Bank of America: AI opens a "new bubble era" endorsed by the government, where prosperity and collapse will become the norm

Bank of America pointed out that every major technological leap since the 19th century has spawned large-scale asset bubbles, and the scale of the AI revolution, supported by the government, is unprecedented. The rapid alternation between prosperity and recession will become the new normal, and all of this stems from the extreme expectation gap triggered by artificial intelligence technology—the gap between people's desire for an "abundant future" brought by AI and reality is creating persistent volatility. Although timing the market is the most difficult, the eventual burst of the AI bubble seems inevitable

The market cycle is being redefined. Bank of America’s latest report points out that the world has entered an unprecedented "bubble era" — the rapid alternation between prosperity and recession will become the new normal, and this is all rooted in the extreme expectation gap triggered by artificial intelligence technology — the gap between people's desire for an "abundant future" brought by AI and reality is creating persistent volatility.

The global research team at Bank of America highlights in their latest report that every major technological leap since the 19th century has spawned large-scale asset bubbles, and the scale of the AI revolution, supported by the government, is unprecedented. The bank's bubble risk indicator shows that although core AI assets have not completely detached from fundamentals, the market is evolving towards a more bubble-like state, and a eventual collapse seems inevitable.

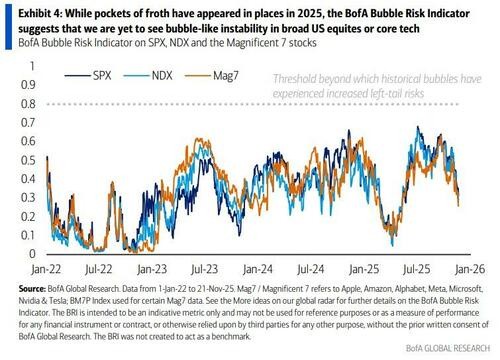

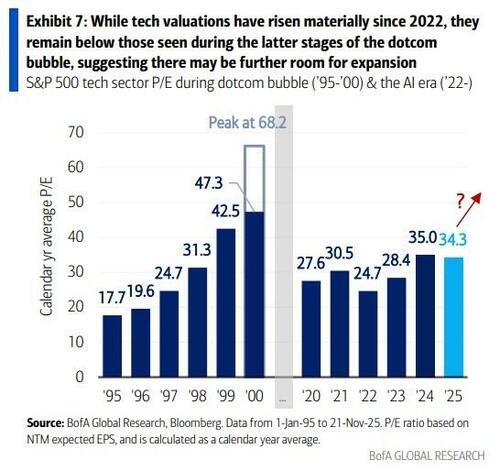

Although typical bubble characteristics have emerged in the market by 2025, Bank of America's risk indicators show that core U.S. tech stocks have not yet entered an extremely unstable zone, and current valuation levels are far from the madness of the 1990s internet bubble.

Bank of America also overturns traditional investment wisdom, clearly stating that "diversification is wrong" in the bubble era. Instead, the correct strategy is to concentrate holdings in leading assets combined with cash hedging, as bubble assets often perform best just before they burst.

Government Endorsement Rewrites the Rules of the Bubble Game

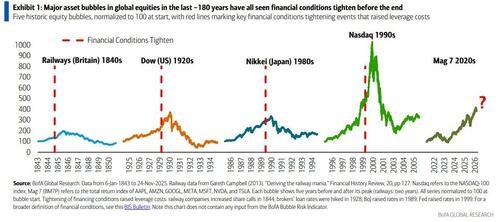

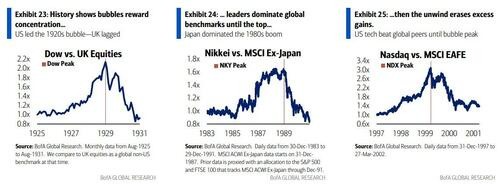

Bank of America emphasizes in the report that there is an inseparable historical connection between major technological changes and asset bubbles. The first industrial revolution in 19th century Britain triggered multiple booms in railway stocks, the roaring twenties in America stemmed from the invention of automobiles, radios, and electronics, while the internet gave rise to the tech bubble at the end of the 1990s.

These bubbles all underwent years of accumulation and led to prolonged periods of recession. Bank of America points out that when investors gather around the idea that technology will create a "magical future," bubbles form, but their scale and timing are highly uncertain. Historically, all three technology-driven bubbles have two key elements: retail participation and leverage expansion.

Unlike in the past, the current AI bubble has strong government support. Many countries view the integration of AI into their economies as a necessary condition to maintain global competitiveness, and the dominance of AI is seen as a survival threat to geopolitical power.

Government support means that funding supply is more abundant, and policy tolerance is higher. When private capital shows signs of fatigue, government funding often steps in timely to extend the bubble's expansion cycle. This "official endorsement" gives AI-related investments a sustainability that transcends pure market logic.

At the same time, geopolitical competition has intensified countries' determination to invest in the AI field. No country wants to fall behind in this "arms race," and this strategic consideration further reinforces the resilience of the bubble.

Expectation Gap Drives New Normal of Volatility

Bank of America attributes the root of current market volatility to the "expectation gap effect" of AI technology. On one hand, the transformative future promised by AI is within reach; on the other hand, this future has not yet fully materialized, and the time lag creates a vast space for imagination and uncertaintyThis expectation gap causes market sentiment to frequently oscillate between extreme optimism and cautious skepticism. Whenever there is a breakthrough in AI technology, the market experiences a wave of prosperity; however, when the actual progress falls short of expectations, adjustments follow immediately.

Unlike traditional cycles, this volatility based on technological expectations has stronger suddenness and faster conversion speed, rendering traditional cycle forecasting models ineffective.

Bubble Indicators Flash Warning Signals

The bubble risk indicator developed by Bank of America is based on four key characteristics of asset prices: yield, volatility, momentum, and fragility.

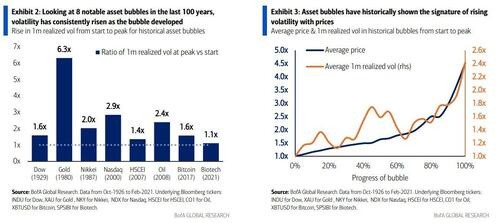

One notable feature is that volatility increases when prices rise. This is in stark contrast to the usual situation, where asset volatility tends to decrease as prices rise and increase as prices fall. When prices become more unstable during an upward trend, it may be due to extreme one-sided positions driven by fear of missing out (FOMO). Asset prices often decouple from fundamentals, partly because when their future value is highly uncertain (for example, during periods of technological leaps), the fundamentals themselves are very transient.

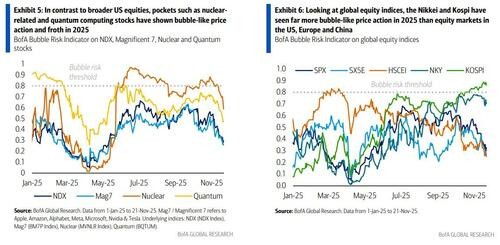

The indicator shows that although the overall U.S. stock market and the core technology sector (Mag 7) have not yet exhibited typical bubble instability, certain sub-markets have already shown bubble characteristics. When this indicator exceeds 0.8, the instability of stock prices tends to become more severe.

For example, U.S. nuclear energy-related stocks, quantum computing stocks, as well as the Nikkei Index and the Korea Composite Index are experiencing bubble-like instability.

Bank of America points out that although the valuations of U.S. tech stocks have risen significantly since 2022, they are still below the levels seen during the most frenzied period of the internet bubble in the late 1990s.

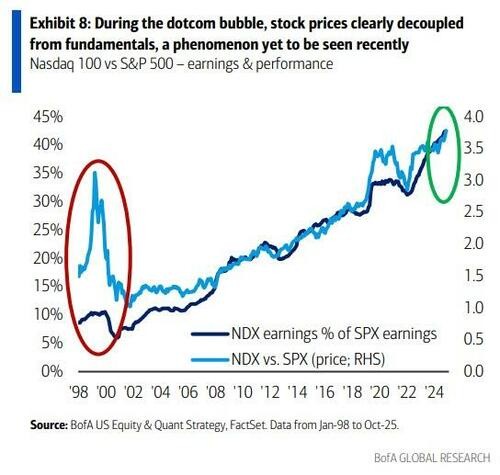

More broadly, during the internet bubble period, stock prices were clearly decoupled from fundamentals, whereas Bank of America states that this has not yet been observed in the broader market. From this perspective, valuations (and stock prices) may still have room to rise.

Beware of New Risks from Unprecedented Scale

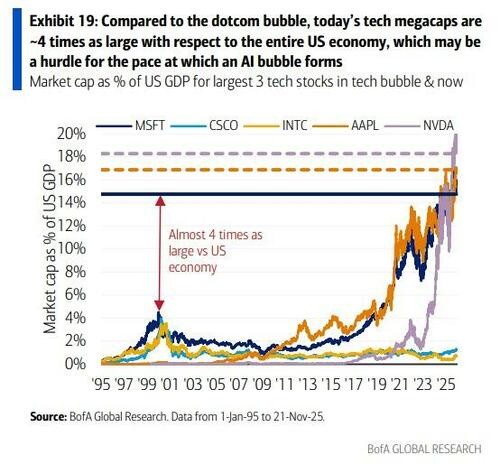

Despite this, Bank of America still emphasizes that a unique risk facing the current AI bubble is its unprecedented scale. Market concentration has reached historical highs, with NVIDIA's market value even surpassing that of any European country. Due to the enormous scale and profitability of giant companies like NVIDIA, they may find it difficult to generate the instability commonly seen in asset bubbles.

If NVIDIA were to be revalued at Cisco's peak price-to-earnings ratio of about 200 times in 2000, its market value would reach $20.8 trillion. Bank of America warns that this scale means core AI stocks could experience sell-offs due to negative surprises in forward earnings expectations without undergoing the typical instability of bubble stocks.

Jensen Huang predicts that AI spending could reach $3-4 trillion annually by 2030, potentially reaching $5 trillion in the long term. McKinsey predicts that cumulative spending on data centers could be around $7 trillion by 2030. But the key question is whether large language models can truly lead us to achieve general artificial intelligence, and whether the current crowd experimenting with AI is overly optimistic about its potential to enhance productivity.

Concentrated Holdings vs. Diversification?

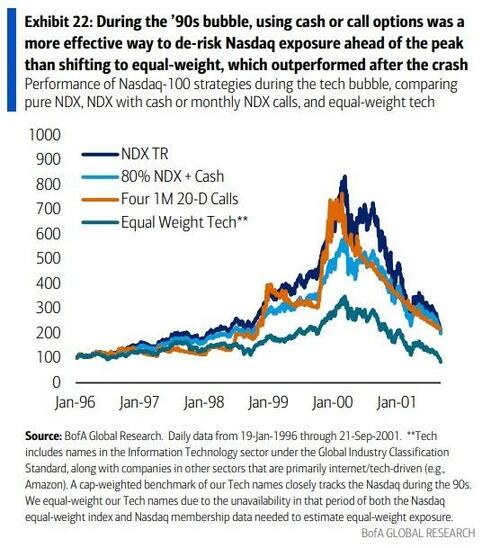

Bank of America offers a counterintuitive investment strategy: during a bubble, diversification strategies carry greater risks. Historical data shows that assets at the forefront of a bubble often continue to outperform until the bubble bursts. Therefore, seeking safety through diversified investments is essentially equivalent to predicting the bubble's peak, which is the most dangerous approach.

For example, during the tech bubble of the late 1990s, a better strategy was to maintain long-term concentrated holdings but diversify through cash or derivatives coverage.

Additionally, during the roaring 20s, the center of the bubble often outperformed global markets, which also explains why the "American exceptionalism peak" theme emerging in 2025 contradicts the further development of the AI bubble.

Bank of America concludes that while timing the market is the most difficult, the eventual bursting of the AI bubble seems inevitable. The bank predicts that tightening financial conditions will be the biggest risk, a common characteristic before all major bubbles burst. Volatility will remain high, the market will still be fragile, and the debate surrounding the AI outlook will continue to heighten uncertainty and instability