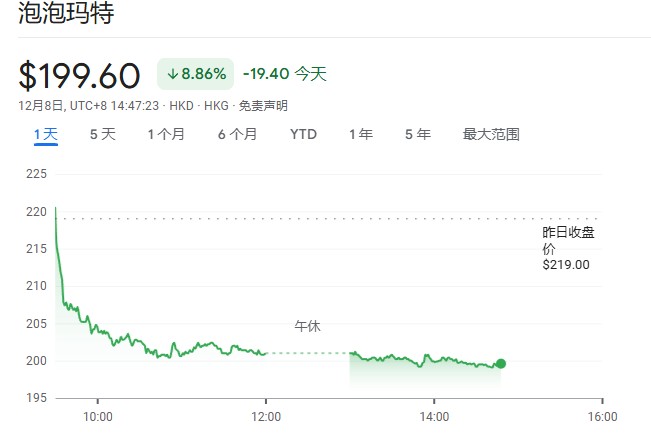

POP MART plummeted 9% during the session! U.S. "Black Friday" sales are suspected to fall short of expectations, with short interest reaching a two-year high

POP MART's Hong Kong stock once plummeted 9% during trading, marking the largest decline in over a month. As the stock price comes under pressure, short-selling forces continue to gather. According to S&P Global data, as of last Thursday, the short interest in POP MART has risen to 6.3% of its outstanding shares, the highest level since August 2023. Analysts expect that POP MART's U.S. sales growth this quarter will slow to below 500%, down from a previous forecast of 1200%

POP MART's stock price suffered a sharp decline on Monday, as investors expressed doubts about the growth momentum of this trendy toy manufacturer in the U.S. market. Following the company's previous announcement of better-than-expected growth in the U.S. market, the market is closely monitoring whether its sales momentum can be sustained.

On Monday, POP MART's Hong Kong stock price plummeted by as much as 9% during trading, marking the largest drop in over a month, and has cumulatively retreated about 40% from its August peak. Market concerns that its sales during the U.S. "Black Friday" promotion may not meet expectations have dampened investor confidence.

As the stock price comes under pressure, short-selling forces continue to gather. According to S&P Global data, as of last Thursday, the short interest in POP MART had risen to 6.3% of its float, the highest level since August 2023.

Kenny Ng, an international strategist at Everbright Securities, stated that investors are concerned about the slowdown in POP MART's sales momentum, while some cautious views from sellers have also weighed on the stock price.

From 1200% Growth to Below 500%? U.S. Sales Growth May Slow Significantly

The performance in the U.S. market has become a focal point, as POP MART previously disclosed in its third-quarter earnings report that U.S. sales had increased by over 1200% year-on-year, raising investor expectations for overseas expansion.

However, the latest signs indicate that growth momentum is weakening. Bernstein's Asia consumer stock analyst Melinda Hu noted that the weak stock price "is likely driven by a decline in North American offline sales trends in November," and she expects the company's U.S. sales growth rate to slow to below 500% this quarter.

Morningstar analyst Jeff Zhang warned that potential weakness in U.S. sales could undermine market confidence in POP MART's growth, as overseas sales momentum has been a key indicator closely tracked by investors.

Traders continue to increase bearish bets, with the short-selling ratio reaching a 28-month high, reflecting concerns among investors about the sustainability of the company's growth. Market observers pointed out that POP MART faces worries about insufficient product diversity and a lack of new revenue drivers. The company's stock price has experienced a rollercoaster ride in recent months, with increased volatility.

Citigroup Maintains Bullish Bets

Despite the recent sharp pullback in stock price, investment banks remain optimistic about POP MART's long-term growth trend.

In a research report last month, Citigroup stated that the value of the company's core IP Labubu has not yet been fully realized. The Labubu 4.0 version is confirmed to be launched in 2026, and Sony Pictures has acquired the film adaptation rights for this IP. Citigroup pointed out that the diverse IP matrix such as SKULLPANDA and progress in overseas expansion together constitute growth momentum