The mystery of "liquidity tightening" in the U.S. market revealed? JP Morgan withdrew nearly $350 billion from the Federal Reserve account and invested it in U.S. Treasuries

JPMorgan Chase is transferring $350 billion in reserves from its Federal Reserve account to invest in U.S. Treasury bonds, aiming to lock in yields before interest rate cuts. The scale of this move is large enough to offset changes in the rest of the banks across the U.S., leading to a significant tightening of system liquidity. Some market analysts compare this move to the triggers of the 2019 repo crisis, believing it could once again become a catalyst for instability in the financial system and force the Federal Reserve to adopt more accommodative policies

A significant asset allocation by the largest bank in the United States may be revealing part of the reasons for the recent market liquidity tightness.

JP Morgan has recently withdrawn its tens of billions of dollars in cash reserves from the Federal Reserve, instead opting to significantly purchase U.S. Treasury bonds. This strategic move, aimed at hedging against the risk of falling interest rates, has had a significant impact on the liquidity of the entire banking system due to its massive scale, sparking intense discussions in the market about whether a repeat of the 2019 repo crisis is imminent.

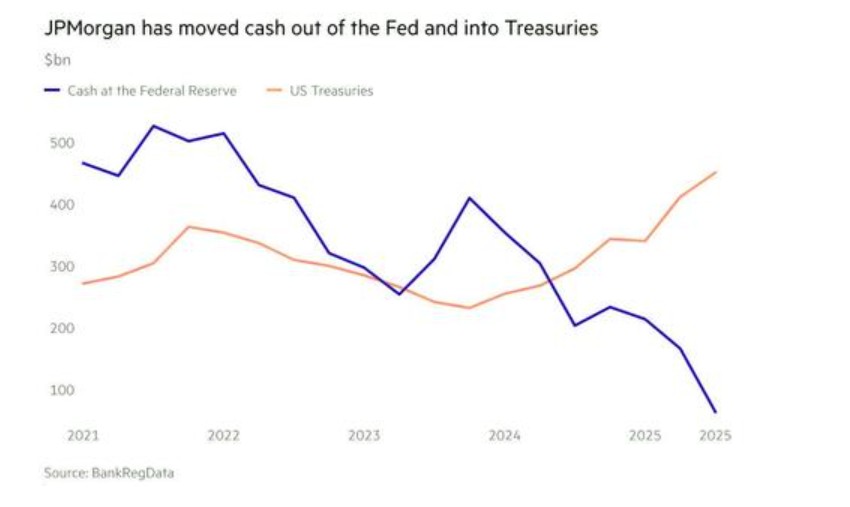

According to the latest data compiled by the industry data tracking agency BankRegData, since the end of 2023, JP Morgan has drastically reduced its deposit balance at the Federal Reserve from $409 billion to $63 billion in the third quarter of this year, with nearly $350 billion withdrawn. Meanwhile, the bank's holdings of U.S. Treasury bonds surged from $231 billion to $450 billion during the same period.

Analysis by the Financial Times indicates that the scale of JP Morgan's fund withdrawals is sufficient to offset the total flow of funds at the Federal Reserve from the remaining 4,000+ banks in the U.S., becoming a decisive factor leading to a net outflow of system reserves. Data shows that since the end of 2023, the total deposits of all U.S. banks at the Federal Reserve have decreased from $1.9 trillion to about $1.6 trillion. This means that, excluding JP Morgan's operations, the total reserves of the U.S. banking system have actually increased.

This move highlights how this banking giant, with assets exceeding $4 trillion, is preparing for the end of the high-interest rate era. In the past, banks could deposit cash at the Federal Reserve to earn high interest while paying very low interest to depositors, thus easily profiting. Now, with interest rates declining, JP Morgan is defending its future profitability by locking in higher yields on Treasury bonds.

Rushing to Lower Rates, JP Morgan Locks in High Yields

JP Morgan's shift in asset allocation is a direct response to changes in the interest rate environment. According to the Financial Times, the Federal Reserve is expected to begin lowering its target range for the benchmark interest rate by the end of 2024 and has hinted at more rate cuts. This month, the Federal Reserve has already lowered rates to their lowest level in three years.

Bill Moreland, founder of BankRegData, commented, “It’s clear that JP Morgan is moving funds from the Federal Reserve to Treasury bonds. Interest rates are falling, and they are rushing ahead.”

This strategy contrasts sharply with JP Morgan's operations during the last cycle. In the low-interest periods of 2020 and 2021, the bank avoided significant investments in long-term bonds, successfully sidestepping the massive paper losses incurred by its competitors (such as Bank of America) due to bond investments when interest rates surged in 2022. Now, facing a downward trend in interest rates, JP Morgan is taking the opposite action.

JP Morgan declined to comment on this matter and did not disclose the duration of the Treasury bonds held in its portfolio or the specifics of how it manages risks using interest rate swap contracts.

"Influencing System Liquidity by One's Own Efforts"

JP Morgan's operation this time is so large that it can have a substantial impact on the liquidity of the entire financial system. The reserves that banks hold at the Federal Reserve are an important "lubricant" for the financial system, and changes in their total amount are a key indicator of the market's liquidity.

Since 2008, the Federal Reserve has begun paying interest on reserve balances (Interest on Reserve Balances, IORB) to banks, which has become an important tool for influencing short-term interest rates and system liquidity. In the high-interest-rate environment of the past two years, the interest paid by the Federal Reserve has increased significantly, amounting to $186.5 billion in 2024 alone.

However, JP Morgan's massive withdrawal of funds has directly led to a contraction in the total reserve levels of the banking system. Such a significant liquidity change triggered by a single institution has naturally drawn close attention and concern from the market.

History Repeats? Market Debates the Shadow of the 2019 Repo Crisis

JP Morgan's actions have led some market observers to draw parallels with the "repo crisis" of September 2019. An analysis by financial blog ZeroHedge pointed out that the current market dynamics bear a striking resemblance to those of that year.

The analysis suggests that the repo rate soared to 10% in 2019, with one important factor being JP Morgan's significant reduction of its cash position at the Federal Reserve that year. An analysis by Reuters at the time also indicated that changes in JP Morgan's balance sheet were a contributing factor to the market lockup. Ultimately, that crisis forced the Federal Reserve to halt its balance sheet reduction and initiate what the market referred to as "lightweight quantitative easing" (QE Lite) asset purchase program.

ZeroHedge's analysis emphasizes that today's script is almost identical: as a new round of easing by the Federal Reserve begins, JP Morgan has once again withdrawn reserves on a large scale, leading to signs of tightening in market liquidity, while the Federal Reserve has ended quantitative tightening (QT) and restarted bond-buying operations. The analysis argues that the capital movement of a single bank is sufficient to trigger a liquidity shortage and may force the Federal Reserve to adopt a more accommodative monetary policy than originally planned.

Of course, the viewpoint of directly comparing the two remains controversial and is seen by some as a rather radical interpretation. However, it does provide a cautionary perspective for understanding the current market liquidity tension.

Controversy Over Reserve Interest Payments Resurfaces

JP Morgan's massive profits and asset movements have once again brought the Federal Reserve's policy of paying interest on reserves to the forefront of controversy. This practice has long been contentious.

Critics, including U.S. Senator Rand Paul, argue that the Federal Reserve's payment of hundreds of billions of dollars to banks merely allows them to keep their funds "idle" rather than flowing into the real economy. Although the Senate rejected a bill to ban interest payments on reserves in October, dissenting voices still persist.

In a report earlier this month, Rand Paul pointed out that since 2013, the top 20 banks receiving interest payments from the Federal Reserve have collectively received $305 billion. Among them, JP Morgan earned $15 billion in interest income in 2024 alone, while the bank's total profit for that year was $58.5 billion These data undoubtedly add fuel to the fire in this policy debate