How much insurance has been purchased from banks?

Changjiang Securities stated that as of June 20, among the 19 stake increases by insurance companies in 2025, 9 were in bank stocks, of which 7 were Hong Kong bank stocks. In terms of holding scale, the reference market value of insurance institutions in A-share banks reached 265.78 billion yuan; among the 7 Hong Kong bank stocks with higher weights in the Hang Seng Financial Index, the market value of insurance institutions' holdings exceeded 560 billion yuan, accounting for about 20% of the total insurance stock holdings, indicating a relatively high concentration

Report Highlights

This year, insurance capital's stake increases have continued the hot momentum from last year, and in terms of sector and industry characteristics, the number of stake increases in Hong Kong stocks and banks is greater than in previous periods. As of June 20, 2025, there have been a total of 19 stake increases by insurance companies in 2025, involving 16 companies, of which 13 are Hong Kong stocks; in terms of industry distribution, among the 19 stake increases this year, 9 were in bank stocks, including 7 in Hong Kong bank stocks. Based on the disclosure data of the top ten shareholders from the 2025 Q1 reports of listed companies (excluding related party holdings), the market value held by banks as of the end of Q1 was approximately 265.78 billion yuan. Selecting the top 7 bank stocks by weight in the Hang Seng Financial Index, the reference market value held by insurance institutions in these 7 bank targets exceeds 560 billion yuan.

Report Overview

The Trend of Insurance Stake Increases Continues in 2025

This year, insurance capital's stake increases have continued the hot momentum from last year, and in terms of sector and industry characteristics, the number of stake increases in Hong Kong stocks and banks is greater than in previous periods. As of June 20, 2025, there have been a total of 19 stake increases by insurance companies in 2025, involving 16 companies, of which 13 are Hong Kong stocks; in terms of industry distribution, among the 19 stake increases this year, 9 were in bank stocks, including 7 in Hong Kong bank stocks.

Bank Holdings from the Perspective of Major Stocks

A-share Major Holdings Situation:

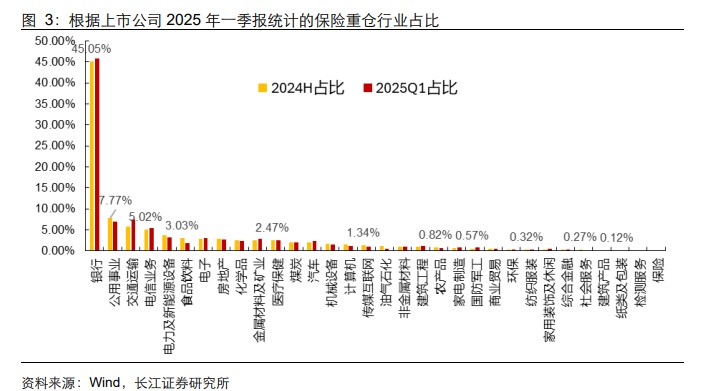

Based on the disclosure data of the top ten shareholders from the 2025 Q1 reports of listed companies (excluding related party holdings), in terms of the industry distribution of heavily held insurance stocks, the latest marginal changes in heavily held industries are not significant. The proportion of holdings in industries such as banking, transportation, and telecommunications has increased, while public utilities and new energy have slightly declined, and the proportion of food and beverage holdings continues to decline. According to the statistics of insurance institutions among the top ten shareholders of listed companies, the reference market value held by banks as of the end of Q1 was approximately 265.78 billion yuan.

Hong Kong Bank Major Holdings Situation:

Selecting the top 7 bank stocks by weight in the Hang Seng Financial Index, analyzing their global shareholder holdings disclosed as of June 20, 2026. In terms of institutional types, the total market value held by various institutions in these 7 bank targets shows that insurance institutions hold a reference market value exceeding 560 billion yuan in the relevant targets, with the market value proportion exceeding 58% excluding general legal persons. According to the Q1 data on the insurance investment balance for 2025, the total market value of stocks held by insurance companies is approximately 2.8 trillion yuan, with the market value of the aforementioned 7 stocks accounting for about 20% of the insurance stock inventory weight, indicating relatively high concentration.

Report Body

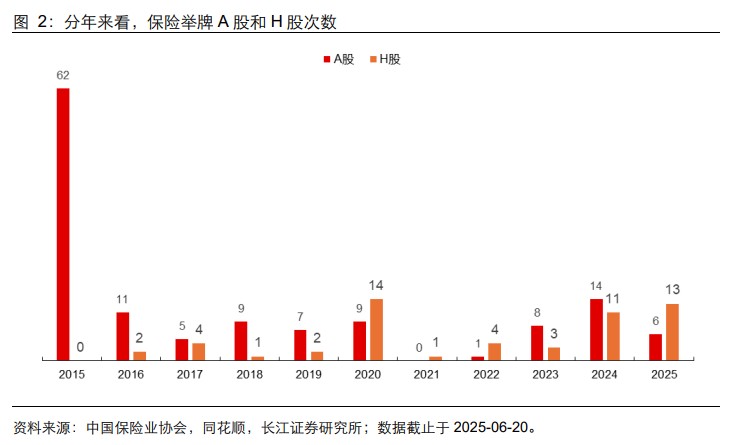

The Trend of Insurance Stake Increases Continues in 2025

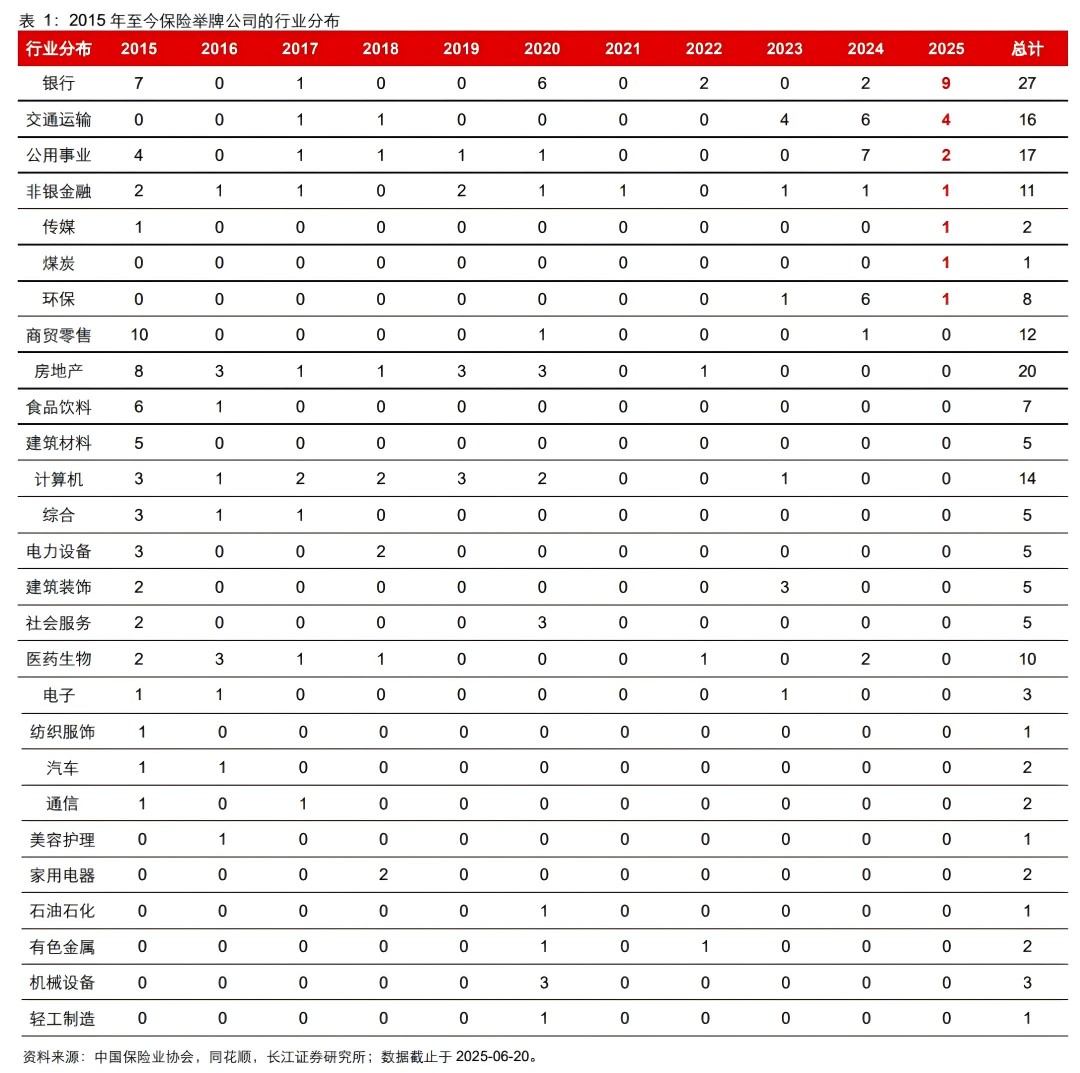

Insurance capital's stake increases mean that when insurance funds hold more than 5% of a listed company’s shares, they must disclose this information according to the law, and every additional 1% stake increase after meeting the disclosure requirement must also be disclosed. This year, insurance capital's stake increases have continued the hot momentum from last year, and in terms of sector and industry characteristics, the number of stake increases in Hong Kong stocks and banks is greater than in previous periods. **

This year, the number of stake acquisitions in Hong Kong stocks has exceeded that in A-shares.

From the perspective of industry distribution, among the 19 stake acquisitions this year, 9 were in bank stocks, with 7 of them being Hong Kong bank stocks.

Considering the amount of insurance holdings after the stake acquisition, based on the closing price on June 20, 2025, the market value held is 116.94 billion yuan, of which the market value of bank holdings is 74.63 billion yuan, accounting for more than half.

From the perspective of heavily held stocks, what is the proportion of banks?

From another perspective, based on the disclosed data of the top ten shareholders in the first quarter of 2025 (excluding related party holdings), the industry distribution of heavily held stocks by insurance shows that the latest marginal changes in heavily held industries are not significant. The proportion of holdings in industries such as banking, transportation, and telecommunications has increased, while public utilities and new energy have slightly declined, and the food and beverage sector continues to show a downward trend in holding proportion.

According to the statistics of insurance institutions among the top ten shareholders of listed companies, as of the end of the first quarter, the reference market value held in banks is 265.78 billion yuan.

If we penetrate into the shareholders of Hong Kong bank stocks, we can estimate the holdings of insurance institutions in Hong Kong bank stocks through the disclosures from the Hong Kong Stock Exchange.

Selecting the top 7 bank stocks by weight in the Hang Seng Financial Index, we analyze the global shareholder holding situation as of June 20, 2025. Taking Company A as an example, the shareholder proportions are generally shown in the table below.

According to the types of institutions, the total market value of holdings by various institutions in the 7 bank stocks is shown in the following chart:

As of recently, insurance institutions have a reference market value of over 560 billion yuan in related stocks, with the market value proportion exceeding 58% when excluding general legal entities, which may indirectly reflect the preference of insurance for Hong Kong financial stocks.

According to the first quarter data of the insurance investment balance in 2025, the total market value of stocks held by insurance companies is approximately 2.8 trillion yuan, the market value of the aforementioned 7 individual stocks accounts for about 20% of the stock holdings of insurance companies, indicating a relatively high concentration.

According to the first quarter data of the insurance investment balance in 2025, the total market value of stocks held by insurance companies is approximately 2.8 trillion yuan, the market value of the aforementioned 7 individual stocks accounts for about 20% of the stock holdings of insurance companies, indicating a relatively high concentration.

Author of this article: Chen Jiemin, Source: Changjiang Securities, Original title: "How Much Banks Have Insurance Bought?"