Goldman Sachs reminds clients: Before the outbreak of the 2008 financial crisis, Las Vegas was the first to collapse, and now it has "reappeared."

Goldman Sachs analysts warn that the current decline in Las Vegas gaming revenue consumption trends is highly similar to early warning signs before the 2008 financial crisis. The report points out that while certain areas, such as air travel demand, remain resilient, if the weakness spreads to broader sectors like aviation in the future, it may force the Federal Reserve to consider a more aggressive interest rate cut policy

Goldman Sachs analysts point out that the current consumer spending environment is sending early warning signals, characterized almost identically to the period leading up to the 2008 financial crisis, with Las Vegas gaming revenue once again becoming a "bellwether" for measuring the economic cycle.

According to a report released by the Goldman Sachs analysis team led by Lizzie Dove, the consumption trends in Las Vegas have begun to decline, reflecting the early signs of weakness seen during the previous economic recession. Meanwhile, although the current consumption environment exhibits K-shaped differentiation and dual-track characteristics, this early signal warrants high vigilance from the market.

Goldman Sachs believes that investors should closely monitor consumption trends until early 2026. While demand in the aviation industry remains strong at present, if demand in this sector begins to decline subsequently, it will be a clear signal of an expanding economic weakness, which may compel Federal Reserve Chairman Jerome Powell to adopt a more open stance towards further interest rate cuts.

Treasury Secretary Yellen previously conveyed that positive factors for wage-earning consumers are expected to begin to emerge sometime in the first quarter. Meanwhile, Goldman Sachs' analytical framework provides important references for identifying the transmission paths of consumer pressure in the travel and leisure sectors.

Transmission Path of Recession Cycles

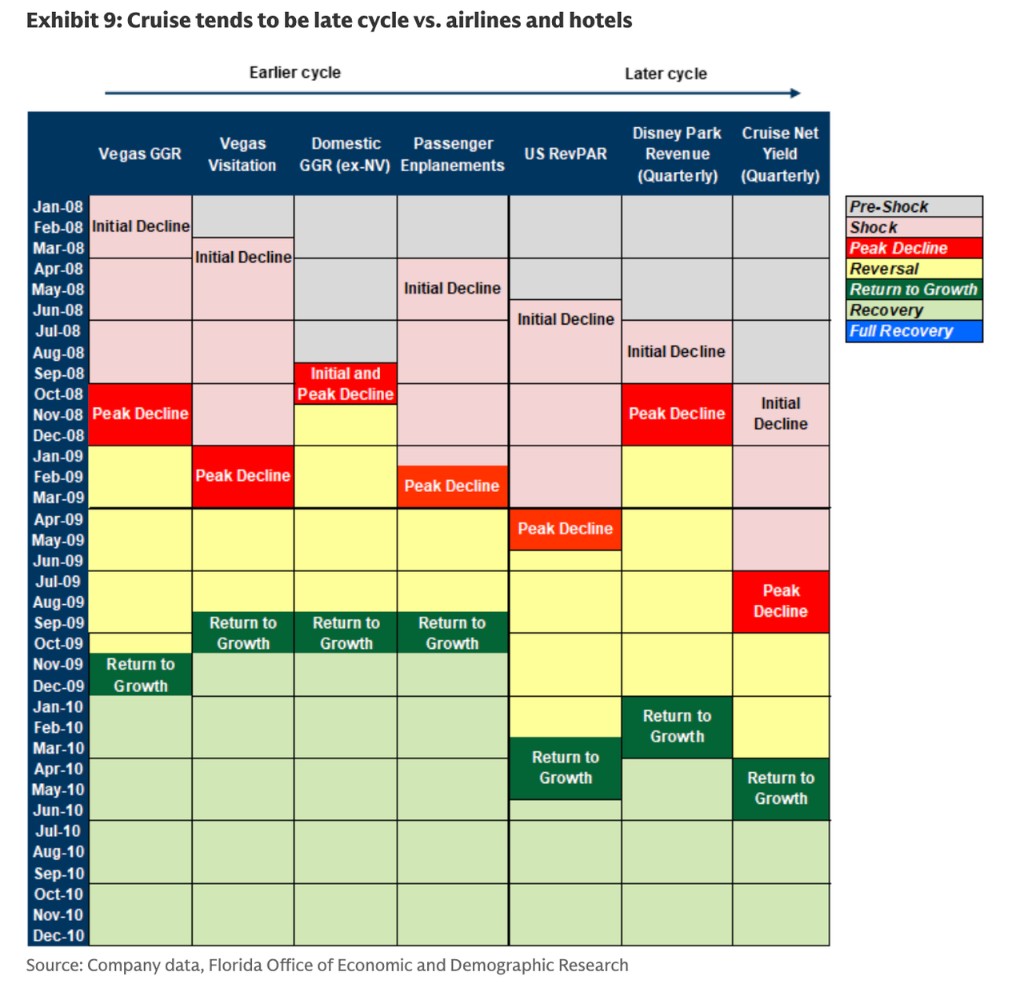

Goldman Sachs analyst Lizzie Dove's research establishes an analytical framework for identifying the sequence of consumer pressure transmission by reviewing the responses and recovery processes of different segments of the travel and leisure industry during the 2008-2009 recession. The analysis shows significant differences in the timing of recessions across different industries.

During the 2008 global financial crisis (GFC), Las Vegas and the aviation industry were the first sectors to be impacted. Las Vegas gaming revenue began to decline as early as February to March 2008, while airline boarding numbers showed a decline by mid-2008.

In contrast, the decline in the hotel and cruise industries was relatively delayed. The revenue per available room (RevPAR) for U.S. hotels only began to decline in the latter half of 2008. The cruise industry typically experiences downturns later in the cycle, with net yields reaching their maximum decline only by mid-2009, and growth did not resume until mid-2010.

This indicates that there is a lag of 18 to 24 months between the late-cycle downturn in the cruise industry and the early-cycle pullback in Las Vegas and the aviation industry.

Early Warning Signals in K-shaped Recovery

Goldman Sachs emphasizes this historical consumer behavior pattern at present because the current K-shaped recovery and differentiated spending environment are flashing early warning signals.

The report indicates that the trend in Las Vegas has pointed downward, consistent with the characteristics of early economic downturns. However, the market currently exhibits a fragmented state: the performance of airlines remains robust, and the "baby boomer generation" continues to book cruise trips to the Caribbean Based on historical experience, the downturn in the cruise industry often occurs at the end of the cycle, while the pullback in gaming, aviation, and hotels usually becomes apparent before the cycle turns downward.

Goldman Sachs recommends continuing to track these consumer trends until early 2026 to observe whether the weakness will spread more broadly across the entire travel industry. If airline demand also begins to decline after Las Vegas, it will provide clearer evidence of the spread of economic weakness, at which point adjustments to macro policies may become inevitable