Riding the tailwind of regulatory easing, PayPal applies to become a bank, reversing its decline to rise after hours

PayPal applies to establish a chartered industrial loan company in Utah, PayPal Bank, with the main purpose of enhancing small business lending capabilities and plans to offer savings accounts to customers. This digital payment giant claims that since 2013, it has provided over $30 billion in loans and working capital to more than 420,000 business accounts worldwide

Riding the wave of deregulation under the Trump administration, American digital payment giant PayPal Holdings Inc. has submitted a bank charter application to regulators, seeking to leverage the government's open attitude towards fintech companies entering the banking system to expand its small business lending capabilities and offer interest-bearing savings accounts to customers.

On Monday, the 15th, Eastern Time, PayPal announced that it has submitted an application to the Federal Deposit Insurance Corporation (FDIC) and the Utah Department of Financial Institutions to establish a Utah-chartered industrial loan company, PayPal Bank. If approved, the bank will enable PayPal to provide loan solutions to U.S. small businesses more efficiently. Since 2013, PayPal has provided over $30 billion in loans and working capital to more than 420,000 business accounts worldwide.

PayPal's CEO Alex Chriss stated that access to funding remains a significant barrier for small businesses striving to grow and expand. Establishing PayPal Bank will enhance the company's operations and improve efficiency, allowing it to better support the growth and economic opportunities of small businesses across the United States.

This move comes as the Trump administration adopts a more lenient stance towards fintech companies. Last week, several cryptocurrency companies, including "the first stablecoin stock" Circle Internet Group Inc., Ripple, and Paxos, received preliminary regulatory approval to become banks, contrasting sharply with the stringent approval attitude during the Biden administration.

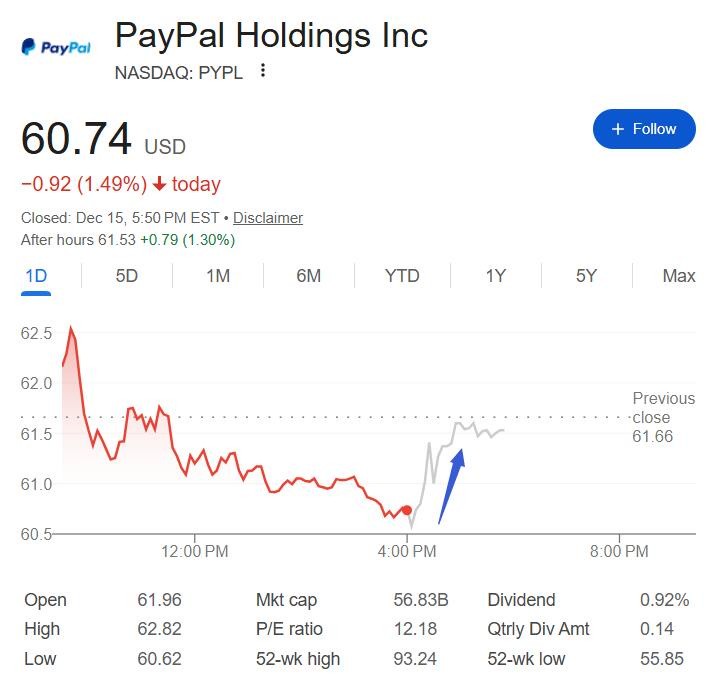

After announcing the bank application, PayPal's stock, which fell 1.5% on Monday, reversed course in after-hours trading, rising by as much as 1.5%.

In October, PayPal reported that its revenue for the third quarter of this year increased by 7% year-on-year to $8.42 billion, exceeding analysts' expectations. However, the company's stock has fallen nearly 30% this year, while the S&P 500 index has risen nearly 16% during the same period.

Establishing a bank could provide PayPal with new growth momentum while improving operational efficiency and reducing costs. By decreasing reliance on third-party financial institutions, PayPal is expected to gain greater control and higher profit margins when providing financial services to small businesses and consumers.

Small Business Lending as a Core Driver

The primary purpose of establishing PayPal Bank is to enhance small business lending capabilities. According to PayPal's statement, since 2013, the company has provided over $30 billion in loans and working capital to more than 420,000 business accounts worldwide, filling a critical funding gap for small businesses seeking to expand, procure inventory, or invest in personnel and tools.

Once approved, PayPal Bank will enable the company to provide loan solutions to U.S. small businesses more efficiently while reducing reliance on third parties and enhancing its own operations. The bank also plans to become a direct member of the U.S. card networks to complement processing and settlement activities conducted through existing banking relationships If approved, the president of PayPal Bank will be Mara McNeill, who has over 25 years of experience in banking, commercial lending, and private equity. She previously served as the president and CEO of Toyota Financial Savings Bank, the financing division of Toyota Motor Corporation.

Expanding Consumer Finance Product Line

In addition to small business loans, PayPal Bank also plans to offer interest-bearing savings accounts to customers. This is part of the company's strategy to expand and improve its consumer finance product offerings. PayPal has already provided credit lines to consumers and has been working to broaden its quasi-banking service portfolio to compete with an increasing number of fintech companies that are trying to capture business from traditional brick-and-mortar banks.

PayPal already holds a banking license in Luxembourg. If the application in the U.S. is approved, customer deposits at PayPal Bank will qualify for FDIC insurance coverage. The company also owns the popular payment app Venmo.

Regulatory Environment Shift Brings New Opportunities

PayPal's application comes at a time when the Trump administration has been open to fintech companies entering the banking system. Since President Trump took office in January, interest in becoming a bank has surged, in stark contrast to the Biden administration's term, during which few companies submitted applications, let alone received approvals, as the market generally perceived the approval process to be very difficult.

This situation has now changed. In addition to the cryptocurrency company approved last week, Nissan Motor Company's financing division applied for the same charter as PayPal earlier this year, and Japan's Sony Group Corporation has also applied to become a bank