Adobe After-Hours Turmoil: Key AI Indicators "Absent," Even Strong Earnings Report and Guidance Struggle to Alleviate Market Concerns | Earnings Report Insights

Adobe reported better-than-expected earnings and annual guidance, but its stock price still experienced significant volatility in after-hours trading, reflecting the market's cautious attitude towards its growth potential in the AI era. Although the company emphasized the rapid adoption of AI tools, it did not update key quantitative metrics for its AI business, failing to effectively alleviate investors' deep concerns about the potential disruption of its core business by generative AI

Adobe Inc. released an annual performance guidance that exceeded expectations and reported quarterly results that also surpassed forecasts, attempting to demonstrate its adaptability and growth potential in the era of artificial intelligence.

However, despite robust financial data, the market remains cautious about its ability to effectively withstand the disruptive threats posed by generative AI technology due to a lack of specific updated quantitative metrics regarding its AI business.

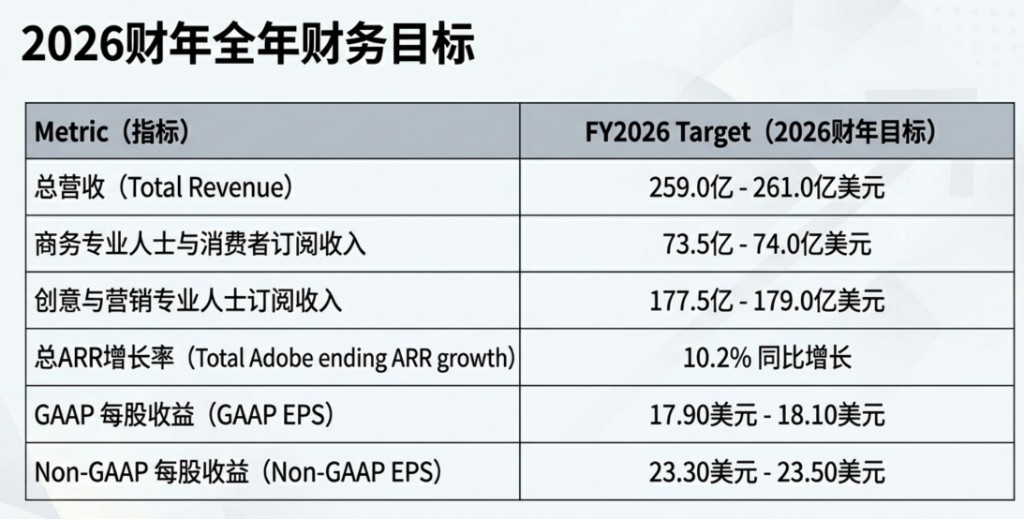

The software giant projected in a statement on Wednesday that for the fiscal year ending November 2026, the company's revenue will be between $25.9 billion and $26.1 billion. Although the midpoint of this guidance range is above market average expectations, it still falls short of some analysts' predictions of $26.4 billion.

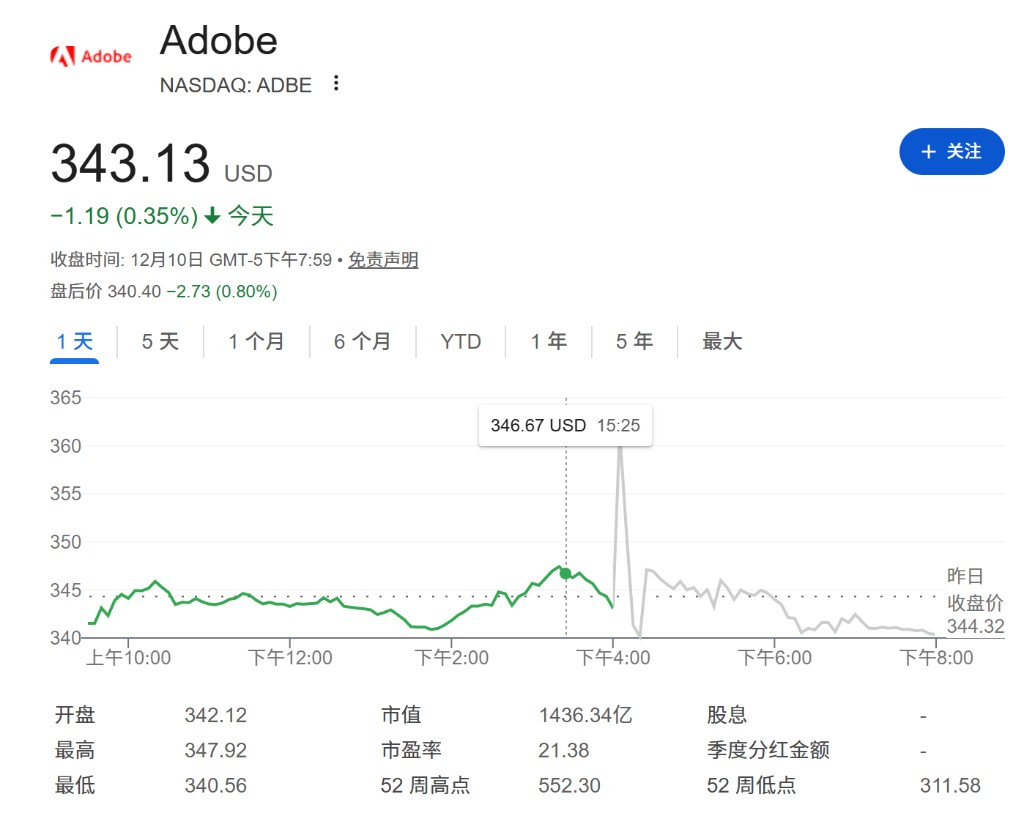

After the announcement, Adobe's stock price fluctuated sharply in after-hours trading, closing at $343.13. The company's stock has fallen about one-fifth this year, reflecting investors' urgency and anxiety in searching for clear signals of its AI growth.

Adobe CEO Shantanu Narayen stated in the announcement that the previous fiscal year's performance reflects the company's "increasingly important position in the global AI ecosystem" and the rapid adoption of its AI-driven tools. Nevertheless, investor reactions remain tepid, as the market has been seeking clearer evidence that this software manufacturer can thrive in the era of artificial intelligence, rather than merely maintaining the status quo.

Performance Exceeds Expectations and Future Guidance

According to the financial report data, Adobe's fourth-quarter sales grew by 10% year-on-year, reaching $6.19 billion, surpassing analysts' expectations of $6.11 billion. For the period ending November 28, adjusted earnings per share rose to $5.50, also exceeding market forecasts of $5.39.

For the upcoming new fiscal year, Adobe's profit guidance appears slightly optimistic. The company expects adjusted earnings per share to be between $23.30 and $23.50, while analysts' average expectation is $23.37. Although the overall data is robust, merely "meeting expectations" or "slightly exceeding expectations" seems insufficient to soothe anxious investors.

Absence of AI Metric Updates Draws Attention

It is noteworthy that, despite management emphasizing the proliferation of AI tools, this financial report did not update some specific artificial intelligence metrics listed in its report three months ago In September this year, Adobe revealed that its annual recurring revenue impacted by AI has exceeded $5 billion, and sales of AI-priority products have surpassed $250 million. The absence of these key metrics has, to some extent, intensified investors' wait-and-see sentiment.

To ensure its features can reach a broader audience, Adobe announced a strategic move earlier on Wednesday to integrate its Photoshop and Acrobat into OpenAI's ChatGPT, providing some free features for chatbot users.

Although AI features in applications like Photoshop have been used tens of billions of times, the market remains focused on the potential threats posed by popular tools developed by competitors, such as Google's video generation model Veo.

Concerns About Disruption Persist

The main challenge Adobe currently faces is investor concerns that generative AI could disrupt its core business model. This worry has led to a lackluster performance in Adobe's stock price this year, with declines similar to those of other existing giants in the application software industry, such as Salesforce Inc.

Jefferies analyst Brent Thill pointed out in a report prior to the earnings release that concerns about AI disruption are troubling Adobe and the entire application software industry. He believes that investors may currently be looking for signs of "significant and sustained accelerated growth," and only when they see concrete evidence that alleviates fears of AI disruption will market funds re-enter in large numbers