Who will be the next Chairman of the Federal Reserve? Wall Street expresses its stance! JP Morgan CEO Jamie Dimon supports Waller, not Harker

Dimon stated that Waller will become a "great chairman" and warned that another popular candidate, Kevin Hassett, might be more compliant with the White House's willingness to cut interest rates, which could trigger a counter-market bet, leading to an increase in long-term borrowing costs and harming the crucial independence of the Federal Reserve

On Thursday, Jamie Dimon, CEO of JP Morgan and one of Wall Street's most powerful bankers, made it clear at a private asset management CEO meeting in New York that he supports former Federal Reserve Governor Kevin Warsh to lead the Federal Reserve.

Dimon stated that Warsh would be a "great chairman" and warned the Wall Street executives present that another popular candidate, Kevin Hassett, might be more compliant with the White House's desire for interest rate cuts, which could trigger a counter-market reaction, leading to an increase in long-term borrowing costs and damaging the crucial independence of the Federal Reserve.

Dimon's Warning: Short End Obeys the President, Long End Obeys the Market

According to the Financial Times, Dimon analyzed in the closed-door meeting that if Hassett were elected, he would likely quickly lower short-term interest rates to align with Trump's economic demands. However, the Federal Reserve can only control short-end rates, while long-term rates (such as the 10-year Treasury yield) are priced by the market.

Dimon warned that due to market concerns about Hassett's lack of independence and excessive reliance on the White House, such aggressive rate cuts could ignite inflation expectations. At that time, the long-end rates (such as the 10-year Treasury yield) would soar due to investors selling off bonds.

In other words, the White House's attempt to lower financing costs by changing personnel is likely to be overturned by the "vigilantes" of the bond market.

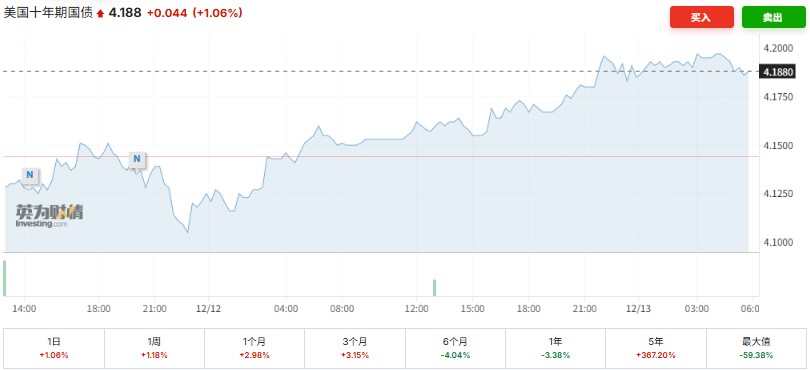

The market is already pricing in this risk. Since late November when media reported Hassett as a frontrunner, the yield on the 10-year U.S. Treasury, which serves as a global asset pricing anchor, has jumped from 4.0% to 4.2%. Meanwhile, bond market traders' anxiety about inflation is heating up—key indicators measuring long-term inflation expectations, such as the 5-year forward inflation swap rate (5y5y forward inflation swap), recently rose by 0.06 percentage points, reaching a one-month high.

Such concerns are not unique to Wall Street. Several senior investors managing the $30 trillion U.S. Treasury market have directly expressed their concerns about Hassett's political leanings to Treasury officials, questioning whether his close political alliance with Trump could undermine the credibility of monetary policy.

The Trade-off Between Loyalty and Professionalism

Trump has long been dissatisfied with current Chairman Jay Powell's approach of not only failing to significantly cut rates but also raising them, even privately calling him a "moron." Trump has made it clear that loyalty and a willingness to aggressively cut rates are key criteria for his selections.

On Friday, Trump confirmed to the Wall Street Journal that Warsh and Hassett are currently the frontrunners:

- Kevin Hassett: The top favorite in the betting market. As a former White House insider, he has publicly supported Trump's calls for aggressive rate cuts—even suggesting that the cuts should be twice the current level. Although he has recently attempted to argue that he would maintain central bank independence, the "executor" label attached to him is hard to shake off in the eyes of Wall Street

- Kevin Warsh: Former Federal Reserve Governor and economist at the Hoover Institution. Although he is unpopular within the Federal Reserve due to frequent criticisms after leaving office and was viewed by some as "overly hawkish" for his excessive concerns about inflation on the eve of Lehman Brothers' collapse in 2008, he has received endorsements from Wall Street giants like Jamie Dimon.

According to The Wall Street Journal, Trump, Treasury Secretary Becerra, and other senior officials interviewed Warsh at the White House this Wednesday.

Currently, the selection process led by incoming Treasury Secretary Scott Becerra is still ongoing, and Trump is expected to interview more candidates next week. Whether to choose the "independent" trusted by Wall Street or the "loyalists" favored by the White House will be revealed in a few weeks