Buffett's farewell, OpenAI stirs up trillion-dollar market value, Google's strong rise... A review of the top ten global business events of 2025

In 2025, the global business landscape is reshuffled by AI: OpenAI, although not publicly listed, leverages orders and narratives to influence trillion-dollar market fluctuations, becoming a "shadow giant" in the capital market; NVIDIA crowns itself with a $50 trillion throne, while Google is aggressively challenging AI pricing power; Buffett takes a bow, and Musk pushes aerospace into industrialization, as Europe urgently slams the brakes on fuel vehicles. A mix of high-stakes bets and reversals, the collision of old and new orders is reshaping technology, capital, and the direction of the era

Looking back at the soon-to-end year of 2025, a series of iconic business events have etched a clear and profound era note for this year.

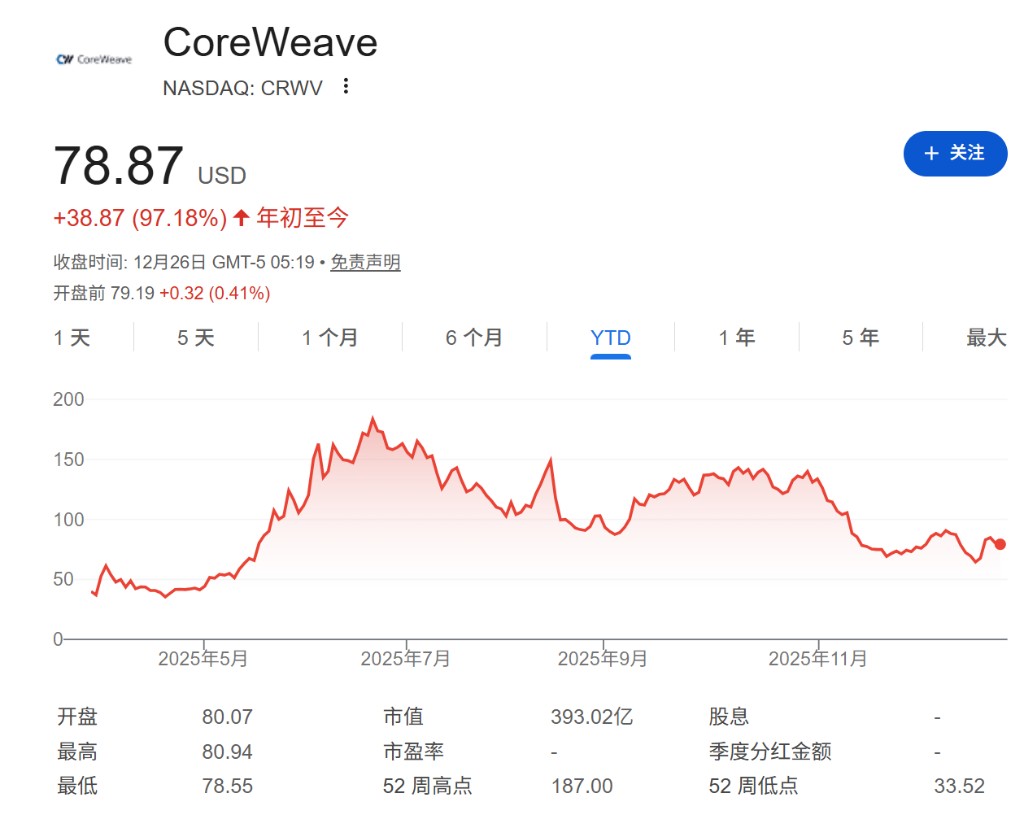

The AI competition has fully heated up. The White House ignited "Stargate," betting $500 billion on the foundation of American AI; CoreWeave brought computing power leasing to the capital scale; although OpenAI is not publicly listed, it has leveraged orders and narratives to drive trillion-dollar market value fluctuations, becoming the "shadow giant" of the market.

NVIDIA crowned as the world's first $5 trillion company, acquiring shares in Intel and securing Groq's inference capabilities, consolidating its throne in computing power through alliances and defenses. Google, on the other hand, launched a direct assault on AI pricing power with its dual engines of TPU and Gemini.

On the capital stage, the 95-year-old Buffett penned "the last letter," marking the curtain call of an era. At a higher level, Musk industrialized space travel with 155 launches. Meanwhile, Europe hit the brakes, with Germany rewriting the ban on fuel vehicles, buying time for traditional industries.

In Europe, Germany urgently hit the brakes, rewriting the 2035 ban on fuel vehicles to buy time for internal combustion engines, exposing the tension between radical transformation and market realities.

The old order is loosening, and new forces are rising. Alliances, games, gambles, and reversals constitute the most authentic commercial backdrop of 2025.

At the end of the year, we review the most representative Top 10 Global Business Events of 2025, reflecting on how this year reshaped the technological landscape, capital logic, and the direction of the era.

The White House Ignites "Stargate": $500 Billion Bet on American AI Foundation

In January 2025, “Stargate” made a high-profile debut at the White House. OpenAI, SoftBank, and Oracle announced a rolling investment of $500 billion over four years, with an immediate investment of $100 billion to build 20 super-large AI data centers across the U.S., creating "the largest AI infrastructure project in history." Masayoshi Son was appointed chairman, creating an unparalleled momentum.

However, two months later, reality began to cool down. In March, construction began at the Abilene base in Texas, planning for 64,000 NVIDIA GB200 chips, with an initial phase of 16,000 chips. However, differences between SoftBank and OpenAI regarding equity ratios, data sovereignty, and funding rhythms became public, revealing cracks in the cooperation.

By May, multiple media reported that the project was "stalled". The $500 billion had not been secured, and the originally scheduled summer installation milestone was delayed. To ensure ChatGPT's computing power, OpenAI bypassed SoftBank and signed contracts with third-party data centers independently, forcing the "alliance project" to yield to real demands. In July, [the target further shrank](https://wallstreetcn.com/articles/3751631? keyword=Star Gateway). The company has lowered its 2025 target to "build a small pilot center in Ohio by the end of the year," which is a stark contrast to the earlier commitment of "100 billion immediately in place," with "shell protection advancement" becoming the new tone.

On October 30, [the project announced the construction of a 1GW park in Saline, Michigan](https://wallstreetcn.com/articles/3758370?keyword=Star Gateway) as a symbolic fulfillment of the "4.5GW total plan," with construction expected to start in early 2026. The scale remains, but it is significantly lower than the initial blueprint. In November, [financing and supply chain supplementation advanced simultaneously](https://wallstreetcn.com/articles/3758950?keyword=Star Gateway): Blue Owl provided $3 billion in equity plus $18 billion in syndicated loans; in the same month, SoftBank acquired server chip company Ampere for $6.5 billion in cash to "fill tickets" for the subsequent supply chain.

Entering December, Abilene became the only substantial progress. Four data center buildings have been topped out, with the installation of electromechanical and cooling systems underway, and it is planned to launch 400,000 GPUs by mid-2026, expected to become "the largest known single AI cluster." However, there are still no formal contracts for sites in Arizona, California, Florida, and other locations.

Meanwhile, risk hedging has accelerated. Oracle has at least postponed the construction of one data center and sold Ampere shares to cash out $2.7 billion, reducing unilateral exposure. SoftBank, hindered by external financing, has reduced its holdings of NVIDIA stocks to raise cash, indicating that the $500 billion target is far from being met.

From "epic official announcement" to "single point landing," the "Star Gateway" has not been aborted but has significantly shrunk. The conclusion is becoming clearer: Abilene is expected to become a landmark of AI computing power in the U.S. by mid-2026, but the original concept of "500 billion, 20 parks" has been reshaped by competition, financing, and uncertainty. The real test will come after Abilene goes into production, determined by operational effectiveness and a new round of capital.

From "card hoarding business" to public pricing: CoreWeave pushes AI computing power onto the capital scale

On March 28, CoreWeave debuted on NASDAQ at $40 per share, with an estimated valuation of about $23 billion, raising $1.5 billion. It opened at $39, and over the next four months, the stock price surged to a high of $187, with a market value once approaching $90 billion.

This is not just a company's IPO, but also the first time "AI computing power leasing" has been priced by the public market.

This is not just a company's IPO, but also the first time "AI computing power leasing" has been priced by the public market.

CoreWeave's origins are not glamorous. In 2017, it was an Ethereum mining farm. After the crypto winter, the company transformed 250,000 NVIDIA GPUs into cloud assets, pivoting to a "pure GPU cloud," avoiding CPUs and general IaaS, focusing solely on one thing: accumulating cards and then leasing them out.

Its revenue formula is highly simple: priced per card, long-term locked. Major clients sign contracts worth billions of dollars for 3 to 6 years at a time, while small and medium clients pay by the hour, creating high visibility cash flow.

In the 11 months before the IPO, CoreWeave signed a 5-year lease with OpenAI worth $11.9 billion; 9 months after the IPO, it added another $6.5 billion, bringing the total to $22.4 billion. During the same period, Meta secured orders worth up to $14.2 billion, and NVIDIA committed $6.3 billion to "underwrite" unsold capacity, providing a safety net for demand. These three large orders pushed the backlog to $55.6 billion, which is 29 times the revenue for 2024.

Valuation was thus rapidly pushed up: based on the IPO price, CoreWeave corresponds to a 12 times P/S ratio for 2024 revenue; at its peak market value, the P/S ratio approached 47 times, higher than NVIDIA during the same period, and was labeled by short sellers as the "core of the AI bubble."

Behind the controversy, the industry coordinates have been rewritten. CoreWeave proves that "computing power intermediaries" can go public and gain institutional recognition, prompting similar companies like Lambda and Crusoe to initiate IPO guidance. Its structure of "long-term leases + GPU collateral financing" also provides banks with a quantifiable model, promoting GPU leasing ABS pilots and lowering the financing threshold for the AI industry chain.

More importantly, there is a change in perception. The volatility of the public market has reversed-educated clients: computing power is no longer just a hard currency of "not being able to buy cards," but an asset that can be compared in rental and sales ratios and flexibly transferred. The industry is moving from "card hoarding panic" to "on-demand allocation."

From mining farm to the main board, CoreWeave has written "GPU as an asset, computing power as a service" into its valuation model. $23 billion is just the starting point; what is truly being priced is a brand new category of capital expenditure.

NVIDIA invests $5 billion in old rival Intel

NVIDIA and Intel, long-time rivals, suddenly choose to join forces. On September 18, NVIDIA announced it would invest $5 billion in Intel and jointly develop chips for PCs and data centers.

According to the agreement, NVIDIA will purchase Intel common stock at $23.28 per share. After the cooperation was announced, the market reacted quickly. Intel's stock surged nearly 30% in pre-market trading, while another competitor, AMD, plummeted, with a drop of over 4%.

For Intel, this is a timely rain. In recent years, it has been retreating in the high-performance chip market, struggling to bear the high costs of advanced processes with its own cash flow. The company has received about 10% shareholding support from the U.S. government, a $2 billion strategic investment from SoftBank, and has accelerated financing through asset sales. The addition of NVIDIA further solidifies its funding chain. For NVIDIA, this is a strategic move with a small investment for a large return. The $5 billion is not heavy relative to its size, yet it opens up the x86 ecosystem and a broader CPU collaboration space.

For Intel, this is a timely rain. In recent years, it has been retreating in the high-performance chip market, struggling to bear the high costs of advanced processes with its own cash flow. The company has received about 10% shareholding support from the U.S. government, a $2 billion strategic investment from SoftBank, and has accelerated financing through asset sales. The addition of NVIDIA further solidifies its funding chain. For NVIDIA, this is a strategic move with a small investment for a large return. The $5 billion is not heavy relative to its size, yet it opens up the x86 ecosystem and a broader CPU collaboration space.

The core of the cooperation between the two parties directly targets the two major strongholds of PCs and data centers. Intel will introduce NVIDIA's graphics processing technology in its next-generation PC chips to enhance its competitiveness against AMD; in data centers, Intel will provide general-purpose processors for AI clusters built on NVIDIA hardware, compensating for the shortcomings of accelerated chips in general computing.

NVIDIA CEO Jensen Huang stated that this cooperation will combine NVIDIA's AI and accelerated computing stack with Intel's CPUs and the vast x86 ecosystem, laying the foundation for the next generation of computing. Intel CEO Pat Gelsinger emphasized that x86 remains the cornerstone of modern computing, and the company will continue to drive innovation. Both parties also stated that the cooperation will not change their independent strategies, and NVIDIA will continue to design its processors using Arm technology.

This turning point feels more like an inevitable outcome after a period of mutual rise and fall. From rivals to partners, this $5 billion bet is not just a capital transaction but an important signal in the restructuring of the industrial landscape: in the new computing era dominated by AI, closed defenses are no longer sustainable, and alliances among the strong are becoming the new survival rule.

The Roller Coaster of Shadow Giants: OpenAI Shakes Up the 2025 AI Capital Narrative

In 2025, OpenAI has not gone public, yet it has become the strongest "emotional engine" in the capital market. Financing, orders, and executive statements continuously amplify throughout the entire AI industry chain, creating a series of roller coaster market trends.

From the beginning of the year to April, the story was ignited by infrastructure. OpenAI teamed up with SoftBank and Oracle to launch a $500 billion "Stargate" computing alliance, with Trump endorsing it at the White House. Oracle surged in a single day, and SoftBank also skyrocketed, quickly positioning OpenAI as the "flag bearer of AI infrastructure," leading to a collective revaluation of computing power, servers, and chip stocks.

From May to August, the halo began to crack. The GPT-5 performance was mediocre when released in August, suppressed by Google's Gemini 3.0 and xAI Grok on multiple metrics. Meanwhile, the mismatch of "annual revenue of about $20 billion, yet a valuation exceeding $500 billion" was frequently mentioned, and the "AI revolution" began to be replaced by the "AI bubble," with the rise of concept stocks significantly cooling down.

In September, OpenAI announced its first consumer-grade AI hardware was manufactured by Luxshare Precision, leading Luxshare to hit the daily limit, with the "fruit chain" collectively rising; In the same month, Oracle's remaining performance obligations rose to $455 billion, and the stock price reached a new high, with sentiment being pulled back to a high level again.

In October, financial issues intensified and stirred market sentiment. SoftBank recorded an unrealized gain of $14.6 billion from its stake in OpenAI, achieving a record quarterly net profit, and the stock price peaked; however, OpenAI's acquisition of financial AI application Roi and its deep ties with AMD led the outside world to begin calculating its cash burn and financing intensity. The CDS market saw the first occurrence of default swap transactions involving multiple tech giants, bringing debt risk to the forefront.

On November 7, sentiment experienced a "nuclear explosion." A CFO's statement that "the federal government may need to backstop chip financing" was interpreted as "even the strongest AI company is short on cash." That evening, the six major tech giants and computing power suppliers in the U.S. stock market collectively evaporated about $500 billion. CEO Altman quickly clarified in a post that "we do not need government guarantees," but this only resulted in a limited rebound, leading the market into a "trust deficit."

In December, the competitive landscape reversed. Google's Gemini continued to gain a good reputation, and Alphabet's ecosystem doubled within the year; in contrast, the "OpenAI system," including Oracle and SoftBank, fell about 40% from their peaks, with a market value shrinkage of over $100 billion, and the "OpenAI concept" shifted from a premium label to a risk exposure.

Looking back over the year, OpenAI's "stock price effect" was first pushed to a boiling point by grand infrastructure and hardware narratives, and then continuously stirred by model competitiveness, debt concerns, and verbal missteps. The capital logic has shifted from "changing the world" to "realizing cash flow." Whether it can move towards more sustainable growth with approximately $20 billion in revenue will determine whether the AI sector matures by 2026 or continues in a cycle of high valuations and high volatility.

NVIDIA Becomes the World's First "$5 Trillion Company"

On October 30, NVIDIA's stock price rose about 3% to $207.16, with a market value rising to $5.03 trillion, becoming the first company in the world to reach this milestone

This number has surpassed the total market capitalization of AMD, Arm, ASML, Broadcom, Intel, Lam Research, Qualcomm, and TSMC, and is greater than the market sizes of utilities, industrials, and consumer staples sectors in the S&P 500. Over the past six months, NVIDIA's stock price has increased by approximately 90%. Its current size even exceeds the combined market capitalization of the major indices in Germany, France, and Italy.

Three years ago, before the launch of ChatGPT, NVIDIA's market capitalization was only about $400 billion. Subsequently, the demand for GPUs required for training and running large models surged, and its market capitalization broke through $1 trillion within months, accelerating further: reaching $2 trillion in February 2024, $3 trillion in June, $4 trillion in July 2025, and surpassing $5 trillion in October.

Demand is the core driving force behind this leap. Angelo Zino, Senior Vice President of CFRA Research, bluntly stated: “They are the cornerstone of the entire AI trade.” NVIDIA disclosed that the Blackwell chips released last year have shipped 6 million units, with 14 million units still on order. Jensen Huang predicted at the GTC conference that total sales over the next five quarters will reach $500 billion.

However, amidst the surge, skepticism is also rising. Some investors compare the current AI stock trends to the internet bubble: companies are investing hundreds of billions of dollars and accumulating debt, while actual revenues remain limited. Valuations are also under pressure, with NVIDIA's stock price being about 33 times next year's expected earnings, higher than the S&P 500's average of about 24 times.

From $400 billion to $5 trillion, NVIDIA has completed a "10-bagger" leap in three years. It has not only reshaped its own destiny but also defined the computational power coordinates of the AI era. However, as the market capitalization soars beyond the trillion-dollar mark, the growth story must continue to be fulfilled to deserve this most dazzling crown.

Buffett's "Last Letter": I was "just lucky," but "time has caught up," and I will "keep quiet"

At 95 years old, Buffett wrote his last annual shareholder letter on November 10, 2025. In the letter, he stated “I’m going quiet,” announcing that he will step down as CEO and exit daily management by the end of the year. This investor, who has led Berkshire Hathaway for nearly sixty years, is officially moving towards his curtain call.

The baton is being passed to the new CEO, Greg Abel. Buffett praised him for his excellent management, diligence, practicality, and sincere communication, jokingly hoping he would “keep going.” From now on, the annual letter will be penned by someone else, but Buffett promised to still write to shareholders every Thanksgiving, maintaining the emotional bond with Berkshire.

The most touching part of this "farewell letter" is his reflection on life. At 95, he expressed gratitude for his "incredible luck": being born in America in 1930, enjoying health and the benefits of the era. In 1938, he nearly lost his life to appendicitis, and in the hospital, he even asked a nun for her fingerprint, fantasizing about solving cases for the FBI Talking about Charlie Munger and several old friends, he jokingly said, "There might be magic in Omaha's water." Now, with a slower pace and reading becoming a challenge, he still insists on going to work every week and occasionally comes up with good ideas.

At the farewell moment, he once again shared business wisdom, directly pointing to corporate greed. Buffett criticized the disclosure of executive compensation, which sparked a competition of "who is richer": "What often troubles very wealthy CEOs is that others are richer." He advised Berkshire to avoid leaders who are eager to retire at 65, pursue "notably wealthy" status, or attempt to establish a "dynasty."

His long-termism also contrasts with the current speculative trend. Starting from investing in Berkshire during its struggles in 1962, he developed it into a business empire spanning insurance, manufacturing, utilities, railroads, and brands like Dairy Queen and Fruit of the Loom, emphasizing the need to avoid paths that could lead the company to "become beggars."

A letter encapsulates a lifetime. Saying goodbye to power, adhering to principles, and giving back to society. For the market, this marks a historic turning point for Berkshire; for investors, it is a final demonstration grounded in data and driven by rationality.

After 155 launches, Musk brings space travel into the "Industrial Age"

In 2025, SpaceX redefined the meaning of "scaled space travel" with an almost frenzied launch pace.

As of November 22, the Falcon 9 had completed 150 orbital missions, along with 5 Starship test flights, totaling 155 launches for the year, averaging one rocket launch every 2 to 3 days. Just at Cape Canaveral, there were 94 launches, accounting for about 40% of the global total. Space travel has, for the first time, presented the rhythm of an industrial assembly line.

Musk's core asset is the reusable "re-evolution." Booster B1067 flew 31 times, setting a world record; over 20 rockets in the active fleet have surpassed 10 flights, with certification goals being pushed to 40. There were 532 first-stage recoveries and 454 re-flights throughout the year, with a success rate exceeding 97%. The simultaneous reuse of fairings and control surfaces has reduced the marginal cost of a single launch to the range of $150,000 to $200,000, transforming rockets from "expensive equipment" into "reusable assets."

Starship represents an even further asset. In 5 comprehensive test flights throughout the year, the latest one achieved complete recovery of the second stage upon re-entry; Block 2's body and thermal protection tiles completed over 300 ground thermal cycle tests. Launch Complex 39A at Kennedy Space Center is being renovated for "Starship exclusivity," paving the way for the first flight on the East Coast in 2026, as well as subsequent HLS and GTO missions.

The industry depth research report released by Guojin Securities on December 10 shows that SpaceX is not a traditional aerospace manufacturer, but rather a "monopoly in space logistics and infrastructure that applies first principles (breaking the myth that rockets must be expensive, breaking the convention of single-use, breaking material selection, and iterating quickly without seeking perfection) to the extreme."

The report points out that the seemingly insurmountable industry barriers are not derived from a single technological breakthrough, but rather from the deep integration of three dimensions: cost, manufacturing, and customer moats.

Currently, SpaceX has officially launched the investment bank selection process, marking the most substantial step the commercial aerospace giant has taken towards an IPO. If all goes well, this could become one of the largest IPOs in the capital market in recent years.

This is not just a victory for Musk; it also signifies that commercial aerospace is transitioning from "engineering marvels" to "scaled industry." The foundation of the great aerospace era is being solidified by the re-flying rockets.

Ban Emergency Brake: Germany Wins Time for Fuel Vehicles

After more than two years of implementation, the 2035 ban on fuel vehicles, regarded as the "crown jewel" of the EU climate agenda, has been shattered under strong intervention from Berlin.

The once unshakeable "100% zero emissions" target has now been urgently revised to "90% reduction." According to the latest plan disclosed by the media on the 23rd, the remaining 10% gap can be filled with e-fuels or biofuels. This means that as long as "green fuels" are injected, internal combustion engines and plug-in hybrid vehicles will still have legal road rights after 2035.

Behind this reversal is the disconnection between harsh market data and aggressive reduction targets:

- Market Gap: By 2025, car manufacturers are required to have an electric vehicle share of 25% for carbon reduction compliance, but the current actual share is only 16.4%.

- Popularization Gap: The share of electric vehicle sales in the Netherlands is 35%, while in Spain it is only 8%, with uneven infrastructure making "full electric transformation" a mirage.

- Fine Red Line: If the status quo is maintained, European car manufacturers face hefty fines amounting to hundreds of millions of euros.

German Chancellor Merz and European People's Party (EPP) Chairman Weber have joined forces to end the "pure electric ideology." Weber called this move a "great achievement in coordinating climate goals with market realities." Meanwhile, giants like Mercedes-Benz and Volkswagen, through intensive lobbying, ultimately pressured the von der Leyen government to "soften" its stance under political pressure.

In the short term, Germany has secured a survival window for its domestic internal combustion engine supply chain, leveraging its strong trade discourse power (60% of products are consumed within the EU); however, in the long term, whether this "resurrection" can withstand the iterative speed of Chinese car manufacturers remains questionable. As German Finance Minister Lindner warned:

"If we cling to old dreams, the future will only become more difficult."

The Rise of Google: Driven by Chips and Models, Launching a Challenge for the World's Top Market Value

Alphabet is turning a technological evolution into a market value competition. In 2025, driven by the AI wave, its stock price rebounded over 60%, and its market value rose to $3.8 trillion, ranking third globally.

This round of betting is not centered on advertising, but on the dual drive of "chips + models."

On one end is hardware. Google is betting on self-developed TPUs and partnering with Meta to advance the project codenamed “ TorchTPU”, aiming directly at NVIDIA's most solid moat—CUDA. By enhancing TPU compatibility with PyTorch, Google is attempting to "unlock" developers from the GPU ecosystem. More importantly, TPUs are no longer just serving its own cloud but are starting to be sold directly to the market. Under the leadership of the new AI infrastructure head Amin Vahdat, Google is pushing its internal capabilities to the market, building a computing power option independent of the NVIDIA system.

On the other end is the model. Gemini 3 Flash is positioned as a high-efficiency "main model": it is three times faster than the previous generation Gemini 2.5 Pro, with costs only a quarter of Gemini 3 Pro; in the SWE-bench Verified programming tests, it even outperformed more expensive versions. Google quickly set it as the default engine for Gemini App and search AI models, exchanging distribution advantages for scale, and using scale to gain data and stickiness.

Behind this is a strategic restructuring: using TPUs to lower computing power costs, using Gemini to compress model prices, and then completing the distribution loop through search and application entry. What Google aims to do is not just catch up with OpenAI but fundamentally shake NVIDIA's pricing power in AI infrastructure.

The trend is clear. AI competition is shifting from "who is stronger" to "who is cheaper, who is easier to use, and who is easier to migrate." If the synergy between software and hardware continues to expand, Alphabet will not only be a cloud vendor and model provider but may become a rule-maker for the next generation of AI platforms.

The battle for market value has evolved from a capital game to a direct confrontation of technological routes. Google is sprinting towards the throne.

Not Buying Companies, Just Buying Brains: NVIDIA's "Quasi-Acquisition" of Groq's Battle of Reasoning

The rumored acquisition has finally landed. **On December 25, [NVIDIA spent about $20 billion](https://wallstreetcn.com/articles/3762030? With the keyword = 英伟达, the core capabilities of the AI chip unicorn Groq are secured through "technology licensing + talent acquisition." ** The company does not take equity but instead absorbs the most important technology and talent, marking the official start of a defensive battle centered around "inference."

NVIDIA will obtain a non-exclusive license for Groq's low-latency inference technology and recruit founder and CEO Jonathan Ross, president Sunny Madra, and the core engineering team. Groq will continue to operate independently, with former CFO Simon Edwards serving as CEO, and GroqCloud business will proceed as usual. This is a "quasi-acquisition" deal: bypassing antitrust scrutiny while effectively weakening a potential competitor.

The $20 billion price tag is about three times Groq's valuation of $6.9 billion last September, reflecting NVIDIA's urgency. The focus of AI computing power is shifting from training to inference. Whoever can run the model "cheaper" can determine commercialization costs and profit margins. GPUs are unbeatable in general computing, but they are facing direct challenges from custom architectures in terms of low latency and energy efficiency.

Ross, the soul of Groq, was an early core member of Google's TPU. The LPU architecture he led was designed specifically for inference, trading embedded memory for deterministic execution and lower power consumption. For NVIDIA, what they are buying is not just a solution, but a mature technology roadmap.

For Groq, this is both a highlight and a reality. Its valuation has jumped from $2.8 billion to $6.9 billion within a year, but under the pressure of NVIDIA's CUDA ecosystem and the onslaught of major players' self-developed technologies, independent breakthroughs are becoming increasingly difficult. Being "recruited" brings both realization and survival.

The trend is already clear: AI is entering the inference era, and the competition for computing power is shifting from scale to efficiency. NVIDIA is not buying companies, but rather key capabilities, with only one goal in mind - to ensure that the pricing power in the next phase remains in its hands