Is the market underestimating the probability of a rate cut in January? This week's employment and CPI data will be key variables

UBS believes that Powell has not ruled out the possibility of a rate cut in January, as his concerns about the labor market have surpassed his worries about rising inflation. If this week's data confirms that the labor market remains weak (the key is whether the unemployment rate rises to 4.5%) while inflationary pressures are manageable, the FOMC may reconsider a more accommodative policy stance. The non-farm payroll reports for October and November will be released this Tuesday, and CPI data will be announced on Thursday

Powell's statements after the December interest rate meeting were interpreted by the market as hawkish signals. However, UBS's latest report indicates that the market may be overreacting, and the upcoming employment and CPI data will provide key judgment criteria for a potential rate cut in January.

According to the Chase Wind Trading Desk, UBS's Jonathan Pingle team recently released a report mentioning that Powell's "cautious" stance on certain data primarily targets the quality issues of household survey data affected by the government shutdown, rather than a blanket denial of all economic data. Previously, Powell clearly stated at a press conference that the Federal Open Market Committee (FOMC) has not made any decisions regarding the January meeting and emphasized that policy-making will rely on the data to be released soon.

This Tuesday, non-farm payroll reports for both October and November will be released simultaneously, a rare arrangement that will provide the FOMC with a more comprehensive assessment of the labor market. UBS expects that due to the federal government's delayed retirement plan (DRP), non-farm employment in October will decrease by 20,000, while November will see an increase of 45,000. More importantly, the unemployment rate in November may rise to 4.5%, continuing the trend of labor market slowdown.

The November CPI data will be released on Thursday. However, due to the government shutdown causing interruptions in data collection, the CPI report may contain significant noise.

Powell Does Not Rule Out Rate Cut in January; Is the Market Overreacting?

The market's "hawkish" interpretation of Powell's December press conference may be overly cautious.

UBS analysis suggests that Powell's statements actually imply room for continued rate cuts. Powell explicitly pointed out that when inflation and employment risks are balanced, the federal funds rate should be close to 3.0% rather than 3.5%, indicating that even if inflation is slightly above target, there is still room for policy rate reductions.

"When the risks of the two objectives become more equal, you should shift from a position that truly favors addressing one of the objectives to a more balanced, more neutral setting," Powell stated at the press conference. According to this logic, the target rate range should span the long-term neutral level of the federal funds rate at 3.0%.

Powell also emphasized that the FOMC will "need to carefully assess" the data affected by the government shutdown, particularly the household survey data, which may have technical distortions. However, he did not indicate that these data would be completely ignored, but rather stressed the need for careful analysis to extract valid signals.

The report pointed out that the market currently has a relatively low implied probability of a rate cut in January, but if this week's data confirms continued weakness in the labor market and manageable inflation pressures, the FOMC may reconsider a more accommodative policy stance. As Powell stated, he hopes for "inflation to be controlled and return to 2%, while also hoping for a strong labor market."

Weak Labor Market Remains the Focus; Key Lies in Unemployment Rate

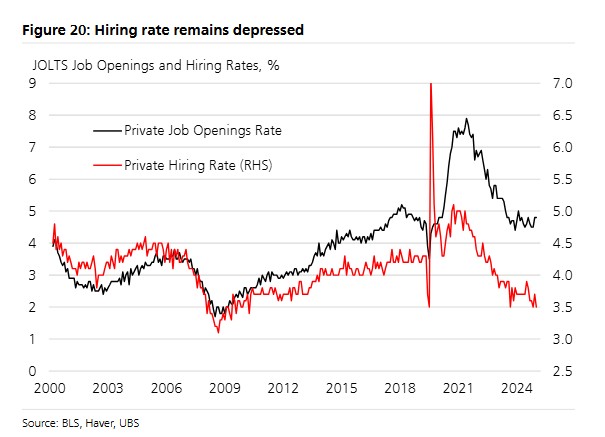

UBS believes that Powell's concerns about the labor market outweigh his worries about rising inflation. Powell stated at the press conference that the slowdown in labor demand exceeds the contraction in supply and believes this will not pose an inflation risk.

"If job creation is actually negative, I think we need to watch this situation very carefully and ensure that we do not suppress job creation through policy," Powell said. This statement indicates his inclination to avoid an overly tight policy stance It is particularly noteworthy that Powell stated at the press conference that his team estimates non-farm payroll data is overestimated by about 60,000 each month. This means that actual job creation could be negative, and the labor market conditions are weaker than the surface data suggests.

Data supports this judgment. The Employment Cost Index shows that wage growth in the leisure and hospitality sector has slowed to an annualized rate of 2.9%, the lowest since 2016, which contradicts the assumption that a significant reduction in immigration should drive up labor costs.

UBS expects that the upcoming employment reports for October and November will show a continued cooling in the labor market:

-

October non-farm payrolls are expected to decline by 20,000, mainly affected by the federal government's deferred retirement plans.

-

November non-farm payrolls are expected to increase by 45,000, still far below historical normal levels.

-

The unemployment rate is expected to rise to 4.5%, continuing the upward trend.

UBS believes the key is whether the unemployment rate rises to 4.5% as expected, which would provide further evidence of a continued slowdown in the labor market.

Concerns Over Inflation Data Quality, Arguments for Rate Cuts May Strengthen

The November CPI data will be severely affected by the government shutdown, with the number of data collection days being about half of the normal level. UBS advises investors to maintain a cautious attitude towards this data.

More importantly, Powell is relatively optimistic about the inflation outlook. He pointed out that the current inflation overshoot is mainly driven by tariffs on goods prices, and this impact is expected to gradually fade, while inflation in the service sector continues to show a slowing trend.

"I think the evidence increasingly suggests that the current situation is that service sector inflation is declining, offset by rising goods inflation, which is entirely concentrated in industries subject to tariffs," Powell explained.

Recent inflation expectation data also supports a relatively optimistic judgment. The New York Fed's consumer survey shows that three-year inflation expectations have remained at 3.0% for seven consecutive months, indicating relatively stable expectations.

UBS expects that the core CPI in November will grow by 3.15% year-on-year, slightly higher than the market expectation of 3.06%. However, analysts remind that the November CPI data will be severely affected by the government shutdown, with the number of data collection days being about half of the normal level, so the quality may not be as good as usual, and truly reliable inflation readings will have to wait for the December data