Next week's heavy schedule: "Technology Spring Festival" CES, Maduro may be tried in the U.S., U.S. non-farm payrolls, KNOWLEDGE ATLAS MiniMax Hong Kong stock listing

Next week (January 5 to January 11), there will be several important financial events, including the release of China's December CPI, PPI, and financial data, the publication of the U.S. December non-farm payroll report, and the "Technology Spring Festival" CES exhibition. Several technology companies from China and Hong Kong, such as KNOWLEDGE ATLAS and MiniMax, will conduct IPOs. Meanwhile, Venezuelan President Maduro may be tried in the U.S., and South Korean President Lee Jae-myung will visit China. The annual weight rebalancing of the Bloomberg Commodity Index will also impact the global commodity market

January 5 - January 11 Weekly Major Financial Events Overview, all times in Beijing:

Key Focus for Next Week: On the macroeconomic front, China will intensively release December CPI, PPI, and financial data, while the U.S. December non-farm payroll report will be unveiled. At the forefront of technology, the "Technology Spring Festival" CES exhibition will be held in Las Vegas from January 4 to 9. Many tech giants, including NVIDIA CEO Jensen Huang and AMD head Lisa Su, will attend. In the capital markets, several tech companies from China and Hong Kong, such as KNOWLEDGE ATLAS, MINIMAX, Precision Medical, TianShu Intelligent Chip, and Zhaoyi Innovation, will successively conduct IPOs, with KNOWLEDGE ATLAS and MINIMAX set to be listed soon.

Meanwhile, South Korean President Lee Jae-myung will visit China for the first time to strengthen China-South Korea economic and trade cooperation. In political events, Venezuelan President Maduro may appear in court in the U.S., and Ukrainian President Zelensky will hold a new round of talks with the U.S., making international geopolitical dynamics also noteworthy. The annual rebalancing of the Bloomberg Commodity Index, particularly the "technical sell-off" warning for gold and silver, will also impact the global commodity market.

Economic Indicators

- China December CPI, PPI

On January 9, Friday, China will release December CPI and PPI data. Zheshang Securities expects the December CPI year-on-year growth rate to remain at 0.7%, the same as last month, with a month-on-month change expected to shift from negative to flat; the year-on-year decline in PPI may narrow to -1.9%, down from -2.2%. This month, pork and oil prices continue to decline, and core CPI may continue to warm. In the industrial sector, the inventory cycle is unlikely to provide effective support for prices, and the capacity clearance in the midstream manufacturing sector may take a longer time.

- China January to December Financial Data: Social Financing, RMB Loans, etc.

Next week, China’s December financial data will be released, possibly after January 9. Zheshang Securities expects approximately 900 billion RMB in new RMB loans for December, with the social financing scale increasing by about 2.2 trillion RMB, but both may show a slight decrease year-on-year, and the growth rate of broad money M2 may slightly decline.

- U.S. December Non-Farm Employment Data

On January 9, Friday, the U.S. will release the December non-farm employment report. Current market expectations are for an increase of about 55,000 jobs, with the unemployment rate remaining at 4.6%. Bloomberg Economics has a more optimistic forecast, expecting job growth of 80,000. The key focus of this data is the contradictory phenomenon of job growth coexisting with a high unemployment rate. The report's results will directly affect the market's judgment on economic resilience and the Federal Reserve's policy path.

Financial Events

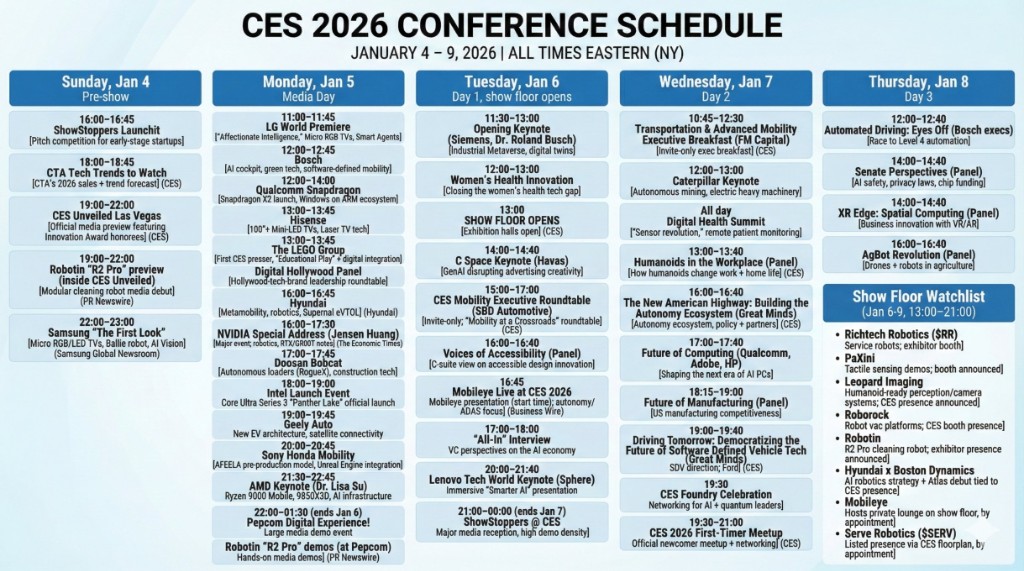

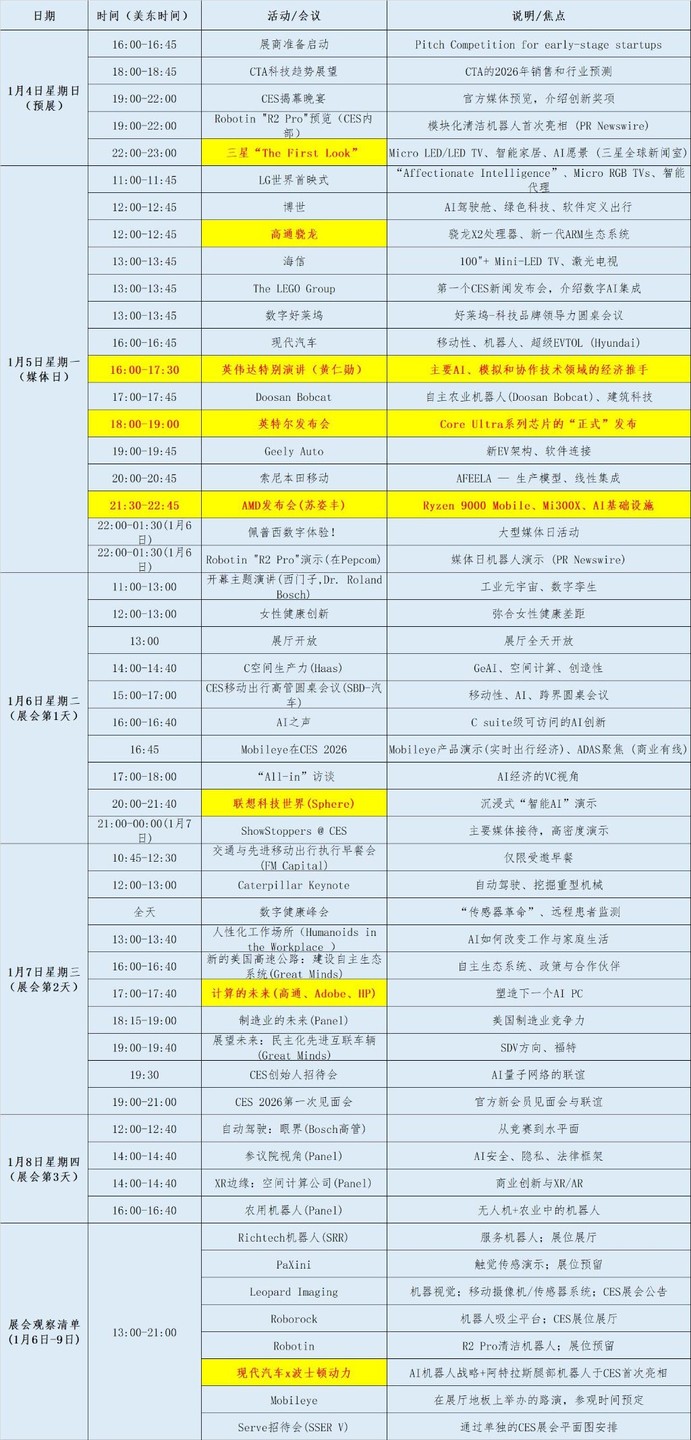

- The "Technology Spring Festival Gala" International Consumer Electronics Show will be held from January 4 to 9, featuring speeches by Jensen Huang, Lisa Su, and others.

The annual "Technology Spring Festival Gala" - the 2026 Consumer Electronics Show (CES) will take place from January 4 to 9 in Las Vegas, USA. CES has always been an important stage for technology companies to unveil their annual new products, showcasing items that are about to be launched as well as devices that are still in the conceptual stage and may not be produced.

NVIDIA CEO Jensen Huang and AMD CEO Lisa Su, among other tech leaders, will deliver keynote speeches on January 5 (Tuesday morning Beijing time). Asian tech giants such as Alibaba, Lenovo, Samsung Electronics, and LG will make a concentrated appearance in Las Vegas. The first "18A" chip, which is crucial to Intel's foundry business, will also be unveiled.

Jensen Huang will deliver a keynote speech from 16:00 to 17:30 Eastern Time on January 5, followed by Intel's press conference from 18:00 to 19:00 Eastern Time, and Lisa Su will speak from 21:30 to 22:45 Eastern Time on the same day.

This year's exhibition will particularly focus on AI hardware, including wearable devices such as smart glasses. Meta, Snap, and Apple will participate in related displays, although they may not release new hardware, they are expected to showcase the latest developments in software and applications. Additionally, CES will feature several AI humanoid robots, some for home scenarios, while others target enterprise applications in manufacturing, logistics, and catering.

- Maduro may appear in a federal court in New York on the 5th.

According to CCTV News, Venezuelan President Maduro may appear in a federal court in Manhattan, New York, as early as the 5th. However, this schedule may still change.

On January 3 local time, it was reported that the plane carrying President Maduro had arrived in New York, USA. In the early hours of January 3, explosions were suddenly heard in Caracas, the capital of Venezuela, and air raid sirens sounded. Subsequently, U.S. President Trump announced that U.S. military forces successfully struck Venezuela, capturing President Maduro and his wife and taking them out of Venezuela. Trump also stated that the couple had been taken aboard the U.S. Navy amphibious assault ship "Iwo Jima" and were heading to New York, where they would face U.S. judicial proceedings. Trump mentioned that he watched in real-time the operation by U.S. special forces to capture Maduro, describing it as like watching a "TV show," seeing "every detail."Trump also told the American media that the United States will deeply intervene in Venezuela's oil industry.

According to media reports citing two informed sources, the U.S. Department of Justice is expected to file new charges against Maduro and his wife in New York, along with a supplemental indictment. Previously, Maduro was indicted in New York in 2020. These cases allege a decades-long conspiracy in which Maduro and his senior aides provided political and military protection to drug terrorists while stealing billions of dollars from the state.

- Zelensky announced that Ukraine and the U.S. will hold a new round of talks on the 6th

According to CCTV News, on January 3, Ukrainian President Zelensky stated that on January 6, he will hold talks in Paris, France, with the team of U.S. President Trump. Zelensky mentioned that he will visit Paris, with the key task of finalizing the last details of the security guarantee document for Ukraine under the framework of the willingness alliance and signing a joint statement. Subsequently, the statement will be submitted to the parliaments of various countries for approval. In addition, he stated that he will also hold talks with U.S. representatives, with the level of U.S. participation to be officially announced by the White House.

- Bloomberg Commodity Index (BCOM) will undergo annual weight rebalancing from January 8 to 14, 2026

A predictable "technical storm" driven by index rules is about to arrive, with the center of the storm being the recently strong-performing gold and silver. JPMorgan warned that due to outperforming the market for three consecutive years, the weight of gold and silver in the Bloomberg Commodity Index (BCOM) has been severely overweighted. During the index rebalancing in January 2026, passive funds will be forced to conduct "technical sell-offs." It is expected that the futures selling volume will account for 9% and 3% of the total holdings of silver and gold, respectively.

- Knowledge Atlas Hong Kong IPO, expected to start trading on January 8

"The first stock of large models," Knowledge Atlas: Hong Kong IPO priced at HKD 116.2, plans to issue over 37 million shares, with an issue price of HKD 116.20 per share, and the stock is expected to start trading on January 8.

- MiniMax Hong Kong IPO, expected to be priced on January 7 and start trading on January 9

MiniMax Group applied for an IPO in Hong Kong to issue 25.4 million shares, with a price guidance range of HKD 151-165 per share. According to Bloomberg's calculations, the company will raise up to HKD 4.19 billion. The stock is expected to be priced on January 7 and start trading on January 9. Cornerstone investors include Abu Dhabi Investment Authority, Alibaba, Aspex Master Fund, and Boyu Capital.

- Precision Medical Hong Kong IPO, expected to start trading on January 8

Surgical robot manufacturer Precision Medical seeks to raise HKD 1.2 billion through a Hong Kong IPO. It plans to issue 22.7 million shares at an issue price of HKD 43.24 per share. The stock is expected to start trading on January 8

- TianShu ZhiXin Hong Kong IPO, expected to start trading on January 8

Shanghai TianShu ZhiXin Semiconductor Co., Ltd. seeks to raise HKD 3.68 billion through a Hong Kong IPO. It aims to issue 25.4 million shares at an issue price of HKD 144.60 per share. The stock is expected to start trading on January 8.

- GigaDevice Hong Kong IPO, expected to be priced on January 9 and start trading on January 13

GigaDevice Semiconductor Inc. has applied for a Hong Kong IPO. It seeks to issue 28.9 million shares, with the upper end of the price guidance at HKD 162 per share. The stock is expected to be priced on January 9 and start trading on January 13.

- South Korean President Lee Jae-myung's first visit to China from January 4 to 7

According to Global Times, South Korean President Lee Jae-myung will make a state visit to China from January 4 to 7, 2026. Yonhap News reported on the 30th that this will be Lee Jae-myung's first visit to China since taking office. Yonhap News cited business sources stating that over 200 South Korean entrepreneurs, including Samsung Electronics Chairman Lee Jae-yong, SK Group Chairman Chey Tae-won, Hyundai Motor Group Chairman Chung Eui-sun, and LG Group Chairman Koo Kwang-mo, will form an economic delegation accompanying Lee Jae-myung to China. The South Korean side also announced Lee Jae-myung's itinerary in Shanghai. Blue House spokesperson Kang You-jeong stated that 2026 marks the 150th anniversary of the birth of Korean independence activist Kim Gu (also known as Baekbeom), as well as the 100th anniversary of the establishment of the Provisional Government of the Republic of Korea in Shanghai. The South Korean side will commemorate these events in Shanghai and reflect on their historical significance.

- Lenovo Group to jointly launch an enterprise-level AI product with NVIDIA on January 6

According to Jiemian News, recently, Lenovo Group Chairman and CEO Yang Yuanqing had a discussion with NVIDIA founder and CEO Jensen Huang. Huang stated that artificial intelligence is evolving from "generative AI" to "agent-based AI," the latter having stronger problem-solving capabilities and the ability to reason based on facts. Yang Yuanqing and Jensen Huang agreed that the core opportunity for the future development of artificial intelligence lies in "hybrid artificial intelligence." It is reported that Lenovo Group will jointly launch a significant enterprise-level AI product with NVIDIA at the Innovation Technology Conference on January 6. Huang also mentioned that there is "no reason" for the cooperation not to expand fivefold in the next two years.

- The State Council Information Office will hold a press conference on January 5 regarding the progress and achievements of the Yangtze River Economic Belt development over the past decade

The State Council Information Office will hold a press conference on January 5, 2026 (Monday) at 10 a.m., where Wang Changlin, Deputy Director of the National Development and Reform Commission, along with relevant officials from the Ministry of Ecology and Environment, the Ministry of Transport, the Ministry of Water Resources, and the Ministry of Agriculture and Rural Affairs, will introduce the progress and achievements of the Yangtze River Economic Belt development over the past decade and answer questions from reporters

- The State Council Information Office will hold a press conference on January 6 to promote green consumption

The State Council Information Office is scheduled to hold a press conference on January 6, 2026 (Tuesday) at 3 PM, where Vice Minister of Commerce Sheng Qiuping and relevant officials from the Ministry of Ecology and Environment, Ministry of Agriculture and Rural Affairs, and State Administration for Market Regulation will introduce the situation regarding the promotion of green consumption and answer questions from reporters.

- Childcare subsidies for 2026 will be fully open for application starting January 5

According to CCTV News, as of now, all 31 provinces (autonomous regions and municipalities) in the country have issued childcare subsidies, with over 24 million recipients, and the issuance rate for the 2025 childcare subsidies is about 80%. According to work arrangements, the application for childcare subsidies for 2026 will soon be open. From January 1 to 4, 2026, the information management system for childcare subsidies will be upgraded and tested, and applications will be fully open starting January 5.

- AliExpress seemingly challenges Amazon: See you in Hangzhou on January 7

On December 23, AliExpress released a "boxing match" themed poster with the text "See you in Hangzhou on January 7." Industry insiders pointed out that the red and black boxing gloves in the poster correspond to the brand colors of AliExpress and Amazon, indicating that AliExpress is publicly challenging Amazon. Wall Street Journal learned from several merchants that AliExpress will hold a brand overseas conference in Hangzhou on January 7, 2026, primarily inviting merchants who are stocking up for overseas sales. Not long ago, Amazon's annual merchant conference was also held in Hangzhou.

- Eurogroup: Eurozone member states must submit candidates for the position of ECB Vice President by January 9

Eurogroup: Eurozone member states must submit candidates for the position of ECB Vice President by January 9. Eurozone finance ministers will make a decision at the meeting on January 19.

- Zhongwei Company: Plans to issue shares and pay cash to acquire 64.69% equity of Hangzhou Zhonggui, stock will resume trading on January 5

Zhongwei Company announced that it plans to acquire 64.69% equity of Hangzhou Zhonggui held by a total of 41 trading partners including Hangzhou Zhongxin Silicon, Ning Rong Haichuan, Lin'an Zhongxin Silicon, Lin'an Zhongxin Silicon, Hangzhou Xinjian, and Hangzhou Zhongchengxin through issuing shares and paying cash. At the same time, the listed company plans to issue shares to no more than 35 specific investors to raise supporting funds. The target company's main business is the research, development, production, and sales of Chemical Mechanical Planarization (CMP) equipment, which is a core equipment of wet process technology, and provides customers with overall solutions for CMP equipment. It is one of the few companies in China that has mastered the core technology of 12-inch high-end CMP equipment and achieved mass production. Through this transaction, the listed company will become a manufacturer with core process capabilities in "etching + film deposition + measurement + wet process," successfully achieving a key leap from "dry process" to "dry process + wet process" overall solutions. The company's stock will resume trading on January 5, 2026

- Financial Reports

January 8, Thursday: Fast Retailing, Aeon, RPM International, Jefferies Financial.

January 9, Friday: Yaskawa Electric.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk