Oracle and Broadcom earnings reports: The higher the market expectations, the harder the sell-off

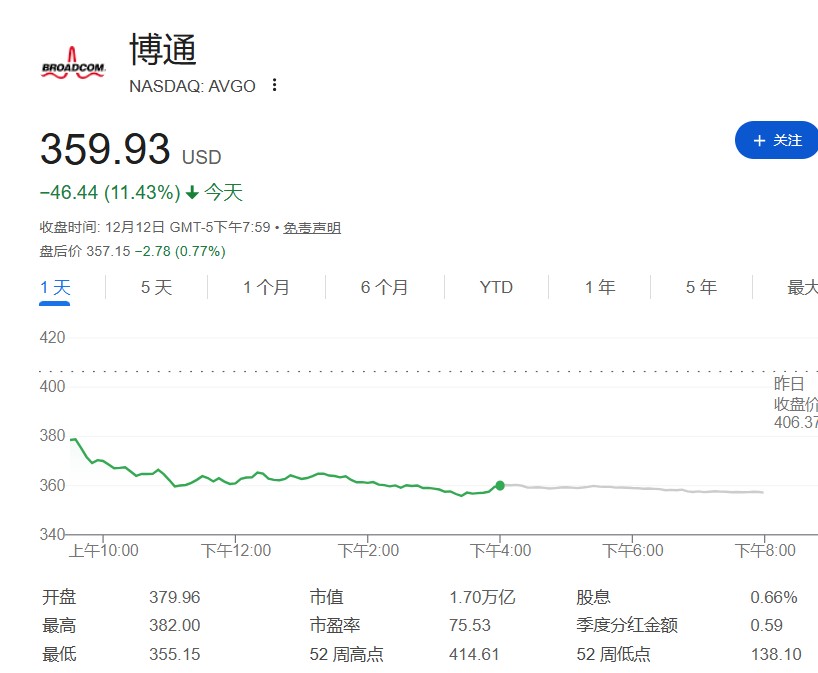

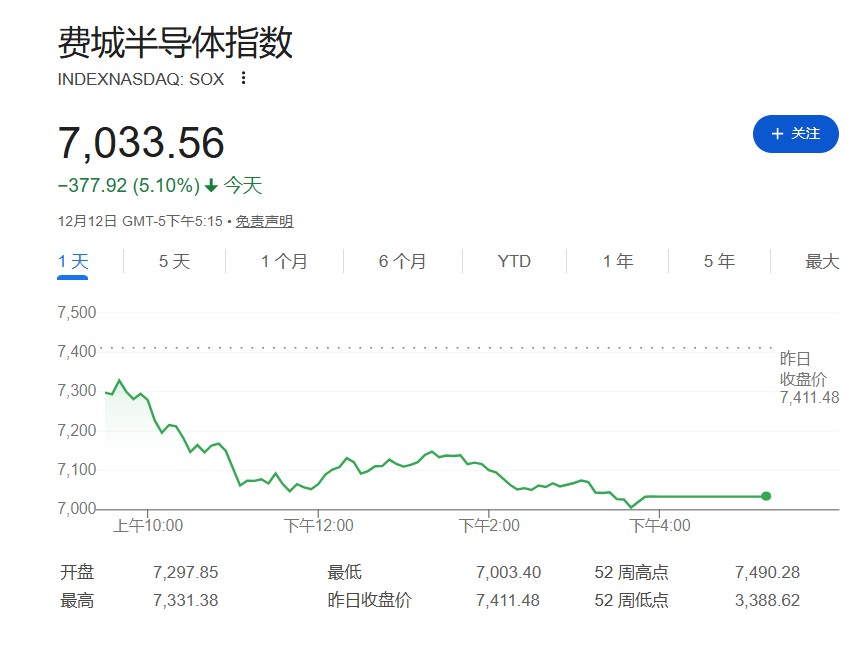

Due to Broadcom's disappointing earnings guidance and rumors of delays in Oracle's projects, investor confidence has been severely impacted, triggering a sharp market sell-off. Broadcom's stock price plummeted 12% on Friday, while the Philadelphia Semiconductor Index fell 5%, marking the largest decline in several months. The sell-off in the stock market even spread to the bond market, with the yield premium on AI giants' bonds significantly rising. This chain reaction may be questioning: how much patience does the market have for the promised AI returns?

A frenzy triggered by artificial intelligence (AI) faced a brutal "reality check" on Friday. When chip giant Broadcom and cloud service provider Oracle released unfavorable news, the overly inflated expectations of the market were instantly punctured.

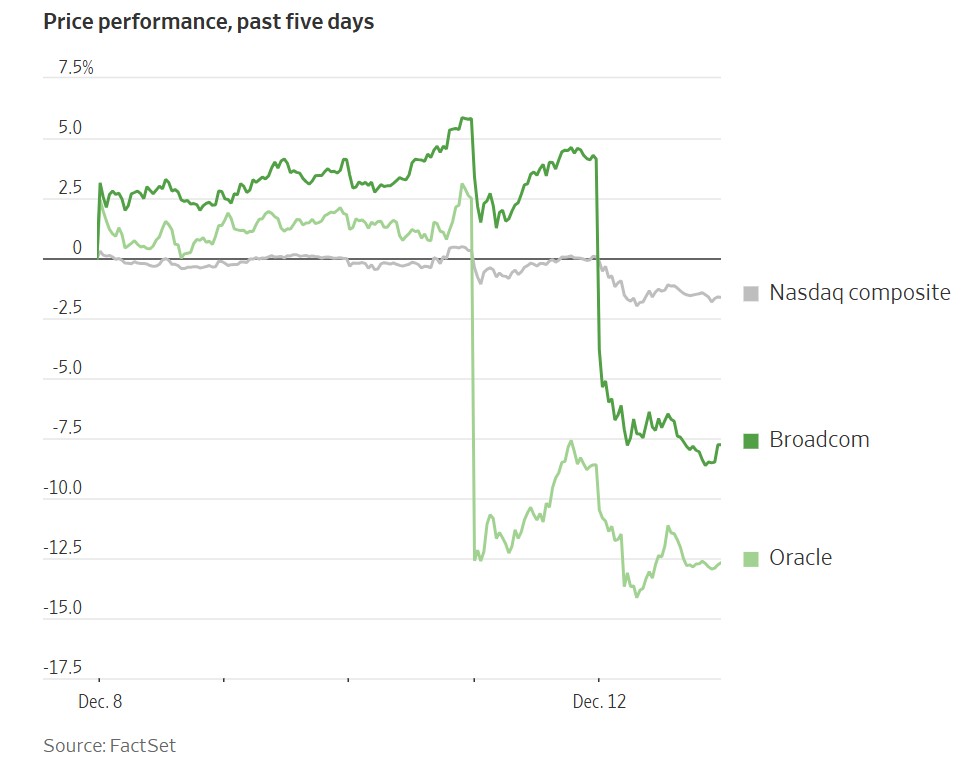

On Friday, December 12, a wave of selling swept through AI-related stocks. Broadcom's stock price plummeted by as much as 12%, dragging the S&P 500 index and the Nasdaq Composite index down more than 1% each, completely reversing the historic highs reached earlier in the week due to interest rate cut expectations. Oracle also continued to decline by over 4%.

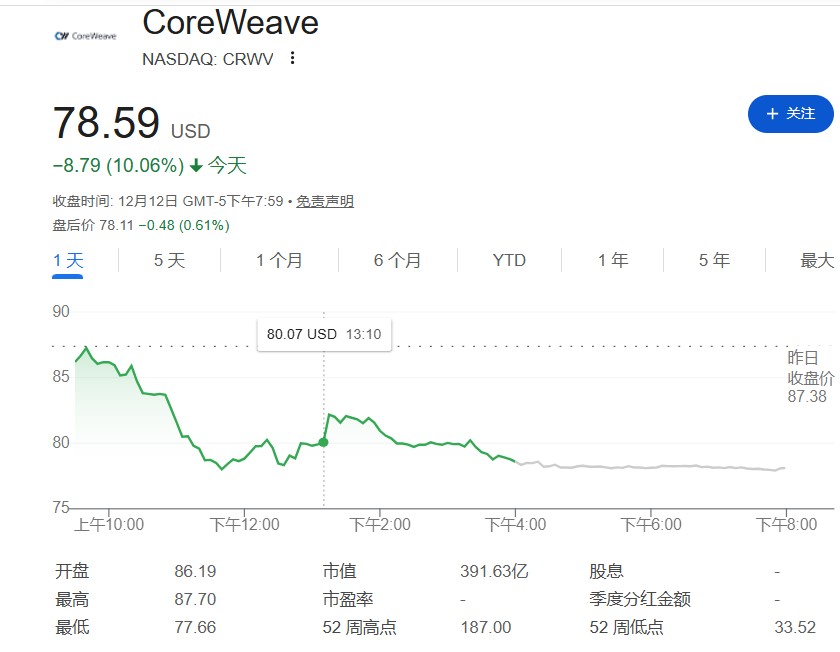

The decline of Broadcom and Oracle quickly transmitted throughout the entire AI supply chain, with the Philadelphia Semiconductor Index plummeting by 5%, heading towards its worst single-day performance in about two months. At the same time, it severely impacted the stock prices of a range of companies from NVIDIA to cloud service provider CoreWeave.

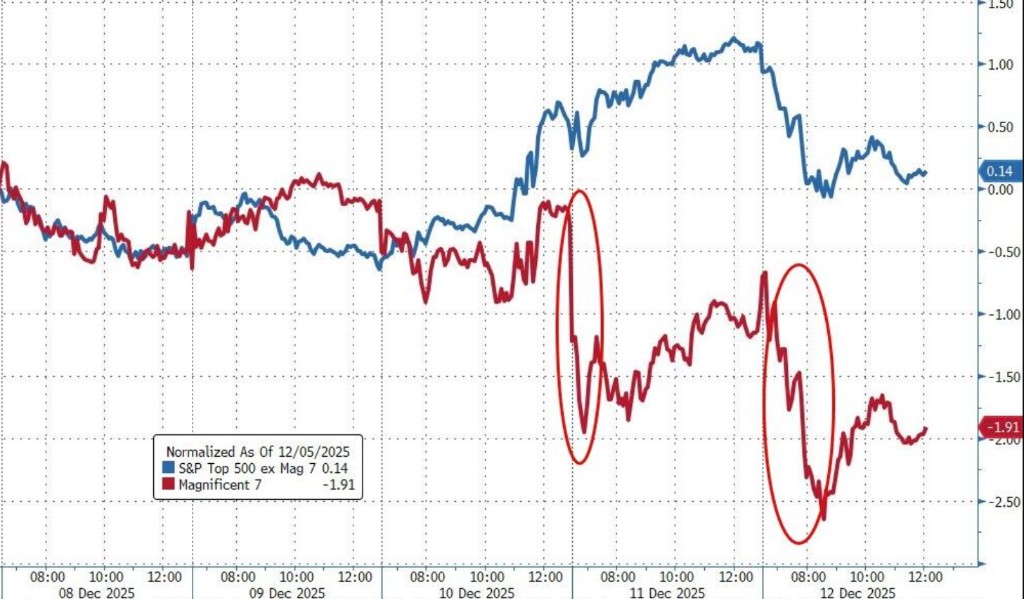

The market's panic spread rapidly, with the performance of the seven tech giants, Mag7 stocks, lagging far behind the other 493 companies in the S&P 500 index. More critically, this shockwave was not limited to the stock market; bond traders also took action to reduce their risk exposure to the sector. According to MarketAxess, the yield premium demanded by investors holding Oracle corporate bonds surged significantly.

This sell-off was ignited by two heavy blows. First, chip designer Broadcom reported its earnings after the market closed on Thursday. Despite achieving record sales, its revenue forecast for the AI business failed to meet Wall Street's extremely high expectations.

Second, shortly after Oracle released its disappointing earnings report, it was revealed that the completion date for some data centers being built for ChatGPT owner OpenAI might be pushed back from 2027 to 2028, directly raising market doubts about the speed of AI infrastructure development.

This series of chain reactions highlights the critical importance of the AI narrative to the current market, which is enough to drag down the entire market and poses a core question to investors: How much patience does the market have for the promised AI returns?

Expectations Missed, Broadcom's Earnings Trigger Chain Reaction

Friday's market dynamics provided investors with an excellent case study demonstrating the outcome when reality collides with high expectations. Broadcom reported record sales of $18 billion and strong profit growth on Thursday evening. However, the market's reaction quickly deteriorated According to an analysis by The Wall Street Journal, investors are focusing on several key issues: the profit margins of its custom AI chips, the timeline for commitments from giants like OpenAI, and the company's visibility into its business beyond 2027.

When the answers to these questions failed to satisfy the market, its stock price fell by 11%, becoming one of the worst-performing components of the S&P 500 index, quickly transmitting the chill to other AI concept companies.

Oracle's troubles worsen as disappointing earnings and rumors of data center delays shake confidence

Before the news from Broadcom, Oracle had already made the market uneasy. The database software giant's previously released earnings report showed that its revenue fell short of analyst expectations, while capital expenditures exceeded expectations.

Subsequently, Bloomberg's report about potential delays in the data centers it is building for OpenAI became the last straw. Although an Oracle spokesperson denied this, stating that "all sites meeting contractual commitments are on schedule, and all milestones are proceeding as planned," it did not stop investors from selling off.

Oracle's stock price fell by 4.5% last Friday, accumulating a 13% decline for the week. RBC Capital Markets analyst Rishi Jaluria pointed out: "People are now viewing Oracle as a bellwether and thinking, 'What does this mean for chips or power?' There are a lot of downstream implications."

The sell-off spreads, affecting everything from chips to the bond market

The impact of this sell-off extends far beyond Broadcom and Oracle. As the biggest beneficiaries of the AI boom, the world's most valuable company, NVIDIA, saw its stock price drop by 3.2%. Other chip-related companies like Astera Labs and Coherent experienced declines of over 10%. AI computing service provider CoreWeave also fell by 10%.

The sell-off even spread beyond the tech industry, with stocks related to electricity, such as Constellation Energy Corp. and Vistra Corp., also experiencing declines.

More notably, the bond market also felt the chill. The so-called "AI hyperscalers" like Oracle, Microsoft, and Meta saw an unusual increase in bond trading volume. According to MarketAxess, the yield premium demanded by investors for holding Oracle's 5.95% bonds maturing in 2055 jumped by about 0.2 percentage points compared to U.S. Treasuries, reaching 2.07 percentage points

Market Divergence Under "AI Reality Check"

The "reality check" in the AI field sharply contrasts with the optimism ignited earlier this week by the dovish signals from the Federal Reserve. Previously, bets on interest rate declines reviving the economy had driven investors into cyclical stocks such as banks, industrials, and materials.

Some analysts believe that this rapid reversal precisely proves the central role of AI trading in the market. Steve Wyett, Chief Investment Strategist at BOK Financial, stated, "The market will face a big question: How patient do we need to be while waiting for these companies to transition from the enthusiasm phase of AI construction to the period when we start expecting returns?"

However, some investors hold the opposite view. Robert Edwards, Chief Investment Officer at Edwards Asset Management, believes that the widespread anxiety triggered by high AI valuations and massive expenditures is actually a healthy caution signal, suggesting that the market still has room to rise.

He pointed out that this "wall of worry" is a contrarian indicator; as long as there are concerns in the market and a significant amount of capital (such as the $7.7 trillion in money market funds) waiting on the sidelines, the stock market could continue to rise