CICC: How to make a choice among the US, Hong Kong, and mainland China?

CICC analyzed the quarterly switching context and performance of the US stock market, A-shares, and Hong Kong stocks. Since the beginning of 2025, the three markets have shown a "seesaw" effect and inter-market linkage. Recently, the Hong Kong stock market has performed weakly, mainly due to its greater sensitivity to changes in liquidity, a slowdown in southbound capital inflows, and structural differences. Future choices among the three markets still require further observation

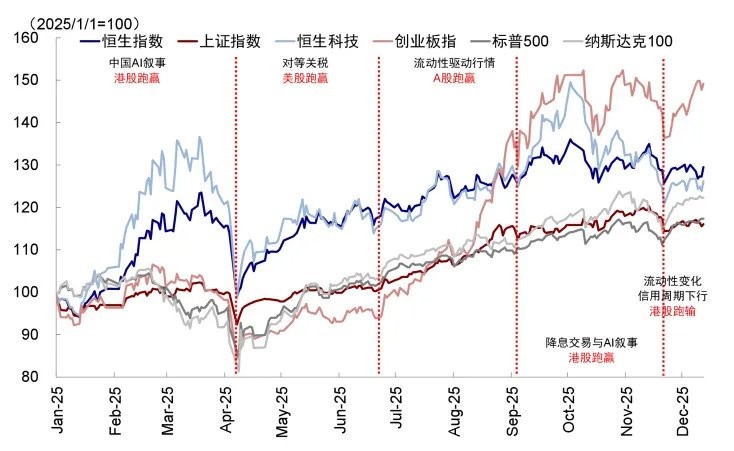

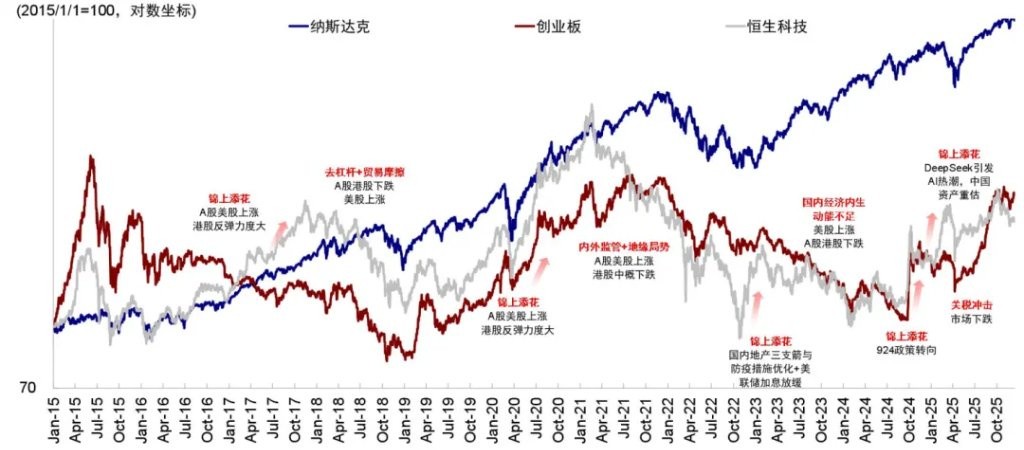

Since the beginning of 2025, the markets in the US, Hong Kong, and mainland China have shown a quarterly switching pattern, characterized by a "seesaw" effect of mutual gains and losses, as well as inter-market reflections and linkages. In the first quarter, DeepSeek led the revaluation of Chinese assets, with the Hang Seng Index leading the way; in the second quarter, following the US's equivalent tariffs, US stocks outperformed with leading AI companies exceeding expectations in performance and capital expenditure, while Hong Kong stocks saw a rise in new consumption and innovative pharmaceuticals, but the Hang Seng Index never returned to its March peak; in the third quarter, the narrative of domestic capital entering the market strengthened, and the tech innovation sector propelled A-shares to catch up; in September, the "loose trading" and the strengthening narrative of leading Chinese internet AI companies allowed Hong Kong stocks to outperform once again.

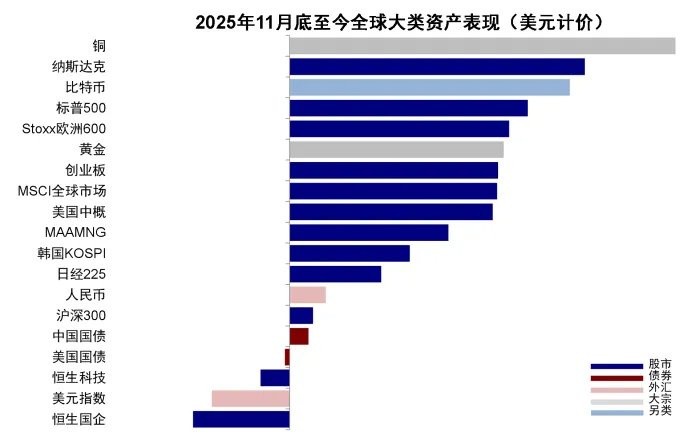

However, since late November, Hong Kong stocks have been particularly weak among the three markets, not only experiencing larger declines but also failing to keep pace with the recovery rhythms of US and A-shares. The Hang Seng China Enterprises Index fell by 2.2%, and the Hang Seng Index dropped by 0.7%. In contrast, both A-shares and US stocks recorded positive returns, with the CSI 300 rising by 0.5%, and the S&P 500 and Nasdaq increasing by 5.5% and 6.9%, respectively. It wasn't until last Friday that Hong Kong stocks saw a rebound. So, why have Hong Kong stocks been weaker recently among the three markets? Looking ahead, how should one choose among the US, A-shares, and Hong Kong markets?

Chart 1: The quarterly market switching pattern of the US, Hong Kong, and A-shares

Source: Wind, CICC Research Department

Chart 2: Since the end of November, Hong Kong stocks have underperformed major global markets

Source: Bloomberg, CICC Research Department

Why have Hong Kong stocks been weaker among the three markets recently? The market is more sensitive to liquidity, and the structure is more sensitive to fundamentals.

The recent weakness of Hong Kong stocks among the three markets is directly related to the characteristics of the Hong Kong market being more sensitive to liquidity changes and structural differences. As an offshore market, Hong Kong stocks are more sensitive to liquidity fluctuations, and the recent funding environment has been relatively weak with many disturbances.

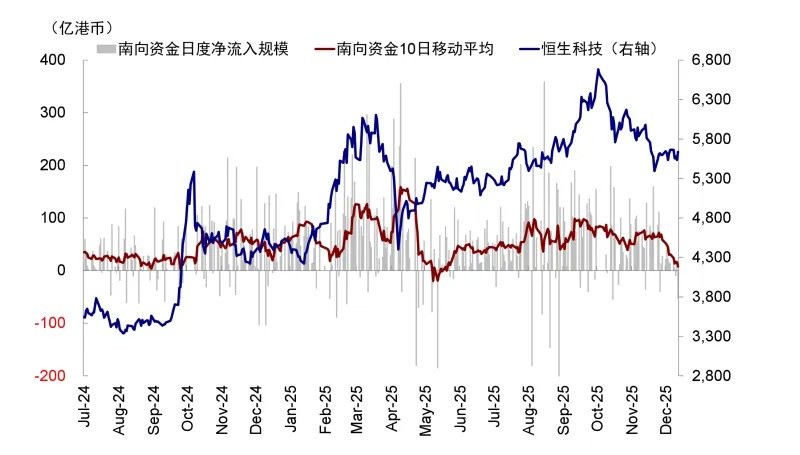

► First, the inflow of southbound funds has slowed, and investors speculate that this may be partially related to new fund regulations. Since late November, net inflows of southbound funds have continued to shrink, with the 10-day moving average dropping from an average of HKD 7 billion to less than HKD 1 billion, and last week even turning into a net outflow. On December 6, regulatory authorities issued the "Guidelines for Performance Assessment Management of Fund Management Companies (Draft for Comments)," requiring fund companies to establish a performance assessment system centered on investment returns and to strengthen performance benchmark constraints. As of the third quarter, domestic actively managed equity funds had a total overweight of approximately HKD 198 billion in Hong Kong stocks, with the holdings of Hong Kong stocks accounting for 30.8% of the fund's equity holdings, while the proportion of Hong Kong stocks in the performance benchmark was only 17%, indicating a significant overweight. Therefore, the market is concerned that rebalancing may lead to capital outflows. We do not rule out that this factor has a short-term impact, but it should not be extrapolated indefinitely because: 1) this is directly related to investors' expectations of the market's future strength or weakness; 2) The proportion of actively managed public funds in the southbound market is decreasing. As of the third quarter, the holdings in Hong Kong stocks amounted to RMB 522.8 billion, accounting for only 9.1% of the southbound market, which is not dominated by insurance, individuals, and trading funds. In terms of incremental funds, we estimate that the net increase of actively managed public funds in Hong Kong stocks will be around HKD 80-100 billion by 2025, contributing only about 10-12% of the southbound funds since the beginning of the year.

Chart 3: The scale of net inflows in the southbound market has shrunk since late November

Source: Wind, CICC Research Department

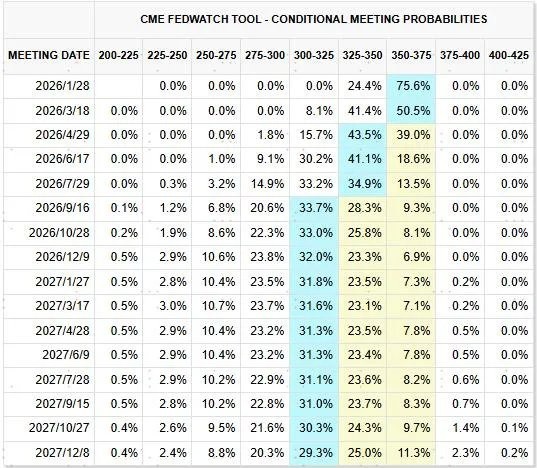

► Secondly, the external liquidity for Hong Kong stocks also lacks support, with active foreign capital outflows and rising U.S. Treasury yields following the Fed's hawkish rate cut. In addition to the EPFR data showing recent weakness in foreign capital (with active foreign capital having cumulatively flowed out of Hong Kong stocks and ADRs by USD 460 million over the past three weeks, while inflows into A-shares were USD 20 million during the same period; passive foreign capital inflows slowed from USD 4.87 billion in the previous three weeks to USD 3.15 billion in the last three weeks), concerns over the Bank of Japan's interest rate hikes persist. The Fed's hawkish rate cut in December led to a rise in the 10-year U.S. Treasury yield, which also left Hong Kong stocks lacking external liquidity support. Although the Fed's December FOMC cut rates by 25 basis points as expected, the updated "dot plot" and revised statement hinted at a "hawkish" signal that rate cuts may be paused. The expansion of the balance sheet further affects short-term interest rates and the liquidity of the U.S. repo market itself, causing long-term U.S. Treasury yields to rise instead of fall. We have consistently pointed out a common "misunderstanding" in the market: one should not equate rate cuts with declines in U.S. Treasury yields and the U.S. dollar, especially with hawkish rate cuts. The trend since the rate cut in September has continuously validated this point.

Chart 4: CME interest rate futures expect 2 rate cuts in 2026

Source: Federal Reserve, CICC Research Department

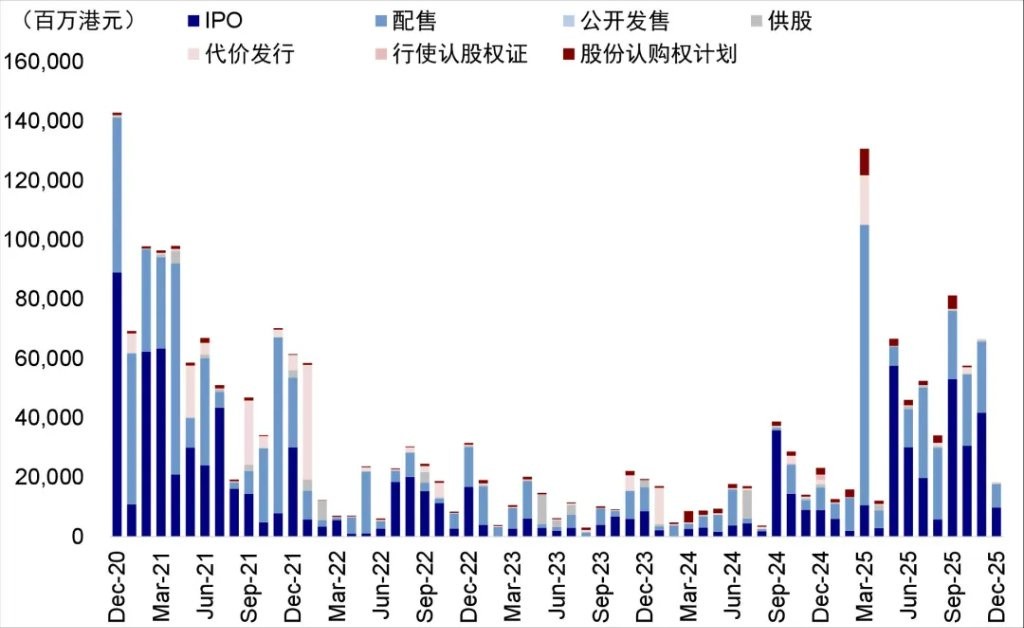

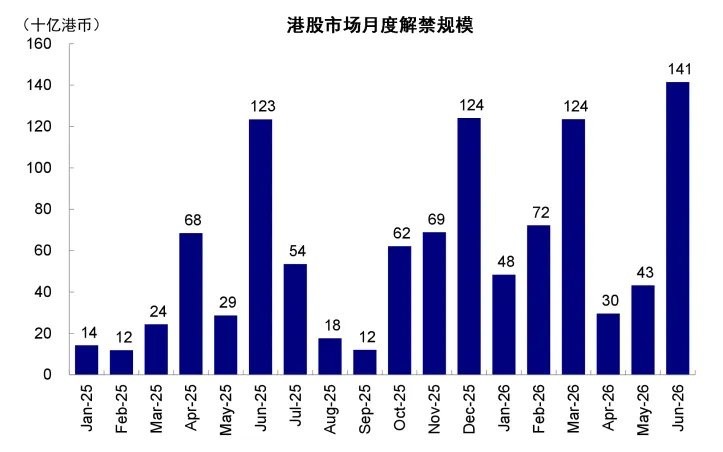

► Against this backdrop, the continuous demand for funds in the Hong Kong stock market becomes even more "eye-catching." Hong Kong IPOs remain active, and many large IPOs are approaching their lock-up periods. As of the end of November, the cumulative fundraising for Hong Kong IPOs in 2025 reached approximately HKD 260 billion, ranking first among global exchanges. As the year-end approaches, Hong Kong IPOs remain active, with a total of 20 companies listed on the main board since November, raising over HKD 50 billion. In addition, companies that went public in the first half of the year are also nearing their 6-month lock-up period, with potential unlock amounts in December reaching HKD 120 billion, which has become a contributing factor to the pressure on liquidity.

Chart 5: As the year-end approaches, Hong Kong IPOs remain active

Data source: Wind, China International Capital Corporation Research

Chart 6: Potential unlock amount of Hong Kong stocks in December is HKD 120 billion

Data source: Wind, China International Capital Corporation Research Department

Overall, there are indeed short-term disturbances in liquidity, but it is also not difficult to see that some factors may be exaggerated by short-term emotions. For example, whether actively managed public funds need to significantly reduce their positions in Hong Kong stocks is directly related to expectations for the future market. The large number of IPOs not only brings funding demands but also increases the supply of quality companies, both of which have positive and negative impacts, but the negative side has been amplified by short-term emotions. However, one thing is certain: it is precisely the weakness of the fundamentals and the lack of positive catalysts that cause this emotion to be amplified, making the market sensitive to negative news.

Therefore, the fundamental issue is not how severe the changes in the funding situation are, but rather that under weak fundamentals, their impact is further amplified, which is directly related to the unique industry structure of Hong Kong stocks.

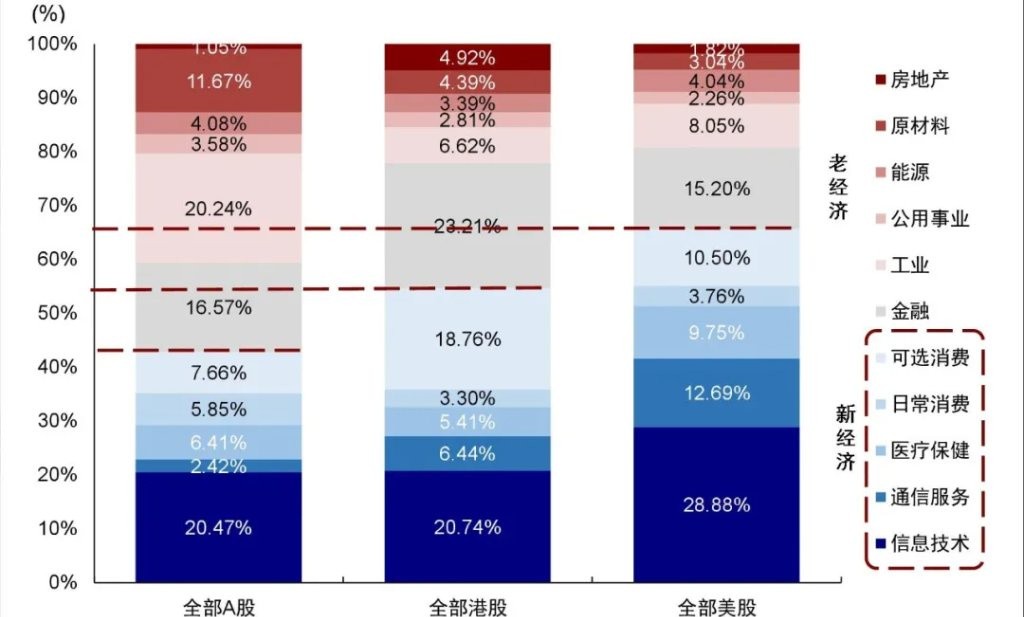

Among the four major sectors of dividends, technology, consumption, and cyclical, technology is mainly focused on Hong Kong's internet applications, with a small proportion of hardware; the consumption feature is mainly in new consumption; the weight of strong cyclical sectors is also less than that of A-shares; the dividend sector goes without saying, but it is mainly defensive in nature, with limited impact on market elasticity. Excluding dividends, what truly supports the Hong Kong stock market and valuation elasticity are technology (especially AI) and consumption.

Chart 7: The technology and consumption sectors account for a large proportion of the Hong Kong stock market

Data source: Wind, China International Capital Corporation Research Department

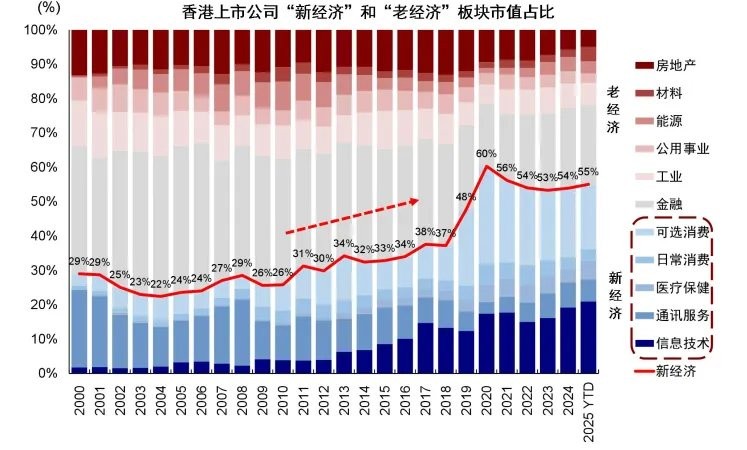

Chart 8: The proportion of new economy sectors in Hong Kong stocks has significantly increased

Data source: Wind, China International Capital Corporation Research Department

-

Technology: The overall environment is that concerns about the AI bubble are still present, and there are many disturbances in the US stock market, but the specific environment is that the relatively strong AI hardware has a small proportion in Hong Kong stocks. Recent concerns about the AI bubble have been ongoing, and there have been many disturbances in the US stock market. Coupled with the fact that expectations and valuations in this sector are not low, the AI-related sectors in all three markets have shown weak fluctuations. We believe that although AI expectations are not low, it is still too early to call it a bubble. Currently, the development of the AI industry from the demand side is similar to 1996-1997, investment is similar to 1997-1998, and capital market pricing is similar to 1998-1999. However, the market still has concerns about the AI bubble, and the continuous disturbances in individual US stocks have suppressed the overall performance of the AI chain in the three markets In addition, the characteristics of the Hong Kong stock market are application-oriented and focused on internet platforms, meaning it is more concentrated on the "application layer" of AI rather than the "hardware layer." The A-share market emphasizes hardware and domestic substitution in the AI structure, including sub-sectors like chips and computing power, with higher visibility in orders, investments, and policy support. Even if the AI application side and monetization progress fall short of expectations, the hardware side still has stronger certainty and clearer paths for realization. This is also the reason why the recent performance of the Hong Kong stock market has been inferior to that of the A-share market, as the higher hardware proportion in the A-share market provides stronger support.

-

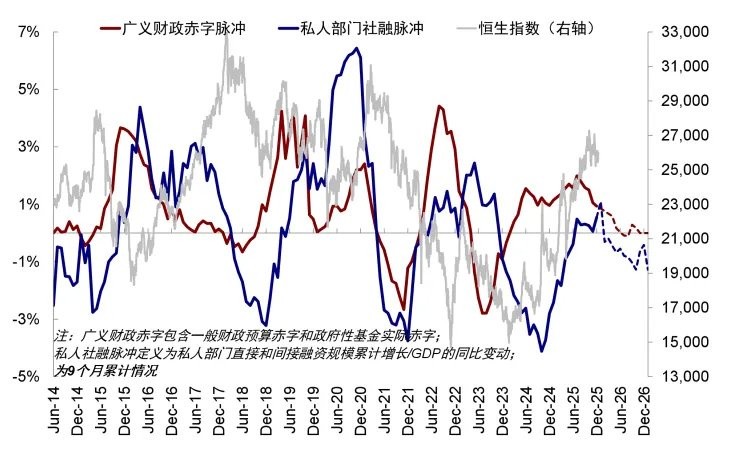

Consumption: The consumption sector in the Hong Kong stock market mainly consists of discretionary consumption. Currently, domestic consumption recovery is relatively weak, with fluctuations in the credit cycle and even a downturn, along with no significant improvement in residents' income expectations. It is difficult for the consumption sector to become a main line, and the new consumption sector, which was expected to perform well in the first half of the year, is also hard to escape this fate. Recently, the fundamentals have accelerated their weakening, and the credit cycle has turned downward. In September, we pointed out that due to the high base effect from the fourth quarter of last year, coupled with the ineffective recovery of the private credit cycle and the slowdown in fiscal stimulus, China's credit cycle is likely to fluctuate or even weaken in stages. This is also the reason we have maintained our judgment of the Hang Seng Index's central point at 26,000 this year without raising it. However, at that time, market expectations were relatively optimistic, and this signal was somewhat ignored and masked. The credit cycle is a slow variable at the macro level but will determine the overall central direction of the market, especially when other factors (such as concerns about the AI bubble) and optimistic sentiment dissipate. The structural characteristics of the Hong Kong stock market also determine that it will be more sensitive to these changes.

-

Cycles: Recently, strong cycles, especially in the non-ferrous sector, have performed well, but they do not account for a high proportion in the Hong Kong stock market, making it difficult to provide major support.

In summary, the Hong Kong stock market, lacking in cycles and hard technology, is more affected by the performance of consumption and application-based technology and is more reliant on fundamental catalysts. When the credit cycle recovers and risk appetite rises, the Hong Kong stock market has stronger elasticity; however, once there is insufficient fundamental catalysis and the market begins to worry about AI progress and monetization on the application side, the structural shortcomings of the Hong Kong stock market will become apparent, making it more susceptible to pressure. This further explains the recent weak performance of the Hong Kong stock market.

When has the Hong Kong stock market been stronger historically? Fundamental recovery and ample liquidity bring strong beta, with clear structural opportunities for strong alpha

As an offshore market, the Hong Kong stock market is more sensitive to changes in liquidity and fundamentals. This leads to a simple historical observation that when the A-share and U.S. stock markets recover, the Hong Kong stock market rebounds more significantly, and conversely, the declines in the Hong Kong stock market can be deeper. However, since 2024, this pattern seems to have been "broken": for example, before September 2024, while the A-share market was weak, the Hong Kong stock market outperformed due to higher dividends. In 2025, when the Chinese market was recovering, the A-share market outperformed in certain areas due to the high proportion of technology hardware. This also indicates that, in addition to traditional fundamentals and liquidity logic, structural differences among the U.S., A-share, and Hong Kong markets need to be considered.

Chart 9: When the A-share and U.S. stock markets recover, the Hong Kong stock market rebounds more significantly; conversely, the declines in the Hong Kong stock market can be deeper

Source: Wind, CICC Research Department

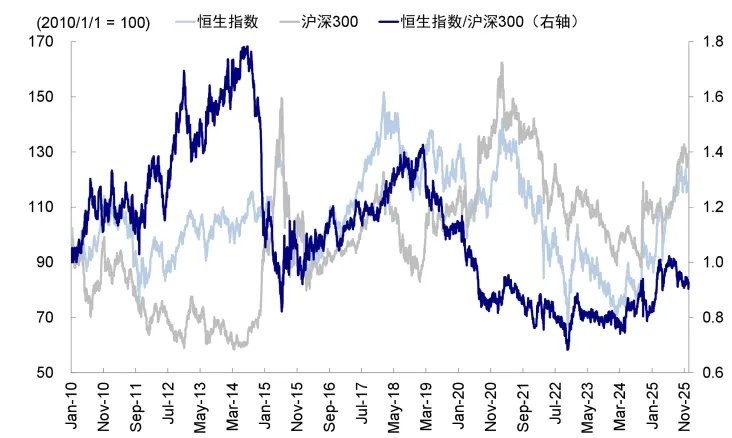

Hong Kong stocks typically outperform under conditions of fundamental recovery, ample external liquidity, or clear structural opportunities. Since 2010, the periods when Hong Kong stocks outperformed A-shares were mainly from early 2010 to December 2012, September 2013 to July 2014, June 2015 to January 2019, October 2022 to January 2023, and April 2024 to June 2025. In summary, the following factors have contributed to the outperformance of Hong Kong stocks:

► Inflow of southbound funds or ample external liquidity: During the phase of accelerated inflow of southbound funds and rising expectations of interest rate cuts by the Federal Reserve, the Hong Kong stock market, benefiting from its offshore market attributes, linked exchange rate system, and lower trading activity, is more sensitive to liquidity and tends to outperform A-shares, such as in the periods from early 2010 to December 2012, September 2013 to July 2014, and April 2024 to June 2025.

In contrast, if there is a situation of high liquidity and strong sentiment in the mainland, A-shares tend to benefit more, making it difficult for Hong Kong stocks to outperform, as seen in the periods of market leverage in 2014-2015 and since June this year when deposit activation funds entered the market, where A-shares clearly outperformed Hong Kong stocks.

► Fundamental recovery: The periods when Hong Kong stocks outperformed A-shares mostly correspond to times when domestic fundamentals stabilized or corporate profits recovered. The relative returns of the Hang Seng Index to the CSI 300 are generally positively correlated with the trend of China's manufacturing PMI. During periods of upward revision of dynamic EPS, Hong Kong stocks also tend to outperform A-shares, as evidenced in the period from October 2022 to January 2023.

► Clear structural themes with scarcity: The periods when Hong Kong stocks outperformed A-shares are often accompanied by clear structural themes where Hong Kong stocks have advantages, including the valuation recovery of internet platforms from October 2022 to January 2023, high dividends in 2024, and the rotation of sectors such as AI, new consumption, and innovative drugs since 2025, driving the outperformance of Hong Kong stocks.

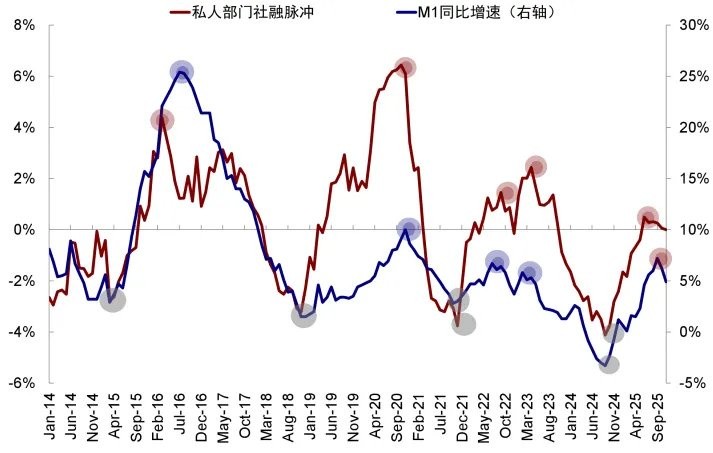

Chart 10: Periods when Hong Kong stocks outperformed A-shares

Source: Wind, CICC Research Department

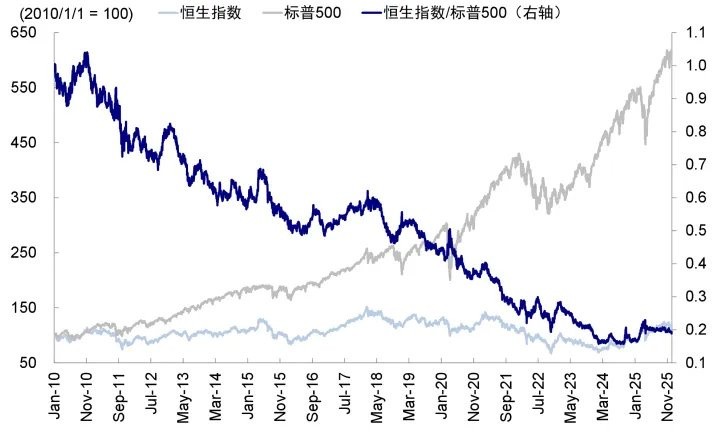

Since 2010, Hong Kong stocks have generally underperformed U.S. stocks, achieving relative returns only in a few periods. Before 2025, the reason U.S. stocks and the U.S. dollar stood out is that, globally, only the U.S. was able to expand credit (the AI industry driven by ChatGPT at the end of 2022 and continuous fiscal efforts during the Biden administration), forming the underlying basis for the "American exceptionalism," continuously attracting global funds and creating positive feedback between capital and the market In contrast, the factors supporting the Hong Kong stock market's phase of outperformance mainly include significant inflows of southbound capital and the recovery of the domestic fundamentals. The Hang Seng Index often achieves relative returns compared to the S&P 500 during periods of accelerated southbound capital inflows, an increase in China's manufacturing PMI, and an upward pulse in private social financing, such as from May to November 2010, December 2016 to March 2018, February to March 2020, and October 2022 to January 2023. Additionally, clear structural opportunities will also provide chances for the Hong Kong stock market to outperform the U.S. stock market, with a typical example being the launch of DeepSeek since January this year, leading to a revaluation of Chinese assets.

Chart 11: Overall underperformance of Hong Kong stocks compared to U.S. stocks since 2010

Source: Wind, CICC Research Department

How to make choices among the U.S., A-shares, and Hong Kong stocks in 2026? Hong Kong stock liquidity relies on spillover, fundamentals are weaker than U.S. A-shares, and there are structural opportunities

Although we project a space of 13-16% for U.S. stocks (S&P 500 at 7600-7800 points) and 8-10% for Hong Kong stocks (Hang Seng Index at 28000-29000 points) in 2026, such an overall comparison may be overly simplistic and lazy, and we must fully consider the differences in liquidity, fundamentals, and structural opportunities across different times and structures.

1. Liquidity: Hong Kong stocks are more sensitive to U.S. easing, but to outperform, both markets need to perceive limited local opportunities

► U.S. liquidity will be ample in the first half of next year, providing support for the stock market. On one hand, the Federal Reserve will begin expanding its balance sheet (RMP) at the December FOMC, deciding to purchase $40 billion of short- to medium-term government bonds in the first month, maintaining a high level in the following months, with a possible slowdown thereafter. Unlike quantitative easing (QE), which mainly purchases long-term bonds, balance sheet expansion primarily involves short-term bonds, which can more directly improve liquidity and boost risk appetite. On the other hand, the nomination of the new Federal Reserve chairman early next year introduces uncertainty regarding policy and stance, but there is an objective probability of a dovish outcome. Once the nomination is announced, the market may trade in anticipation of their statements and views. Currently, the market expects Kevin Hassett to have the highest probability of winning, and he is indeed somewhat more dovish than existing Federal Reserve officials. Therefore, based on both reality and expectations, U.S. stocks will not lack liquidity support at least in the first half of the year.

► The liquidity situation in the A-share market is likely to continue. First, domestic macro liquidity remains excessive, primarily due to insufficient effective demand. Second, micro liquidity is also likely to remain ample. Although we have consistently advised against overemphasizing the role of capital inflows as a single variable on the market, especially since the positive feedback of the wealth effect requires coordination with income expectations and real estate, a series of recent changes, including the removal of large-denomination certificates of deposit, adjustments to insurance fund risk factors, and increased leverage space for brokerages, still convey signals of policy guidance for capital inflows into the market Therefore, it is not an exaggeration to assume overall abundance.

Chart 12: Abundance of China's total money supply

Source: Wind, CICC Research Department

► Hong Kong stocks are influenced by both foreign capital and southbound flows, but need to overflow; in other words, both local and overseas funds need to believe that local opportunities are limited. 1) Hong Kong stocks are more sensitive to changes in external liquidity compared to A-shares. If the Federal Reserve cuts interest rates more than expected, Hong Kong stocks can indeed benefit directly from the denominator side. However, for Hong Kong stocks to attract more overseas capital inflows, they need to provide clear attractiveness in terms of structure and return expectations. In other words, if the Federal Reserve only cuts rates moderately, this effect will be significant, as seen recently. 2) The logic of southbound capital is similar. This year, southbound capital inflows reached a record HKD 1.4 trillion. Looking ahead, we expect that in the coming year, the incremental active public offerings and insurance capital may reach HKD 600 billion. The dividend sector of Hong Kong stocks still has appeal for insurance capital, but greater uncertainty comes from individual investors entering the market, with potential scale reaching HKD 500 billion. In total, this may be slightly lower than this year's inflow scale, essentially depending on investors' judgment of the relative returns of the AH markets.

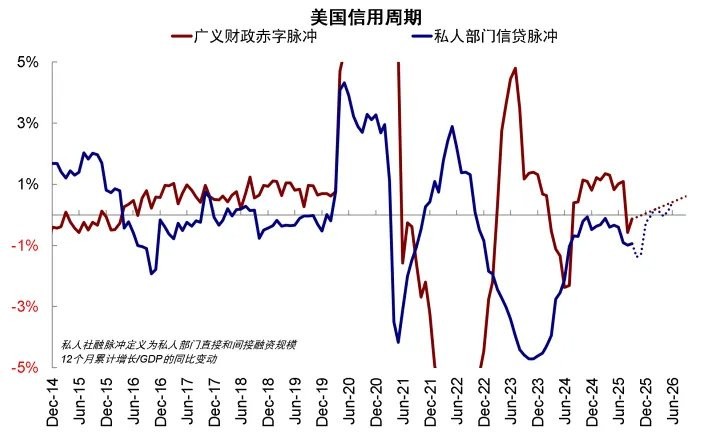

II. Fundamentals: The U.S. credit cycle is recovering, while China's credit cycle is fluctuating or even weakening; in terms of profitability, U.S. stocks outperform A-shares, which outperform Hong Kong stocks

We judge that by 2026, the U.S. credit cycle may gradually recover, and under certain conditions, may even become "overheated"; China's credit cycle has structural prosperity, but after a year of recovery from last year's low of 924, it faces structural challenges again, fluctuating or even weakening, unless policies are significantly strengthened. Specifically: 1) There is not much difference between the U.S. and China in emerging industries, both sides are fully invested in the "AI race," which is difficult to falsify in the short term, and to some extent, China's policy support is stronger. Conversely, if AI is indeed falsified, it would be a loss for both. 2) On the fiscal side, under baseline conditions, U.S. fiscal policy is expected to moderately expand, but next year, mid-term election demands may lead to upward risks of unexpected expenditures in the first half of the year; China's situation depends on policy willingness and preferences. From the signals of the 2025 economic work conference, fiscal and monetary policies will "continue to be implemented," but from 2024's "increase the fiscal deficit ratio," "continue to exert effort, and be more forceful," it shifts to 2025's "maintain necessary fiscal deficits, total debt scale, and total expenditure" and "flexibly and efficiently utilize rate cuts and interest rate reductions," indicating a weaker overall stimulus willingness compared to 2024, with more emphasis on rhythm and efficiency, thus the overall strength is weaker and more focused on structure. 3) In terms of traditional demand, the differences between the U.S. and China are the largest. The currently weak real estate and traditional manufacturing sectors in the U.S. are more easily reactivated by the Federal Reserve's interest rate cuts, with limited differences in cost and returns, while China is more likely to slow down again after the recovery since last year.

Chart 13: The U.S. credit cycle is expected to recover by 2026, and may even become "overheated" under certain conditions

Source: Wind, CICC Research Department

Chart 14: China's credit cycle is fluctuating or even weakening

Source: Wind, CICC Research Department

In this context, we expect U.S. stock earnings to maintain high growth rates (baseline scenario 12-14%, consistent with 2025), while the overall credit cycle in the domestic market is lacking expansion, making significant improvements in earnings difficult to anticipate, with more structural highlights. We estimate that the earnings growth rate of A-shares in 2026 will be 4-5% (non-financial +8%, financial +1.6%), weaker than the 6.5% in 2025 (non-financial +4%, financial +9%). The earnings growth rate of Hong Kong stocks is slightly lower than that of A-shares, at 3% (6% in 2025, current market expectations 9-10%), with non-financial growth at 6-7% (8% in 2025) and financial expected to have zero growth.

III. Structural Main Line: AI Main Line Short-term Hardware Visibility Better than Applications, Strong Cycle A-shares More, Dividend Hong Kong Stocks Better

In addition to the overall liquidity and earnings impact, structural differences are also worth noting, even dominating the relative strength and weakness of the three markets at certain stages. Starting from the four major sectors: technology, dividends, cycles, and consumption.

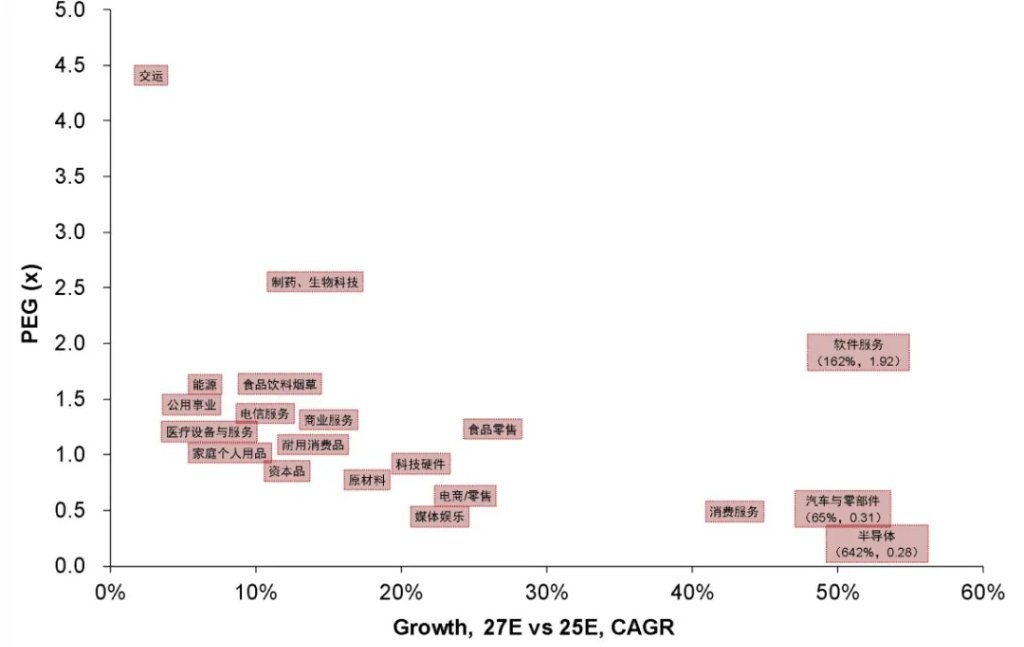

► AI: Hardware has higher short-term certainty than applications, with the former more in A-shares and the latter more in Hong Kong stocks. As mentioned earlier, we do not believe that AI has entered a bubble comparable to the tech internet period.

Currently, the investment expectations and valuations for AI in the U.S. stock market are high, largely based on the assumption of large-scale realization on the application side. Therefore, the key going forward is whether the application side can continuously and verifiably convert into revenue and profit. If the realization pace is slow, stock prices may fluctuate, similar to the current situation.

Unlike the U.S. stock market, one of the characteristics of domestic AI is the higher certainty of policy support, especially in areas such as computing power infrastructure, domestic substitution, and industrial chain security. The visibility and sustainability of policy investment are clearer, and in the short term, it may not be weaker than the U.S. However, this policy-driven credit expansion directly benefits the AI hardware side, especially in sectors like semiconductors and computing power. Moreover, market expectations for the performance growth of hardware (e.g., MSCI China Semiconductor Industry) are higher than for application sectors (e.g., MSCI China Software, Media & Entertainment). A-shares have more hardware, thus benefiting more clearly in the short term, while Hong Kong stocks are more concentrated in the internet and application side, where the profit model remains unclear.

Chart 15: Current market expectations for AI hardware assets are higher than for software

Source: FactSet, CICC Research Department

Source: FactSet, CICC Research Department

► Dividends: Hong Kong stocks have higher investment value. If the credit cycle returns to volatility, dividends still have allocation value to hedge portfolio fluctuations. The dividend yield of Hong Kong stocks is higher than that of A-shares (for example, the dividend yield of the banking sector in Hong Kong is 6.1%, higher than the 4.3% of the A-share banking sector), which is particularly advantageous for investors such as domestic insurance funds that do not need to consider dividend tax.

► Cycle: Focus on catalysts in the first and second quarters, stemming from the demand transmission of U.S. fiscal and monetary policies, as well as the trading window of domestic PPI lagging behind and recovering. Investment opportunities in cyclical sectors mainly come from the recovery of U.S. demand rather than domestically. If U.S. fiscal and monetary policies exceed expectations, it will bring "overheating" risks, benefiting sectors directly related to physical investment in U.S. stocks, as well as driving the performance of related resource products (such as non-ferrous metals, aluminum, chemicals) and external demand chains (such as machinery, chemicals, and even hardware tools, home furnishings) in the Chinese market, with these sectors being more prevalent in A-shares than in Hong Kong stocks. The first quarter is a key observation window, while domestically, there is a gap until the Spring Festival and the Two Sessions, with only inflation data available; PPI is also expected to rise deterministically, which may provide trading opportunities.

Chart 16: The credit cycle (peak in June) leads M1 by 4 months (October)

Source: Wind, CICC Research Department

Chart 17: M1 leads PPI by 6-9 months (peak in the second and third quarters of next year)

Source: Wind, CICC Research Department

► Consumption: The domestic credit cycle is volatile or even weakening, with a low slope of consumption recovery. The consumption sector currently lacks fundamental support, although there are sub-themes such as "new consumption," and these targets are concentrated in Hong Kong stocks, but sentiment is weak and lacks catalysts. In the current environment, the consumption sector is difficult to provide a high-probability structural allocation logic.

In summary, among the four major categories of sectors mentioned above, we recommend using dividends (mostly Hong Kong stocks) and AI as the base positions (A-share hardware has higher short-term certainty, while Hong Kong stocks' applications still need catalysts). Short-term performance requires industrial catalysts or liquidity improvement; in the first quarter, focus on trading catalysts for strong cyclical sectors (non-ferrous metals, aluminum, chemicals, machinery, and tools, with A-shares being more prevalent than Hong Kong stocks), while the consumption sector overall lacks fundamental support. In the U.S. stock market, if fiscal and monetary policies are implemented, cyclical sectors are expected to catch up with technology, while small-cap stocks benefiting from cost reduction and efficiency improvement, as well as financial stocks benefiting from increased credit and financial deregulation, are also worth paying attention to.

Risk warning and disclaimer The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk