A plunge of over 70%! The pioneer of robotic vacuum cleaners, iRobot, announces bankruptcy, and Chinese creditors may take over

The pioneer of robotic vacuum cleaners, iRobot, has filed for bankruptcy protection and plans to be taken over by its major Chinese supplier, Shenzhen Yinxing Intelligent Technology, and delist. iRobot's stock price plummeted by 72%. After the restructuring, Yinxing Intelligent will acquire 100% equity of iRobot and cancel $190 million in debt. iRobot stated that the bankruptcy process will not affect its operations and customer service

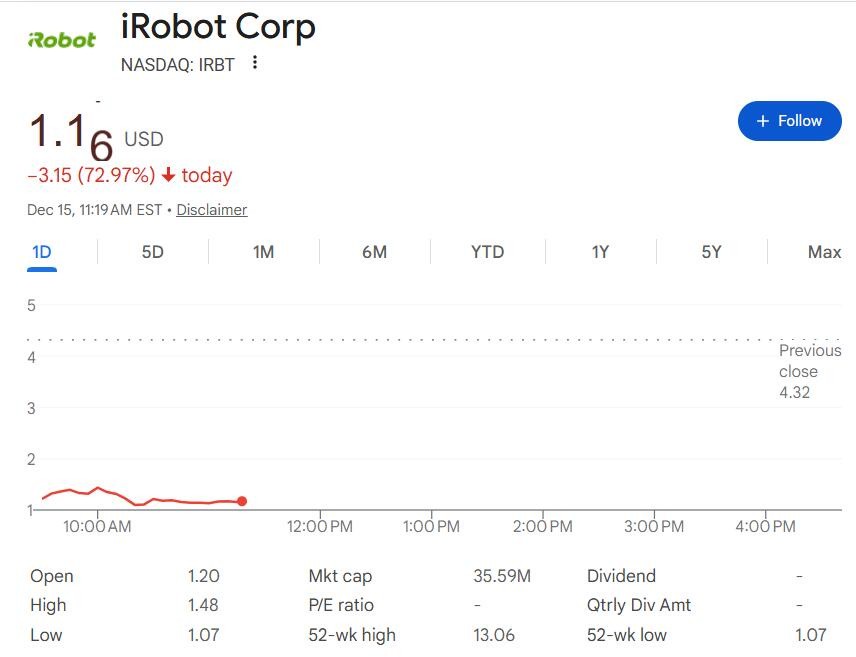

Pioneer in robotic vacuum cleaners iRobot filed for bankruptcy protection on Sunday and plans to be taken over by its main Chinese supplier and contract manufacturer, exiting the market. The company, which once had a market value of up to $3.56 billion, saw its stock price plummet 72% at the opening on Monday, with intraday losses reaching as much as 75%.

According to bankruptcy court documents, iRobot will complete its restructuring through Chapter 11 bankruptcy protection, with Shenzhen Yinxing Intelligent Technology (Picea Robotics) gaining 100% ownership control and writing off the company's $190 million debt. The transaction is expected to be completed in February.

iRobot was founded in 1990 by three MIT researchers and launched the Roomba robotic vacuum cleaner in 2002, achieving great success. However, in recent years, it has faced multiple blows from price pressures from Chinese competitors, U.S. tariff policies, and the failure of an acquisition deal with Amazon.

On the 3rd of this month, iRobot's stock surged over 70% due to news of the Trump administration's "All in" approach to the robotics industry, but it has since erased the gains made earlier in the month.

iRobot's CEO Gary Cohen stated that Sunday’s announcement marks "a critical step for iRobot in ensuring the long-term development of the company," and that the acquisition by Yinxing will "enhance our financial strength and help ensure the continued growth of our consumers, customers, and partners."

Chinese Supplier Takes Over American Robotics Pioneer

According to bankruptcy court documents, Shenzhen Yinxing Intelligent Technology will take full control of iRobot through its subsidiary. Established in 2016, Yinxing Intelligent manufactures home appliances and components for companies such as Xiaomi, Haier, and Electrolux, while also selling its own brand of cleaning robots called "3i."

Under the bankruptcy plan, Yinxing Intelligent will acquire 100% equity of iRobot and write off the $190 million loan balance due in 2023, as well as the $74 million manufacturing agreement debt owed to the company. Existing shareholder equity will be completely wiped out, but other creditors and suppliers will be fully compensated.

iRobot stated that the bankruptcy process will not affect its application functionality, customer programs, global partnerships, supply chain relationships, or product support. The company will continue to operate and fulfill its commitments to employees.

Multiple Pressures Lead to Financial Distress

iRobot generated approximately $682 million in total revenue in 2024, but profits were severely eroded by price competition from Chinese competitors such as Ecovacs. Although the company still holds a dominant position in the U.S. and Japanese markets, with market shares of 42% and 65% respectively, intense competition has forced it to lower prices and invest heavily in technological upgrades The U.S. government's tariff policy has also had a significant impact on the company. The 46% tariff on imported goods from Vietnam has increased iRobot's costs by $23 million in 2025, as the company produces vacuum cleaners for the U.S. market in Vietnam. The tariffs not only raised costs but also complicated future planning.

iRobot currently has approximately $190 million in debt, which stems from loans obtained in 2023 to restructure operations. After the Amazon acquisition deal was stalled due to a European competition investigation, iRobot defaulted on payments to Silver Star Intelligence, which subsequently acquired iRobot's debt from a Carlyle Group-managed investment fund.

The Ups and Downs from Peak to Bankruptcy

iRobot initially focused on defense and aerospace work, with its robots deployed alongside U.S. ground troops, searching the World Trade Center after the September 11 attacks and monitoring oil spills in the Gulf of Mexico. The Roomba vacuum cleaner, launched in 2002, promised to usher in an era where robots became useful components of daily life.

Amid a surge in demand driven by the pandemic, the company's market value peaked at $3.56 billion in 2021. However, this was short-lived; according to LSEG data, the company's recent market value was only about $140 million. During a significant drop in trading on Monday, the market value further shrank to less than $38 million.

In 2022, Amazon proposed to acquire iRobot and its entire debt for about $1.7 billion. However, the deal ultimately fell through under scrutiny from U.S. and European regulators, who were concerned that the transaction could weaken market competition. When the deal officially failed in January 2024, Amazon paid iRobot $94 million in compensation, and on the same day, the company announced the layoff of 350 employees, about one-third of its total workforce.

Currently, iRobot is headquartered in Bedford, Massachusetts, with 274 employees. The company states that it has sold over 40 million home robots.

Risk Warning and Disclaimer

The market carries risks, and investment should be approached with caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk