ICBC will close transactions for "three no" clients in precious metals, with nearly 10 banks taking action this year

Under the fluctuation of gold prices, major banks have actively rectified their personal precious metals business at the Shanghai Gold Exchange. On December 15th, ICBC announced that it will close

Under the fluctuations in gold prices, major banks have actively reorganized their personal precious metals business at the Shanghai Gold Exchange.

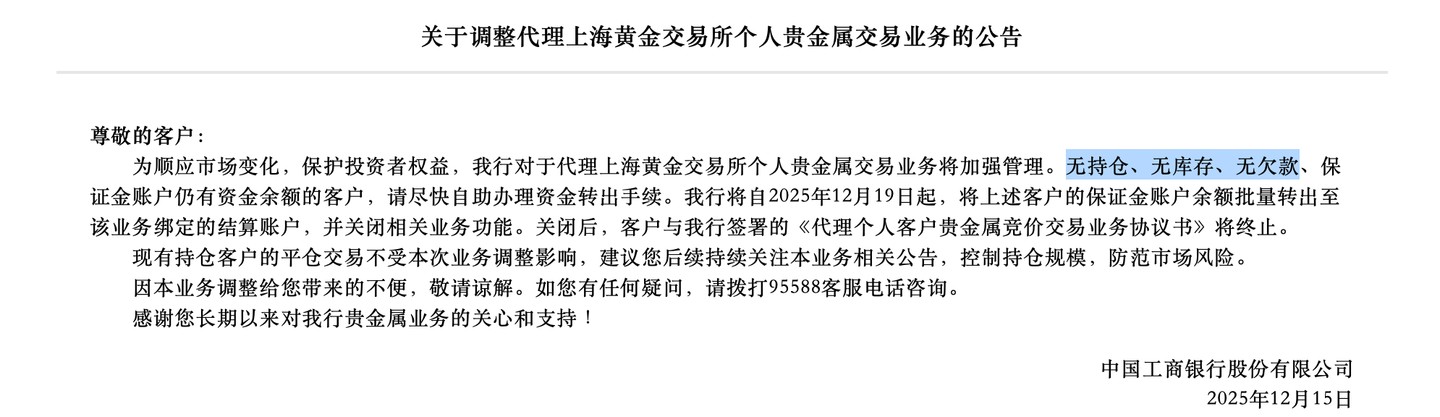

On December 15, ICBC announced that starting from December 19, it would close the relevant business functions for "three no's" (no positions, no inventory, no debts) clients who are agents for personal precious metals trading at the Shanghai Gold Exchange, reminding clients with remaining balances to withdraw in a timely manner.

ICBC noted that the closing transactions of existing position clients would not be affected by the adjustments and suggested that clients pay attention to announcements and control their position sizes.

According to incomplete statistics, since September this year, nearly 10 commercial banks, including Agricultural Bank of China, China Construction Bank, Postal Savings Bank, China Everbright Bank, China CITIC Bank, and Bank of Ningbo, have actively adjusted their personal precious metals trading business within the year:

For example, China Construction Bank issued announcements in August and December to gradually phase out related "three no's" clients, urging them to withdraw their margin balances and terminate contracts as soon as possible;

China Everbright Bank stated that for clients with no positions in related businesses, it would gradually terminate the business entrustment relationship through system adjustments.

The coordinated gradual phase-out by multiple banks is mainly aimed at protecting individual investors:

The agency's personal precious metals trading business involves some leverage (such as T+D business), and under the backdrop of intensified fluctuations in precious metal prices, individual investors find it difficult to fully grasp market conditions, posing significant potential risks;

ICBC, Agricultural Bank of China, China Construction Bank, and other banks have clearly stated that this move aims to "adapt to market changes and protect investors' rights and interests."

It is worth mentioning that the impact of this phase-out on certain personal "gold trading" accounts affects a relatively limited number of investors.

For many years, banks' account gold (paper gold) and other derivative businesses have been strictly restricted;

Since July 2022, ICBC, China Construction Bank, and several other banks have successively announced the suspension of opening trading for personal precious metals deferred delivery contracts at the Shanghai Gold Exchange, adjusting margin ratios, setting position limits, and modifying some channel trading functions;

In the following years, applications for opening personal account precious metals business at banks have remained closed, leaving only a few existing clients;

The newly involved gold-related products are more based on physical gold, with regular fixed investment and the ability to withdraw physical gold.

This year, the precious metals market has performed outstandingly.

As of December 15, the international gold price has increased by about 60% this year, and silver has risen over 110%, leading to changes such as adjustments in the minimum purchase amounts for banks' gold businesses;

On November 3, ICBC suspended the acceptance of account openings, active accumulation, new regular accumulation plans, and applications for withdrawing physical gold for its RuYi Jin accumulation business under risk management requirements, but soon resumed acceptance