The surge far exceeds gold! Silver has surpassed $60, what happened?

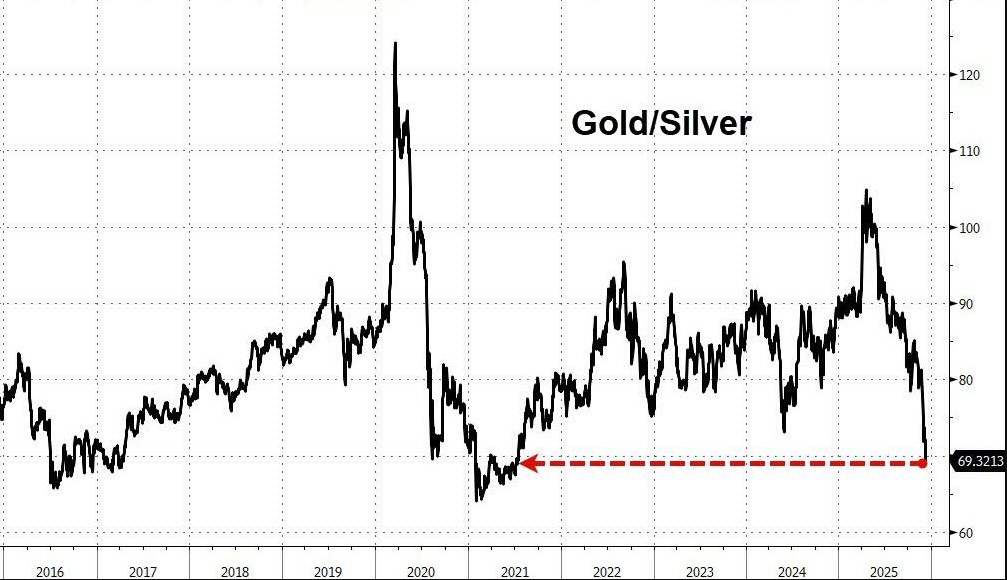

Since the beginning of this year, the silver price has increased by nearly 110%, far exceeding the 60% increase in gold, causing the gold-silver ratio to drop below 70 times for the first time since July 2021. Factors such as expectations of interest rate cuts by the Federal Reserve, supply shortages, and the hoarding effect triggered by being listed as a "critical mineral" in the United States have collectively driven up silver prices

Driven by multiple factors including rising expectations of interest rate cuts by the Federal Reserve, intensified global supply constraints, and being listed on the U.S. critical minerals list, silver prices surged past the $60 per ounce mark on Tuesday, reaching a historic high. Since the beginning of this year, silver has risen nearly 110%, significantly outperforming gold and platinum.

New York futures prices rose 4.4% to $60.97 per ounce, hitting a high of $61.06 per ounce during the session; spot prices increased 3.9% to $60.46 per ounce, with an intraday peak of $60.50 per ounce.

In comparison, although gold has also risen 60% this year and surpassed the $4200 mark, its increase is still less vigorous than that of silver, leading to the gold-silver ratio dropping below 70 for the first time since July 2021.

The immediate catalyst for this round of market activity was the Federal Reserve's monetary policy meeting. The market widely expects the Fed to announce a 25 basis point rate cut at the conclusion of its meeting on Wednesday. More critically, the structural driving force comes from a severe contraction on the supply side. In addition to the traditional supply-demand gap, the U.S. Geological Survey included silver on its "critical minerals" list last month, exacerbating market concerns about supply stability and triggering a stockpiling frenzy.

Rate Cut Expectations Combined with Supply Tightness Drive Silver Prices Soaring

The job openings (JOLTS) data released overnight was slightly better than expected, causing the probability of a Fed rate cut to dip to 87.4%, but this did not hinder the upward momentum of precious metals. Lower borrowing costs typically benefit non-yielding precious metal assets, as investors flock to this market due to concerns over the debt levels and currency devaluation risks in major Western economies.

Although silver usually follows the trend of gold, its smaller market size makes it more volatile and more sensitive to fluctuations in the dollar exchange rate. For investors seeking reasonably priced safe-haven assets, silver appears cheaper and more attractive compared to gold, which is already at historical highs.

Moreover, supply shortages are becoming the core logic supporting silver prices. In addition to the influx of funds and stockpiling effects triggered by being listed on the U.S. "critical minerals" list, the tension in the physical market has yet to ease.

According to Bloomberg observations, although the influx of funds into London vaults has alleviated the historic supply squeeze in October, other markets are facing severe supply constraints. Currently, China's silver inventory is at a ten-year low.

The Silver Institute points out that due to limited production and rising industrial and investment demand, the silver market is expected to experience an annual deficit for the fifth consecutive year by 2025. ING commodity strategist Ewa Manthey emphasized the "structural lack of elasticity" in silver supply: approximately 70-80% of global silver production is a byproduct of lead, zinc, copper, or gold mining This means that unless the prices of major metals can also support higher production, supply cannot quickly expand even if silver prices soar.

Maria Smirnova, Senior Portfolio Manager at Sprott Asset Management, bluntly stated that "unless the deficit issue is resolved, silver prices have only one way to go, which is up."

Bob Haberkorn, Senior Market Strategist at RJO Futures, pointed out that the current trend in gold is partly attributed to the surge in silver, and he expects silver to break through $70 per ounce in the first half of 2026, while gold is heading towards $5,000.

Strong Support from Industrial Demand

In addition to its financial attributes, silver's strong industrial properties also provide solid bottom support. According to research by the Silver Institute, the booming development of solar energy, electric vehicles and their infrastructure, data centers, and artificial intelligence (AI) will continue to drive industrial demand higher until 2030. Fawad Razaqzada, a market analyst at City Index and FOREX.com, stated that the expectation of strong industrial demand for silver in the coming years is a significant reason for pushing up silver prices.

Moreover, silver plays a key role in the broader electrification process, grid upgrades, and hybrid and pure electric vehicles. Against this backdrop of long-term structural benefits, combined with the Federal Reserve's loose monetary policy and geopolitical tensions, market views generally believe that silver is in a long-term bull market