After the surge in silver prices, will gold experience a rebound?

Analysis suggests that after a significant squeeze and rise in silver, gold is now presenting an opportunity for a rebound. The technical pattern of gold prices is robust, and the relatively low options volatility provides a tactical layout window. Capital inflows remain insufficient, and emerging market central banks have room to increase holdings. Coupled with the seasonal strength from the end of the year to early next year, the subsequent upward momentum of gold is worth paying attention to

After experiencing a dramatic short squeeze in silver, gold is showing significant potential for a rebound. The technical support is solid, and the pricing of options volatility is attractive, indicating that the market's bullish momentum has not yet been fully released.

According to a previous article from Wallstreetcn, since the beginning of this year, silver has risen nearly 110%, far exceeding gold's 60% increase, causing the gold-silver ratio to drop below 70 for the first time since July 2021. Factors such as expectations of interest rate cuts by the Federal Reserve, supply shortages, and a hoarding effect triggered by being listed as a "critical mineral" in the U.S. have collectively driven up silver prices.

According to The Market Ear's analysis, although silver has experienced a squeeze-driven surge as a high beta asset, gold's performance has lagged significantly. Currently, gold prices are stabilizing above the 21-day moving average trend line, forming a so-called "bull flag" pattern, which is typically a precursor to a push towards higher points.

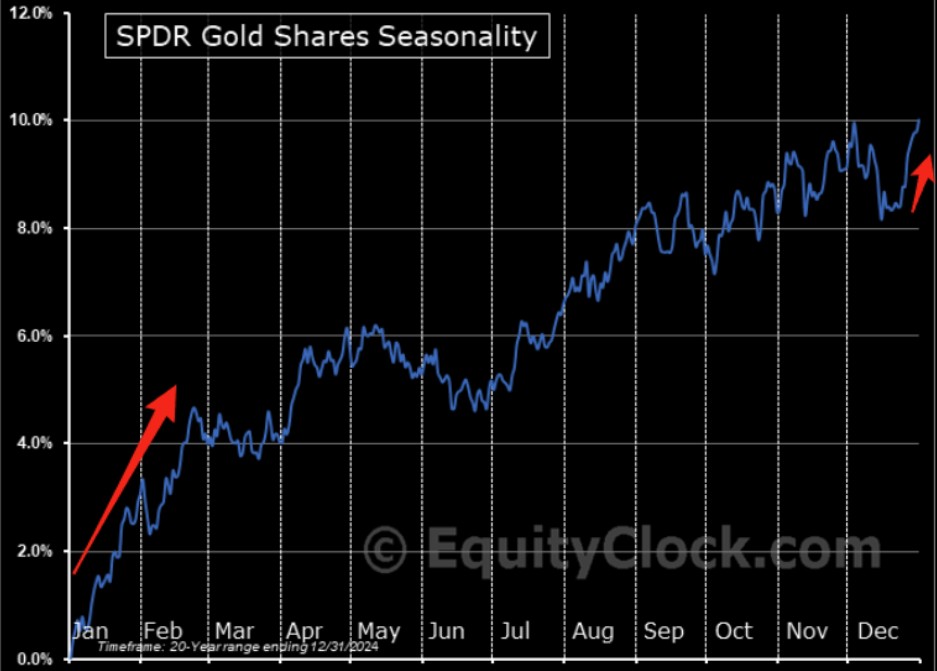

The pricing discrepancies in the derivatives market provide a tactical buying opportunity for gold. Traders' panic buying of silver call options has led to a surge in its volatility, causing the gold-silver volatility spread to widen significantly in the short term. In terms of capital flow, the investment inflow in this bull market is still lower than in past cycles, and there remains substantial room for central banks in emerging markets to increase their holdings. Coupled with the fact that the period from the end of the year to early next year is typically the strongest seasonal window for gold historically, the upward momentum for gold prices is expected to continue.

Volatility Spread and Technical Accumulation

Silver is typically viewed as a high beta asset within the precious metals sector, and the recent dramatic squeeze has not fully driven gold, resulting in a noticeable lag in gold's performance. Market analysis suggests that this divergence may indicate that gold is about to experience a rebound.

Technically, gold prices are currently maintaining a good upward trend above the 21-day moving average. The Market Ear points out that the consolidation of gold prices near the trend line resembles a "bull flag" structure, suggesting that prices are accumulating strength before attacking previous highs.

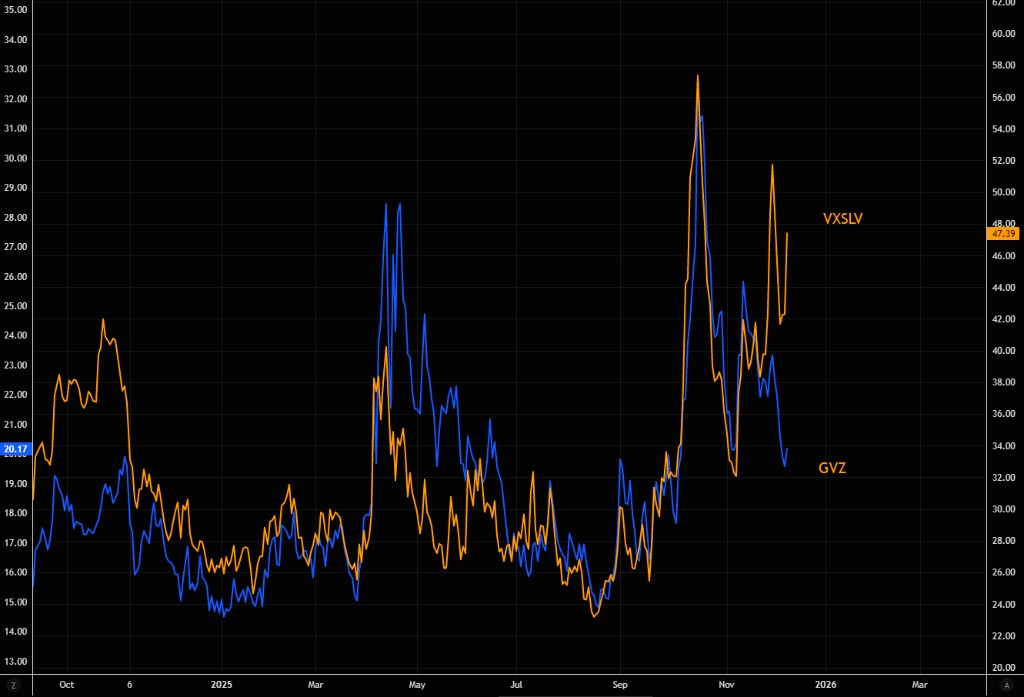

At the same time, the volatility pricing differences in the options market provide arbitrage opportunities for investors. As traders panic-buy silver call options to chase the rise, the volatility of silver has surged sharply. In contrast, the volatility of gold has not exploded in sync, and the volatility spread between the two has rapidly widened in the short term. This divergence makes constructing a gold call option structure an attractive catch-up strategy.

At the same time, the volatility pricing differences in the options market provide arbitrage opportunities for investors. As traders panic-buy silver call options to chase the rise, the volatility of silver has surged sharply. In contrast, the volatility of gold has not exploded in sync, and the volatility spread between the two has rapidly widened in the short term. This divergence makes constructing a gold call option structure an attractive catch-up strategy.

Capital Flows and Central Bank Demand

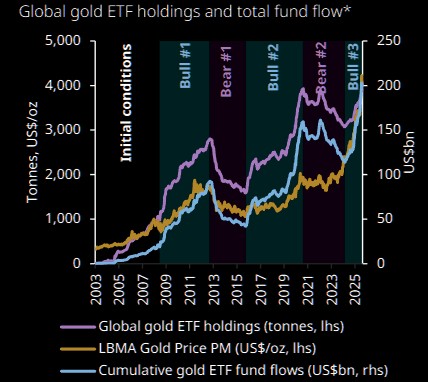

In addition to short-term trading logic, capital flow data also indicates that the upside potential for gold has not yet been fully realized. Analysis citing data from Gold.org shows that despite gold being in this bull market, the current investment inflow is still below the levels of previous cycles. This suggests that market capital is not yet overcrowded, and there is still potential for subsequent capital to enter.

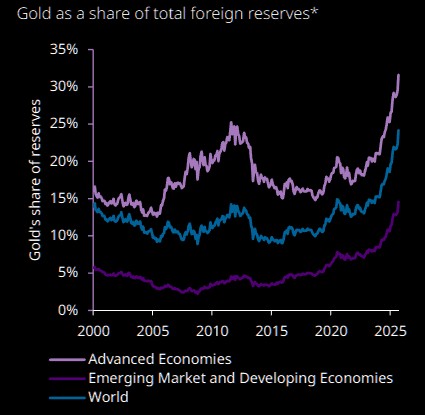

On the demand side, emerging market reserves also have structural support. Currently, the gold reserves of emerging market countries still have a significant gap compared to developed countries, providing room to "catch up" to the levels of developed nations. Analysis points out that if geopolitical tensions escalate, the pace of gold purchases in emerging markets may accelerate, thereby providing strong structural support for gold prices.

The timing window is also in favor of gold bulls. Historical data shows that gold typically experiences a short squeeze rally at the end of the year, and this momentum often continues into January and February of the following year.

Currently, gold is entering its historically strongest seasonal performance window. Combined with technical patterns, relatively low volatility pricing, and unsaturated capital allocation, the trend of gold before the end of the year is worth close attention from investors.