Real estate surges, market expectations are strong, understand in one article the "mortgage interest subsidy" that has been attempted in multiple regions

On December 10th, the A-share real estate sector surged, and Hong Kong's property stocks rose, with strong market expectations for mortgage interest subsidy policies. Vanke held a creditors' meeting to discuss bond extension matters. Local governments have introduced home loan interest subsidy policies, and analysts believe the core goal is to stabilize housing prices and achieve a win-win-win situation through fiscal interest subsidies. A national mortgage interest subsidy policy has not yet been introduced, but the market hopes it can stabilize housing prices and bank profits

On December 10th, during the midday session, the A-share real estate sector surged sharply, with stocks such as China Fortune Land Development, Vanke A, and Caixin Development hitting the daily limit, while companies like TeFa Service and Gemdale Group also saw gains. Hong Kong's property stocks rose, with China Vanke up over 17%, and companies like Ronshine China, China Jinmao, and Sunac China rising over 9%.

According to Shanghai Securities News, on the 10th, the creditor meeting for Vanke's first bond extension, "22 Vanke MTN004," was held to discuss the bond extension matters. A broker stated that this creditor meeting is very important for Vanke's relief efforts. There are three proposals for this meeting, with two new proposals added compared to previous market expectations, which is conducive to reaching a consensus among all parties.

The dynamics of this leading enterprise, combined with the market's strong expectations for fiscal interest subsidies to stabilize the real estate market, have ignited market sentiment. According to incomplete statistics from the team of Qi Kangxu at Huatai Securities, as of 2023, cities such as Nanjing, Changchun, Yuncheng, and Wuhan have all introduced housing loan interest subsidy policies. Wang Song, an analyst at Founder Securities, believes that compared to simply stimulating sales, the core goal of the potential housing loan interest subsidy policy is to "stabilize housing prices," that is, through "invisible interest rate cuts," to narrow the interest rate spread between housing loan rates and rental yields, thereby rebuilding bottom support for asset prices.

It is important to emphasize that the nationwide housing loan interest subsidy policy currently discussed in the market is only market expectations and broker assessments, with no specific policies issued. However, the preliminary explorations by local governments and the technical demonstration of policy feasibility are providing support for this expectation.

Broker Interpretation: "Invisible Interest Rate Cuts" and Win-Win for Multiple Parties

Regarding why the market has high hopes for "housing loan interest subsidies," Wang Song, an analyst at Founder Securities, pointed out in a research report that the core of this model references the successful experience of previous consumer loan interest subsidies. Its logic is to construct a win-win model for "fiscal interest subsidies, bank expansion of lending, and demand enjoying dividends."

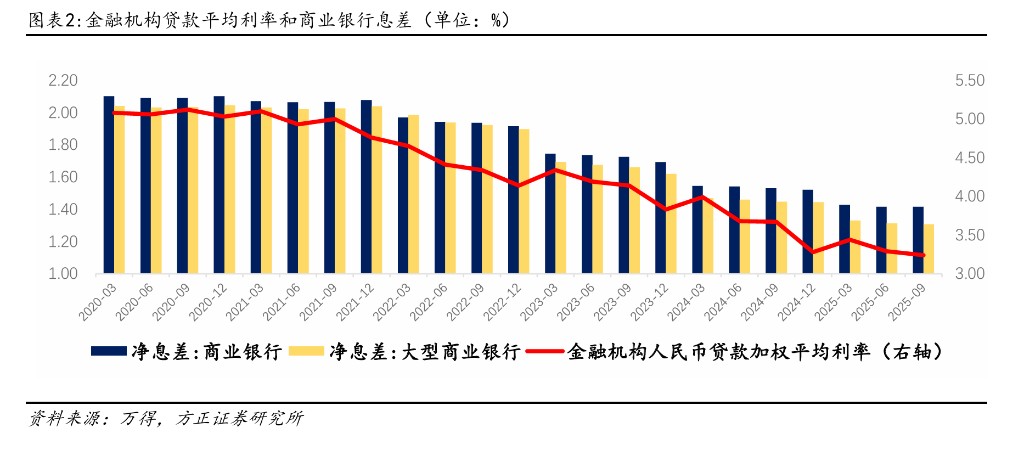

Analysts believe that for the banking system, interest margin pressure is the main constraint on the current decline in housing loan rates. As of the third quarter of 2025, the net interest margin of state-owned banks is only 1.31%. If the LPR is simply lowered, it will directly compress the banks' profit margins. However, with the fiscal burden covering part of the interest costs for housing loan subsidies, banks do not lose revenue, which meets the demand for cost reduction from homebuyers while ensuring the profitability stability of financial institutions, making it the "optimal solution" that balances policy effectiveness and financial security.

In addition, this model focuses on rigid demand and improvement demand through scenario limitations, aligning with the "housing is for living, not speculation" directive, which can avoid speculative demand from crowding out policy dividends and achieve precise drip irrigation of fiscal funds.  Fangzheng Securities believes that the so-called "mortgage interest subsidy" is essentially a form of "invisible interest rate reduction." Its policy goal is to gradually align the potential returns of housing with the cost of funds by narrowing the interest spread, thereby rebuilding a bottom support for housing prices, blocking the downward spiral, and encouraging the first-time homebuyers with low leverage and low risk appetite to enter the market.

Fangzheng Securities believes that the so-called "mortgage interest subsidy" is essentially a form of "invisible interest rate reduction." Its policy goal is to gradually align the potential returns of housing with the cost of funds by narrowing the interest spread, thereby rebuilding a bottom support for housing prices, blocking the downward spiral, and encouraging the first-time homebuyers with low leverage and low risk appetite to enter the market.

Core Contradiction: Inversion of Interest Rates and Rental Yields

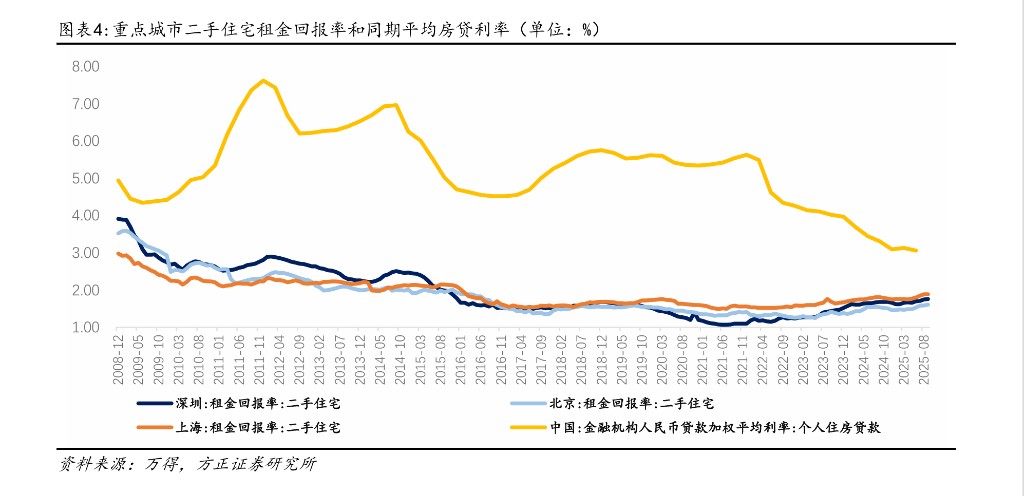

Fangzheng Securities points out that the current real estate market is facing a significant inversion between mortgage interest rates and rental yields. The rental yield in the 50 key cities in 2025 is 2.08%, with first-tier cities Beijing, Shanghai, and Shenzhen at 1.61%, 1.89%, and 1.76%, respectively, while the average mortgage interest rate nationwide in the third quarter is 3.06%. This interest spread inversion results in potential housing returns being lower than the cost of funds, leading to a lack of bottom support for housing prices.

The pressure on banks' net interest margins is the main constraint on the current decline in mortgage interest rates. The net interest margin of state-owned banks is only 1.31%, with the industry average at 1.42%. The advantage of the fiscal interest subsidy model is that it allows the government to bear part of the interest cost, enabling banks to maintain their original profit levels while reducing the actual cost for homebuyers, without harming the stability of bank profits.

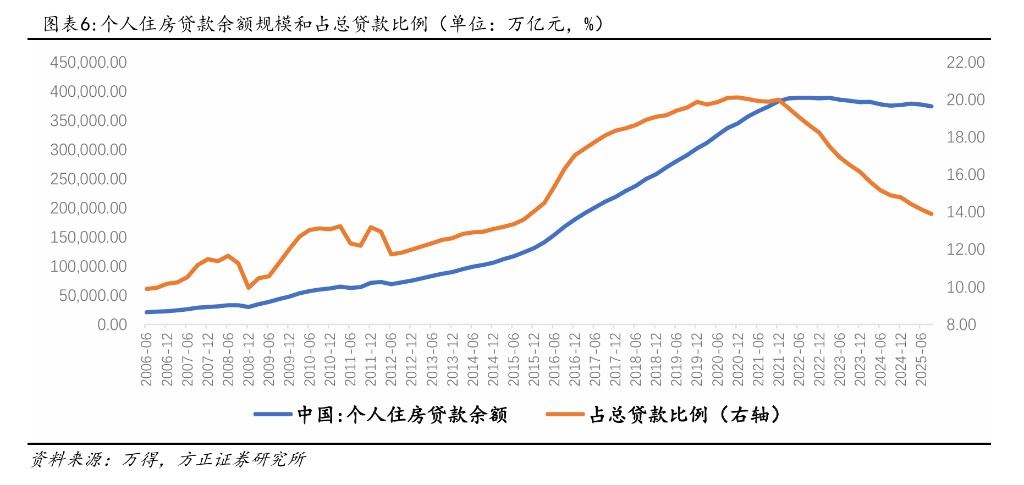

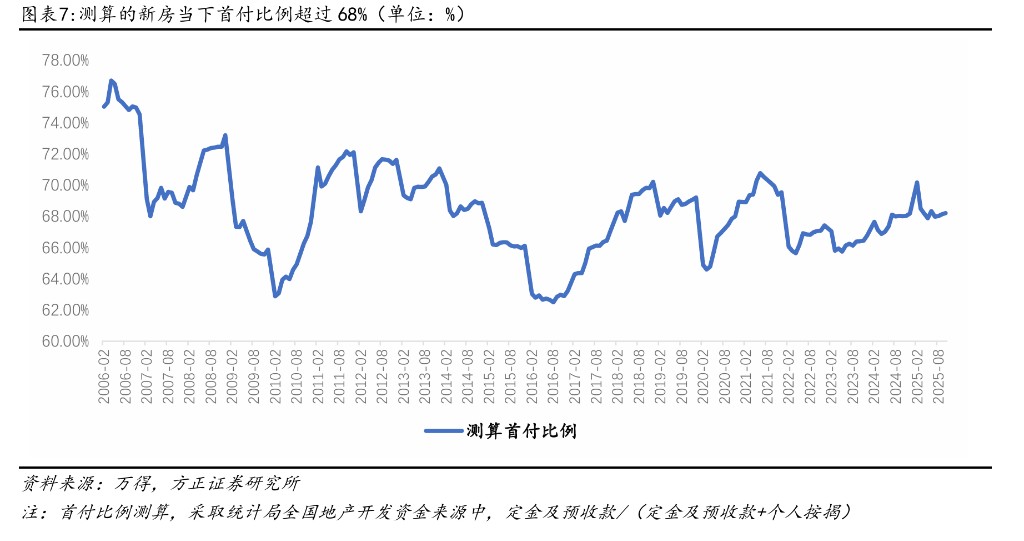

Personal housing loans are a core credit asset for banks. By the third quarter of 2025, the balance of personal housing loans reached 37.4 trillion yuan, accounting for 13.9% of the total loan balance of financial institutions. The report indicates that the current new homebuyers are adopting a higher down payment ratio, with the actual down payment ratio for new home sales from January to October 2025 reaching 68.22%, indicating that this group has relatively low credit risk.

Outlook on Implementation Path

Regarding how the policy will be implemented if it is put into place, the Fangzheng Securities team has conducted simulations. Considering the enormous fiscal pressure of covering all existing housing loans, the future path is likely to adopt a "step-by-step, gradient implementation" strategy.

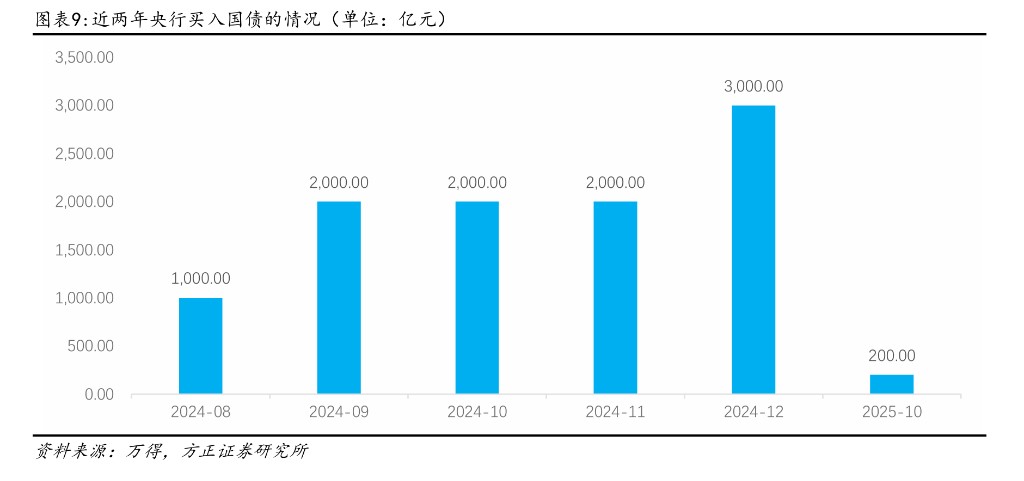

Analysts expect that the policy may prioritize new first-home loans and may initially pilot in first-tier and core second-tier cities, as the inversion of interest rates is more pronounced in these cities. It is estimated that if the annual personal housing loan issuance scale of national commercial banks is about 3-4.5 trillion yuan, and if the interest subsidy only covers new housing loans at a rate of 1 percentage point, the annual fiscal expenditure pressure would be about 30-45 billion yuan. If it fully covers the 37.4 trillion yuan of existing loans and provides a subsidy of 100 basis points, the annual funding demand will reach approximately 380 billion yuan In terms of funding sources, ultra-long-term special government bonds may become the core vehicle. Through a closed loop of "government bond issuance + central bank bond purchases + bank disbursement + fiscal interest subsidies," it can ensure funding supply while releasing clear liquidity support signals to the market.

Local Initiatives: Nanjing and Wuhan Have Already Practiced

In fact, some local governments have accumulated certain experiences in housing loan interest subsidies. Huatai Securities real estate researchers Qi Kangxu and Chen Shen have reported that since 2023, several cities, including Nanjing, Changchun, Yuncheng, and Wuhan, have implemented housing loan interest subsidy policies.

In terms of subsidy rates, Changchun and Wuhan provide loan interest subsidies at 1% of the initial loan amount; Nanjing's Yuhua District implements a tiered policy, offering fiscal subsidies of 2%, 1.5%, and 1% for purchasing new homes of different sizes. Yuncheng provides interest subsidies of 30%-50% of the housing loan interest for high-level talents.

The subsidy period generally ranges from 1 to 3 years. Hangzhou's subsidy period is 36 months, with the loan disbursed in a lump sum in the first month; Changchun's subsidy period is 3 years, disbursed in equal monthly installments; Wuhan's subsidy period is 2 years, also disbursed in equal installments over 2 years. Various regions typically have a maximum subsidy limit, such as Nanjing's Yuhua District with a maximum of 40,000 yuan, Changchun with a cumulative maximum of 30,000 yuan over 3 years, and Wuhan with a maximum of no more than 20,000 yuan.

The effects reported by Huatai Securities indicate that the policy has indeed had a short-term uplifting effect. After the Changchun policy was introduced in August 2024, the number of new home sales in August and September increased by 29% and 30% month-on-month, respectively; after Wuhan's interest subsidy policy was introduced in September 2025, the number of new home transactions in October increased by 50% month-on-month, 45% higher than the average from January to September 2025. However, Changchun's sales in October saw a month-on-month decline of 32%, and the sustainability of the policy remains to be observed.

It is worth noting that discussions about nationwide or large-scale fiscal interest subsidies are still at the market expectation stage, and no specific official policies have been issued yet.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk