Trump Media & Tech surged over 30% in pre-market trading, as the company plans to acquire the fusion startup TAE and aims to begin construction of a fusion power plant next year

Trump Media & Tech will acquire TAE Technologies in an all-stock transaction, with a deal valuation exceeding $6 billion, and shareholders of both parties will hold approximately 50% of the new company. After the merger, the company aims to focus on utility-scale fusion power generation, planning to begin site selection and construction of fusion power plants in 2026, directly addressing the energy demand brought about by AI computing power

Trump Media & Technology Group Corp (TMTG) has signed a definitive merger agreement with fusion energy startup TAE Technologies, valuing this all-stock transaction at over $6 billion.

According to the terms of the agreement, TMTG and TAE will merge, with existing shareholders of both parties holding approximately 50% of the new company on a fully diluted basis. To support the transaction, TMTG will provide up to $200 million in cash injection to TAE at the time of signing and an additional $100 million after filing the S-4 document.

The merger aims to create one of the first publicly listed fusion energy companies in the market. According to reports from Bloomberg and Fox News on the 18th, the merged company plans to select a site and begin construction of a utility-scale fusion power plant by 2026. Management stated that this strategic layout aims to address the enormous energy demand brought about by the development of artificial intelligence and is committed to establishing the United States' advantage in energy security.

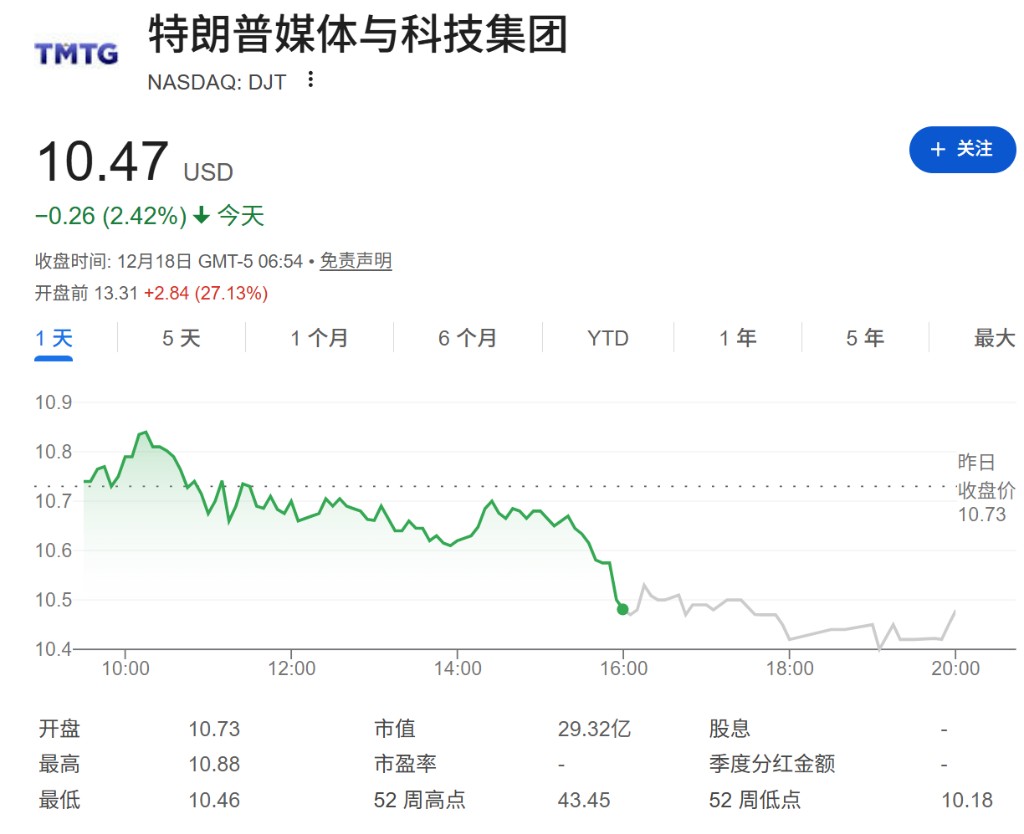

The market reacted swiftly to the news, with Trump Media's stock price rising by about 30% in pre-market trading. Investors showed high interest in this unexpected business transformation, and although the specific commercialization path still needs time to be validated, the intention to accelerate the implementation of fusion technology through the capital market has triggered significant market fluctuations.

Strategic Restructuring and Management Structure

The transaction is expected to be completed by mid-2026. Upon completion, Trump Media & Technology Group will transform into a holding company, with assets covering the original social media business Truth Social, Truth+, Truth.Fi, as well as the newly integrated energy and life sciences sectors including TAE, TAE Power Solutions, and TAE Life Sciences.

In terms of management structure, the new company will implement a co-CEO system. Current TMTG CEO Devin Nunes will serve as co-CEO alongside TAE CEO Michl Binderbauer. Additionally, Michael Schwab, founder and managing director of Big Sky Partners, is expected to be nominated as the chairman of the nine-member board.

As one of the world's leading fusion energy companies, TAE Technologies brings deep technical expertise to this merger. The company has been developing fusion technology for over 25 years, has raised over $1.5 billion in private capital to date, and has successfully built and safely operated five fusion reactors. TAE claims that its technology has significantly reduced the size, cost, and complexity of reactors.

The merged entity will prioritize commercialization. The company plans to determine the first plant site in 2026 and begin construction of the world's first utility-scale fusion power plant (subject to regulatory approval), with plans to build more fusion power plants already in place. ** Devin Nunes stated to the media that the capital and public market access brought by TMTG will help rapidly advance the commercial viability of TAE's proven technology.

Targeting AI Computing Power and Energy Security

The core logic of this merger closely aligns with the enormous demand for electricity driven by the current artificial intelligence (AI) boom. The company's statement pointed out that the economical, abundant, and reliable power provided by fusion power plants will help the United States win the AI revolution. Devin Nunes believes that fusion power is the most remarkable energy breakthrough since the advent of commercial nuclear power in the 1950s, and this innovation not only can lower energy prices but is also key to ensuring "American AI hegemony," revitalizing the manufacturing base, and strengthening national defense.

Michl Binderbauer emphasized that TAE's recent technological breakthroughs enable it to accelerate capital deployment. He stated that the team is ready to tackle the enormous global challenge of energy shortages and fundamentally change the structure of America's energy supply. The merger itself is seen as a crucial step in leveraging the power of capital markets to transform cutting-edge science into infrastructure advantages