U.S. Stock Outlook | Three Major Index Futures Rise Together as U.S. Government Shutdown Risk and Non-Farm Payroll Data Hit This Week

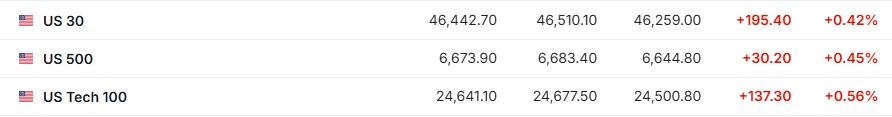

U.S. stock index futures are all up, with the market focusing on the risk of a government shutdown and non-farm payroll data. Dow futures rose by 0.42%, S&P 500 futures increased by 0.45%, and Nasdaq futures climbed by 0.56%. BMO Capital Markets raised its year-end target for the S&P 500 to 7,000 points, believing that U.S. stocks are still in a long-term bull market. The release of non-farm employment data may be delayed due to the government shutdown, affecting market sentiment

Pre-Market Market Trends

- As of September 29 (Monday), U.S. stock index futures are all up before the market opens. As of the time of writing, Dow futures are up 0.42%, S&P 500 futures are up 0.45%, and Nasdaq futures are up 0.56%.

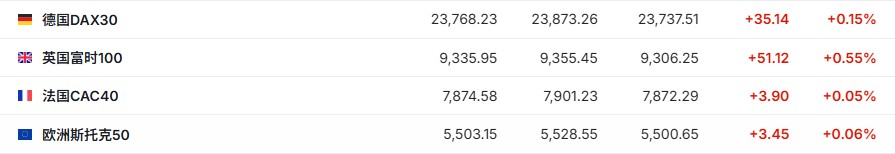

- As of the time of writing, the German DAX index is up 0.15%, the UK FTSE 100 index is up 0.55%, the French CAC 40 index is up 0.05%, and the Euro Stoxx 50 index is up 0.06%.

- As of the time of writing, WTI crude oil is down 1.90%, priced at $64.47 per barrel. Brent crude oil is down 1.70%, priced at $68.04 per barrel.

Market News

U.S. government shutdown risk and non-farm data hit this week. Following last week's unexpectedly optimistic U.S. second-quarter GDP revision data and August consumer spending data, as well as stable inflation data that met market expectations, global financial market investors are increasingly focused on August non-farm employment data, as this U.S. economic data is crucial for their interest rate cut expectations for the Federal Reserve's FOMC decisions in October and December. For the financial market, whether the bullish trend can continue may depend on the non-farm data to be released this week. Additionally, the financial market faces a significant complex factor—the potential U.S. federal government shutdown starting October 1. This event may delay the release of key economic data, including Friday's non-farm employment data. If the non-farm employment report is delayed, the bullish narrative in the bond and stock markets may also be put on hold by the market.

Benchmarking the "Golden 90s," BMO sets a new target for the S&P 500: 7000 points! BMO Capital Markets Chief Investment Strategist Brian Belski has raised the year-end target for the S&P 500 index to 7000 points. As the strong performance of U.S. stocks continues to break market doubts, the firm has set its previous bullish scenario as the base expectation. He pointed out that the market has repeatedly shown resilience beyond mainstream macro narrative expectations, and U.S. stocks are still in a long-term bull market that has lasted for decades. Belski maintains his forecast of $275 earnings per share for S&P 500 constituent companies in 2025—this figure is close to the upper limit of the market consensus expectation range. He believes that if the Federal Reserve further cuts interest rates, it could drive cyclical stocks to rebound before the end of the year Federal Reserve's Harker "Hawks": Inflation Outlook Worrisome, Opposes Rate Cuts. Cleveland Fed President Harker stated that the U.S. inflation rate may remain above the target level until 2028, which concerns her, hence she opposes rate cuts. She noted that the Federal Reserve has failed to achieve the 2% inflation target for over four and a half years, and this situation is likely to persist for some time. Although some Fed officials have acknowledged that the impact of tariffs on prices is currently relatively mild, Harker remains cautious and disagrees with the view that this impact is merely temporary. She stated, "I am still concerned about inflation. I believe we do need to maintain a restrictive policy stance."

Gold Breaks Records Again! After achieving six consecutive weeks of gains, gold prices rose another 1% on Monday, surpassing the historical high of $3,800, exceeding the peak set last Tuesday. Deutsche Bank analyst Michael Hsueh said, "The strong resurgence of gold ETF demand in the market indicates two types of 'active buyer' behavior towards gold, one from central banks and the other from ETF investors. This helps explain why gold has consistently outperformed expectations. In our view, the Fed's easing tendency should make it more likely for ETF holdings to rise rather than fall by 2026."

Ignoring Oversupply Warnings! OPEC+ Plans to Increase Production by at Least 137,000 Barrels/Day in November, Oil Price Resilience Under Test. According to insiders, OPEC+ is continuing to push its strategy to regain global market share, and the organization may again increase oil production in November. Specifically, the OPEC+ alliance, led by Saudi Arabia, plans to discuss in an online meeting on October 5 the possibility of increasing November production by the same amount as the 137,000 barrels/day planned for October. Despite multiple warnings of oversupply from the oil industry, the Organization of the Petroleum Exporting Countries and its allies have chosen to gradually restore previously halted oil production, with a total recovery scale now reaching 1.66 million barrels/day.

Individual Stock News

MoonLake (MLTX.US) Drug Trial Data Failure Causes Stock Price Collapse. Swiss biotechnology company MoonLake Immunotherapeutics announced that the late-stage clinical trial data for an experimental skin disease drug fell short of expectations. According to Morgan Stanley analysts, the key data point for MoonLake's sonelokimab, used to treat patients with moderate to severe hidradenitis suppurativa, showed a placebo-adjusted efficacy of only 14% when combined across two studies. In contrast, UCB's Bimzelx showed an 18% placebo-adjusted efficacy in previously announced trial results. As a result of this news, MoonLake's stock plummeted over 87% in pre-market trading on Monday.

Nine-Year Tenure Fails to Gain Investor Trust! GlaxoSmithKline (GSK.US) CEO to Step Down. After a nine-year tenure that consistently struggled to gain firm support from investors, Emma Walmsley, CEO of British pharmaceutical giant GlaxoSmithKline, will step down The company stated that the current Chief Commercial Officer Luke Miels, who has worked for several large European pharmaceutical companies including AstraZeneca, will officially take over as CEO on January 1, 2026. During her tenure as CEO, Emma Walmsley faced pressure from investors over issues with the new drug development pipeline, raising concerns about whether the company has the right strategy to achieve its goal of over £40 billion (approximately $54 billion) in sales by 2031. Under Walmsley's leadership, GlaxoSmithKline's stock price has fallen by about 11%. Following the announcement of Walmsley's departure, GlaxoSmithKline's stock rose over 3% in pre-market trading on Monday.

Strong demand in the U.S. market, Toyota (TM.US) global sales rise for the eighth consecutive month. Toyota announced on Monday that its global sales increased for the eighth consecutive month in August. This growth is attributed to the sustained strong demand for some of its hybrid models in the U.S. market, while performance in the Japanese market has declined. Global sales in August increased by 2.2% year-on-year, reaching 844,963 vehicles, thanks to a 13.6% increase in sales in the U.S. market. However, sales in its home market fell by 12.1%. Global vehicle production increased by 4.9%, marking the third consecutive month of growth.

Uxin (UXIN.US) Q2 financial report: Retail transaction volume increased by over 150% year-on-year. Leading Chinese used car retailer Uxin Group released its unaudited financial report for the second quarter ending June 30, 2025. The report shows that the company's sales and revenue saw significant year-on-year and quarter-on-quarter growth, with the warehouse-style hypermarket model demonstrating strong growth potential. In the second quarter, Uxin Group's total transaction volume reached 11,606 vehicles, a substantial year-on-year increase of 107.1% and a quarter-on-quarter increase of 40.4%; among them, retail transaction volume was 10,385 vehicles, up 153.9% year-on-year and 37.6% quarter-on-quarter, marking five consecutive quarters of year-on-year growth exceeding 140%. As of the time of writing, Uxin's stock rose over 5% in pre-market trading on Monday.

Important Economic Data and Event Forecasts

Beijing time the next day at 01:30, FOMC permanent voting member and New York Fed President John Williams will deliver a speech.

Beijing time the next day at 01:30, 2025 FOMC voting member and St. Louis Fed President James Bullard will deliver a speech.

Beijing time the next day at 06:00, 2027 FOMC voting member and Atlanta Fed President Raphael Bostic will engage in a dialogue with Delta Air Lines CEO on topics related to the Atlanta economy