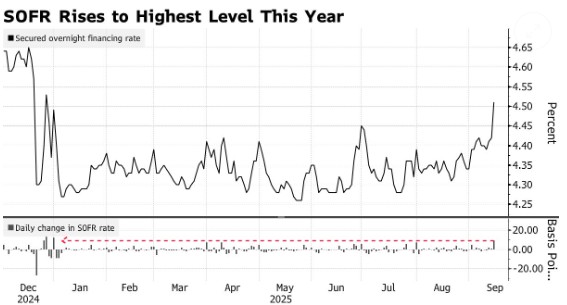

Liquidity indicators are flashing red! The key U.S. borrowing rate SOFR has recorded the largest increase of the year

The U.S. short-term borrowing rate SOFR has risen sharply, marking the largest increase of the year, reflecting liquidity tightening. This rate increased from 4.42% to 4.51%, widening the gap with the federal funds rate to 18 basis points. The reduction in liquidity is mainly due to the settlement of Treasury auctions and the approaching corporate tax payment dates. Despite the rise in the benchmark rate, the market expects a brief calm before the end of the quarter, followed by increased volatility

According to the Zhitong Finance APP, this week, a key interest rate in the U.S. financial system has risen sharply, exceeding the target range set by the Federal Reserve. This phenomenon has emerged due to a continued decrease in liquidity, which is caused by the settlement of U.S. Treasury auctions and the approaching quarterly corporate tax payment dates. According to the latest data released by the New York Fed on Tuesday, the Secured Overnight Financing Rate (SOFR) rose from 4.42% on the previous trading day to 4.51% on September 15, marking the largest increase in this rate since December 31 of last year. This benchmark short-term lending rate is related to activity in the repurchase agreement market.

This increase has widened the gap between SOFR and the actual federal funds rate to 18 basis points—the largest gap since December 26 of last year; policymakers are expected to lower the federal funds rate by 25 basis points on Wednesday. This rate is 11 basis points higher than the rate paid by the Federal Reserve on reserves held at the central bank, which is currently 4.40%.

The overnight financing rate used for interbank lending between banks and asset management companies has been steadily rising as the U.S. Treasury expands its cash reserves while the Federal Reserve reduces the size of its balance sheet. Meanwhile, the usage of a Federal Reserve overnight lending mechanism (which has long been viewed as an indicator of the excess liquidity in the funding market) has fallen to its lowest level in four years.

At the beginning of September, the repurchase rate exceeded the Federal Reserve's target range for the overnight lending rate and has remained at a high level since then.

Even with the recent sharp rise in benchmark rates, market participants still expect a brief period of calm before the end of the quarter, followed by increased market volatility. This is because two long-term Cash Management Bills (with maturities typically under one month) will mature, resulting in a net supply of $50 billion being repaid. Additionally, a large amount of cash provided monthly by government-sponsored enterprises will also flow into the market in the coming days