The first batch of L3 autonomous driving has been granted entry permits, marking a new era of "commercial application" for driverless technology in China

The Ministry of Industry and Information Technology has issued the first batch of L3 autonomous driving permits. CHANGAN AUTOMOBILE and BAIC Jihu have been approved for commercial pilot projects on designated roads, marking China's official transition from the testing phase of autonomous driving to a new cycle of deliverability, operability, and accountability. The definition of responsibilities has been established, and a regulatory closed loop has taken shape, opening a realistic path for L3 commercial use and the scaling of the industry chain and Robotaxi

China's autonomous driving industry has reached a historic turning point, officially crossing the watershed between "testing demonstration" and "commercial application."

The Ministry of Industry and Information Technology today (15th) officially announced the first batch of L3 conditional autonomous driving vehicle access permits in China. CHANGAN AUTOMOBILE and BAIC Jihu have become the first batch of shortlisted companies, with their approved models set to conduct road trials in designated congested areas in Chongqing and designated highways in Beijing, with maximum operating speeds limited to 50 km/h and 80 km/h, respectively. This means that advanced intelligent driving is no longer just a technical demonstration but has entered a new stage of delivery, operation, and regulatory compliance as required by law.

The core significance of this access permit lies in breaking the long-standing deadlock in defining responsibilities that has constrained the development of autonomous driving. Unlike the currently popular L2 level assisted driving, L3 level, as "conditional autonomous driving," allows drivers to briefly take their eyes off the road under specific conditions, with the vehicle system assuming the primary driving tasks. This shift means that if an accident occurs during system operation and meets the design operating conditions, the responsibility will shift from the driver to the vehicle manufacturer and system supplier.

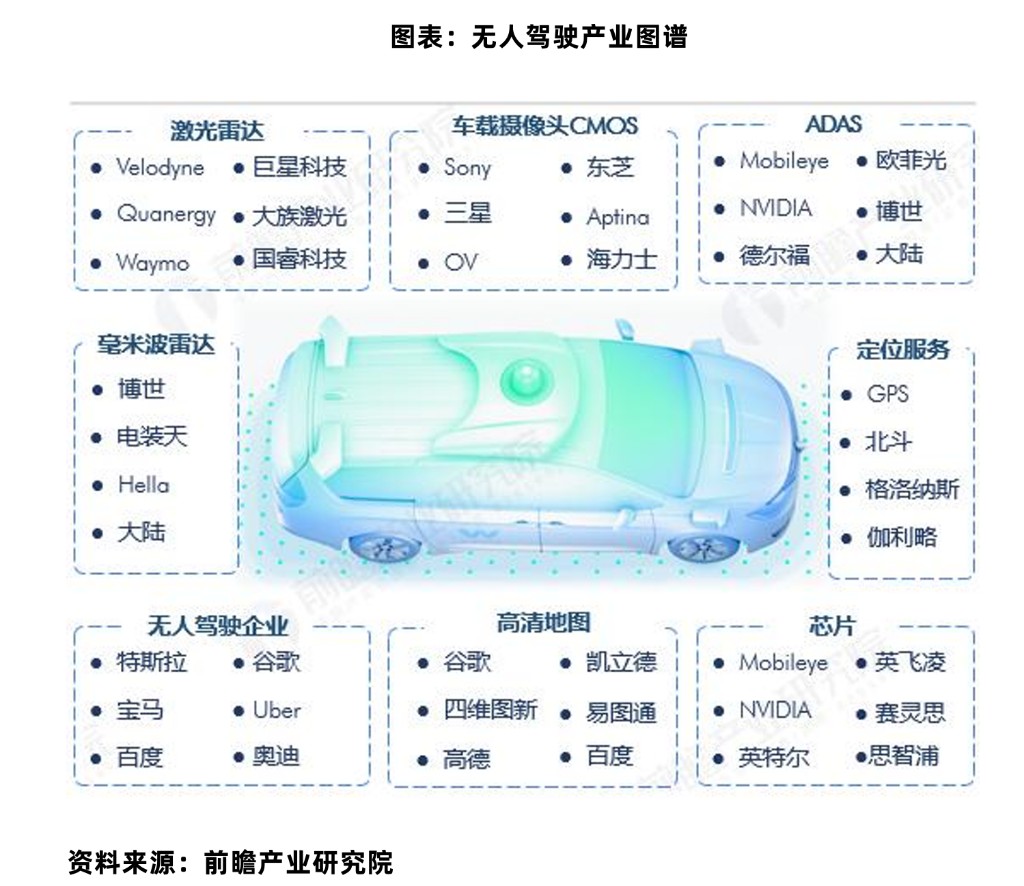

This policy breakthrough brings a certain growth expectation to the autonomous driving industry chain. As L3 commercialization is implemented through the "access permit + pilot operation" model, market focus will shift from the penetration rate of L2 to the technological reliability of L3. For investors, core component suppliers such as lidar, high-performance chips, intelligent chassis (steer-by-wire/brake-by-wire), and high-precision maps will see clearer demand for "automotive-grade" mass production orders.

From "Can Test" to "Can Run": Regulatory Closed Loop Formally Established

Before the release of this access permit, Chinese autonomous driving companies mainly held road testing or licensing, focusing on technical validation. The recent actions by the Ministry of Industry and Information Technology essentially construct a regulatory closed loop of "vehicle safety technology certification + usage scenario limitation + accident responsibility definition."

Road trial is a term with specific legal connotations. It specifically refers to L3 vehicles that have obtained "access permits" from national authorities, which can be used by real users (including ordinary consumers or professional drivers) on specific public roads within the legal limits. This move highlights China's ambition to lead global development in the field of autonomous driving by establishing a comprehensive standard system.

According to national standards, L3 autonomous driving requires the system to continuously perform all driving tasks under designed conditions. During vehicle operation, target detection and event response are the responsibility of the system, and the driver only needs to intervene when the system issues a takeover request. This is fundamentally different from Tesla's currently approved FSD (Full Self-Driving) system in some parts of China, which still belongs to L2 level assisted driving and requires the driver to maintain attention throughout Under the new L3 regulatory framework, the government has clarified the compensation responsibilities of automakers and parts suppliers in the event of accidents caused by system failures. This liability-driven mechanism will force the industry chain to elevate technical standards from "usable" to the ultimate "reliable," establishing an executable legal foundation for transitioning from pilot projects to large-scale promotion.

The Path Dispute of Business Models

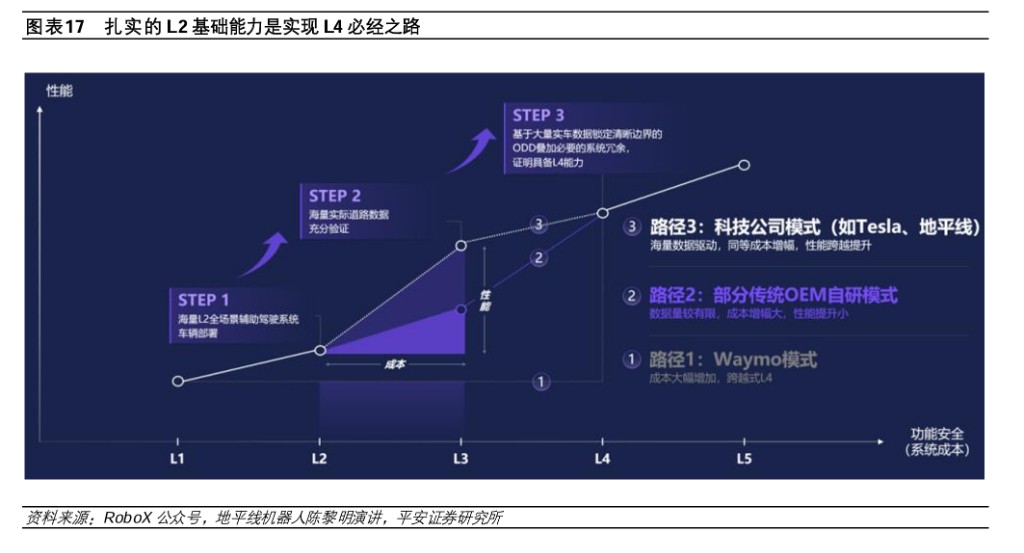

In terms of commercialization, the Robotaxi (autonomous taxi) business based on mass-produced vehicles is accelerating. According to an analysis by the Ping An Securities team led by Wang De'an on November 24, there are currently two main technical routes for autonomous driving commercialization: one is the "leapfrog route" represented by Waymo, and the other is the "incremental route" represented by Tesla.

The Waymo model emphasizes the completeness and compliance of the system architecture. Although it has high safety redundancy, it relies on exclusive fleets and limited areas, resulting in high hardware costs and slow regional expansion. In contrast, Tesla's incremental model iterates algorithms in real scenarios through a large number of mass-produced vehicles, reusing existing hardware, which provides strong scale effects and commercial flexibility.

Currently, the industry trend is leaning towards the "incremental" approach. The research report points out that mainstream high-level intelligent driving players are accelerating their entry into the Robotaxi business through consumer-grade mass-produced vehicles. This model not only significantly reduces deployment costs but also utilizes the long-tail scenario data provided by mass-produced vehicles as "fuel" to optimize model performance in extreme scenarios, forming a data-driven commercial closed loop.

Leading Players Accelerate Layout

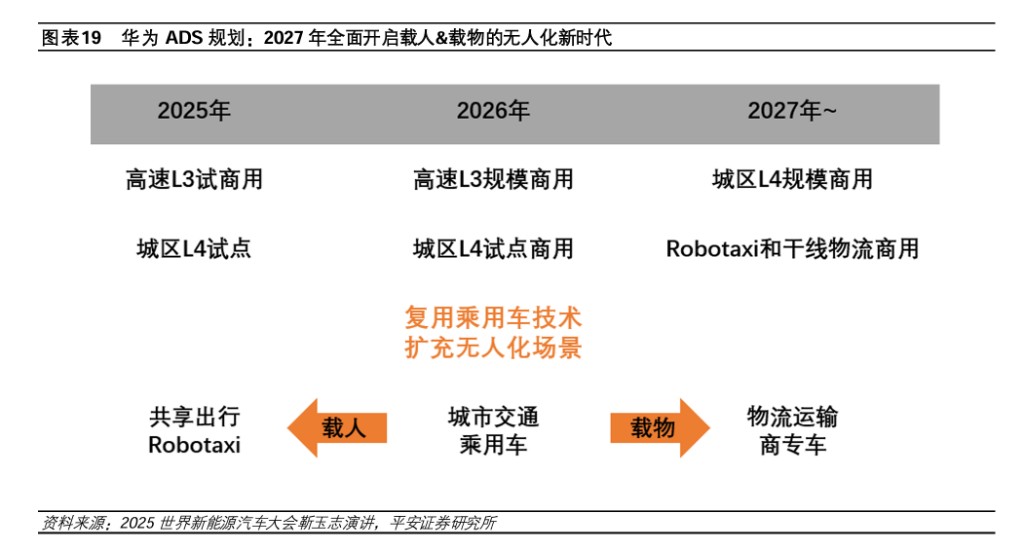

Several companies have announced specific commercialization timelines. According to the Ping An Securities research report, XPeng announced at its 2025 AI Day that it plans to launch three Robotaxi models in 2026, using a pure vision solution that does not rely on high-precision maps, and reusing the intelligent driving chips and software architecture of mass-produced vehicles. Huawei stated that its Intelligent Automotive Solutions BU CEO Jin Yuzhi aims to achieve large-scale commercial use of high-speed L3 and pilot projects for urban L4 by 2026, with expectations to fully usher in an unmanned era for both passenger and cargo transport by 2027.

Supply chain companies are also taking frequent actions. Horizon Robotics has signed a strategic cooperation agreement with Hello, planning to mass-produce its first front-mounted Robotaxi model in 2026, with a target of deploying over 50,000 units by 2027. Momenta insists on a "two-legged" strategy, planning to launch a front-mounted mass-produced Robotaxi solution in 2025. Yuanrong Qixing announced that it will launch its Robotaxi business by the end of 2025, achieving a shared technology framework with its mass-produced vehicles and enabling immediate iteration through data feedback The Chinese autonomous driving industry is shifting from a singular technological competition to a comprehensive game of technology, regulations, and business models. The issuance of the first batch of L3 access licenses is not only a certification of technological maturity but also the official opening of the commercialization door.