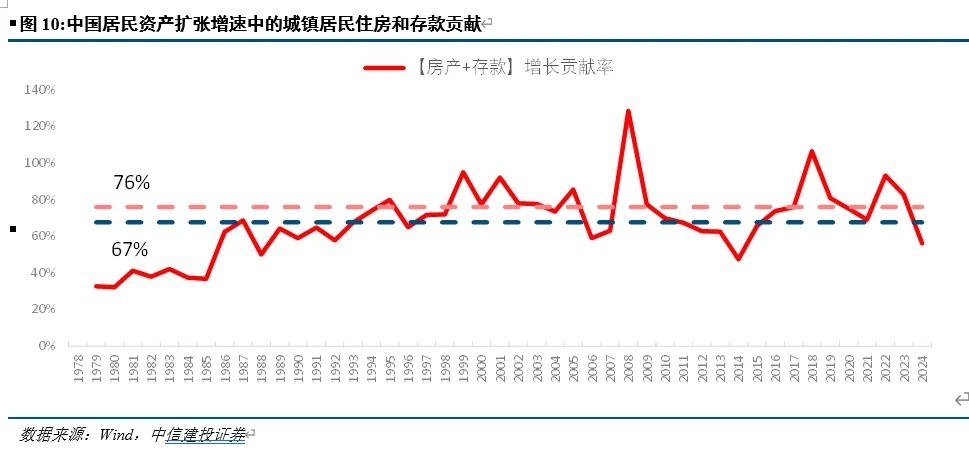

The first set of data shows that real estate has accounted for about 40% of the total assets of Chinese residents over the long term (from 1978 to 2024), and from 2000 to 2024, the expansion of real estate wealth explained 50% of the expansion of total assets for Chinese residents.

In the early historical period, the proportion of real estate in total assets was not high. After two rounds of real estate expansion (one round was the four trillion stimulus, and the other round was the monetization of shantytown renovations), the proportion of real estate in the total assets of Chinese residents rapidly increased.

After entering the 2000s, the proportion of housing assets for urban residents stabilized at over 50% of resident assets, peaking in 2019 (at 56.9%) before slightly declining.

The second set of data indicates that deposits of Chinese residents account for about 19.5% of their total assets, and from 2000 to 2024, the expansion of deposits explained 25% of the expansion of total assets for Chinese residents.

After entering the 2000s, the proportion of deposits in resident assets stabilized at over 15%.

The third set of data shows that the underlying driver of deposit expansion in China is real estate credit, indicating that the real estate chain explains 76% of the cumulative asset expansion for residents from 2000 to 2024.

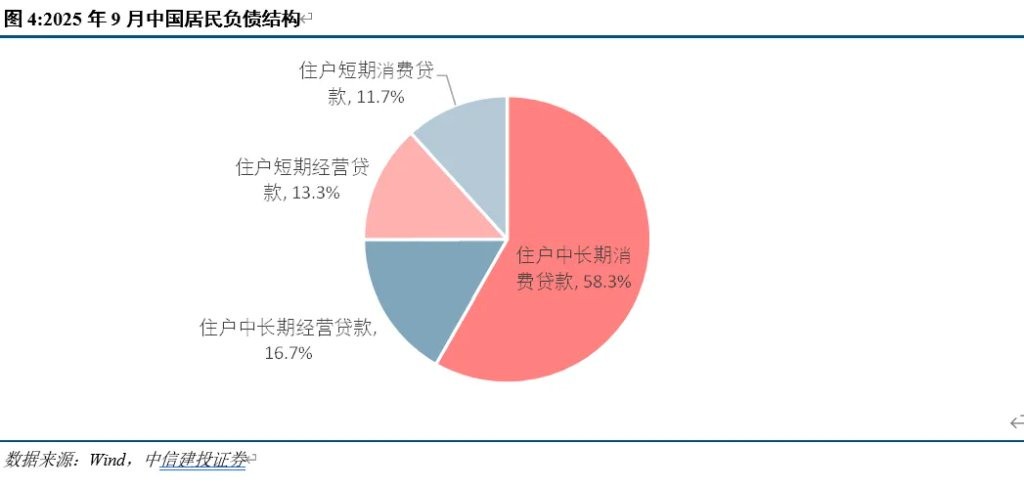

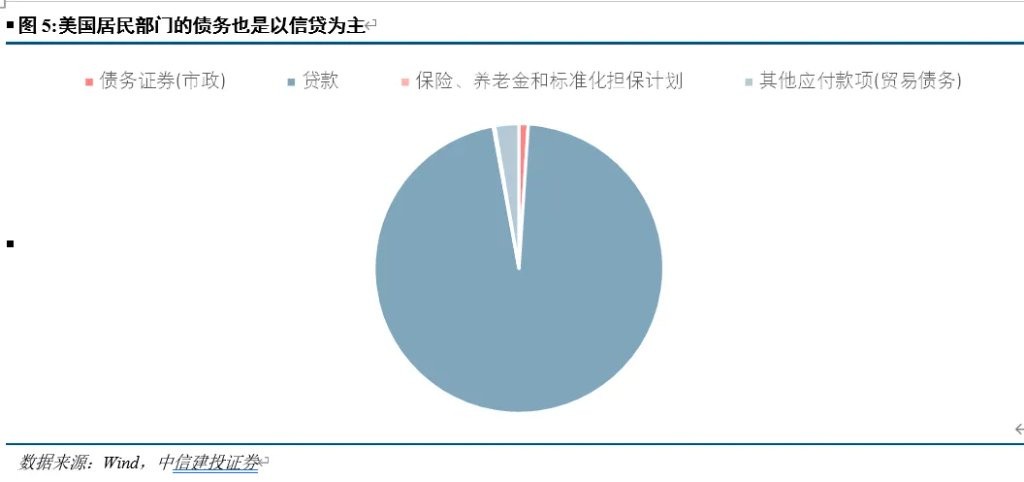

While creating an enormous amount of wealth for residents, China's leveraged consumption has risen.

From 2001 to 2020, the wealth and income of Chinese households expanded rapidly, marking a 20-year period of rapid improvement in residents' living standards.

1.4 billion people benefited from this economic growth, with per capita total income and per capita disposable income maintaining rapid expansion for 20 consecutive years, which is rare on a global scale In the past 20 years, over 900 million urban residents have benefited from real estate "wealth creation."

From 2001 to 2020, the assets of Chinese residents increased from 33.3 trillion to 610.7 trillion, expanding approximately 18 times.

From 2001 to 2020, real estate wealth increased from 17.3 trillion to 346.7 trillion, expanding 20 times.

From 2001 to 2020, resident deposits increased from 7.4 trillion in 2001 to 100.7 trillion in 2020, expanding approximately 14 times.

In the past 20 years, 1.4 billion people have simultaneously experienced a broad increase in income levels.

From 2001 to 2020, the per capita GDP of Chinese residents increased from 8,818.4 yuan to 73,000 yuan, expanding approximately 8.3 times.

From 2001 to 2020, the per capita disposable income of residents increased from 4,070.4 yuan to 32,000 yuan, expanding approximately 7.9 times.

From 2001 to 2020, the disposable income of the resident sector increased from 4.7 trillion to 45.5 trillion, expanding approximately 10 times.

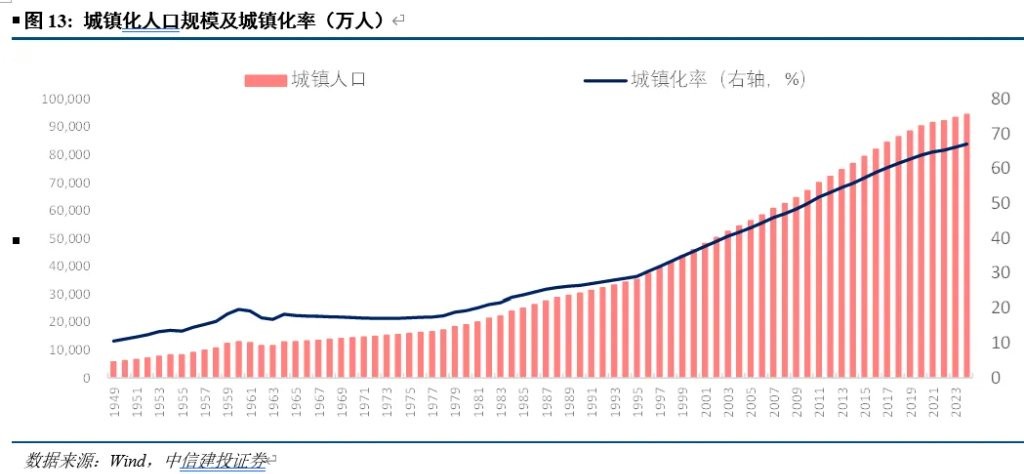

The fundamental reason for the rapid expansion of wealth creation and income growth in the past 20 years is that China has undergone an extreme urbanization process.

The term "extreme" urbanization is used because in 2001, China's urban population was only 480 million, with an urbanization rate of less than 38%. By 2020, the urban population had reached about 900 million, and the urbanization rate had risen to 64%.

In just 20 years, the urbanization rate nearly doubled, a speed that is typical of a "compressed" urbanization process, completing in 20 years what developed economies took 200 years to achieve.

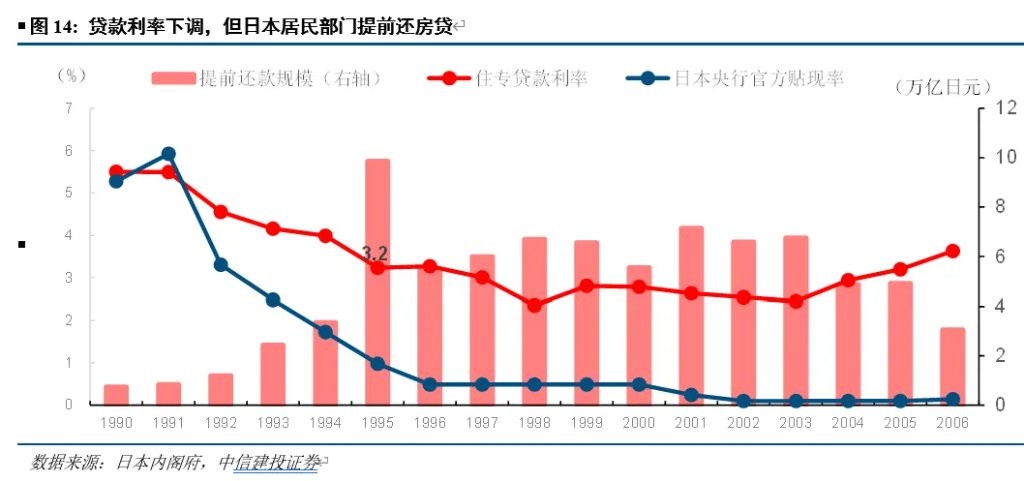

This cycle is not perpetual; it will stop when the fastest period of urbanization ends, leading to a rise in physical asset prices driven by real estate appreciation, an expansion of leverage stimulating monetary growth, and strong supply and demand pushing income increases, entering a period of moderation. The household ratio exceeding 1 in 2021 marks a turning point in this era. The era of wealth expansion and income increase driven by real estate has passed, and the accompanying era of leveraged consumption will also face transformation.

The wealth creation model will transform with changes in real estate trends, and the era of leveraged consumption will also come to an end. Understanding the current pressure on domestic demand is "temporary," and preparing for the four major consumption trends in the future is essential.

As the core driving force behind the expansion of resident assets, real estate is entering a transformation period, and the accompanying "leverage era" is gradually receding. The consumption inflation driven by leverage in the past will also undergo transformation, with four trends worth noting.

Trend One, the retreat of leveraged consumption that relies on wealth "cognitive bias" and over-leveraging the future, will lead to a return to rational consumption anchored in reasonable income and wealth growth.

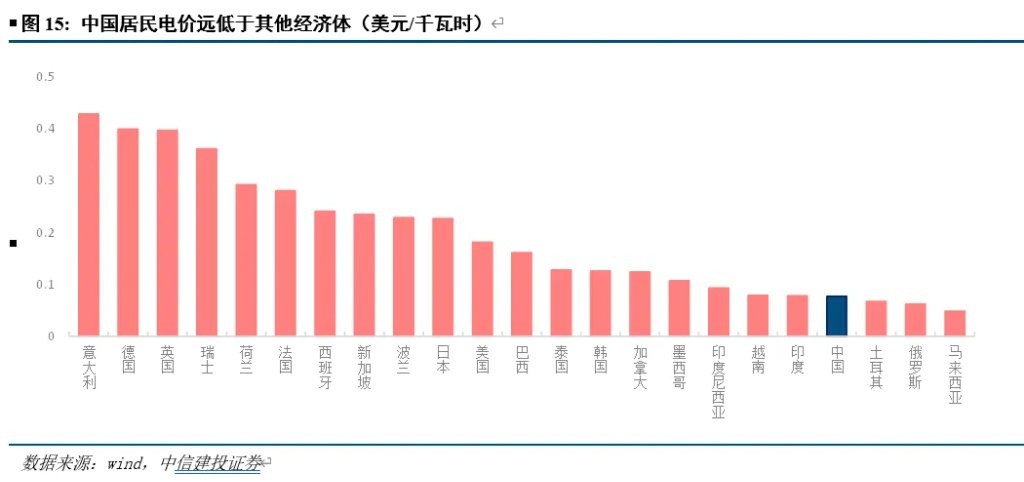

Trend Two, the stratification of resident wealth accumulation anchored by real estate, will correspondingly lead to a stratification of leveraged consumption, which will narrow in the future Trend 3, the re-evaluation of public service prices is shifting the focus of consumption from "goods" to "services."

Trend 4, during the transition of the wealth creation model driven by real estate, consumption will experience "initial suppression followed by stabilization."

In summary, the current "insufficient domestic demand" and "declining consumption" essentially reflect a profound structural transformation in the aggregate data. From this perspective, it is precisely a "problem of development and transformation that can be resolved through effort."

Main Text

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at your own risk