GUOSEN SECURITIES: How to view gold in the future?

GUOSEN SECURITIES released a research report indicating that since September, gold prices have surged significantly, with London spot gold nearing USD 4,000 per ounce. The report analyzes the long-term supporting factors for the gold market, including the reconstruction of the global monetary credit system, the trend of de-dollarization, and central bank gold purchases, believing that the long-term bull market trend for gold will continue. In the short term, although upward momentum has been released, the Federal Reserve's easing policy and geopolitical risks will continue to drive gold prices to maintain high-level fluctuations

According to the Zhitong Finance APP, Guosen Securities has released a research report stating that, considering both long-term logic and short-term factors, the current support system for the gold market remains solid. In the long term, factors such as the reconstruction of the global monetary credit system, the trend of de-dollarization, continuous gold purchases by central banks, and structural imbalances in supply and demand constitute the core support for the rise of gold. This support system is unlikely to undergo fundamental changes in the next 2-3 years, thus the long-term bull market trend for gold will continue. In the short term, although the upward momentum since September has been somewhat released, the continuation of the Federal Reserve's easing cycle, the normalization of geopolitical risks, and the sustained inflow of market investment demand will still drive gold prices to maintain a high-level oscillation with a strong bias.

Key Points:

Since September, gold prices have risen sharply, and as of the evening of October 7th Beijing time, London spot gold is approaching $4,000 per ounce.

The main viewpoints of Guosen Securities are as follows:

Since 2025, the international gold market has experienced a magnificent upward trend. The international spot gold price started at about $2,650 per ounce at the beginning of the year and has broken through several key levels, now nearing $4,000 per ounce. Notably, the rise in September was particularly remarkable, with a monthly increase of 11.6% in dollar terms. This round of increase is not coincidental, but rather the result of the resonance of long-term logic, short-term factors, and market sentiment. This article will conduct an in-depth analysis from three dimensions: the long-term logic of gold's rise, the short-term triggering factors since September, and the outlook for future trends.

Long-term Logic of Gold's Rise: The Long-term Narrative of Monetary System Reconstruction Remains Valid

As a special asset with both commodity and financial attributes, the long-term price trend of gold is always closely linked to the global macroeconomic landscape, the evolution of the monetary system, and changes in supply and demand structure. The current long-term logic supporting the continuous rise of gold mainly focuses on the reconstruction of the global monetary credit system.

The core financial attribute of gold lies in its characteristic as a "natural currency." When the global monetary credit system faces challenges, gold often becomes the "ballast" of the market. Currently, this logic is being fully validated, mainly reflected in two aspects:

First, the trend of de-dollarization is accelerating and shaking the foundation of dollar credit. In recent years, the dominance of the dollar in settlement and reserves has continued to weaken, and more and more countries are beginning to promote the diversification of reserve assets, with gold becoming an important alternative. Under the shift towards U.S. trade protectionism, the global monetary system may be undergoing a profound "paradigm shift"—from a purely credit-based dollar system to a system leaning towards some characteristics of a "gold standard." Many central banks have made gold purchases a strategic measure, viewing it not only as a means of value storage but also as a core resource for stabilizing the economy during global turmoil. Data from the World Gold Council shows that the continuous gold purchasing behavior of global central banks has become an important force supporting gold prices, and even in an interest rate policy environment that is not as expected, this support can still effectively play a role. This adjustment of reserve structure is not a short-term behavior but a long-term trend in the process of reconstructing the global monetary system, providing stable underlying support for gold demand.

Second, the accumulation of U.S. debt risks exacerbates concerns about monetary credit. The heavy interest burden of the U.S. federal government's debt poses severe challenges to its fiscal sustainability. The rising risk of a debt crisis not only undermines market confidence in dollar assets but also strengthens gold's safe-haven attributes The fiscal issues of the U.S. government have become a potential "gray rhino" for the global financial market. Once the risks erupt, gold will become the primary safe-haven choice. Historical experience shows that when sovereign debt risks rise and lead to currency credit deterioration, the long-term upward trend of gold often continues to strengthen, and the current market environment aligns with this historical pattern.

Short-term triggers for the rise in gold since September: Expansion of gold ETF scale under easing expectations and geopolitical risks

If the long-term logic is the "background color" for the rise in gold, then a series of short-term events since September have become the "catalysts" driving the accelerated rise in gold prices. These factors are concentrated on the momentum brought by monetary policy adjustments and geopolitical escalations.

(1) Fed's unexpected rate cuts: Direct driver of monetary policy easing

The Federal Reserve's monetary policy has always been the core short-term variable affecting gold prices, operating through two paths: adjusting real interest rates and the U.S. dollar exchange rate. In September, the Fed's unexpected rate cuts became an important factor boosting the rise in gold.

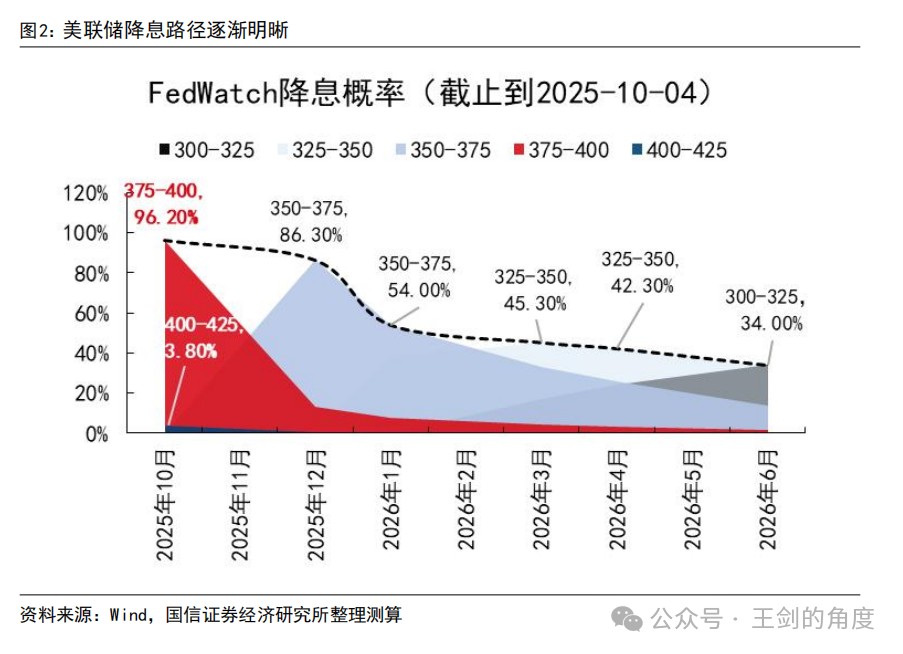

During September, the Fed initiated a rate cut cycle, announcing a 25 basis point cut. Currently, the U.S. non-farm payrolls have weakened for several months, and the momentum in the labor market has significantly diminished. Inflation remains sticky, and the Fed is caught in a "rebalancing dilemma." Core inflation has consistently maintained around 3%, with energy and service costs supporting high prices. However, the Fed believes that the tariff-induced effects are a "one-time shock." Easing has become the "second-best choice," and preemptive rate cuts have been restarted. Faced with the "triple constraints" of weakening employment, high inflation, and tight financial conditions, the Fed is reassessing policy costs. The market generally bets on two more preemptive rate cuts in the second half of 2025, with the rate cut cycle continuing into 2026.

(2) Escalation of geopolitical conflicts: Concentrated release of risk aversion sentiment

The sudden tension in global geopolitical and trade situations in September significantly boosted market risk aversion sentiment, fully demonstrating gold's "safe haven" attributes.

On the geopolitical front, tensions in the Middle East and Eurasia continued to escalate in September and extended into October, creating uncertainty that prompted investors to turn to low-risk assets for safety. More impactful was the sudden change in trade policy—on September 25, local time, the U.S. announced new tariffs on imported goods such as pharmaceuticals, trucks, and furniture, breaking the previous balance in trade policy and exacerbating global trade friction risks. The escalation of trade frictions not only threatens the global economic growth outlook but also leads to increased volatility in global financial markets, with prices of risk assets such as stocks and commodities fluctuating more, prompting funds to flow into safe-haven assets like gold for value preservation. Data-wise, since mid-September, the global geopolitical risk index has significantly risen, further intensifying the demand for gold as a primary safe-haven asset

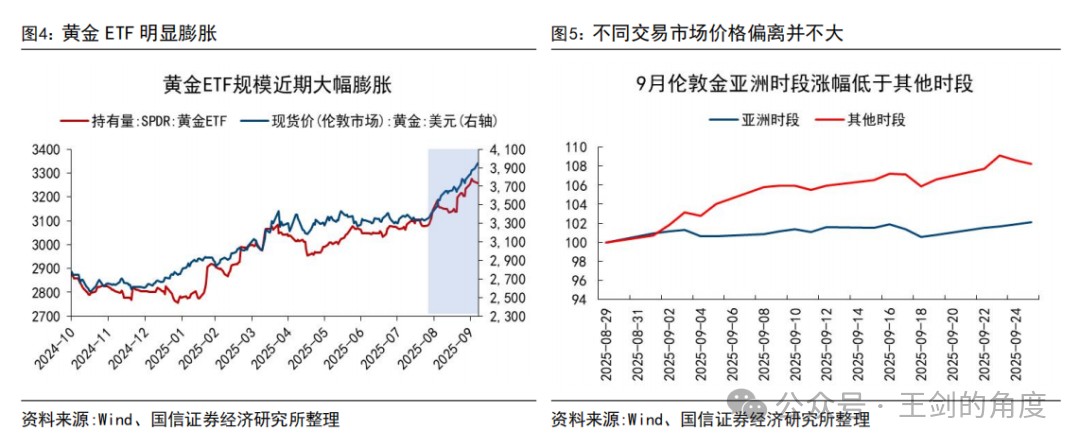

(3) Significant Expansion of ETF Scale

The scale of gold ETFs expanded to 32.57 million ounces in September 2025, marking the second-highest monthly increase since July 2022. From the changes in gold prices and gold ETF scale, both began to rise almost simultaneously in September. This indicates that the current rise in gold prices is largely driven by the increase in ETF scale. North American funds contributed the majority of the capital inflow, reflecting investors' preference for gold amid escalating risks.

It is particularly noteworthy that there are some market views questioning whether central banks may have resumed purchasing gold since September, which is also an important reason for the significant rise in gold prices since then. However, in September, gold in the London market rose by 2.08% during Asian trading hours, while it increased by 8.25% during other hours; during the same period, Shanghai gold rose by 2.70% in Asian trading hours. This performance differs from the past characteristic of "London gold performing better during Asian trading hours," indicating that Chinese official departments did not significantly concentrate on purchasing gold through the London market that month. The main upward momentum for gold prices came from European and American trading hours, possibly related to adjustments in Federal Reserve policy expectations, dollar fluctuations, and rising global risk aversion. No signs of large-scale gold purchases by the People's Bank of China in the London spot market have been observed. Of course, more definitive evidence will need to wait for the release of detailed data on the UK's gold exports in September.

Risk Warning

Policy uncertainty in overseas economies and declining external demand