SK Hynix internal analysis exposed: DRAM shortages will continue until 2028!

SK Hynix expects that the market share of AI servers will soar from 38% in 2025 to 53% in 2030, driving a strong 24% growth in DRAM demand. On the supply side, the fundamental limitation lies in the long capacity expansion cycle. It takes several years for new DRAM factories to be built and reach normal operation, with additional capacity expected to be released by 2028. This expectation is more severe than UBS's forecast (which anticipates supply tightness to last until the first quarter of 2027). Does this mean a price increase cycle or an overshoot?

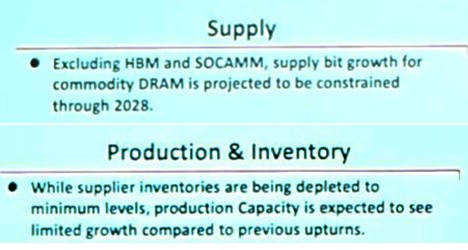

An internal analysis document from SK Hynix has unexpectedly surfaced, revealing the severe supply-demand imbalance facing the global memory chip market. The document indicates that except for HBM and SOCAMM, the supply of standard DRAM will remain tight until 2028, a forecast more severe than UBS's previous estimate of the first quarter of 2027.

According to screenshots shared by social media user @BullsLab last week, SK Hynix believes that the capacity growth of standard DRAM will be severely constrained. Supplier inventories are being depleted to minimal levels, while production capacity is expected to see limited growth compared to previous upcycles.

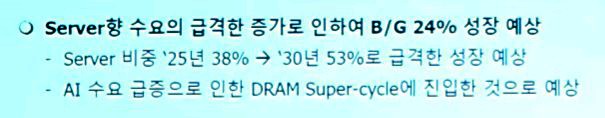

The surge in demand for artificial intelligence has become the core driving force behind this "super cycle." SK Hynix expects the market share of AI servers to soar from 38% in 2025 to 53% in 2030, driving a robust 24% growth in DRAM demand.

This supply-demand pattern will have far-reaching effects on the global technology supply chain. According to a previous article by Wallstreetcn, UBS predicts that DDR contract prices will rise by 35% quarter-on-quarter in the fourth quarter of this year, with a further increase of 30% in the first quarter of 2026. Tech giants like Apple will also face cost pressures, as their long-term supply agreements with Samsung and SK Hynix will expire in January 2026.

Supply Side: Long Capacity Expansion Cycle, Difficult to Solve Urgent Needs

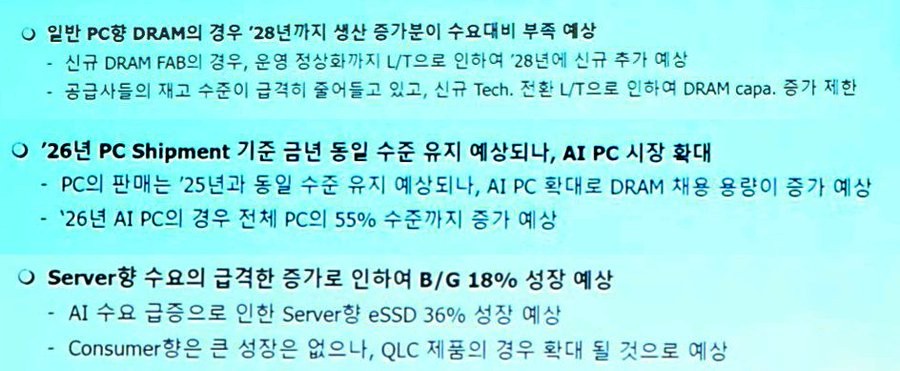

SK Hynix's internal analysis points out that the fundamental reason for the limited supply of standard DRAM is the long capacity expansion cycle. New DRAM factories take several years from construction to normal operation, and it is expected that new capacity will not be released until 2028.

Even utilizing existing facilities for technology conversion faces challenges. Whether transitioning from DDR4 to DDR5 or converting NAND processes to DRAM production, a considerable adjustment period is required. This makes it difficult to alleviate supply-demand conflicts in the short term through capacity allocation.

Meanwhile, supplier inventory levels are plummeting. SK Hynix's Vice President of Finance, Kim Yoo-hyun, revealed in the last quarterly earnings call that "next year, not only HBM but also DRAM and NAND capacities are sold out, and some customers have even purchased traditional storage chips for 2026 in advance."

Demand Side: AI Drives Storage "Super Cycle"

The explosive growth of artificial intelligence applications is reshaping the demand pattern for memory chips. SK Hynix expects the share of AI servers to leap from 38% in 2025 to 53% in 2030, driving a 24% increase in server DRAM demand The PC market is also affected by the AI wave. Although the overall PC shipment volume is expected to remain flat in 2026 compared to 2025, the share of AI PCs in the total will expand from 38% to 55%, significantly increasing the demand for single-machine DRAM capacity.

The NAND Flash market is also welcoming growth opportunities. SK Hynix expects server eSSD demand to grow by 36% year-on-year, with overall NAND demand increasing by 18%. Storage manufacturers will mainly focus their investments on server DRAM and HBM, leading to a relative shortage of NAND supply and continuous upward pressure on prices.

Price Increase Cycle May Exceed Expectations?

UBS previously predicted that DDR contract prices would increase by 35% quarter-on-quarter in the fourth quarter of this year, and NAND Flash contract prices would rise by 20%. In the first quarter of 2026, DDR contract prices are expected to further increase by 30%, with NAND prices continuing to rise by 20%.

Internal analysis from SK Hynix shows that supply tightness will persist until 2028, more severe than UBS's forecast of the first quarter of 2027. This means that the price increase cycle for memory chips may exceed market expectations.

Tech giants will also face cost pressures. Apple's long-term supply agreements with Samsung and SK Hynix are reported to expire in January 2026, and both Korean manufacturers plan to raise the prices of storage chip supplies to Apple starting in January next year.

In the face of severe supply-demand imbalance, SK Hynix is actively expanding its production capacity. The M15X factory, focused on HBM production, has completed two years of construction and will open early, starting full-scale production next year.

The company is also building advanced production infrastructure, including the M15X and the Yongin wafer fab, which is planned to start construction in the first half of 2027, to ensure that "wafer fab space" and "capacity" meet the growing demand for AI storage.

However, considering the long cycle characteristics of semiconductor capacity construction, there is still uncertainty about whether these new capacities can timely alleviate the current supply-demand tightness. Investors need to closely monitor the price trends of memory chips and their transmission effects on the downstream industry chain