Warner's acquisition battle escalates! Ellison personally backs $40.4 billion, Paramount directly confronts Netflix

甲骨文创始人拉里·埃里森为其子领导的派拉蒙收购华纳兄弟提供个人担保,升级与奈飞的竞争。奈飞通过债务再融资维持投资级信用评级。派拉蒙提出每股 30 美元的要约,总价约 1084 亿美元。埃里森的担保可能迫使华纳兄弟重新评估局势。

甲骨文创始人拉里·埃里森(Larry Ellison)正动用其个人财富,为其子领导的派拉蒙(Paramount Skydance Corp.)对华纳兄弟(Warner Bros. Discovery Inc.)的收购要约兜底,使其与奈飞(Netflix)之间这场竞争激烈的争夺战进一步升级。

周一,双方竞购方均采取行动,强化各自出价背后的资金支持,尽管并未直接提高报价。奈飞通过为其计划中的 590 亿美元债务中的一部分进行再融资,来确保其长期维持投资级信用评级。分析称,这是其相较于信用评级更低的派拉蒙所具备的一项关键优势。

但真正可能迫使华纳兄弟重新评估局势的,是埃里森提供的个人担保。埃里森是全球第五大富豪,个人财富约 2460 亿美元。

派拉蒙在新闻稿中表示:

“拉里·埃里森已同意,就此次收购所需的 404 亿美元股权融资,以及针对派拉蒙的任何损害赔偿索赔,提供一项不可撤销的个人担保。”

此前,华纳兄弟董事会曾敦促股东拒绝派拉蒙的要约,部分原因在于:拉里·埃里森是通过一个可撤销信托为 404 亿美元的股权融资提供支持,而 “可撤销” 意味着该信托可在任何时间被撤回或修改。

派拉蒙已积极追求华纳兄弟数月。此前,当华纳兄弟董事会同意以 827 亿美元将其流媒体和电影制片资产出售给奈飞时,埃里森方面感到措手不及。在这场收购战中,各方出价的融资实力已成为决定性因素。

这场争夺引发了两笔主要依靠债务推动的巨额收购提议,规模跻身过去十年来最大之列。派拉蒙直接向股东提出了对整个公司的要约:每股 30 美元,包含债务在内总价约 1084 亿美元。

派拉蒙表示:

“为回应华纳兄弟在过渡期运营中对 ‘灵活性’ 这一较为模糊的需求,派拉蒙修订后的合并协议提案,进一步提升了华纳兄弟在债务再融资交易、陈述条款以及过渡期经营约束方面的灵活度。”

个人背书

除了提供不可撤销的个人担保,埃里森还同意在华纳兄弟交易完成前,不撤销其家族信托,并保持信托资产不变。该项担保并不会取代 RedBird Capital 及主权财富基金此前已承诺的资金,而是在此基础上新增了一层安全保障。

派拉蒙表示,公司将公布相关文件,确认埃里森家族信托持有约 11.6 亿股甲骨文普通股,且所有重大负债均已对外披露。

此外,派拉蒙还提出,将其监管反向解约金从 50 亿美元提高至 58 亿美元。根据协议条款,如果华纳兄弟退出与奈飞的交易、转而选择其他竞购方,则需向奈飞支付 28 亿美元。

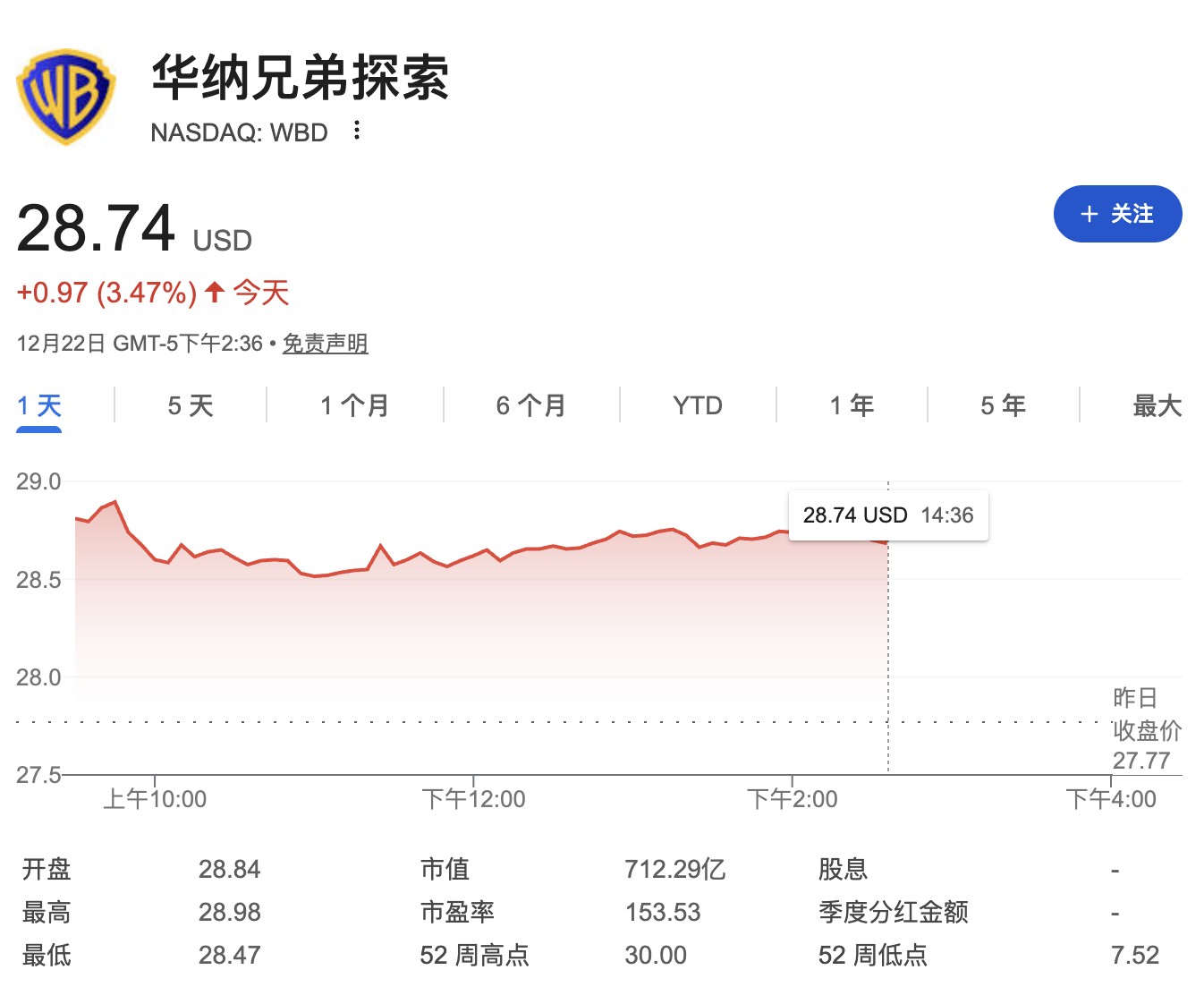

周一纽约股市午后交易中,华纳兄弟股价上涨 3.4%,盘中最高触及 28.98 美元。派拉蒙股价一度上涨 8.1%,而奈飞股价下跌约 1%。

拉里埃里森之子、派拉蒙 CEO 大卫·埃里森(David Ellison)在声明中表示,派拉蒙的收购方案 “仍然是实现华纳兄弟股东价值最大化的最佳选择”。他说:

“基于我们对投资和增长的承诺,这笔收购将优于其他方案,惠及所有华纳兄弟相关方,并成为推动更多内容制作、更大规模院线发行以及更多消费者选择的催化剂。”

交易前景

媒体表示,部分市场人士认为,埃里森的个人担保为派拉蒙的融资提供了关键性补强。Navellier & Associates 首席投资官 Louis Navellier 对媒体表示,华纳兄弟反对该收购的理由 “正在迅速瓦解”。他说:

“因为质疑一个信托,就去接受一个价值更低的报价,这完全站不住脚。债务不是问题,因为背后有拉里·埃里森的完全信用与担保。”

不过,根据媒体的初步分析,这可能仍不足以说服华纳兄弟董事会。分析称,尽管解约金条款和融资结构有所改善,但 “每股 30 美元的报价仍然不如奈飞的方案”。

围绕华纳兄弟的争夺战,是近年来规模最大的媒体交易之一。这家拥有百年历史的电影公司,曾推出《卡萨布兰卡》《蝙蝠侠》等经典作品,其最终归属有可能重塑整个娱乐产业格局。大卫·埃里森认为,与其公司合并将有助于保留更传统的好莱坞结构,并延续华纳兄弟的部分历史传承。他主张,由家族信托支持的全现金收购在财务上更具优势,也更容易获得监管批准。

若与奈飞合并,将把全球两大流媒体巨头结合在一起,总订阅用户规模约 4.5 亿人,并为奈飞提供庞大的内容库,从而在与迪士尼和亚马逊等竞争对手的较量中占据优势。

银行融资

派拉蒙的收购要约获得了美国银行(Bank of America)、花旗(Citigroup)以及 Apollo Global Management Inc.合计 540 亿美元的融资承诺,同时还计划筹集 410 亿美元股权资金。此前有报道称,其中 118 亿美元来自埃里森家族,此外还包括三家中东主权财富基金以及 RedBird Capital Partners 的资金。为获得这些融资,派拉蒙正向信贷市场展示自身定位为有望获得投资级评级的借款人,以争取更低的利率和承销费用。

目前,派拉蒙在 S&P Global Ratings 的评级仅比投资级低一个级别,在 Fitch Ratings 的评级中也仅略高于垃圾级。若要跻身蓝筹信用行列,公司必须实施大规模的成本削减和效率提升。更为复杂的是,派拉蒙的债务结构安排意味着:若在可能拖延至 2026 年甚至更久的收购战期间,长期融资利率上升,相关成本将由公司自身承担,而非银行方面。

与此同时,奈飞已为其针对部分华纳兄弟资产的收购,安排了来自富国银行(Wells Fargo & Co.)、法国巴黎银行(BNP Paribas SA)和汇丰(HSBC Holdings Plc)的 590 亿美元无担保融资。根据周一披露的文件,奈飞获得了一笔 50 亿美元的循环信贷额度,以及两笔各 100 亿美元的延迟提取定期贷款,用于对部分过桥融资进行再融资。这意味着仍有 340 亿美元将进行银团分销,而其稳固的投资级评级也确保了其在一级债券市场上的低融资成本。

风险因素

在上周致股东的信函及一份长达 94 页的详细监管文件中,华纳兄弟反复强调派拉蒙方案的风险,包括董事会所称的埃里森家族未能充分为其股权承诺提供兜底支持。董事会表示,该股权由 “一个不透明、情况不明的可撤销信托” 支持,派拉蒙提供的文件 “存在缺口、漏洞和限制,使股东和公司面临风险”。

董事会还指出,派拉蒙此前声称其最初方案获得埃里森家族 “完全兜底支持” 的说法,并不坦诚。

华纳兄弟表示,若派拉蒙的交易完成,合并后公司的债务规模将接近其息税折旧摊销前利润(EBITDA)的七倍。

“如此高的负债水平,意味着资本结构风险极高,即便在签约与交割之间,派拉蒙或华纳兄弟业务出现较小变化,也可能带来严重影响。”

华纳兄弟称,公司曾多次提出,对埃里森家族是否会为交易兜底缺乏充分证据的担忧;相比之下,奈飞逐一回应并解决了董事会的所有关切。大卫·埃里森则批评竞购过程不公,指责华纳兄弟偏袒奈飞。

派拉蒙表示,将把其要约收购的截止时间延长至纽约时间 1 月 21 日下午 5 点。截至 12 月 19 日,已有 397,252 股被提交要约。华纳兄弟目前的流通股总数超过 24.7 亿股。

市场有风险,投资需谨慎。本文不构成个人投资建议,也未考虑到个别用户特殊的投资目标、财务状况或需要。用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。