From metals to the stock market, overseas markets are re-pricing "the acceleration of the U.S. economy."

Goldman Sachs' "Global Growth" factor recorded one of its largest rebounds since 2000 in the past three weeks, indicating a more optimistic market outlook for U.S. economic growth. In the stock market, the materials and financial sectors led cyclical stocks to significantly outperform defensive stocks. Goldman Sachs strategists believe that U.S. stocks are currently pricing in a consensus market estimate of 2.0% for U.S. real GDP growth in 2026, but this is still below Goldman Sachs' forecast of 2.5%. This suggests that if economic data continues to exceed expectations, the asset revaluation process may continue

From the rebound in copper prices to the cyclical sectors leading the stock market, from the rise in bond yields to the dollar regaining momentum—global financial markets are undergoing a broad and profound repricing, with the core logic pointing to a reassessment of the U.S. economic growth outlook.

According to the Chase Wind Trading Desk, the latest report from Goldman Sachs' Andrea Ferrario team shows that the bank's risk appetite indicator reached 0.75 last Thursday, the highest level since January this year. The driving force behind this round of market reassessment comes from more optimistic growth expectations, with Goldman Sachs' PC1 "Global Growth" factor recording one of the largest rebounds since 2000 over the past three weeks.

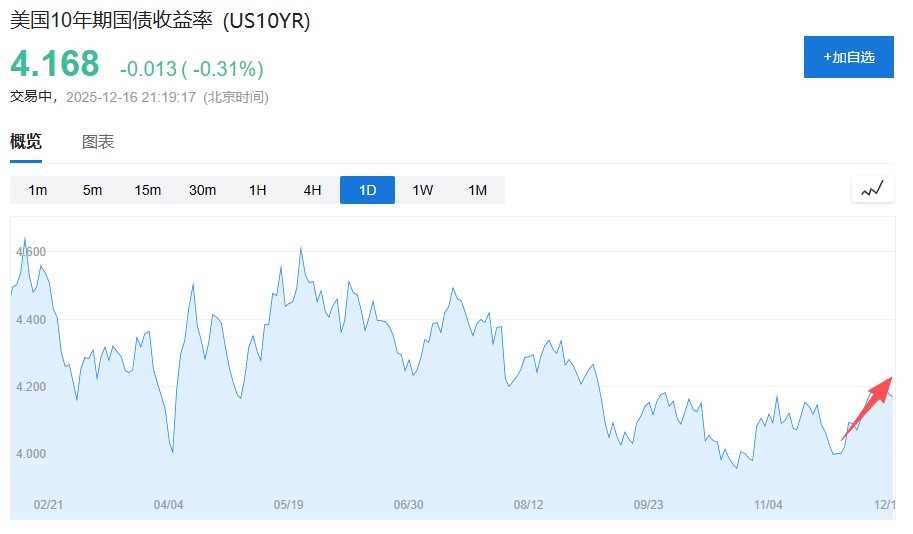

In this round of reassessment, cyclical assets have performed particularly well. The materials and financial sectors are leading the global stock market, while U.S. growth pricing is beginning to catch up with other regions of the world, after the U.S. market had lagged behind earlier this year. Meanwhile, most bond markets have seen sell-offs, with rising real interest rates becoming the main factor driving yields higher.

Goldman Sachs strategists believe that the current pricing level of U.S. stocks reflects a near consensus market expectation of 2.0% real GDP growth in the U.S. by 2026, but still below Goldman Sachs' forecast of 2.5%. This means that if economic data continues to exceed expectations, the asset reassessment process may continue.

Growth Expectation Reassessment Hits Multi-Year High

According to Goldman Sachs data, its risk appetite indicator reached 0.75 last Thursday, the highest level since January. The strong performance of risk assets in this round is mainly driven by improved growth expectations, with the PC1 "Global Growth" factor recording one of the largest increases since 2000 over the past three weeks.

It is noteworthy that such a large-scale reassessment of growth expectations typically occurs early in the economic cycle, but it is relatively rare to see such a sharp rebound in the later stages of the cycle when the PC1 factor is already above zero. The market's growth reassessment is highly synchronized with the global macro surprise index, with macro data from developed and emerging market economies generally exceeding expectations recently.

This week will see key U.S. economic data tests, including Tuesday's non-farm payroll report and Thursday's CPI data. Goldman Sachs expects an increase of 55,000 in non-farm payrolls for November, with the unemployment rate rising to 4.5%.

Cyclical Assets Strengthen Across the Board

In this round of growth reassessment, cross-regional performance shows significant cyclical characteristics. Within the stock market, cyclical sectors have significantly outperformed defensive sectors, with materials and financial industries leading the way. Goldman Sachs strategists expect a 12% growth in earnings per share for the S&P 500 index by 2026.

In the bond market, the rise in yields on 10-year U.S. and German government bonds is mainly driven by real interest rates, with inflation pricing lagging behind the rebound of pro-cyclical assets. U.K. government bonds have performed relatively well, mainly due to disappointing U.K. economic data. Although the policy expectations of several G10 central banks have shifted from rate cuts to rate hikes based on fundamental support, Goldman Sachs' rate team believes that the current pricing carries two-way risks

The commodity market also benefits from improved growth expectations. Copper prices, as an important indicator of economic growth, have performed strongly recently, while gold prices have remained relatively resilient under the pressure of a stronger dollar and rising real interest rates.

Asset Allocation Strategy Adjustment

In light of the current market environment, Goldman Sachs maintains a moderately risk-on allocation recommendation for 2026, overweighting stocks on both 3-month and 12-month horizons, with neutral allocations to bonds, commodities, and cash, and underweighting credit.

Goldman Sachs emphasizes the importance of diversified allocation and hedging strategies to protect overweight stock positions. Front-end rate receivers, CDS buyers, and put options on cyclical stock sectors continue to be viewed as effective tools for hedging against negative growth shocks.

From a valuation perspective, the current pricing of U.S. stocks seems to reflect growth expectations close to market consensus, but there is still room for further upside. If economic data continues to exceed expectations, particularly if U.S. economic growth can reach Goldman Sachs' forecast of 2.5%, the current trend of asset revaluation may continue.

The market's repricing of accelerated U.S. economic growth is unfolding globally, with various assets adjusting their expectations for future economic prospects, from traditional cyclical indicators to stock market valuations. Whether this trend can be sustained will largely depend on whether the upcoming economic data can validate the current optimism