Tesla's costs are 40% lower, Waymo's safety is 7 times higher, and the U.S. Robotaxi market is set to welcome a battle between two giants!

Morgan Stanley predicts that 2026 will be a key turning point for the commercialization of autonomous driving, with 33 cities in the United States launching services, marking the beginning of a market explosion. The report believes that in the future, Waymo and Tesla will dominate, forming a dual oligopoly in safety and cost, and warns that this trend will directly impact the ride-hailing businesses and valuations of Uber and Lyft

Morgan Stanley's latest research report points out that 2026 will be a key "turning point" for the autonomous driving industry.

According to Chasing Wind Trading Desk, on December 7th, Morgan Stanley believes that for investors, this means a brutal transition from concept hype to commercial realization. Here are the core impacts of this transformation on the capital market:

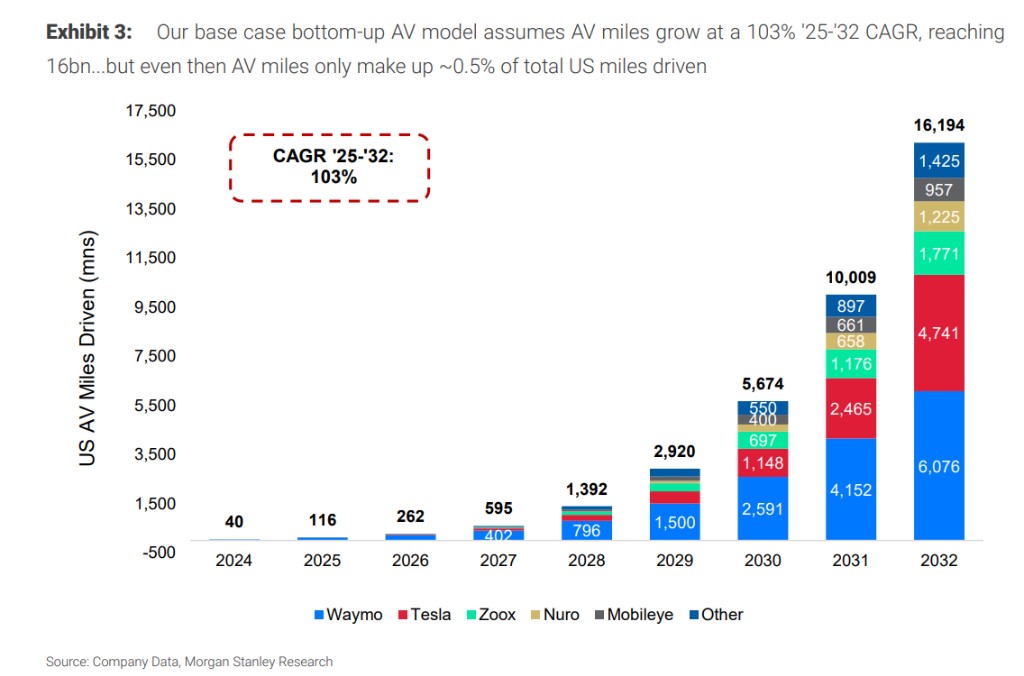

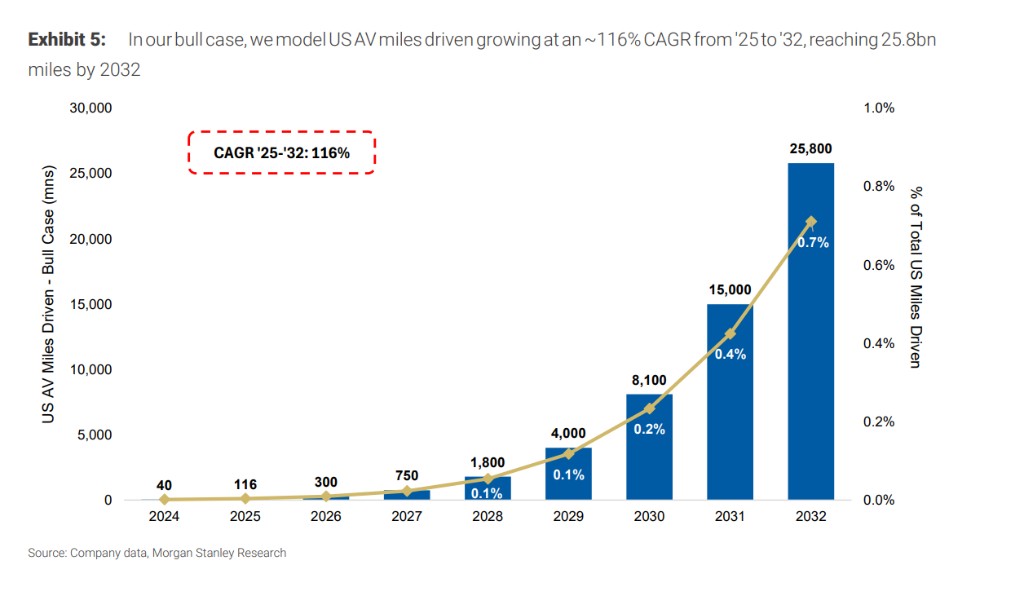

- Explosive market growth: It is expected that from 2025 to 2032, the autonomous driving mileage in the United States will grow 140 times, reaching 16 billion miles.

Establishment of a dual oligopoly: Waymo and Tesla will together occupy about 70% of the market share of autonomous driving mileage in the United States by 2032. This is an ultimate showdown about "cost" and "safety."

The darkest hour for Uber/Lyft? With the rise of autonomous driving technology companies, traditional ride-hailing platforms face severe challenges to their competitive moat. Morgan Stanley predicts that Uber and Lyft's market share in the autonomous driving sector will shrink significantly, and as a result, has lowered the valuation multiples for both companies by about 10%.

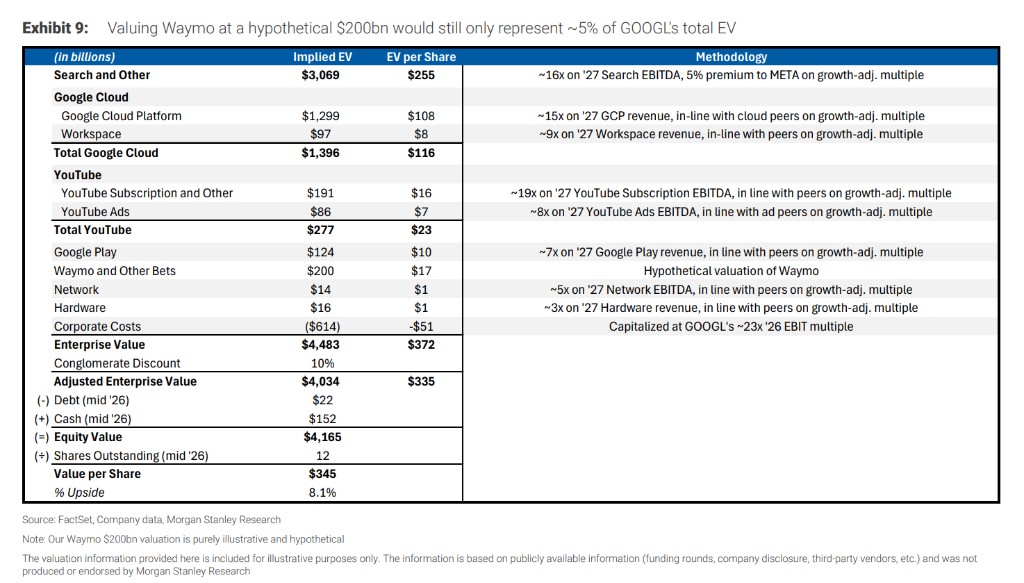

Reshaping valuation logic: Even if Waymo's valuation reaches $200 billion, it would only account for about 5% of Google's (Alphabet) enterprise value, making it difficult to significantly boost Google's stock price in the short term; while Tesla's low-cost advantage will become its core moat.

2026: The "Singularity" Moment for Autonomous Driving

The market is about to bid farewell to the long testing period and enter the explosive phase. Morgan Stanley predicts that by 2026, 33 U.S. cities will launch autonomous driving services (of which 17 have been announced, and 9 are highly likely to launch).

From the data model perspective, the growth curve is extremely steep:

The estimated autonomous driving mileage in the U.S. in 2025 is only 116 million miles.

Under the baseline scenario, the annual compound growth rate (CAGR) from 2025 to 2032 is expected to reach as high as 103%.

By 2032, autonomous driving mileage will reach 16 billion miles.

Although this figure is astonishing, it only accounts for 0.5% of the total driving mileage of cars in the United States, yet it can occupy 30% of the mileage in the U.S. ride-hailing industry. This means that autonomous driving will first disrupt the ride-hailing market rather than the personal car ownership market.

Waymo vs Tesla: The Game of Safety and Cost

The future autonomous driving market will be dominated by Waymo and Tesla, with completely different competitive logics: Waymo builds barriers based on safety, while Tesla breaks through the bottom line based on cost **

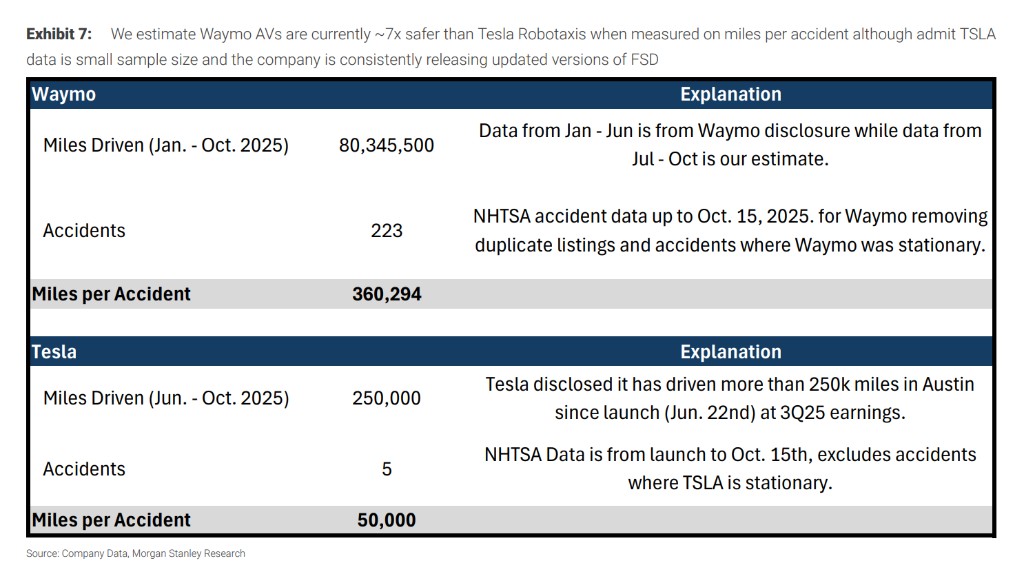

1. Safety Data: Waymo is far ahead

According to NHTSA data estimates, Waymo's current average accident-free mileage is about 360,000 miles.

Tesla Robotaxi data in Austin shows an average accident-free mileage of about 50,000 miles.

Conclusion: Currently, Waymo's safety is about 7 times that of Tesla. Tesla needs to significantly improve the safety of FSD to close the gap.

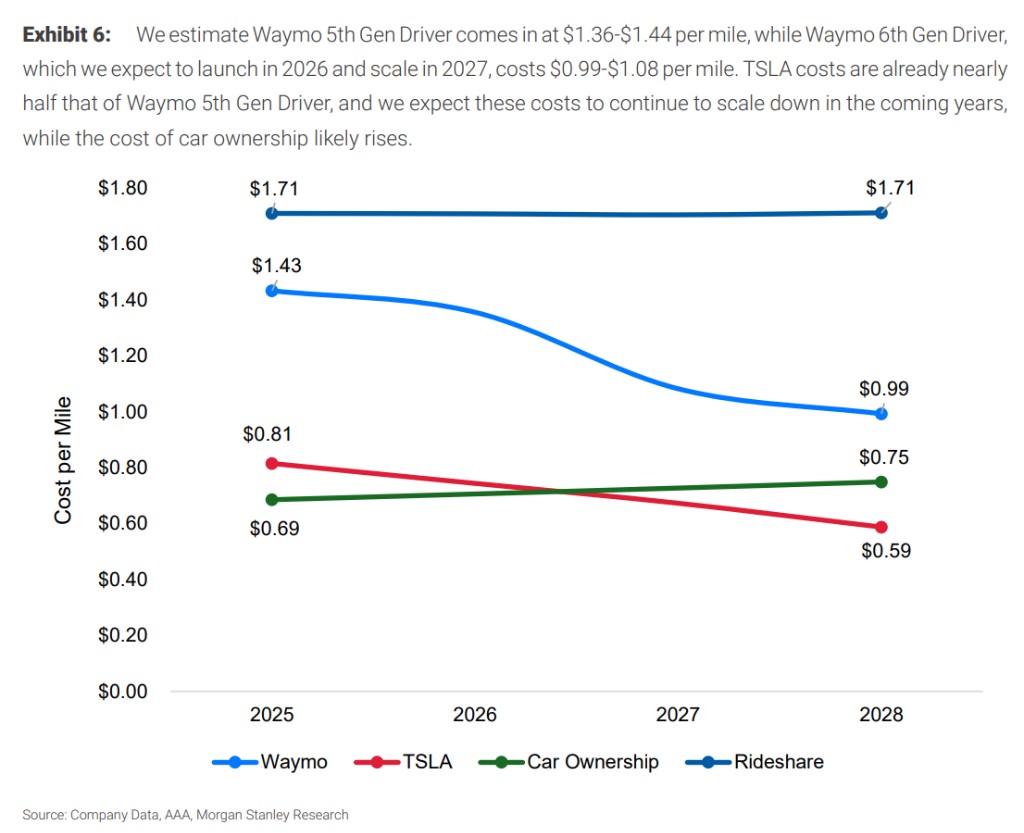

2. Cost Data: Tesla has an overwhelming advantage

Waymo: Currently, the cost per mile for the 5th generation model is as high as $1.36-$1.43. Even for the 6th generation model expected to launch in 2026 and scale in 2027, the cost only drops to $0.99-$1.08.

Tesla: The estimated cost per mile is only $0.81.

Comparison: Tesla's current cost is already about 40%-43% lower than Waymo's existing models and is close to the cost of private car ownership in the U.S. (about $0.70/mile).

Key Point: Whoever can quickly address their shortcomings (Waymo reducing costs vs. Tesla improving safety) will be the ultimate winner.

Uber and Lyft: Facing "Erosion" Risks, Valuation Under Pressure

For ride-hailing platforms Uber and Lyft, autonomous driving is both an opportunity and a significant survival threat. The key variable is "incremental"—does autonomous driving create new travel demand, or does it merely take away business from existing human drivers?

- Warning of Market Share Decline:

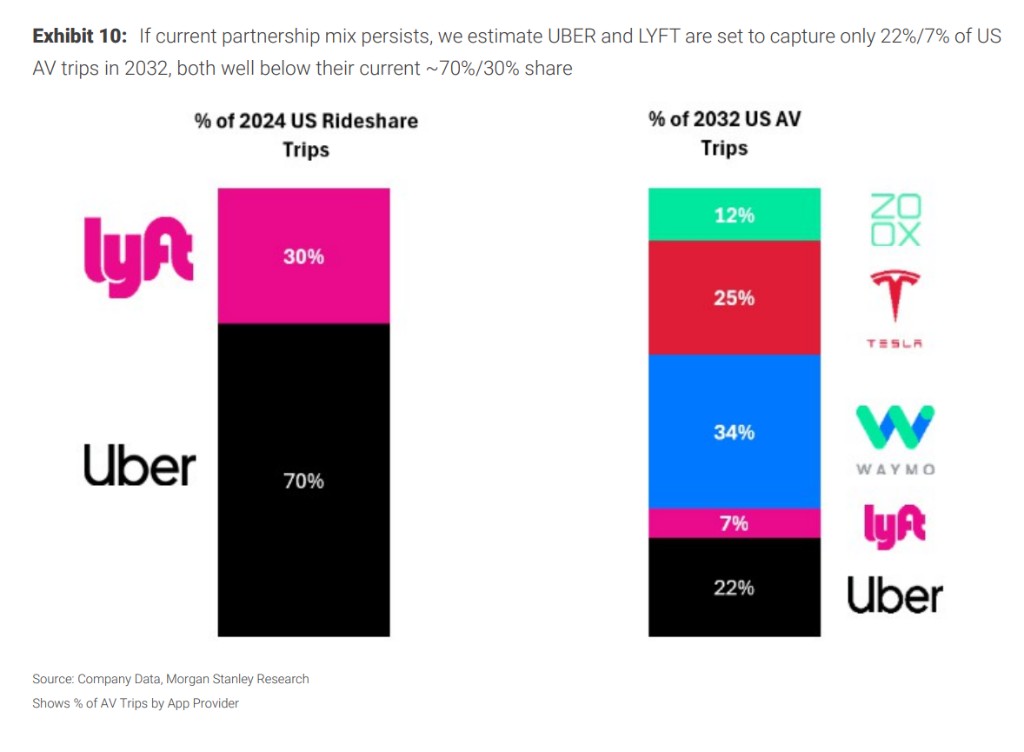

Currently, Uber and Lyft hold about 70% and 30% of the ride-hailing market, respectively.

However, in Morgan Stanley's model, by 2032, Uber and Lyft are expected to capture only 22% and 7% of the U.S. autonomous driving trips (assuming Waymo and others operate some trips through their own apps, and Tesla does not cooperate with them).

- Profit Impact:

If autonomous driving is entirely "erosive" to existing business, it is expected to lead to a 4% decline in Uber's EBITDA by 2030 and a 16% decline for Lyft.

Only if autonomous driving brings complete "incremental" demand can it have a positive contribution to EBITDA (Uber +1%, Lyft +3%)

- Valuation Downgrade:

- In light of the long-term uncertainties posed by autonomous driving, Morgan Stanley has reduced the target valuation multiples for Uber and Lyft by approximately 10%. The target price for Uber has been lowered from $115 to $110.

Google (Alphabet): Waymo is good, but just a drop in the bucket

Although Waymo leads in technology and cities of operation, and has achieved a valuation of over $45 billion in its 2024 funding, its overall impact on the parent company Alphabet's market value is limited.

- Valuation Estimate: Even in a hypothetical scenario where Waymo's valuation is raised to $200 billion (equivalent to the total of Uber's global ride-hailing and delivery businesses), this would only account for about 5% of Alphabet's current enterprise value.

- Investment Insight: Waymo's success is more a reflection of Google's long-term technological reserves and is unlikely to become a core driver of Google's stock price increase in the short term.

AI Agents: The Overlooked Accelerator

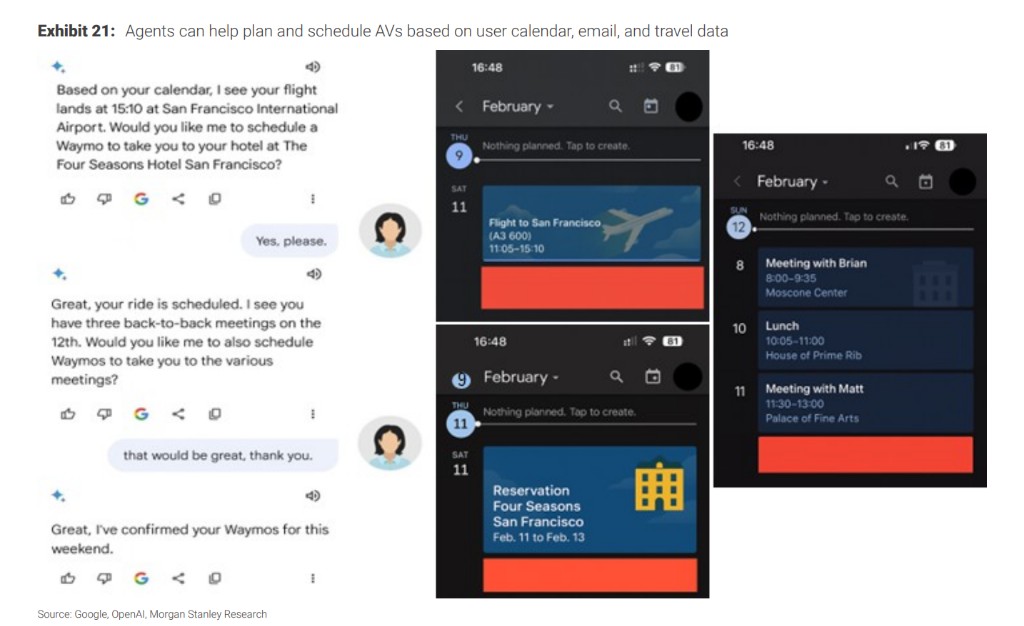

Morgan Stanley has identified a catalyst overlooked by the market: AI Agent Integration.

Future AI agents could access users' calendars, emails, and travel plans to automatically and seamlessly schedule autonomous vehicles.

Google's Advantage: With its capabilities in search, G-suite, Google Calendar, and vertical integration with Waymo, Google has the greatest potential to provide this "proactive" travel service experience, thereby lowering the user threshold and accelerating the adoption of autonomous driving. This will be another trump card for Google in the autonomous driving war besides Waymo.