How does the conflict between Trump and Musk affect Tesla? Short-term damage to financial reports, long-term no pressure?

The breakdown of the relationship between Trump and Musk has led to a sharp decline in Tesla's stock price, creating a historic low in market value. Analysts believe that this will impact electric vehicle sales in the short term, but the long-term effects are limited. It is expected that Tesla's delivery volume may decrease by 15% in 2025. Goldman Sachs has lowered Tesla's stock price target due to declining delivery expectations. Although the deterioration of relations with the government may reduce Tesla's subsidies and tax incentives, Musk believes that this will have a limited impact on Tesla and may actually help consolidate its market leadership

TradingKey - Last week, the relationship between Trump and Musk broke down, leading to a Tesla stock price plunge, with market value evaporating at an unprecedented scale. Although the Trump-Musk alliance has essentially collapsed, Wall Street analysts believe this will only temporarily drag down Tesla's electric vehicle sales, as Tesla still holds several non-political trump cards to maintain its growth narrative in the long term.

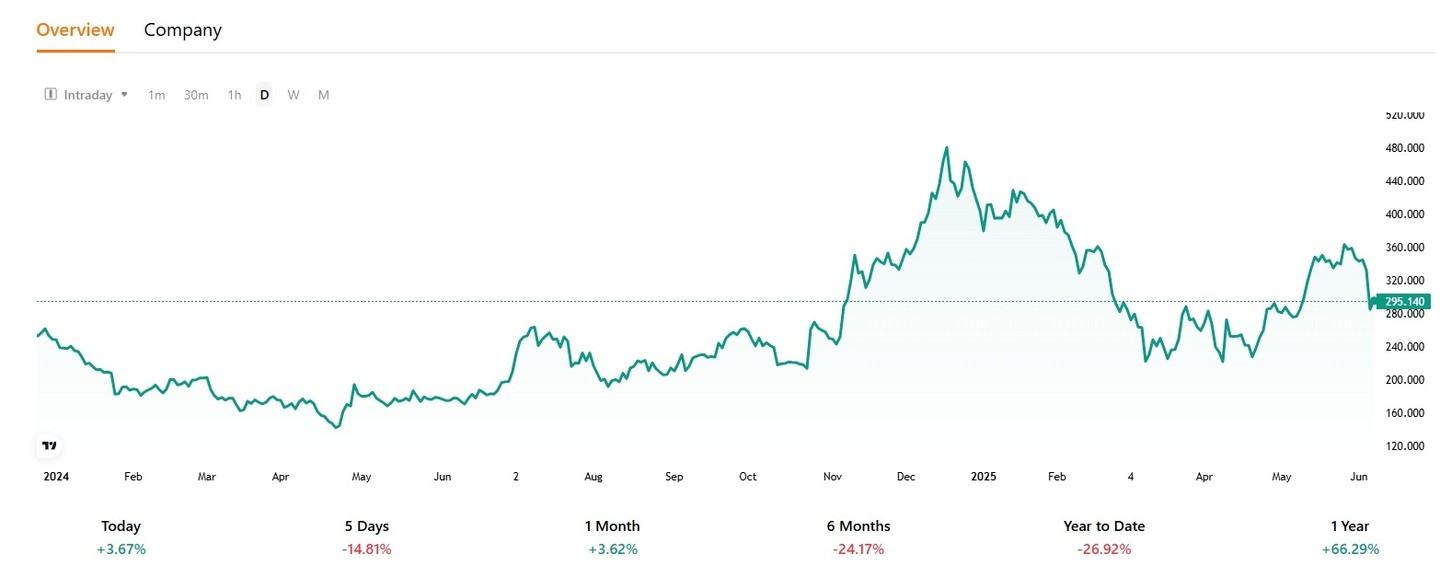

On June 5, 2025, a public spat between U.S. President Trump and Tesla CEO Musk on the internet raised investors' concerns about the future prospects of this electric vehicle manufacturing giant, causing the stock price to plummet over 14%. Just a day later, Tesla's stock price rebounded by 7% at one point, closing up 3.67% at $295.14.

【Tesla stock price trend chart, source: TradingKey】

Despite the huge uproar caused by this online spat, which even threatened U.S. space security, Wall Street analysts remain generally pessimistic about the overall impact of this event.

"Government benefits" related to electric vehicles are no longer available

The most direct impact of the breakdown in their relationship is on Tesla's electric vehicle business, as Trump's tax reform plan aims to cut electric vehicle subsidies and tax reductions. Gene Munster, managing partner at Deepwater Asset Management, predicts that the cancellation of tax reductions could lead to a 15% decrease in Tesla's vehicle deliveries in 2025.

Musk is well aware of the impact of the cancellation of tax reductions and has stated that this would deal a devastating blow to Tesla's competitors, while having limited negative effects on Tesla itself, ultimately helping to solidify Tesla's leadership position in the long run.

Last Thursday, Goldman Sachs lowered its target price for Tesla stock, citing a downward revision in delivery expectations for 2025—this quarter's U.S. market deliveries have declined, European market deliveries halved in April and further declined in May, and sales in the Chinese market have also dropped by about 20% over the past two months.

On the other hand, deteriorating relations with the government may cut some of the "benefits" that Tesla has long enjoyed. According to statistics, Musk and his companies have received at least $38 billion in government contracts, loans, subsidies, and tax credits over the past 20 years; in 2024 alone, Musk received over $6.3 billion in commitments from state and local governments, setting a historical record.

In the first quarter of this year, Tesla sold regulatory credits worth $595 million, which is higher than Tesla's net profit of $409 million. Jesse Jenkins, an assistant professor at Princeton University studying the electric vehicle industry, stated, this makes a difference between profit and loss for Tesla.**

Tesla still has many politically neutral trump cards

Morningstar analyst Seth Goldstein believes that the relationship between Musk and Trump will indeed affect Tesla's stock price and even investor sentiment, but in terms of the actual business impact on Tesla, "I have never thought that Trump's election was a negative or positive for Tesla."

Tesla will launch its Robotaxi feature on June 12, trialing 10 to 20 self-driving taxi services in Austin and planning to expand to markets such as San Francisco and Los Angeles, which is seen as another key engine for Tesla's growth. Musk stated that this will unlock trillions of dollars in market value for Tesla.

Unlike Tesla's automotive business, Wall Street believes that the Trump administration may "let go" of the development of Tesla's self-driving car technology and AI technology.

Deepwater's Munster stated that the White House's hindrance to corporate autonomy offers almost no benefits. Autonomy is at the core of physical artificial intelligence, and for the U.S. to become a leader in the global AI field, it must first become a leader in the field of physical AI.

Munster expects that calm minds will prevail, and the federal government will continue to support the development of these services.

Morgan Stanley analysts also stated that the discord between Musk and Trump will not affect the long-term factors driving stock value. Tesla still holds many valuable, politically neutral cards, including AI leadership, autonomy/robotics technology, manufacturing, supply chain restructuring, renewable energy, and critical infrastructure.

Cox Automotive analysts noted that Tesla's overall valuation depends on his vision for self-driving and AI. If he steps back from right-wing politics, Tesla could benefit significantly