Rising electricity prices lead to resistance from residents, U.S. data centers face challenges, solar energy and storage will be key in the short term

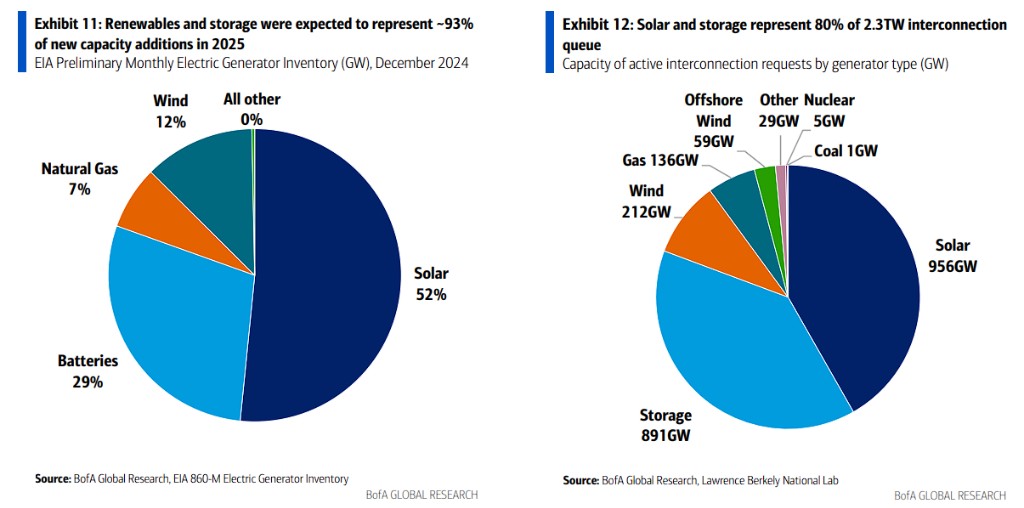

Bank of America Merrill Lynch stated that the surge in AI data center construction and the enormous demand for electricity have become one of the direct driving forces behind rising electricity prices. Taking the PJM grid as an example, the skyrocketing capacity prices have led to an increase of 18%-25% in residential users' bills, causing strong resistance from residents and putting them in a dual dilemma of "electricity scarcity" and "community opposition." To address the challenges, solar energy and storage are key solutions to meet the new electricity demand in the short term, accounting for 80% of the new power generation capacity in the United States

The wave of AI has triggered a construction boom in data centers, which is colliding head-on with the increasingly strained power supply and rising electricity prices in the United States. American data centers are caught in a dual dilemma of "power scarcity + community opposition," with solar energy and energy storage becoming key solutions to alleviate the crisis in the short term.

On September 28, according to news from the Chasing Wind Trading Desk, Bank of America Merrill Lynch stated in its latest research report that taking the PJM power grid, which covers 13 states, as an example, its power capacity prices have skyrocketed in recent years, directly leading to an 18% to 25% increase in the average bills for users in the region. Although utility rates are regulated, many costs, especially electricity and capacity prices, are directly passed on to consumers.

This cost pressure is translating into growing social and political resistance. The report indicates that at least 12 states across the U.S. have begun or are considering new policies aimed at ensuring that data centers bear all costs from site selection to electricity consumption to avoid rate shocks to ordinary consumers. In states like Virginia, Arizona, and Colorado, some data center projects have slowed down or even been hindered due to concerns over electricity, water resource consumption, and higher utility costs.

In the face of power shortages and resistance to data center construction, the market is seeking solutions. The research report clearly states that in the short term, solar energy and energy storage will be key to meeting the new electricity demand. These two technologies accounted for 80% of the new power generation capacity in the U.S. in 2024 and are favored by many data center owners with renewable energy goals. However, to ensure grid stability, dispatchable energy sources like natural gas remain an indispensable supplement in the near term, while nuclear energy is viewed as a long-term option beyond the 2030s.

Soaring Electricity Prices, Increased Pressure on Residents and Regulators

The enormous demand for electricity from data centers is one of the direct driving forces behind rising electricity prices.

The Bank of America report elaborates on the situation in the PJM interconnection grid, providing a very clear case through the changes in capacity prices in the PJM interconnection grid (covering 13 states in the U.S.).

The research report states that the capacity market value in the region has skyrocketed from $2.2 billion for the 2023/2024 delivery year to $16.1 billion for the 2026/2027 delivery year. Specifically:

The capacity price in the PJM "rest of market" area surged from $29 per megawatt-day for the 2024/2025 delivery year to $269 per megawatt-day for the 2025/2026 delivery year, achieving more than a fivefold increase within a year.

This increase has led to an average bill increase of 18% to 25% for residential users in the PJM region. In the auction for the 2026/2027 delivery year, prices further climbed to $329 per megawatt-day.

This means that the power shortage driven by data centers is unequivocally being transformed into an economic burden for residents through market mechanisms.

Faced with growing public dissatisfaction over rising electricity prices, local policymakers are under immense pressure.

The research report mentions that decision-makers in 12 states have begun to take action, attempting to establish special rate structures to internalize the costs brought by data centers. This marks an important policy shift: ordinary residents can no longer bear the electricity demands of data centers.

Bank of America analyst Ross Fowler pointed out:

State-level legislatures will become the key battleground for balancing growth and the cost pressures on people's livelihoods in the future. While regulators can review the capital expenditures and operating costs of utility companies, their power to pass on electricity procurement costs is limited. They may alleviate price pressures by lowering the return on equity (ROE) of utility companies or slowing down capital expenditure approvals, but this could sacrifice the growth prospects or service quality of utility companies.

Power Scarcity and Community Resistance as Dual Obstacles for Data Centers

Bank of America Merrill Lynch believes that the challenges for data center operators are twofold: on one hand, there is the physical scarcity of electricity, and on the other, the social aspect of "Not In My Backyard" (NIMBYism).

The report points out that the power consumption of a hyperscale data center can be comparable to that of a medium-sized city, reaching 100-300 megawatts, which puts immense pressure on an already strained power grid.

Bank of America Merrill Lynch states that the most direct consequence of rising electricity prices is the strong public opposition to data center construction. Community resistance is becoming a "new and increasingly significant threat."

Residents' concerns encompass various aspects, from rising electricity bills and water resource shortages to equipment noise and land use conflicts. This "NIMBYism" has already translated into actual actions in many places, delaying or even halting projects. The report lists several examples:

In Mesa, Arizona, Meta's data center plans faced strong criticism due to concerns over the Colorado River water resource shortage.

In Colorado Springs, concerns over electricity demand and rising electricity prices have slowed down several proposed projects.

In Prince William County, Virginia, a large project called "Digital Gateway" faced strong opposition from residents due to noise, land use conflicts, and other issues, leading to lawsuits and ultimately the revocation of its zoning authorization.

In Clayton County, Georgia, the approval of new data center constructions has been suspended until September 2025.

Bank of America Merrill Lynch analyst Justin Post believes that AI workloads consume more electricity than traditional cloud computing, which will exacerbate power scarcity and community conflicts. This dilemma may lead to a slowdown in the construction of new facilities, rising cloud service prices, and even delay the popularization of General Artificial Intelligence (Gen-AI).

Short-term Reliance on Solar and Energy Storage, Long-term Focus on Natural Gas and Nuclear Energy

To address the imminent power gap, a transformation of the energy structure is imperative. The report analyzes that a "multi-pronged" strategy is needed for the construction of new power generation and stable power supply capacities In the short term, solar energy and energy storage are the main forces. According to the U.S. Energy Information Administration (EIA), the new installed capacity of the U.S. grid is 48.6 gigawatts (GW), of which about 80% comes from solar energy and energy storage, specifically including 30 GW of utility-scale solar and 10.3 GW of energy storage.

The planned 63 GW of new capacity at the beginning of 2025 also shows a similar structure: about 80% of the share comes from solar energy and energy storage, but the internal composition has changed— the proportion of energy storage has increased (18.2 GW), while solar energy growth is relatively moderate (32.5 GW), which further highlights the stability of the system in the short term.

Looking ahead, in the 2.3 terawatt (TW) grid interconnection application queue, there are 956 GW of solar energy, 891 GW of energy storage, 212 GW of wind power, and 136 GW of natural gas, clearly indicating that solar energy and energy storage will continue to maintain an absolute dominant position.

However, Bank of America Merrill Lynch stated that data centers require 24/7 stable power, which exceeds the capacity of intermittent renewable energy. Therefore, dispatchable baseload power sources are essential.

In the short term, natural gas power plants will fill this gap, with turbine orders significantly increasing in the first half of 2025. From a longer-term perspective (2030s), nuclear energy, especially small modular reactors (SMRs), is being viewed as the ultimate solution.

Large tech companies like Microsoft, Amazon, and Google have begun signing agreements with nuclear energy companies to explore the possibility of directly powering data centers