What has the market overlooked regarding Japan's expansive fiscal policy?

Shenwan Hongyuan believes that the combination of fiscal stimulus from Japanese Prime Minister Sanae Takaichi and the central bank's monetary tightening policy may pose risks. Due to the narrowing of the US-Japan interest rate differential (which has decreased from 3.7% to 2.5%) and the potential for policy uncertainty to increase market volatility, the yen carry trade faces significant reversal pressure. Policy conflicts are likely to lead to increased volatility in the yen exchange rate and bond market, undermining the profit foundation of carry trades

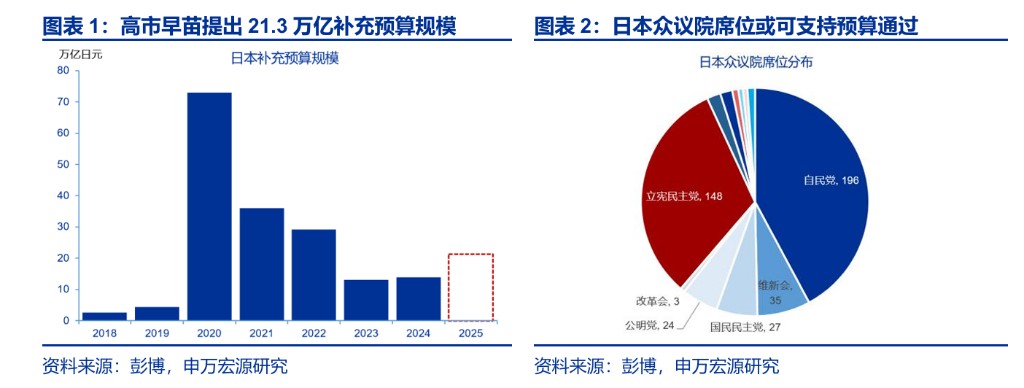

The 21.3 trillion yen economic stimulus plan launched by Japanese Prime Minister Sanae Takaichi, although slightly exceeding expectations, may trigger risks overlooked by the market due to the combination of fiscal easing and cautious monetary tightening policies.

In a research report released on the 30th, Shenwan Hongyuan pointed out that this policy combination may not only have a weaker actual impact on the economy compared to countries like the U.S. and Germany, but it may also exacerbate the reversal pressure on yen carry trades, which investors should be wary of.

On November 21, 2025, Sanae Takaichi announced an economic stimulus plan with a total scale of 21.3 trillion yen (approximately 135 billion USD), slightly higher than the market expectation of 17 trillion yen. The plan focuses on livelihood subsidies, with 55% allocated for inflation and livelihood protection, 34% directed towards strategic industries, and 8% for defense spending. The Japanese government aims to obtain final approval from the Diet by the end of 2025, with funds to be allocated in January next year.

According to estimates from Shenwan Hongyuan research, this fiscal stimulus may raise Japan's deficit ratio to 3.0% in 2026, with an expected boost to GDP growth of 0.5 percentage points. However, the report warns that due to the incompatibility of Japan's fiscal easing with the Bank of Japan's monetary tightening policy, the narrowing of the Japan-U.S. interest rate differential combined with policy uncertainty may increase market volatility and the risk of carry trade reversals.

The stimulus plan focuses on livelihood, with uncertainties in budget approval

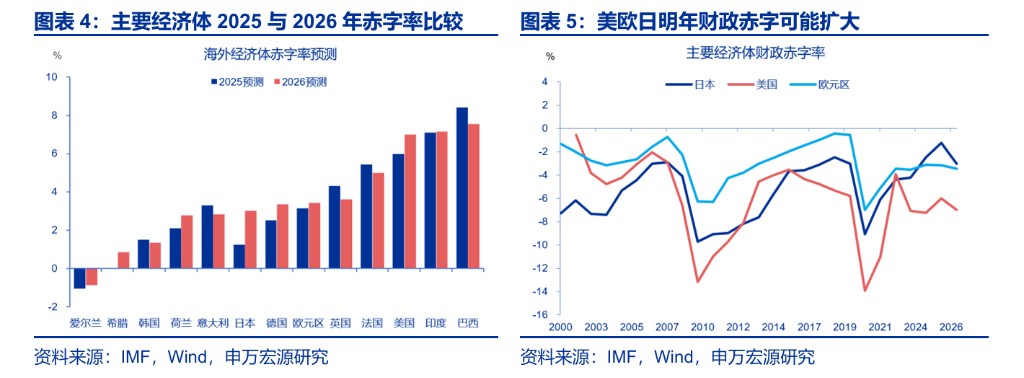

The Shenwan Hongyuan research report shows that Sanae Takaichi's fiscal stimulus includes three major areas. Inflation subsidies and livelihood protection amount to 11.7 trillion yen, accounting for 55%, including subsidies for household electricity and gas costs, a 20,000 yen allowance for each child under 18, and tax reductions. Strategic industry investments total 7.2 trillion yen, accounting for 34%, mainly directed towards semiconductors, shipbuilding, quantum technology, and energy sectors. Defense and foreign affairs spending is 1.7 trillion yen, accounting for 8%.

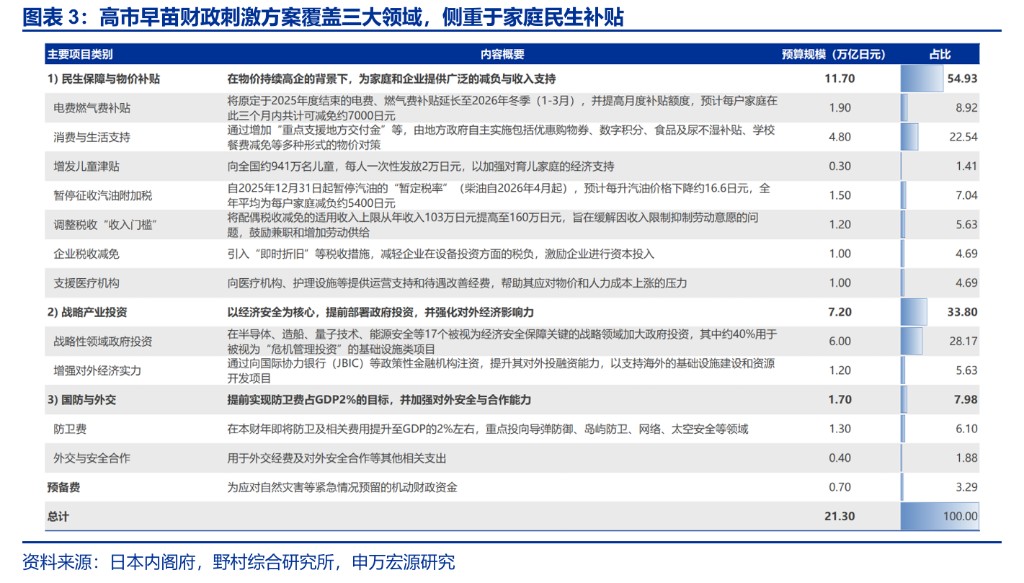

According to the report's analysis, after the government proposed the stimulus plan, a supplementary budget must be prepared and submitted to the Diet for review and voting approval. Japan's fiscal budget follows a House of Representatives priority system, where a simple majority is sufficient for approval. The House of Representatives has a total of 465 seats, with a majority threshold of 233 seats, while Takaichi's coalition government holds 231 seats. Policies that are relatively conservative and friendly to Takaichi's approach will occupy 3 seats. The report believes that considering Takaichi has already adopted some policy proposals from opposition parties in this stimulus plan, it may help reduce resistance to budget approval.

The Japanese Cabinet Office expects that energy subsidies could reduce the year-on-year CPI growth rate by 0.7 percentage points from February to April 2026. Takaichi plans to suspend the temporary gasoline tax starting December 31, 2025, expecting a decrease of approximately 16.6 yen per liter of gasoline, resulting in an average annual savings of 5,400 yen per household. Additionally, electricity and gas subsidies will be extended until early 2026, with an increase in monthly subsidy amounts, expecting a total reduction of about 7,000 yen per household during this period.

Fiscal Stimulus Effect May Be Weaker Than in the U.S. and Germany

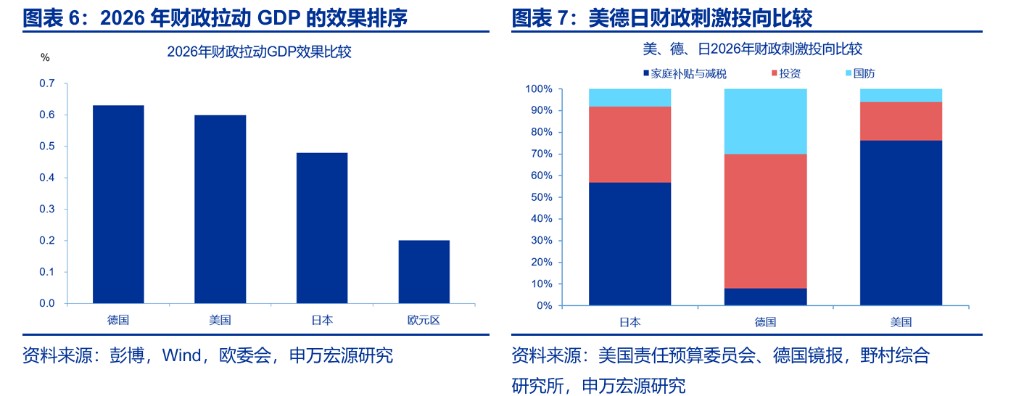

The Shenwan Hongyuan research report compares the fiscal expansion efforts of major developed economies in 2026. According to the report's estimates, the ranking of fiscal contributions to GDP from high to low is as follows: Germany at 0.63 percentage points, the U.S. at 0.6 percentage points, Japan at 0.5 percentage points, and the Eurozone at 0.2 percentage points.

The report points out three reasons for Japan's low fiscal stimulus effect. First, Japanese residents have a low propensity to consume; during the pandemic, the consumption rate from additional cash subsidies in Japan was only 16%, compared to 46% in the U.S. Second, the fiscal spending multiplier is low; Japan's fiscal multiplier is 0.27, while the average multiplier for general economies is 0.8. Third, in Japan's fiscal stimulus structure, 55% is for household subsidies and income support, with low investment spending. In contrast, Germany leans more towards infrastructure and public investment, with 62% of incremental fiscal spending in 2026 allocated to industrial and public investment, higher than in Japan and the U.S.

According to IMF forecasts, ranked by changes in deficit rates from high to low, Japan is expected to expand by 1.77 percentage points in 2026, the U.S. by 1.0 percentage points, Germany by 0.84 percentage points, and the Eurozone by 0.28 percentage points. The report estimates that Japan's deficit rate in 2026 will be 3.0%, which is an increase compared to its own previous levels but still at a relatively low level among developed economies.

The report specifically notes that while inflation subsidies may temporarily lower Japan's overall inflation, their impact on core-core CPI is weak and may increase the stickiness and upward pressure of core-core inflation by supporting demand.

Policy Misalignment Increases Risks of Carry Trade

The Shenwan Hongyuan research report warns that under high inflation and a weak yen, high fiscal spending may not be compatible with the Bank of Japan's loose monetary policy, and the Bank of Japan may still maintain a cautious tone on interest rate hikes, with the possibility of advancing rate hikes due to the yen's weakness.

The report analyzes three key factors. First, Prime Minister Kishida's direct intervention ability with the Bank of Japan is limited; since taking office, he has repeatedly emphasized respecting the independence of the Bank of Japan, and during a meeting with Bank of Japan Governor Ueda Kazuo on November 18, he reiterated his stance of "respecting the independence of the Bank of Japan." Second, Kishida's expansive fiscal policy has led to a significant weakening of the yen, raising inflation expectations, and the Bank of Japan's recent hawkish statements have notably intensified, with the market's pricing for interest rate hikes in December and January having rebounded. Third, although Kishida's fiscal subsidy plan may temporarily lower overall CPI, the Bank of Japan's decision-making is anchored to core-core inflation, which excludes energy and fresh food.

The report concludes that the combination of Japan's fiscal easing and cautious monetary policy rate hikes may increase the pressure for a reversal in carry trades. The U.S.-Japan interest rate differential and volatility are the core driving factors for carry trades; the higher the interest rate differential and the lower the volatility, the more willing funds are to engage in yen carry trades However, Japan's policy mix is likely to lead to a narrowing of interest rate differentials and increased volatility.

According to the report data, the Japan-U.S. 2-year interest rate differential has decreased from 3.7% at the beginning of the year to 2.5%, weakening the profit basis for carry trades. When the Japan-U.S. interest rate differential narrows rapidly, the risk of carry trade reversals increases, as seen in August 2024 and April 2025. The report states that fiscal easing and monetary tightening represent a conflict in policy logic, with the fiscal side attempting to stimulate growth while the monetary side seeks to suppress inflation, leading to confusion in market expectations and potentially causing a temporary increase in the volatility of the yen exchange rate and the bond market.