Valuation may reach $800 billion? Morgan Stanley: SpaceX's next grand narrative will be space data centers

Morgan Stanley stated that the underlying logic behind SpaceX's doubled valuation lies in the expansion of its business boundaries. Musk is outlining a blueprint for SpaceX's entry into orbital data centers, believing that orbital data centers are the fastest way to expand computing power in the next four years, can address the Earth's power shortage, and have advantages such as extreme cooling, unlimited solar energy, and zero operating costs

Morgan Stanley stated that Elon Musk's next grand narrative may be space data centers, a concept that is driving a significant increase in SpaceX's valuation.

On December 9th, according to Chasing Wind Trading Platform, regarding reports of SpaceX selling secondary market shares at a valuation of $800 billion, Morgan Stanley indicated that the market is pricing in a brand new AI infrastructure grand narrative—“orbital data centers.”

Analysts noted that the underlying logic for SpaceX's valuation doubling lies in the expansion of business boundaries. Musk is outlining a blueprint for SpaceX's entry into orbital data centers. Musk stated on X that space data centers are “the fastest way to expand computing power in the next four years.”

Analysts detailed four core advantages of moving data centers into space, including extreme cooling and unlimited energy.

However, despite SpaceX's dominant position, Morgan Stanley emphasized that this sector is not limited to a single player, as tech giants like Google are also actively positioning themselves.

Morgan Stanley: Musk's denial of the “SpaceX valuation of $800 billion” report has subtle differences

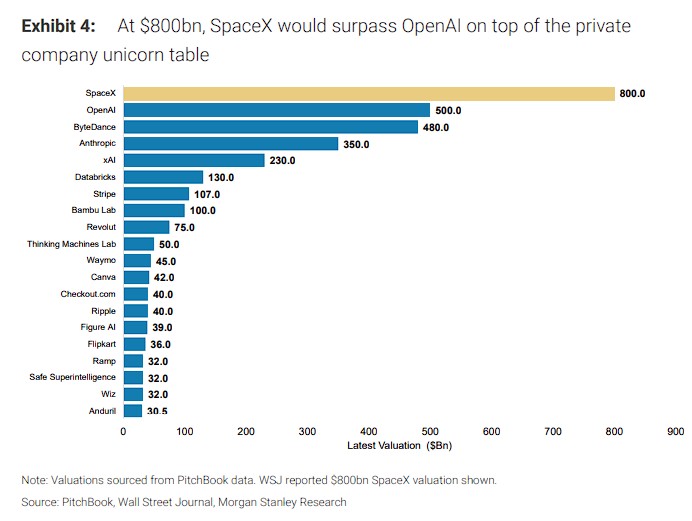

A previous article from Wall Street Insight reported that SpaceX is launching a secondary stock sale, with a valuation as high as $800 billion. This figure is not only double its July valuation of $400 billion but would also surpass OpenAI, making it the highest-valued private unicorn in the world. Musk later stated that the report was inaccurate.

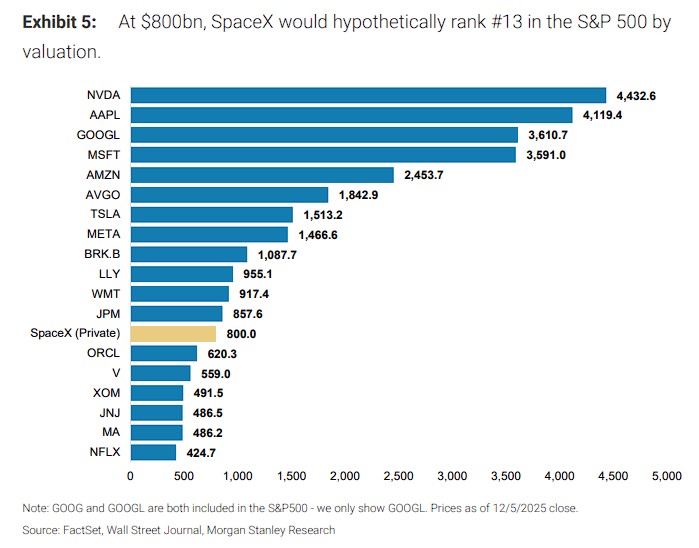

Morgan Stanley noted that if SpaceX were placed in the S&P 500 index, an $800 billion market cap would rank it 13th, between JP Morgan and Oracle.

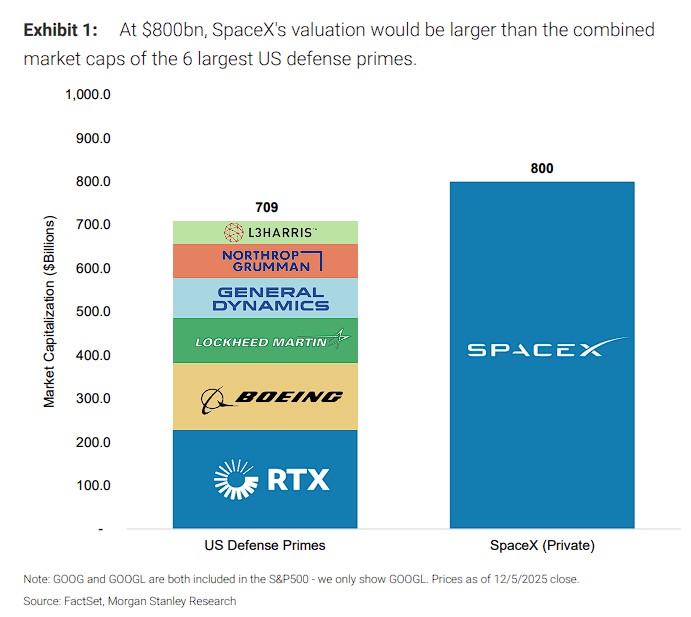

More striking data is: The valuation of SpaceX alone would exceed the total market cap of the six largest U.S. defense contractors (RTX, Boeing, Lockheed Martin, General Dynamics, Northrop Grumman, L3Harris).

Regarding Musk's denial of the “SpaceX valuation of $800 billion” report, Morgan Stanley analyst Adam Jonas keenly pointed out in a research report that Musk's response has subtle differences: He seems to primarily deny “raising new funds,” as he emphasized that the company has had positive cash flow for years and is only conducting employee buybacks. **

Jonas also emphasized in the research report that Musk provided reasons for the valuation growth in subsequent tweets—progress on Starship and Starlink, as well as the significantly increased market space due to the acquisition of global direct cellular spectrum.

Orbital Data Center Concept: Musk's Next Grand Narrative

Morgan Stanley pointed out that Musk is outlining a blueprint for SpaceX's entry into the orbital data center market, with the core logic being to address physical bottlenecks on Earth:

Power Shortage: Easily accessible power resources on Earth are increasingly depleting.

Economies of Scale: Musk envisions launching 1 million tons of payload annually, deploying satellite constellations capable of providing an incremental 100GW of AI computing power.

Zero Operating Costs: These facilities will have no traditional operating or maintenance costs and will connect to the Starlink constellation via high-bandwidth laser links.

The research report noted that in an interview with investor Ron Baron, Musk described this concept as the upcoming "fusion" of SpaceX and Tesla: utilizing upgraded Starlink V3 satellites equipped with GPUs to form a massive computing cloud in orbit through high-speed laser interconnections.

Musk later stated that, provided the technical barriers are overcome, Starship is expected to achieve an annual delivery capacity of 100GW within four to five years.

Meanwhile, Morgan Stanley detailed the hardcore advantages of moving data centers to space in the research report:

Extreme Cooling: Up to 40% of energy consumption in ground data centers is used for cooling. The temperature in space is about 2.7 Kelvin (approximately -270°C). Although radiation heat dissipation requires large metal radiators, industry players believe that the efficiency of radiating heat into deep space is far superior to ground cooling.

Unlimited Energy: Space has nearly complete solar constant (approximately 1361 W/m²), which is about 30% higher than the best lighting conditions on Earth, and is unaffected by atmospheric attenuation, weather, or day-night cycles, providing reliable energy 24/7.

Global Edge Connectivity: Computing resources located in low Earth orbit (LEO) can significantly reduce latency for globally distributed users, allowing computing resources to reach most population centers within milliseconds.

Capacity Barriers: According to Musk, SpaceX currently occupies 90% of the global launch mass capacity. As reusable rockets like Starship mature, the cost per kilogram for orbital launches will significantly decrease, making large-scale modular deployment possible.

Industry Players Competing to Lay Out Space Data Centers

Although SpaceX dominates the market, Morgan Stanley emphasized that this field is not limited to a single player, as multiple companies are actively positioning themselves in the space data center sector According to a research report, the Redmond-based startup Starcloud was established in 2024 and is dedicated to deploying orbital data centers that utilize abundant solar energy, passive radiation cooling, and space-scale infrastructure to serve AI and cloud computing workloads.

The company has raised over $20 million in seed funding from major funds including Y Combinator, NFX, FUSE VC, as well as Andreessen Horowitz and Sequoia Capital.

The Houston-based commercial space infrastructure company Axiom Space is developing an "Orbital Data Center" (ODC) product line, planning to launch the first two free-flying ODC nodes into low Earth orbit by the end of 2025. These nodes are designed to provide secure cloud storage and processing services for commercial, civilian, and national security customers. The company has raised over $700 million in funding.

Tech giant Google is actively advancing a "moon landing" plan called Project Suncatcher, aimed at building a constellation of solar-powered satellites equipped with custom TPU hardware, serving as a space AI/computing data center.

The company plans to launch two prototype satellites to test system feasibility in early 2027 and expects that by the mid-2030s, as launch costs decrease, space computing will approach cost parity with ground data centers.

NVIDIA is also actively positioning itself at the forefront of space/orbital data centers, providing high-performance GPUs and other critical infrastructure.

Starcloud is a member of NVIDIA's Inception program, and earlier this month, NVIDIA and Starcloud launched an H100 GPU aboard a Starcloud test satellite into orbit to validate the feasibility of operating ground-level AI data center hardware in space