Bank of America: Stop believing in the 60/40 stock-bond portfolio! The real returns over the next decade may be negative, and gold is expected to reach $4,500

Bank of America warns that the classic 60/40 portfolio is entering a low-return era, with expected real returns of less than 1% next year and an annualized real return of -0.1% over the next decade, primarily due to the overvaluation of large-cap stocks. Bank of America recommends shifting towards international small and mid-cap stocks, high-quality U.S. stocks, and high-yield bonds. The bank expects gold prices to rise to $4,538 per ounce next year, representing an upside of about 8% from current levels

The Bank of America strategist team has released a latest research report warning that the "60/40" stock-bond portfolio strategy, once regarded as the golden rule in the investment world, is facing extremely weak return prospects over the next decade.

Bank of America predicts that the classic portfolio composed of 60% stocks and 40% bonds will have a real return rate of less than 1% next year after accounting for inflation. More severely, the bank's model shows that the annualized real return rate for this portfolio over the next decade is expected to be -0.1%, which means that investors who stick to this strategy for the long term may face substantial asset shrinkage.

The main reason for this bleak outlook is the expected performance decline of U.S. large-cap stocks. Bank of America points out that U.S. large-cap stocks have achieved strong growth of over 15% for three consecutive years, while historical data indicates that the average return rate after such high-growth cycles is usually significantly lower than the long-term average. The strategists believe that unless there are unexpected surprises in GDP and earnings per share (EPS), it will be difficult for investors to avoid experiencing the seventh "lost decade."

Given the uncertainty in the return expectations of core assets, Bank of America recommends that investors adjust their positions and look towards "satellite" assets outside the consensus. The report lists six investment directions, including international small and mid-cap stocks, high-yield bonds, emerging market assets, and gold, to seek excess returns in a low-return environment.

Equity Assets: Focus on International Small and Mid-Caps and Quality Stocks

In terms of stock allocation, Bank of America believes that rather than sticking to overvalued U.S. large-cap stocks, it is better to turn to international markets and specific style factors.

The report is particularly optimistic about international small and mid-cap stocks. Over the past five years, these stocks have achieved an annualized return rate of 15%, on par with U.S. large-cap growth stocks. However, Bank of America's strategists emphasize that international small and mid-cap stocks not only have lower downside volatility but also experience faster earnings growth, making them more attractive from a valuation perspective.

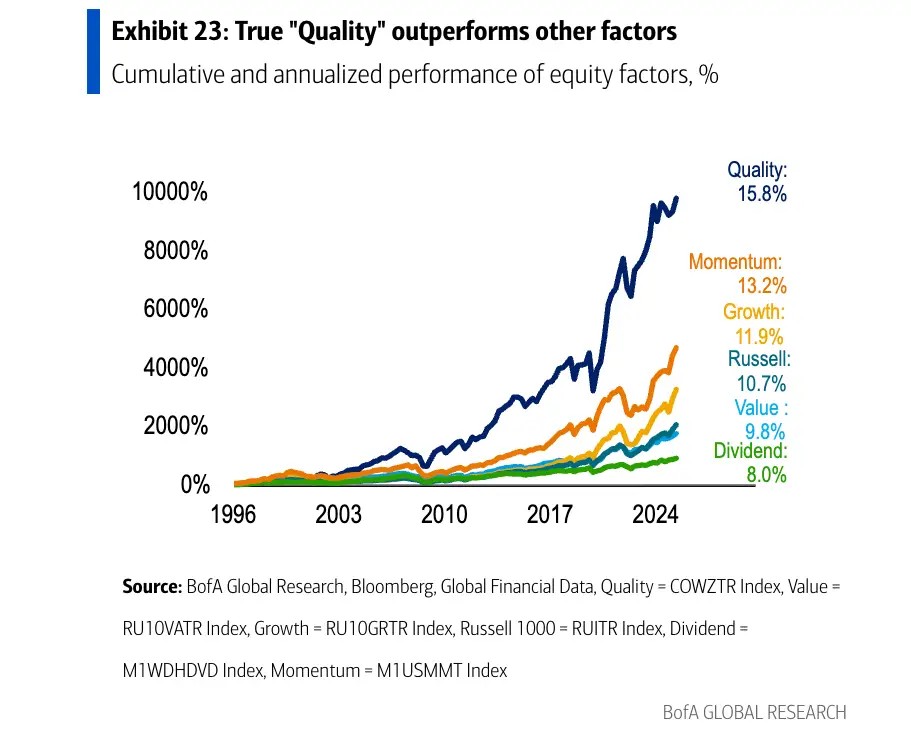

Additionally, Bank of America suggests focusing on "Quality U.S. stocks," which are companies with strong financial conditions and low debt levels. An analysis of data since 1996 shows that quality stocks have consistently performed well in the U.S. stock market in recent years, outperforming other major style factors such as momentum, growth, value, dividends, and small-cap stocks.

Fixed Income: High-Yield Bonds and Emerging Market Dividends

In the fixed income sector, Bank of America believes that credit opportunities are superior to traditional interest rate bonds.

The strategists point out that U.S. high-yield bonds currently offer the best opportunities in the credit market. Compared to loans or private credit, high-yield bonds have higher asset quality and sufficient duration to benefit from the Federal Reserve's easing cycle. Data shows that the current default rate for U.S. high-yield loans hovers around 2.6%, lower than that of private credit and syndicated loans. Bank of America expects that high-yield bonds will outperform investment-grade bonds next year At the same time, emerging market fixed income has become a focus for Bank of America. Over the past three years, this asset class has outperformed U.S. and global bonds, with higher yields. Bank of America specifically pointed out that portfolios including high-dividend emerging market stocks achieved an annualized return of about 9% to 12% over the past five years, far exceeding the 5% return of the MSCI Emerging Markets benchmark index. With 2026 expected to be a year of easing for emerging markets, local bond markets and high-dividend stocks are likely to continue outperforming the broader market.

Physical Assets and Thematic Investments: Bullish on Gold

Regarding physical assets, Bank of America has given a positive forecast, expecting gold prices to rebound to $4,538 per ounce next year, representing an upside of about 8% from current levels. Strategists believe that the factors driving gold prices up this year will persist, including strong demand from global central banks and the ongoing expansion of fiscal deficits.

In terms of commodities, Bank of America previously stated that with strong U.S. economic growth, fiscal and monetary policy stimulus, and the potential for rising inflation, commodities will be one of the best investments in 2026.

Additionally, Bank of America emphasized investment opportunities aligned with key market themes, highlighting three areas with long-term upside potential: artificial intelligence and technology, the revival of U.S. industry, and uranium resources