Net purchases of 49 tons in October! The central bank's gold purchases remain strong, Goldman Sachs: "Tokenized gold" is not yet the main driver of gold prices

Goldman Sachs estimates that global central banks net purchased 49 tons of gold during the market volatility in October, far exceeding the previous average monthly level of 17 tons, and is seen as a long-term strategy to hedge risks. The bank maintains its assumption of an average monthly purchase of 70 tons by central banks in 2026 and expects gold prices to rise to $4,900 by the end of 2026. Furthermore, although "tokenized gold" is worth attention, its current impact on gold prices is limited, serving more as an alternative to gold ETFs

Despite the severe fluctuations in the market in October, global central banks' enthusiasm for gold purchases remains strong, providing solid support for gold prices, while the emerging "tokenized gold" has yet to become a major driving force in the market.

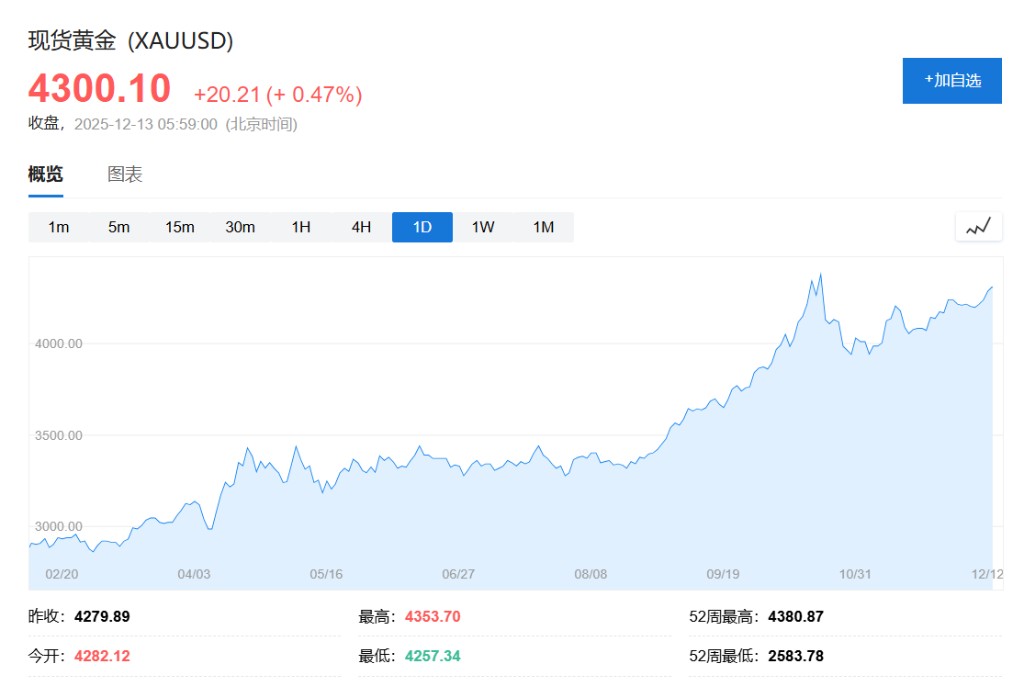

According to news from the Wind Trading Desk, Goldman Sachs' latest report released on December 12 estimates that global central banks net purchased 49 tons of gold in October. This figure is significantly higher than the monthly average of 17 tons before 2022, indicating strong and sustained demand from official sectors.

Among them, Qatar purchased 20 tons in October and China bought 15 tons. Goldman Sachs analysts Lina Thomas and Daan Struyven believe that the central banks' robust purchasing behavior during periods of high price volatility indicates that their decisions are not highly price-sensitive but are based on long-term strategic considerations to hedge geopolitical and financial risks.

Based on this strong official demand, coupled with expectations of a shift towards easing in the Federal Reserve's future policies, Goldman Sachs maintains its optimistic forecast for gold prices, predicting that by the end of 2026, gold prices will rise to $4,900 per ounce. The bank also pointed out that the growth in demand from private investors will be another significant potential upward driver for gold prices.

Central Bank Gold Purchases: A "Multi-Year Trend" for Risk Hedging

Goldman Sachs emphasizes in the report that it continues to view the large-scale accumulation of gold by central banks as a "multi-year trend." The report shows that the net purchase of 49 tons in October, along with a 12-month moving average purchase of 66 tons, is significantly higher than the monthly average of 17 tons before 2022.

Goldman Sachs analysts believe that the fundamental driving force behind this trend is that central banks are actively promoting the diversification of reserve assets to hedge against increasingly severe geopolitical and financial risks. This strategic allocation demand makes central banks' purchasing behavior largely independent of short-term price fluctuations.

Looking ahead, Goldman Sachs maintains its assumption of an average monthly purchase of 70 tons of gold by global central banks in 2026, indicating that official sector demand will continue to provide solid fundamental support for the gold market.

Private Investors Entering the Market May Amplify Gold Prices

In addition to strong demand from official sectors, private investors' behavior is seen by Goldman Sachs as a key variable influencing future gold prices. The report points out that if private investors increase their interest in allocating to gold, it could have a significant "amplifying effect" on gold prices.

Goldman Sachs' model calculations show that for every 1 basis point (0.01%) increase in the share of gold in U.S. private financial portfolios (defined as stocks and bonds), gold prices will rise by approximately 1.4%. Currently, gold ETFs, which are the most common tools for U.S. investors to hold gold, account for only 0.17% of this portfolio, indicating that positions remain low, with significant growth potential in the future.

Goldman Sachs expects that as the Federal Reserve may shift towards easing monetary policy in the future, private investors' interest in gold will rebound, and their capital inflows will work in tandem with central bank gold purchases to jointly push up gold prices

"Tokenized Gold": Worth Attention but Limited Impact

In response to clients' concerns about the role of "tokenized gold" such as Tether Gold in the recent surge of gold prices, Goldman Sachs believes its influence so far "seems limited."

The report points out through data comparison that in the third quarter of 2025, the holdings of Tether Gold increased by approximately 26 tons, while during the same period, the inflow of funds into Western gold ETFs was about 197 tons, and central bank purchases also reached about 134 tons. Clearly, the incremental demand for tokenized gold remains relatively small compared to traditional channels.

Goldman Sachs analyzes that tokenized gold is essentially similar to gold ETFs, both backed by physical gold and providing price exposure to investors. The difference lies in the ownership being recorded on the blockchain, a feature that may lower the entry barrier for some investors but does not necessarily increase significant intrinsic value. Therefore, Goldman Sachs believes that tokenized gold is more likely to become a partial substitute for gold ETFs rather than a huge new source of demand, but this trend is still worth continuous monitoring by the market.

The above content is from [Zhui Feng Trading Platform](https://mp.weixin.qq.com/s/uua05g5qk-N2J7h91pyqxQ).

For more detailed interpretations, including real-time analysis and frontline research, please join the【 [Zhui Feng Trading Platform ▪ Annual Membership](https://wallstreetcn.com/shop/item/1000309)】

[](https://wallstreetcn.com/shop/item/1000309)