The "Half-Century Late" Hong Kong Stock Exchange Index is Here

Supplementary lessons

The Hang Seng Index may be welcoming a strong competitor.

Recently, the Hong Kong Stock Exchange officially launched its first Hong Kong stock index, the "Hong Kong Stock Exchange Technology 100 Index."

This moment has been half a century in the making for the Hong Kong Stock Exchange.

Looking back to 1964, when Hang Seng Bank compiled the first "Hang Seng Index" curve, it was an unintentional move during Hong Kong's financial wilderness era, but it became the "barometer" of the Hong Kong stock market.

At that time, the four major exchanges in Hong Kong were busy competing for customers, missing the key role of "standard setter."

Now, with A-share companies collectively moving south, the Hong Kong Stock Exchange has finally launched its self-developed index at the right time, attempting to establish an independent standard that can more directly reflect the trends of mainland real industries and technological development, providing a more relevant reference benchmark for the increasingly large southbound capital.

The Technology 100 Index is just the beginning.

A spokesperson for the Hong Kong Stock Exchange told Wall Street Journal·Xinfeng that they will continue to develop new indices in thematic investment and related areas of connectivity in the future.

Whether the Hong Kong Stock Exchange index can take over from the Hang Seng Index as an important reference for the allocation of Hong Kong stock assets in the Hong Kong market and even globally is highly anticipated.

Focusing on Self-Developed Indices

The Technology 100 Index aims to reflect the performance of the 100 largest Hong Kong-listed companies whose securities are highly related to the technology sector and meet the qualifications for the Stock Connect.

This Technology 100 Index mainly covers six themes: artificial intelligence, biotechnology and pharmaceuticals, electric vehicles and smart driving, information technology, the internet, and robotics.

As the first index launched by the Hong Kong Stock Exchange, the Technology 100 Index is of milestone significance.

A spokesperson for the Hong Kong Stock Exchange told Wall Street Journal·Xinfeng: "Diversified development is an important strategy for the Hong Kong Stock Exchange, and the index business is an important step. Developing the Hong Kong Stock Exchange Technology 100 Index is our latest attempt in the index business, which aligns very well with the strong demand from mainland investors for investing in technology-related Hong Kong stocks."

Mainland capital has indeed been actively embracing the Hong Kong stock market. According to Wind data, the net inflow of southbound capital has reached HKD 1.39 trillion from the beginning of this year to date, with the top three companies by market value being Tencent, Alibaba, and China Mobile.

"This index very much represents the current characteristics of the Hong Kong stock market—dominated by technology and innovation industries, and all constituent stocks can be purchased through the Stock Connect, making it particularly convenient for mainland fund companies to launch related ETF products. We hope this index provides investors with an effective and comprehensive investment tool to help them seize investment opportunities in technology and emerging fields," a spokesperson for the Hong Kong Stock Exchange told Wall Street Journal·Xinfeng.

This means that in the future, mainland investors will have more choices when investing in Hong Kong technology companies, breaking the historical reliance on the Hang Seng Technology Index as the main reference.

From the specifics of the index, the Technology 100 Index has certain differences in coverage and weighting compared to the Hang Seng Technology Index.

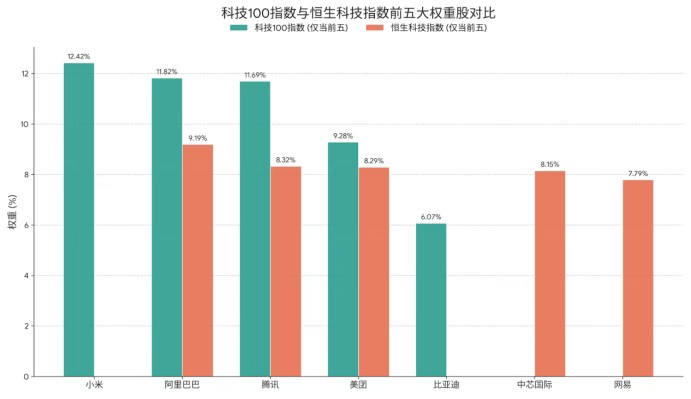

Firstly, compared to the Hang Seng Technology Index, which only covers the 30 largest technology companies listed in Hong Kong, the Technology 100 Index encompasses a more diverse range of technology companies with a broader market capitalization rangeSecond, the weight of the stocks is different. The top five companies with a higher proportion in the Technology 100 Index are Xiaomi, Alibaba, Tencent, Meituan, and BYD, but Xiaomi and BYD rank seventh and sixth respectively in the weight of the Hang Seng TECH Index.

This is not the first time the Hong Kong Stock Exchange has ventured into index business.

In November 2024, the Hong Kong Stock Exchange, in collaboration with Hang Seng Company, launched the "Hang Seng Hong Kong Stock Exchange Shanghai-Shenzhen-Hong Kong Stock Connect China Enterprises Index," which includes 80 Chinese companies with the highest market capitalization listed in Hong Kong, Shanghai, or Shenzhen, and can be traded through the Shanghai-Shenzhen-Hong Kong Stock Connect.

However, according to sources from Wind, the Hong Kong Stock Exchange's index business will fully shift to independent research and development in the future, and plans to launch more index products.

"Independent research and development is the main direction of our index business because the exchange itself has rich data and sufficient conditions to develop indices," a spokesperson for the Hong Kong Stock Exchange pointed out. "We see significant market demand for thematic investments and indices related to connectivity, and we will continue to develop new indices in these areas. Cross-market indices and fixed-income indices are also directions for future exploration."

However, the person emphasized to Wall Street News and Wind that in terms of derivative product development, the Hong Kong Stock Exchange will continue to collaborate with other index companies, such as its recent cooperation with Hang Seng Index Company to launch the Hang Seng Biotechnology Index futures.

Breaking the "Monopoly"?

Historically, it is not uncommon for stock exchanges to compile indices.

The SSE 50 is independently compiled and published by the Shanghai Stock Exchange, while the CSI 300 Index is jointly compiled by the Shanghai Stock Exchange and the Shenzhen Stock Exchange. It was not until the establishment of China Securities Index Co., Ltd. in 2005 that the maintenance of indices like the SSE 50 was transferred to this company.

From the timeline, it can be seen that the A-share market had exchanges first, followed by indices. However, the Hong Kong market is exactly the opposite, with the birth of indices preceding the Hong Kong Stock Exchange.

Turning the clock back to the 1960s in Hong Kong, various forces, including British and Chinese, successively established the Hong Kong Stock Exchange, the Far East Exchange, the Gold and Silver Securities Exchange, and the Kowloon Stock Exchange, a period known as the "Era of Four Exchanges."

During the Era of Four Exchanges, the four major exchanges competed with each other and operated independently, leading to management issues in processes such as company listings and a decline in the quality of listed companies in the Hong Kong stock market at that time.

Against this backdrop, investors needed relatively objective and neutral index products to represent the rise and fall of the entire Hong Kong stock market and sense the market's temperature. However, in the chaotic battles of the Era of Four Exchanges, the exchanges were absent from the key role of "setting standards."

As a leading foreign bank, Hang Seng Bank was the first to see this market opportunity.

In 1964, under the leadership of Hang Seng Bank Chairman Ho Sin Hang, Hang Seng Bank quickly launched the Hang Seng Index, which gradually became a barometer of the Hong Kong economy and has now been in existence for over half a century.

It was not until more than a decade after the birth of the Hang Seng Index that the signs of the end of the Era of Four Exchanges began to emergeIn 1986, the "Four Associations Merger" established the Stock Exchange (the predecessor of the Hong Kong Stock Exchange), becoming the only legal securities exchange in Hong Kong.

In its early days, the Hong Kong Stock Exchange faced a situation of "starting from scratch," with the primary task of building a stable trading system, improving listing and trading rules, and ensuring the compliant operation of the market.

Subsequently, the main positioning of the Hong Kong Stock Exchange was as a securities trading platform, primarily focusing on trading and settlement business, without laying out plans for index business.

As a result, for the past half century, the role of the Hong Kong Stock Exchange has often been that of a "channel": relying on the Hang Seng Index as its brand and depending on foreign investment banks for pricing.

However, the collective "southward" movement of A-share companies is now propelling the Hong Kong Stock Exchange to become the world's largest IPO securities exchange.

From early 2025 to the end of November, the Hong Kong Stock Exchange surpassed New York, the National Stock Exchange of India, Mumbai, and the NASDAQ with an IPO financing amount of approximately $36 billion, rising to become the world's largest securities exchange.

In this process, the proportion of IPO financing from A-share companies reached 30%.

After being half a century late, the Hong Kong Stock Exchange index is finally no longer absent, catching up with the collective "southward" tide of A-share companies in a "catch-up" manner.

The self-developed index of the Hong Kong Stock Exchange may become a new beginning for the Hong Kong financial market: mainland investors will no longer view the market solely through the lens of the Hang Seng Index, but will redefine core Chinese assets.